Maximusnd/iStock via Getty Images

By Elisa Mazen | Michael Testorf | Pawel Wroblewski

Asia Begins to Present Compelling Growth Opportunities

Market Overview

International equities rallied strongly in the fourth quarter, boosted by expectations of lower global inflation, optimism around the reopening of the Chinese economy, resilient earnings and favorable currency trends. The benchmark MSCI ACWI Ex-U.S. Index gained 14.28% for the quarter, paring its 2022 loss to 16.00%. The MSCI Emerging Markets Index advanced 9.70%, finishing 20.09% lower for the year. Small caps experienced a similar rebound with the MSCI ACWI Ex-U.S. Small Cap Index higher by 13.31% in the quarter but finished 19.97% lower for the year.

The rebound was driven by cyclicals and value names, leading to a gain of 15.70% for the MSCI ACWI Ex-U.S. Value Index, which once again outperformed the MSCI ACWI Ex-U.S. Growth Index (+12.89%). Due primarily to a historically wide divergence between value and growth in the first quarter, value outperformed growth by over 1,400 basis points for the year.

As we have highlighted in past commentaries, managing a diversified growth portfolio against a core benchmark in a period of value outperformance can create headwinds to relative results. Despite this backdrop, the ClearBridge International Growth ACWI Ex-US Strategy delivered strong absolute performance (~15%) and outperformed the benchmark for the quarter.

Exhibit 1: MSCI Growth vs. Value Performance

As of Dec. 31, 2022. Source: FactSet.

Much of that above-average performance was a result of a rally in foreign currencies which had been hurt by the strength of the U.S. dollar for most of 2022. This reversal has been driven in part by the interest rate increases pushed through by the European Central Bank and the Bank of England in the second half of 2022, as well as the sudden change in monetary policy by the Bank of Japan (BOJ) in the fourth quarter.

Japan had been the last holdout to rate increases, maintaining a negative/zero interest rate policy. We expected the BOJ would likely make a policy change with its current governor ending his 10-year term in March. The central bank took a step in this direction by increasing the yield curve control (YCC) band from 25 bps to 50 bps, which led most market participants to the conclusion that interest rates would move up. But YCC and interest rate moves are two entirely different things, with the former having no real impact on the economy or earnings for most Japanese companies. We expect the BOJ will increase interest rates when inflation moves above 2%, a scenario the yen and interest sensitive sectors have already factored in.

We have been reducing our underweight to Japan over the last several quarters but remain 300 bps below the benchmark. While the country remains a mixed picture economically, with some segments of the market having high leverage and some segments carrying extra cash on their balance sheets – the driver for equity performance will be the better allocation of capital, a characteristic that has long been overlooked. The eventual return of Chinese tourists, after the lifting of COVID-19 restrictions, should be a positive and one that showed up in the fourth quarter rerating of cosmetics maker Shiseido (OTCPK:SSDOY).

We are even more bullish on the secular and structural growth companies we own in Europe, as earnings have held up better than expected. Like Shiseido, French luxury conglomerate LVMH (OTCPK:LVMHF) was a strong performer on optimism over China’s reopening. A weaker euro has helped but we also attribute the strength to the solid fundamentals and pricing power of companies like Linde (LIN) , a U.K.-based supplier of industrial gases. Linde has benefited from its exposure to the energy transition through its hydrogen projects as well as the strong growth of the health care and technology markets it serves.

Portfolio Positioning

Our recent activity remained squarely focused on increasing exposure to quality, compounding businesses with the sturdy fundamentals to weather unsettled global conditions. At the same time, we have trimmed back positions carrying higher risk or deteriorating fundamentals.

We added to the Strategy’s Asia Ex Japan exposure with the addition of two Australia-based secular growth companies. Computershare is a technology-driven administrator of financial assets operating in five core segments, which include: issuer services, mortgage services, employee share plans, business services and communication services. The company is a blue chip, defensive business whose high cash flows should help to weather a downturn. Recurring revenue represents 75-80% of the total and it should be a prime beneficiary of high and rising short-term rates from the payment flows it handles, while continuous cost cutting initiatives should protect margins. Brambles (OTCPK:BMBLF) is a logistics provider and the founder of global pallet pooling with unmatched advantages of global scale, global sourcing, automation, reliability, quality, and financial power. The company is a secular growth story with a value-added proposition of modernizing supply chains. The recent supply chain crisis should accelerate market share wins as white-wood pallets and small pallet poolers have failed to provide for the essential movement of goods. Meanwhile Brambles’ business is well positioned for optimization through technology with tremendous cost benefits from AI, digitization and the Internet of Things.

