Ralf Geithe/iStock via Getty Images

Earth First Investments 6: Clean Energy Fuels

Clean Energy Fuels (NASDAQ:CLNE) is a major distributor of natural gases of multiple types, with a renewed focus on Renewable Natural Gas (RNG). The company has a network of stations across the US, the majority of which in partnership with Pilot Flying J (BRK.A) (BRK.B), and there are now over 500 locations. Additionally, RNG sales have increased over 30% per year since introducing the product line in 2014. However, multiple issues have led to the company seeing negative income and revenue growth over the past 10 years. Investors have become incensed, and the company has offered some of the worst returns in the sustainable tech market.

The Major Considerations

Renewable Gas Is Good for the Earth

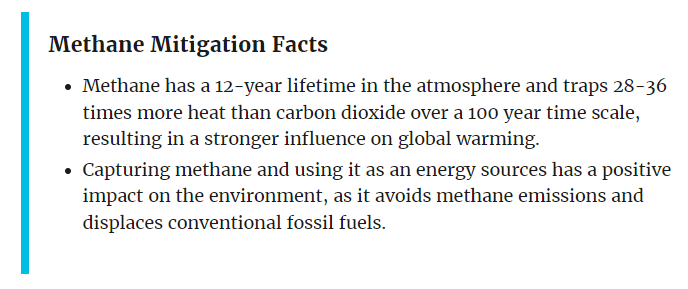

I am sure you hear this enough, so I will make this summary succinct. By leveraging an existing renewable asset, animal waste, CLNE is able to develop a fuel that will not disappear over time and reduces emissions. One may wonder why emissions are reduced, and this is mostly due to the fact that the process captures methane, a far more potent greenhouse gas than CO2. Additionally, while EV and H2 vehicular and grid scale applications advance in feasibility, current green sourced CNG, LNG, and RNG combustion offers far better sustainability profiles than coal or fossil fuel-source gas. Should help growth and profits, right? Nope. However, there is a sizeable niche in manure-based RNG that CLNE can leverage long-term.

EIA

Demand is Not the Issue

Demand for cost-effective renewable gas is huge. This is highlighted by dozens of fiscal policies around the world, B2B arrangements and contracts, and the sheer diversity of applications. As such, this is not the issue, and revenues should be growing. The main problem is that companies such as CLNE are unable to commercialize their products to an extent that is both profitable to the company and competitive with the alternatives. It is a bit of a dog eat dog world as those who require fuel sources contract out just the cheap availability while expensive options face steep losses.

