JHVEPhoto

On Wednesday morning, Citizens Financial Group (NYSE:CFG) reported excellent quarterly results that showed the stock to be extremely cheap after its 23% decline this year. Having completed its two acquisitions, the business is operating strongly with solid credit results and extremely impressive deposit performance. This positions the company to be a significant winner from higher interest rates with over $5 in earnings power next year.

In the company’s third quarter, Citizens earned $1.30 in non-GAAP EPS (which excludes merger integration expenses) on $1.27 billion of revenue, both a bit ahead of consensus. In the quarter, CFG’s return on common equity was 10.9% and on tangible equity, 17%. The company closed its acquisition of HSBC’s east coast branches in February and its purchase of Investors Bancorp in April. These two acquisitions account for about 15% of its loan book now, giving the company deeper penetration in its Northeast markets and more exposure to the growing Florida market. For bank investors, the two focus points this quarter has been deposit retention/net interest income and credit performance. On both counts, CFG impressed.

As with virtually all banks, CFG is reporting higher net interest income and wider margins (NIM) as its floating-rate loan book benefits from the Fed’s hikes. Net interest income rose 45% from last year and 11% sequentially to $1.66 billion. NIM expanded by 52bp from last year to 3.24%. The company grew its loan book by 2% QoQ, led by strong commercial and industrial lending activity. A larger loan book at higher rates compound to create meaningful interest income growth. Overall, interest-earning assets increased by $4.6 billion to $203.6 billion.

This loan growth was supported by extremely strong deposit performance. During a quarter where many banks are seeing deposit flight as consumers spend down savings, the Fed began Quantitative Tightening, and higher rates in money market funds provided competition, CFG grew average deposits by $1 billion quarter over quarter to $177.6 billion. After a merger, I always worry that if things do not go smoothly, there can be some customer churn. CFG has not experienced it and was a clear share winner.

During the quarter, asset yields rose 56bp while funding costs rose 34bp. Deposit costs were up 27bp to 0.39%. In aggregate, its funding costs had a 0.18x beta, meaning for every 1% higher in interest rates, it had to raise the interest it paid by 0.18%, a solid performance in-line with what others reported, so it is not as though CFG is paying up aggressively to generate this better deposit performance. As interest rates continue to rise, funding betas may go up as other investment options become more appealing, but management continues to expect its loan net interest expansion to exceed any increase in funding costs.

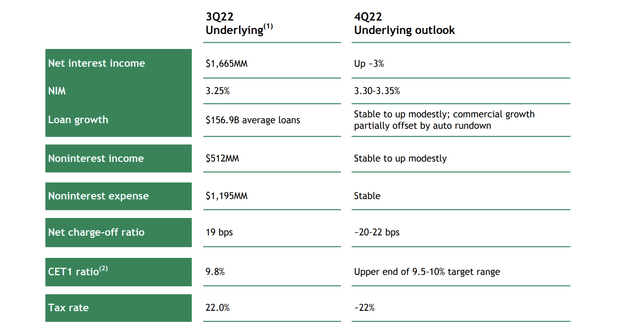

As a result, NIM should expand again in Q3 to 3.3-3.35% on its way to at least 3.50% by the end of 2023. Management also implemented hedges during the quarter, which should keep NIM above 3.25% through the end of 2024 even if rates decline 200bp. Locking in these higher margins should alleviate concerns that CFG is enjoying a one-time benefit, as it should see equal or greater net interest income over the next two years than it is earning now. Indeed, 2023 NII should be about $500 million higher than its Q3 reported run-rate based on this guidance.

While a smaller component of the business, it was encouraging to see noninterest income hold flat from last year at $512 million. Stable capital markets activity during the quarter was a particular bright spot given weakness in investment banking activity reported elsewhere. Mortgage banking fees are moderating, given the slowing in the housing market.

On the credit side, we are seeing ongoing normalization but to reasonable levels. Provisions for credit losses were $123 million, up $51 million from last quarter excluding merger impacts. This resulted in a net build of $49 million during the quarter. The bank has $2.2 billion in allowances for credit losses, providing 2.6x coverage of its nonaccrual loans. This means Citizens can see more delinquencies without necessarily needing to set aside more money to cover them. Its allowance for credit losses accounts for 1.41% of its loan book. On average over an economic cycle, this figure would be 1.3%, so CFG has reserved for a worse-than-normal outcome. This should alleviate some concerns that credit losses will continue to spiral ever higher as CFG has gotten out in front of potential economic weakness.

Moreover, it could triple its quarterly build from the Q3 level and still generate greater earnings next year due to higher net interest income. Higher interest income provides a material buffer against a material worse credit outcome without eroding earnings power. As you can see in the company’s Q4 guidance, NIM should expand with loans stable to up slightly while net charge offs are only marginally higher than experienced in Q3.

The bank’s capital position is solid at 9.8%, just above the midpoint target. This will enable the company to restart buybacks this quarter, and it can sustain a $400 million quarterly pace alongside paying its $0.42 dividend (for a 4.55% dividend yield) while holding capital broadly constant. Tangible book value is $26.62 while book value is $42.55, and these repurchases will help to grow these measures over time.

Assuming a doubling in credit losses from here, CFG has $5.50-$6.00 in earnings power next year depending on just how high interest rates go. With its strong deposit performance, CFG stands out as being able to capitalize particularly well on higher rates, and its existing reserve appear sufficient to cover a meaningful rise in delinquencies should the economy roll over. Shares are trading below 7x earnings, which I view as extremely compelling given these fresh results and strong operating performance. Over the next twelve months as buybacks turn on and investors see the resilience of its earning power, I think shares can return to their high of around $55, which is still just 10x earnings.

Be the first to comment