ipopba

By Elisa Mazen | Michael Testorf | Pawel Wroblewski

International Equity Rebound Could be on Horizon

Market Overview

Global equities rallied in the fourth quarter, boosted by expectations of lower global inflation, optimism around the reopening of the Chinese economy, resilient earnings and favorable currency trends. The benchmark MSCI All Country World gained 9.76% for the quarter, led by developed markets in Europe and Asia, paring its 2022 loss to 18.36%. The MSCI Emerging Markets Index advanced 9.70%, finishing 20.09% lower for the year.

From a regional perspective, Europe Ex U.K. surged 19.28%, the United Kingdom advanced 17.34% while Asia Ex Japan (+15.73%) and Japan (+13.23%) also outperformed the benchmark. North America (+6.83%) underperformed for the quarter.

The rebound was driven by cyclicals and value names, leading to a gain of 14.21% for the MSCI ACWI Value Index, which once again outperformed the MSCI ACWI Ex-U.S. Growth Index (+5.28%).

As we have highlighted in past commentaries, managing a diversified growth portfolio against a core benchmark in a period of value outperformance can create headwinds to relative results. Despite this backdrop, the ClearBridge Global Growth Strategy delivered strong absolute performance (~10%) and outperformed the benchmark for the quarter.

Exhibit 1: MSCI Growth vs. Value Performance

As of Dec. 31, 2022. Source: FactSet.

Much of that above-average performance was a result of a rally in foreign currencies which had been hurt by the strength of the U.S. dollar for most of 2022. This reversal has been driven in part by the interest rate increases pushed through by the European Central Bank (ECB) and the Bank of England in the second half of 2022, as well as the sudden change in monetary policy by the Bank of Japan (BOJ) in the fourth quarter.

Japan had been the last holdout to rate increases, maintaining a negative/zero interest rate policy. We expected the BOJ would likely make a policy change with its current governor ending his 10-year term in March. The central bank took a step in this direction by increasing the yield curve control (YCC) band from 25 bps to 50 bps, which led most market participants to the conclusion that interest rates would move up. But YCC and interest rate moves are two entirely different things, with the former having no real impact on the economy or earnings for most Japanese companies. We expect the BOJ will increase interest rates when inflation moves above 2%, a scenario the yen and interest sensitive sectors have already factored in.

We have been increasing our exposure to Japan over the last several quarters and carried a slight underweight at quarter end. While the country remains a mixed picture economically, with some segments of the market having high leverage and some segments carrying extra cash on their balance sheets – the driver for equity performance will be the better allocation of capital, a characteristic that has long been overlooked. The eventual return of Chinese tourists, after the lifting of COVID-19 restrictions, should be a positive.

We are even more bullish on the secular and structural growth companies we own in Europe and North America, as earnings have held up better than expected. French luxury conglomerate LVMH (OTCPK:LVMHF) was a strong performer on optimism over China’s reopening. A weaker euro has helped but we also attribute the strength to the solid fundamentals and pricing power of companies like Air Liquide (OTCPK:AIQUF), a French-based supplier of industrial gases. The company has benefited from its exposure to the energy transition as well as the strong growth of the health care and technology markets it serves.

The Strategy’s financials exposure was a strength in the quarter, led by Hong Kong insurer AIA Group (OTCPK:AAGIY) whose performance was driven by the removal of China’s zero-COVID policy and the reopening of the Hong Kong market to Chinese nationals. While AIA is not just dependent on its Chinese franchise, the change in policy had a meaningful positive impact on the shares. New buy Hong Kong Exchanges & Clearing was also a prime beneficiary of China reopening. In Europe, meanwhile, French-based global lender BNP Paribas (OTCQX:BNPQF) has seen higher interest rates in the euro area due to aggressive monetary tightening by the ECB filtering through into earnings.

Portfolio Positioning

Our recent activity remained squarely focused on increasing exposure to quality, compounding businesses with the sturdy fundamentals to weather unsettled global conditions. At the same time, we have trimmed back positions carrying higher risk or deteriorating fundamentals.

Deutsche Telekom (OTCQX:DTEGY) was our largest addition in the fourth quarter. The company is a leader in two of the most stable telecom markets – the U.S. and Germany – where it should outgrow the competition. We believe the stock is significantly undervalued, and that continued and accelerating improvements, asset sales and a $60 billion share buyback program should lead to a rerating in its share price. In the U.S., these catalysts include leveraging its superior network to expand T-Mobile’s footprint and rolling out a broadband offering. In Germany, Deutsche Telekom is well positioned to grow its market of broadband and wireless markets.