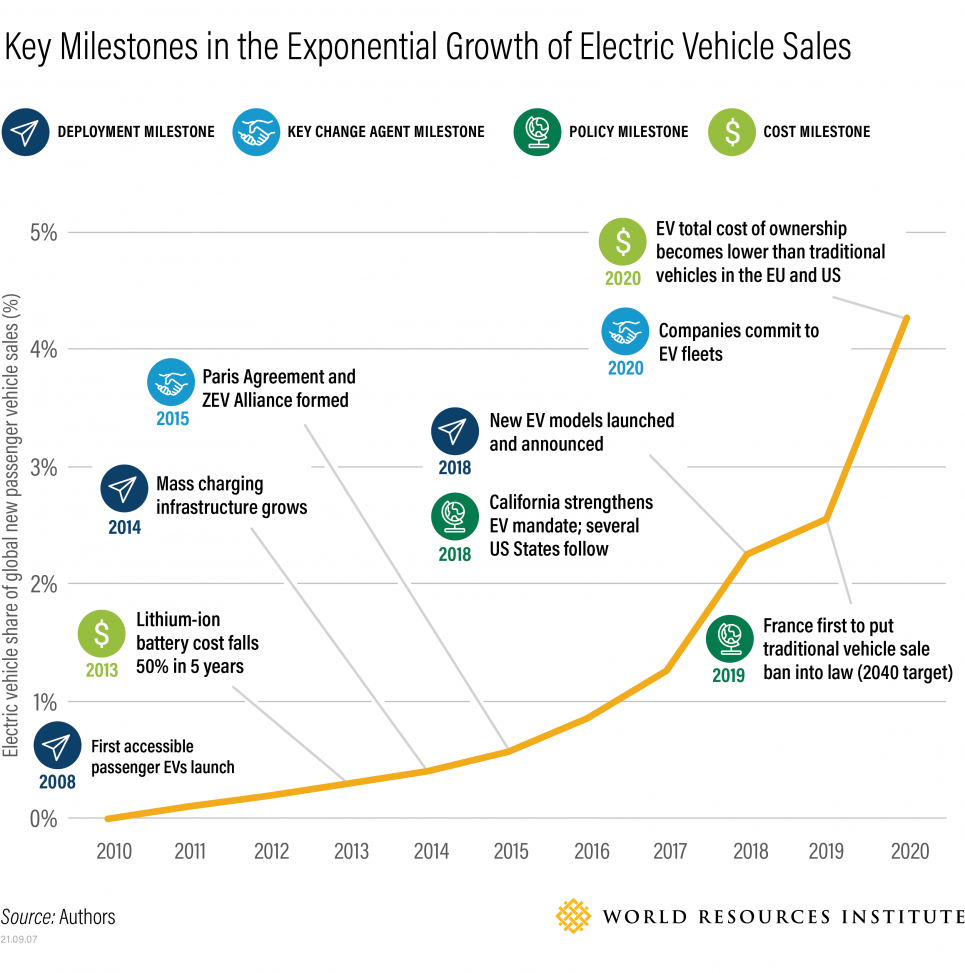

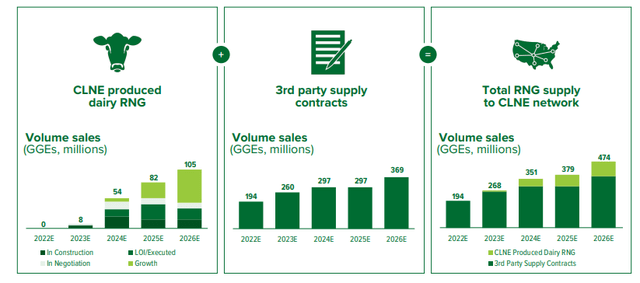

To highlight the slow supply growth, CLNE has only increased RNG sales from 14 to ~194 million gasoline gallon equivalents (CGEs), or 40% per year, since 2014. Meanwhile, EVs have grown at or above a 50% rate during the same period. Further, H2 production and usage is expected to grow over 40% over the next five years as well. Growth is inhibited due to the fact that a single fuel source (animal waste) is required. Additionally, limited growth in dairy cattle, whether due to milk demand or per cattle production efficiency, limits the outlook for RNG production.

WRI

Expanding Station Count, Falling Revenues

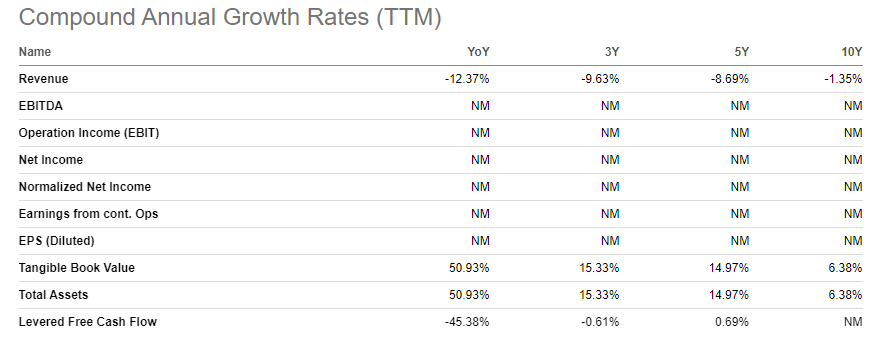

Clean Energy Fuels now distributes gas products at over 550 stations across the US and Canada. Additionally, dozens more are slated for development or already under construction. I also mentioned earlier how RNG sales have increased over 30% per year since 2014. However, a major red flag is that total revenues have been declining over the past decade. Whether this is due to sale price decreases or increased supplier prices. 2022 may end up a critical year to see how the company can operate a high-demand, high-price environment. While traditional fuel and commodity suppliers are seeing higher profits and revenue growth, CLNE has yet to do so at an equivalent rate. Although last quarter saw favorable YoY growth so watch this trend continue.

