Mario Tama

Citigroup (NYSE:C) is currently trading at ~0.55x tangible book value. The most frustrating thing for Citi’s management team (and investors, of course) is that Citi had to suspend its buybacks so that it can grow its common equity Tier 1 (“CET1”) to the new target of 13%. I am sure that Citi’s CEO, Jane Fraser, would love to be buying back shares for 55 cents on the dollar as soon as humanly possible.

In fact, Jane’s strategy for Citigroup is premised on reducing its capital requirements going forward. The strategy of selling the global consumer bank as well as pivoting to more stable and fee-earnings businesses such as the Wealth Management and Services divisions, should by design sustainably drive lower capital requirements for Citi.

In fact, this was my frustration with CEO Michael Corbat for many years. Especially, the insistence on keeping Banamex Mexico and other low-returning global consumer assets that in reality imposed a hefty “capital tax” on Citi.

Why are capital requirements so important for Citi?

In the simplest form, all else being equal, lower capital requirements translate to higher ROE for a bank. In Citi’s case, excess capital can also be deployed in a very accretive way, with share buybacks at well below book value. However, the level of capital requirements is also extremely important on a business operational level.

Take for example FICC trading, where one of the key pricing determinants is the capital allocated to a trade. Simplicity put, If Citi’s CET1 requirement is 11.5% as opposed to 13%, it can price the trade lower and be more likely to win the trade or alternatively generate better margins. The economies of scale in such a business (with a large fixed cost) come to the fore as well. The more trades Citi can underwrite profitably, the better the marginal returns on each trade become and creates that virtuous cycle of increasing returns that JPMorgan (JPM) seems to enjoy. As such, the top #2 players in FICC likely generate returns above their cost of capital, and #3 to #6 likely just meet their cost of capital whereas the rest are destroying capital (and thus many have exited this business completely).

So, in short, for Citi to operate with a lower CET1 ratio is of paramount strategic importance. And as mentioned previously, Jane’s strategy is, by design, a business model that is going to operate sustainably with lower capital requirements.

The recent setbacks

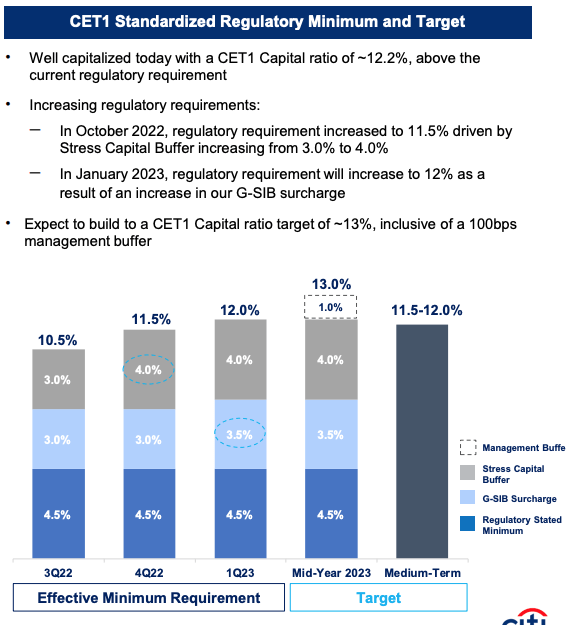

As readers are most likely aware, Citi’s CET1 target ratio has recently moved up from a target of between 11.5%-12% to 13%.

The below slide from the Q3 earnings report sets out the reasons for the increased capital requirements and timelines:

Investor Relations

In summary, there are two elements that have driven the increase. Firstly, it was the G-SIB surcharge that increased by 50 basis points. It is important to note that the G-SIB surcharge is a size/notional and not a risk-based calculation that is denominated in Euros (and hence a strong USD is a headwind for the U.S. banks). Over time, as Citi completes the global consumer divestitures, I expect the G-SIB score to reduce quite mechanically.

The second factor that contributed 100 basis points is the 2022 annual CCAR stress test, which was based on Citi’s balance sheet as of the 31st of December 2021. Citi’s CCAR results were disappointing as I discussed in detail in this article and the main culprit, in my view, has been its positioning in the trading book.

The good news is that CCAR is an annual exercise and the next iteration will be published in June 2023 or 8 months away. I am very confident that Citi will perform well in this cycle. And I expect Citi to reduce its CET1 target in 2023 by 50 basis points (base case) or 100 basis points (more optimistic scenario).

What does that mean for the buybacks?

Citi is likely to reach or exceed its target CET1 ratio of 13% by June 2023.

By June 2023, I expect Citi’s CET1 target to revert to between 12% and 12.5%. This would leave Citi with ~6b to 12b excess capital in June 2023. Add an additional ~$11 billion of annual capital generation (earnings less dividends), then Citi should be able to purchase $17b to $23b of its stock in 12 months or between 19% to 26% of its stock at current market value.

Additional capital may be generated by disposals as well that can be opportunistically deployed to buybacks (e.g., Banamex Mexico could release as much as $8 billion of capital).

Final thoughts

Citi has been leaving profits on the table, especially in FICC trading, where it temporarily ceded market share. The rationale is clear, it is trying to reach its target CET1 ratio of 13% as soon as possible and thus reduced its RWAs allocation to the trading book.

Operating with a lower CET1 target is a strategic imperative for Citigroup both from an ROE perspective, but importantly also at a business profitability and competitive position level.

It is very clear to me that it will look to reposition its book at year-end with the express objective of outperforming in the next CCAR cycle.

Longer term, I expect Citi to operate with a lower buffer that is more similar to its peers (i.e., a buffer of 50 basis points as opposed to the current 100 basis points). Once the divestitures will be completed, this should also put downward pressure on both the G-SIB score as well as CCAR outcomes.

Restarting share buybacks is a game-changer for the stock. There is an outside possibility, Citi will decide to commence some share buybacks as early as Q1 2022.

Given this catalyst (amongst others), I remain very bullish and Citi is a conviction buy for me currently.

Be the first to comment