JHVEPhoto

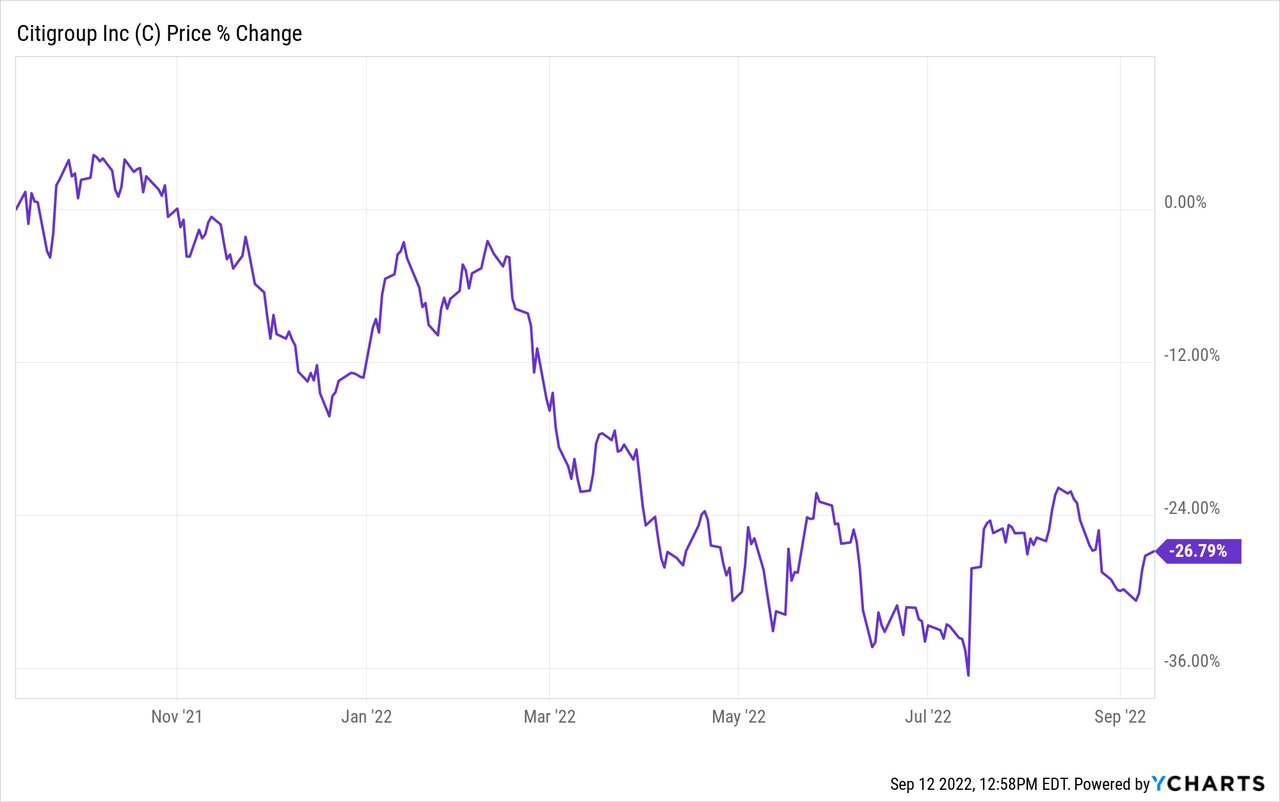

We covered Citigroup (NYSE:NYSE:C) in a bullish article more than a year ago and wanted to revisit our stance. After a severe drawdown in its stock price, the bank’s key metrics imply that its stock might surge. However, we’d like to encourage investors to remain cautious as these metrics can be misleading in the wake of a severe economic downturn, which seems likely at the moment. Therefore, we’re assigning a cautious buy rating to the stock as we believe it’s oversold. Nonetheless, we’ll revisit our rating if we feel that systemic risk isn’t improving.