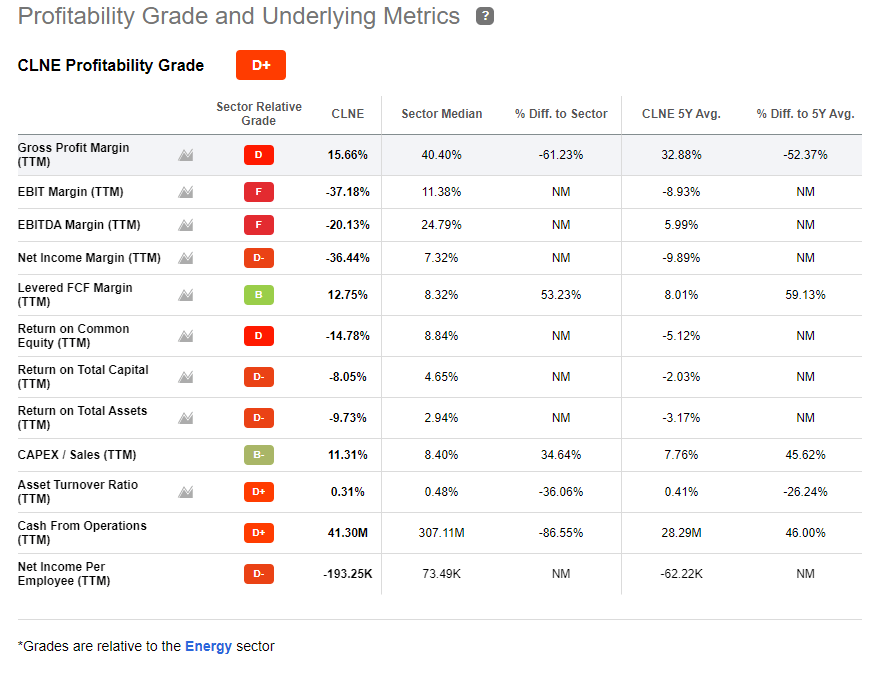

Along with slow revenue growth, earnings are nonexistent. Gross margins have fallen from a 5 year average of 32.9% to 15.7%, while the net income margin has fallen from -9.9% to -36.4%. Not a good look as most other companies in the market show the opposite effect. Some solace can be found in the fact that debt is not an issue, and the positive cash position of $150 million can support around 2 years of operations at 2021 expense levels. This is the only saving grace, especially as sales of in-house RNG may prove more profitable than supplier-based RNG, and are slated to come online in 2024.

Seeking Alpha Seeking Alpha

Diversification VS Specification

The company has begun to move into developing RNG in-house due to lacking supply. This creates significant risk due to the need for contracts with farms. Further, spending related to this segment has led to losses over the past few years, with limited insights into the available output in the future. Current company estimates suggest up to 105 million GGEs by 2026, but this is only a quarter of the estimated total supply in that year. The supply contracts and third party purchases are slow moving and uncertain, but perhaps the company should focus on expanding supply partnerships. If CLNE wants to produce RNG now, why did they sell their upstream RNG assets to BP (BP) in 2017? This lack of focus will present symptoms such as further losses, reduced growth, and lower support valuation in the years ahead.

Significant costs for advertisement, partnership development, and retention of the world’s dairy farmers will be a hidden cost that also detracts from the investment thesis. As exhibited by the reduced anticipated supply growth and continual losses, these factors are playing a large role in the poor financial performance of the company. While the environmental benefits make me desire growth in this segment, I fear the issues are too influential.

Conclusion

The issues above have left some to question the capabilities of the management. While SA comments are hardly a reason to question the results we see, I find that risks outweigh the benefits of an investment in the company. The lack of direction, whether to be solely distributors or not, being the major negative catalyst. Perhaps focusing on one at a time would have been a better option. Even Standard Oil didn’t start out as a distributor, refiner, explorer, and driller all at the same time, but they show the potential of a market built upon limited competition and capable management.

The fact is, competition against peers and other energy sources prevent me from finding interest in the RNG or alternative markets as a whole. This is especially true if there is limited potential in place or a lack of clear goals for the future. To realize their full potential CLNE must: be realistic about the supply capabilities of the RNG market, understand how they be cost-competitive at market average profitability, and create growth through profit reinvestment In the end, I recommend taking a look at other opportunities in the market.

The only other potential for shareholder returns in my eyes would be M&A by a fossil fuel company attempting to diversify (likely Total (TTE)) or sustained extreme gas prices (but the company must make profits to even benefit). If you find that a risk worth taking, feel free to let me know your trading strategy. If you want some exposure to manure based RNG production, then you can consider Dominion Energy (D) which has a partnership with Smithfield (OTCPK:WHGLY) or Sempra (SRE) which uses California dairy farms as a gas source.

Thanks for reading.

Be the first to comment