We also re-entered a position in Hong Kong Exchanges & Clearing (OTCPK:HKXCF), which we sold in 2020 at higher levels. After a large share price correction due to the concerns about trading and IPO activity, the stock had reached an attractive entry point again. A normalized trading environment should support the business and the stock, which we consider a structural grower tied to Asian capital market activity. Purchases of e-commerce and payments platform Alibaba (BABA) and online travel agency TravelSky Technology (OTCPK:TSYHY), meanwhile, represented our first in the mainland China market following a regulatory crackdown of private companies in preceding years.

The most meaningful sale in the quarter was Schlumberger (SLB), an oil services company in the structural growth bucket. We bought this stock during weakness in energy markets during the COVID-19 pandemic. But as energy markets rebounded with the global economic recovery and the Russian invasion of Ukraine, Schlumberger’s earnings significantly stepped up from previously depressed levels and the stock outperformed a very strong energy sector. As part of our valuation-driven sell discipline, we took profits and moved on to areas of the market with a more attractive risk/reward.

We exited software maker Atlassian (TEAM) as part of our repositioning away from emerging growth companies and on valuation and cost concerns as it redomiciles in the U.S. We also sold Canadian Imperial Bank of Commerce (CM:CA) due to concerns over increases in loan loss reserves after recent results.

While we are not seeing many attractive opportunities among emerging growth companies presently, the area is a focus of our research and due diligence. We like many of these companies and are trying to determine what they’re worth at much higher interest rate levels. Some of these stocks have come down 60% to 70% but remain good growth businesses.

Outlook

We expect markets to remain volatile in 2023. The volatility will be driven by changing inflation expectations, the pace of China reopening over a largely unvaccinated population and geopolitical events that had, and will likely continue to have, an outsize impact on the markets. The actions of central banks including the BOJ, which so far has been way behind other central banks in tightening financial conditions, will continue to impact global liquidity and valuation of assets. Higher interest rates will exert pressure on national budgets, consumer wallets and corporate earnings.

We will continue to follow our process and upgrade the portfolio for more upside and less risk, looking for mispriced growth across the whole spectrum of growth: emerging, secular and structural. We recognize that the different types of growth stocks are going to be mispriced in different market regimes. Therefore, the weights of these growth buckets in our portfolio will evolve over time, driven by our ongoing evaluation of price targets and market opportunities.

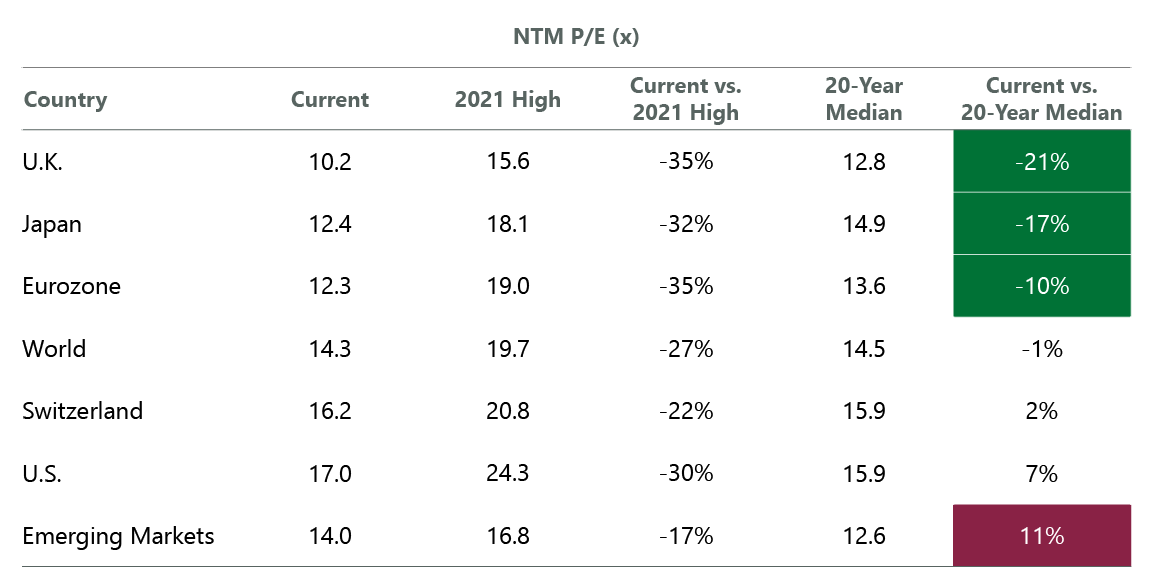

Exhibit 2: International Valuations Increasingly Attractive

Data as of Dec. 31, 2022. Source: FactSet.

