Makiko Tanigawa/DigitalVision via Getty Images

Investment Thesis

In my previous article on Clean Harbors, Inc. (NYSE:CLH), I came to the conclusion that the company has a good business model and a moat. Despite that, I argued that the stock wasn’t cheap and that better opportunities existed in this market. You can read about it here. Since then, CLH lost ~2% vs. a loss of ~9.6% for the S&P 500 and has outperformed the market. The company reported better than expected results in early May 2022 which made me reconsider some of my previous assumptions. For instance, I think CLH has a good chance of growing faster than the industry’s average of 5%. Moreover, TTM sales are now at an all-time high, while profitability is also above the historical average. All in all, I believe the stock has a fair value of $80 per share which is close to the current market price of nearly $87 per share.

Recent Developments

On May 4th, 2022, the company reported full-year results for FY22. Overall, the results were solid and exceeded analysts’ expectations. Sales reached ~$1.17 billion in the last quarter, representing a ~44.7% YoY increase. The results were boosted by the HPC acquisition made in 2021. However, the Environment Service grew by 24% without that acquisition which shows strong demand for the company’s services in its legacy business. The Safety-Kleen segment also performed well, growing by 9% YoY.

Turning to our segments starting on slide four. Environmental Service revenue grew 45% in Q1, this increase reflected the HPC acquisition in late 2021 and healthy organic growth, driven by customer demand and increased pricing. During the quarter the pace of activity in our services business quickened considerably, resulting in strong organic growth. Revenue in our legacy industrial service business, if you exclude HPC, grew 24%.

Safety-Kleen Environmental also continued a positive momentum, increasing 9% from a year ago.

Alan McKim – Chairman, President and Chief Executive Officer

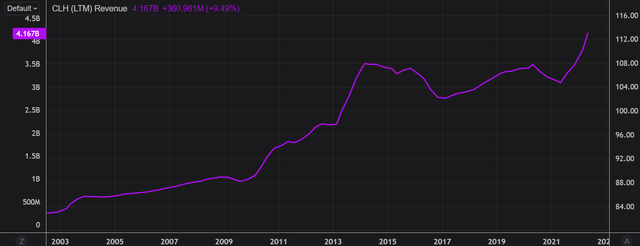

TTM sales have now reached ~$4.2 billion, and are at a multi-decade high. Despite the different business cycles of the past 20 years, it’s interesting to note that CLH managed to grow bigger every year, with a few exceptions, showing a compounder-type DNA. It also reveals how resilient this business is in the face of economic shocks, which might explain why investors are now increasingly interested in CLH and the waste management sector.

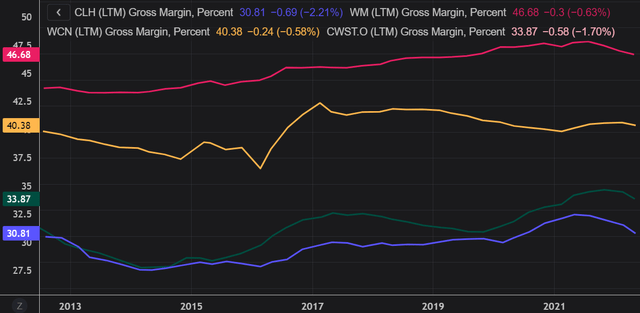

The company has a ~31% TTM gross margin, which is close to the historical high of 32%. Given how high inflation is today and where we are in the business cycle, a decrease in gross margin could be a plausible scenario over the next quarters. As a result, I think it’s totally possible to see the gross margin reverting to the historical average of 28-29%. For the time being though, CLH continues to profit from solid demand as illustrated by the company’s utilization rate which increased from 80% in Q1 FY21 to 85% in Q2 FY22, giving the firm pricing power in the process. Management expects capacity to remain scarce in the future, which makes its plan to add 70,000 tons of additional capacity by FY25 very valuable in this market.

Within our disposal network, incineration utilization improved to 85% from 80% in Q1 a year ago. Average incineration pricing was up 2% from a year ago based on mix in the quarter, which included some project volumes. So, if you use a market basket approach, our average price was up 7%.

Alan McKim – Chairman, President and Chief Executive Officer

When we are looking at how the company performs relative to competitors, CLH’s profitability metrics remain at the lower end of the spectrum. I believe this is the main reason why the stock trades at lower multiples compared to companies such as Waste Management (WM), which generate a higher ROE.

All in all, I think the company is well on track to achieve its annual free cash flow target. Management guided to a range of $250 million to $290 million, which is slightly lower than what I have assumed in my previous article. That said, it’s important to remind investors that CLH is investing a substantial amount of its operating cash flow in the Kimball facility which is expected to increase the company’s capacity in the future.

Based on our Q1 free cash flow results and working capital assumptions, we continue to expect 2022 adjusted free cash flow in the range of $250 million to $290 million or a midpoint of $270 million. I’d like to remind everyone that those numbers include the substantial investment in our Kimball facility of $40 million to $45 million.

Michael Battles – EVP and Chief Financial Officer

Valuation

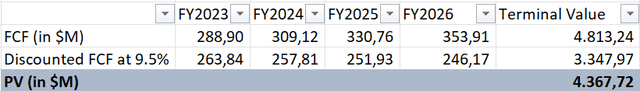

In my previous article on CLH, I have come up with an intrinsic value of $83 per share. We are now trading close to my previous estimate. Based on 54.4 million shares outstanding, the company has a market cap of approximately $4.7 billion. In this part, I have updated my DCF model to reflect some of my latest assumptions:

- Estimated free cash flow for FY23 of $289 million – the amount is calculated assuming the $270 million estimate for FY22 provided by management grows at 7%.

- A growth rate of 7% until FY25 – revised upward. I believe CLH proved it has the ability to grow faster than the market.

- A 2% terminal growth rate – unchanged.

- A 9.5% discount rate – unchanged.

Based on my updated model, the fair value of the stock is around $80 per share, which is ~3.6% lower than my previous estimate. The stock isn’t a bargain yet, but we’re not far off from a level where I would consider CLH an attractive buy. On top of that, there has been some consolidation in the waste management industry over the last months, which signals that CLH could be a potential M&A target for a larger player. There were rumors in early March 2022 that WM was interested in acquiring CLH and I wouldn’t exclude such a transaction in the near future.

The price-sales ratio (“P/S”) is another good indicator to determine if CLH is in value territory at the moment. While we are clearly getting a better deal today on this stock than six months ago, it’s possible we are still far from the bottom. CLH trades at ~1.1x sales which is the average historical P/S value in my opinion. Getting anywhere below 0.8x sales would be closer to historical lows and would imply a better deal for investors. Ultimately, I think this stock will trade below my estimate of $80 per share in the coming months, which will make CLH even more attractive.

Key Takeaways

In early May 2022, the company reported better-than-expected results, prompting me to reconsider some of my previous assumptions. For example, I believe CLH has a good chance of growing faster than the industry average of 5%. Overall, I believe the stock is worth $80 per share, which is close to the current market price of nearly $87 per share. Given how volatile the equity markets have been so far this year, I think patient investors will be rewarded in the future when the stock will trade below my fair value estimate. On top of that, the lower the price will go, the higher the chance CLH becomes a serious takeover target for a larger player.

Be the first to comment