We increased our exposure to a cosmetics market that has proved resilient though downturns with the purchase of Estee Lauder (EL). The manufacturer of cosmetics, fragrances, skin and hair care products across a number of well-known global brands including Clinique, MAC and Bobbi Brown, adds to our group of secular growers. Estee Lauder is a global leader in the prestige beauty space, which has outgrown the broader home and personal care category since 2010. The company has substantial brand and pricing power and is overindexed to the highly profitable prestige skin care category. We believe the company’s most recent earnings report and 2023 guidance update, which was cut significantly due to uncertainty over China’s zero-COVID policy (China and travel retail are key growth drivers), provided an attractive entry point. At this point, we believe the stock has been significantly derisked and could see potential upside from a China recovery.

We added to the Strategy’s Asia Ex Japan exposure with the addition of two Australia-based secular growth companies. Computershare (OTCPK:CMSQF) is a technology-driven administrator of financial assets operating in five core segments, which include: issuer services, mortgage services, employee share plans, business services and communication services. The company is a blue chip, defensive business whose high cash flows should help to weather a downturn. Recurring revenue represents 75-80% of the total and it should be a prime beneficiary of high and rising short-term rates from the payment flows it handles, while continuous cost cutting initiatives should protect margins. Brambles (OTCPK:BMBLF) is a logistics provider and the founder of global pallet pooling with unmatched advantages of global scale, global sourcing, automation, reliability, quality, and financial power. The company is a secular growth story with a value-added proposition of modernizing supply chains. The recent supply chain crisis should accelerate market share wins as white-wood pallets and small pallet poolers have failed to provide for the essential movement of goods. Meanwhile Brambles’ business is well positioned for optimization through technology with tremendous cost benefits from AI, digitization and the Internet of Things.

The most meaningful sale in the quarter was Schlumberger (SLB), an oil services company in the structural growth bucket. We bought this stock during weakness in energy markets during the COVID-19 pandemic. But as energy markets rebounded with the global economic recovery and the Russian invasion of Ukraine, Schlumberger’s earnings significantly stepped up from previously depressed levels and the stock outperformed a very strong energy sector. As part of our valuation-driven sell discipline, we took profits and moved on to areas of the market with a more attractive risk/reward.

We exited software maker Atlassian (TEAM) as part of our repositioning away from emerging growth companies and on valuation and cost concerns as it redomiciles in the U.S.

While we are not seeing many attractive opportunities among emerging growth companies presently, the area is a focus of our research and due diligence. We like many of these companies and are trying to determine what they’re worth at much higher interest rate levels. Some of these stocks have come down 60% to 70% but remain good growth businesses.

Outlook

We expect markets to remain volatile in 2023. The volatility will be driven by changing inflation expectations, the pace of China reopening over a largely unvaccinated population and geopolitical events that had, and will likely continue to have, an outsize impact on the markets. The actions of central banks, led by the U.S. Federal Reserve and including the BOJ, which so far has been way behind other central banks in tightening financial conditions, will continue to impact global liquidity and valuation of assets. Higher interest rates will exert pressure on national budgets, consumer wallets and corporate earnings.

We will continue to follow our process and upgrade the portfolio for more upside and less risk, looking for mispriced growth across the whole spectrum of growth: emerging, secular and structural. We recognize that the different types of growth stocks are going to be mispriced in different market regimes. Therefore, the weights of these growth buckets in our portfolio will evolve over time, driven by our ongoing evaluation of price targets and market opportunities.

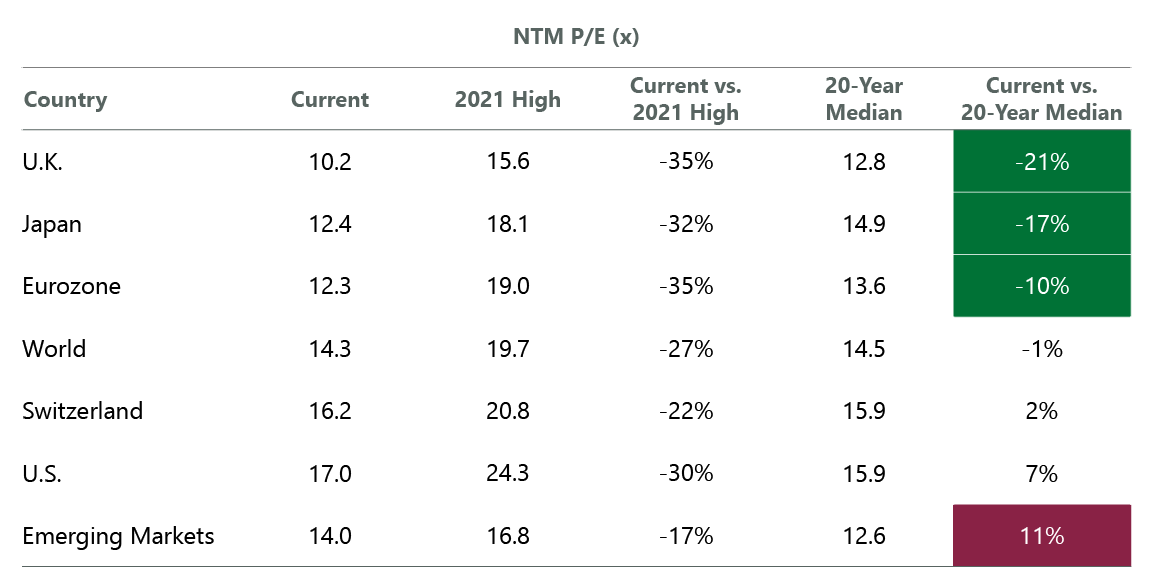

Exhibit 2: International Valuations Increasingly Attractive

Data as of Dec. 31, 2022. Source: FactSet.