International equities have derated and are trading at relatively low multiples. Positioning in overseas equities remains low. As such, we see a favorable risk/reward in this asset class, especially in growth assets that have deviated the most since the peak in 2020.

Non-U.S. stocks are also oversold from an investor allocation standpoint, with large outflows last year amid a flight to safety driven by the Russian invasion of Ukraine and fears over the more direct impact to Europe from that crisis.

Finally, we recognize that regional equity leadership moves in long cycles with the U.S. maintaining a performance advantage over international for the last 11 years. A broad outperformance of international benchmarks in the fourth quarter could be supported next year by reversal of much of the bad news of 2022, including very high energy prices. The relatively low weight of international markets vs the U.S. in technology stocks could also provide better performance in 2023.

Portfolio Highlights

During the fourth quarter, the ClearBridge International Growth ACWI Ex-US Strategy outperformed its MSCI ACWI ex-U.S. Index benchmark. On an absolute basis, the Strategy saw gains across the 10 sectors in which it was invested (out of 11 total) with the financials, industrials and health care sectors the primary contributors.

On a relative basis, overall stock selection contributed to performance. In particular, stock selection in the financials, energy, consumer staples and utilities sectors and an overweight to the IT sector aided results. Conversely, stock selection in the IT, health care and materials sectors detracted from performance. The biggest detractors in IT were due to a bias towards less cyclical segments within the sector, IT services and electronic equipment, which underperformed more cyclical areas such as semiconductors. Our software holdings also underperformed the benchmark.

On a regional basis, stock selection in North America and Asia Ex- Japan, an underweight to emerging markets and an overweight to Europe Ex-U.K. contributed to returns. Meanwhile, stock selection in Europe Ex-U.K., the United Kingdom and Japan as well an overweight to North America, primarily in Canada, were detrimental to performance.

On an individual stock basis, the largest contributors to absolute returns in the quarter included Schlumberger in the energy sector, Novo Nordisk (NVO) in the health care sector, AIA Group (OTCPK:AAGIY) in the financials sector, Keyence (OTCPK:KYCCF) in the IT sector and Linde in the materials sector. The greatest detractors from absolute returns included positions in Atlassian and Elastic (ESTC) in the IT sector as well as Zai Lab (ZLAB), Olympus (OTCPK:OCPNF) and Roche (OTCQX:RHHBY) in the health care sector.

In addition to the transactions mentioned above, we initiated positions in Loblaw (OTCPK:LBLCF) in the consumer staples sector, SONY in the consumer discretionary sector and Aflac (AFL) in the financials sector and closed positions in Hoya in the health care sector, Ashtead Group (OTCPK:ASHTF) in the industrials sector and Barrick Gold (GOLD) in the materials sector.

Elisa Mazen, Managing Director, Head of Global Growth, Portfolio Manager

Michael Testorf, CFA, Managing Director, Portfolio Manager

Pawel Wroblewski, CFA, Managing Director, Portfolio Manager

|

Past performance is no guarantee of future results. Past performance is no guarantee of future results. Copyright © 2022 ClearBridge Investments. All opinions and data included in this commentary are as of the publication date and are subject to change. The opinions and views expressed herein are of the author and may differ from other portfolio managers or the firm as a whole, and are not intended to be a forecast of future events, a guarantee of future results or investment advice. This information should not be used as the sole basis to make any investment decision. The statistics have been obtained from sources believed to be reliable, but the accuracy and completeness of this information cannot be guaranteed. Neither ClearBridge Investments, LLC nor its information providers are responsible for any damages or losses arising from any use of this information. Performance source: Internal. Benchmark source: Morgan Stanley Capital International. Neither ClearBridge Investments, LLC nor its information providers are responsible for any damages or losses arising from any use of this information. Performance is preliminary and subject to change. Neither MSCI nor any other party involved in or related to compiling, computing or creating the MSCI data makes any express or implied warranties or representations with respect to such data (or the results to be obtained by the use thereof), and all such parties hereby expressly disclaim all warranties of originality, accuracy, completeness, merchantability or fitness for a particular purpose with respect to any of such data. Without limiting any of the foregoing, in no event shall MSCI, any of its affiliates or any third party involved in or related to compiling, computing or creating the data have any liability for any direct, indirect, special, punitive, consequential or any other damages (including lost profits) even if notified of the possibility of such damages. No further distribution or dissemination of the MSCI data is permitted without MSCI’s express written consent. Further distribution is prohibited. |

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Be the first to comment