International equities have derated and are trading at relatively low multiples. Positioning in overseas equities remains low. As such, we see a favorable risk/reward in this asset class, especially in growth assets that have deviated the most since the peak in 2020.

Finally, we recognize that regional equity leadership moves in long cycles with the U.S. maintaining a performance advantage over international for the last 11 years. A broad outperformance of international benchmarks in the fourth quarter could be supported next year by reversal of much of the bad news of 2022, including very high energy prices. The relatively low weight of international markets vs the U.S. in technology stocks could also provide better performance in 2023.

Global strategies like ours can capture attractive opportunities in international stocks while also maintaining exposure to a U.S. market where valuations have come down following a year when the S&P 500 Index tumbled 18%.

Portfolio Highlights

During the fourth quarter, the ClearBridge Global Growth Strategy outperformed its MSCI ACWI benchmark. On an absolute basis, the Strategy saw gains across nine of the 10 sectors in which it was invested (out of 11 total) with the health care and financials sectors the primary contributors.

On a relative basis, overall sector allocation contributed to performance. In particular, overweights to the health care and industrials sector, underweights to the communication services and consumer discretionary sectors as well as stock selection in the energy and financials sectors drove results. Conversely, stock selection in the IT, industrials and consumer discretionary sectors detracted from performance.

On a regional basis, overweight allocations to Europe Ex U.K. and the U.K., an underweight to North America and stock selection in North America and Asia Ex- Japan contributed to returns. Meanwhile, stock selection in Europe Ex-U.K., the U.K. and Japan was detrimental to performance.

On an individual stock basis, the largest contributors to absolute returns in the quarter included Schlumberger in the energy sector, AIA Group and BNP Paribas in the financials sector, DexCom (DXCM) in the health care sector and TJX in the consumer discretionary sector. The greatest detractors from absolute returns included positions in Tesla (TSLA) and Amazon.com (AMZN) in the consumer discretionary sector, Atlassian and Apple (AAPL) in the IT sector and Alphabet (GOOG, GOOGL) in the communication services sector.

In addition to the transactions mentioned above, we initiated positions in Loblaw (OTCPK:LBLCF) and Sysco (SYY) in the consumer staples sector and Aflac (AFL) in the financials sector and closed positions in Waste Management (WM) and Recruit Holdings (OTCPK:RCRRF) in the industrials sector, L’Oreal (OTCPK:LRLCF) in the consumer staples sector, Insulet (PODD) in the health care sector, Bank of America (BAC) in the financials sector as well as Fidelity National Information Services (FIS) and Intel (INTC) in the IT sector.

Elisa Mazen, Managing Director, Head of Global Growth, Portfolio Manager

Michael Testorf, CFA, Managing Director, Portfolio Manager

Pawel Wroblewski, CFA, Managing Director, Portfolio Manager

|

Past performance is no guarantee of future results. Copyright © 2022 ClearBridge Investments. All opinions and data included in this commentary are as of the publication date and are subject to change. The opinions and views expressed herein are of the author and may differ from other portfolio managers or the firm as a whole, and are not intended to be a forecast of future events, a guarantee of future results or investment advice. This information should not be used as the sole basis to make any investment decision. The statistics have been obtained from sources believed to be reliable, but the accuracy and completeness of this information cannot be guaranteed. Neither ClearBridge Investments, LLC nor its information providers are responsible for any damages or losses arising from any use of this information. Performance source: Internal. Benchmark source: Morgan Stanley Capital International. Neither ClearBridge Investments, LLC nor its information providers are responsible for any damages or losses arising from any use of this information. Performance is preliminary and subject to change. Neither MSCI nor any other party involved in or related to compiling, computing or creating the MSCI data makes any express or implied warranties or representations with respect to such data (or the results to be obtained by the use thereof), and all such parties hereby expressly disclaim all warranties of originality, accuracy, completeness, merchantability or fitness for a particular purpose with respect to any of such data. Without limiting any of the foregoing, in no event shall MSCI, any of its affiliates or any third party involved in or related to compiling, computing or creating the data have any liability for any direct, indirect, special, punitive, consequential or any other damages (including lost profits) even if notified of the possibility of such damages. No further distribution or dissemination of the MSCI data is permitted without MSCI’s express written consent. Further distribution is prohibited. Performance source: Internal. Benchmark source: Standard & Poor’s. |

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Be the first to comment