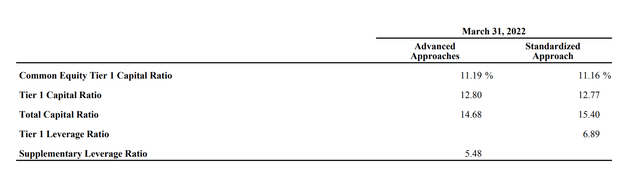

Basel III Stress Test

For those who’re unaware, the Basel III stress test is a globally accepted acid test undertaken by banks to convey their risk-weighted profile pertaining to their investable assets.

Based on Citigroup’s latest stress test, the bank’s in solid shape. The firm’s standardized CET 1 of 11.16% is above the 4.5% requirement, meaning that its equity-based investments provide a sound risk-return profile.

Furthermore, Citi’s general tier 1 capital and total capital ratios exceed the 6% and 8% thresholds, implying a solid composition of the bank’s traded and quoted assets.

De-Risked Business Model & Impressive Earnings

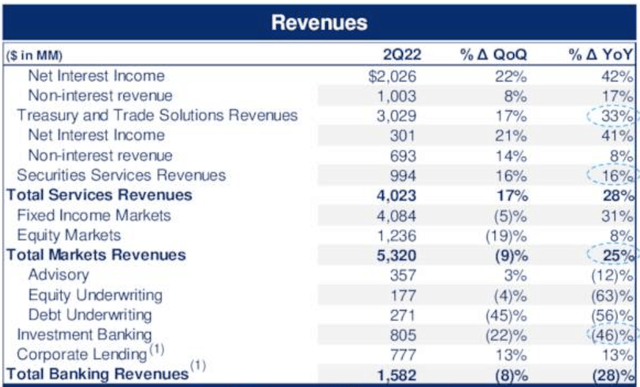

When Jane Fraser took over as CEO in 2020, it was decided that Citigroup’s business model would pivot into a services-orientated vehicle instead of relying on depositary banking and trading services to generate the bulk of its revenue.

A bank generally has three prominent segments: trading, lending and services. The services segment is the least risky of the three segments. As such, it’s prudent to say that Citigroup is aiming to de-risk its business model.

Broadly the bank seems to be performing well. In its previous financial quarter, Citi toppled its earnings estimate by 63 cents per share, with its services segment (revenue) gaining by 28% year-over-year, led by a 33% increase in treasury and trade solutions and a 16% in securities services.

Looking ahead, I won’t be surprised if there’s a slight retracement in the bank’s earnings. Citi managed to capitalize on FX trading and interest income in the past year, which grew by 31% and 48%, respectively. However, considering the unpredictable central banking policies across the globe and the topsy-turvy economy, it’s unlikely that FX trading revenues and lending income will persist at their current levels.

Furthermore, 2022’s bear market is bound to put a dent in the firm’s ex-post earnings report, especially with its interlinkage to investment banking revenue, which has already plummeted by 46% since Q-2 2021.

Lastly, although Citi’s services-based business plan could de-risk its business model, we’re still in a recession/pending recession, meaning that we’ll almost certainly see softening in earnings of its key strategic division.

The Yield Curve

I’m sure you’ve heard the following statement about a thousand times during the past few years, but I need to repeat it as a formality. A rise in the yield curve implies that the market anticipates higher future benchmark rates, causing banking stocks to proliferate as a consequence of higher margins on loans.

However, there’s one fundamental problem here. Most analysts (including myself) mistook a bearish steepening of the curve for bullish steepening. Therefore, we didn’t consider the possible dominance of recession risk. Moreover, the yield curve is starting to flatten, meaning economists believe that long-term interest rates will rise slower than short-term rates, implying a prolonged stagnation of the economy.

A lengthy stagnation of the economy will possibly have an adverse effect on Citigroup as it’s a cyclical stock that requires robust economic support to thrive.

Relative Valuation Metrics & Dividend Analysis

I wanted to put in a bit of extra effort by doing an absolute valuation, but Citi’s ROE, CAPM, and dividend growth rate didn’t quite fit into the model I wanted to use. Thus, I opted for a parsimonious relative valuation.

Citi’s price-to-book ratio shows that the stock might be undervalued. Banks are always best valued by observing their price-to-book ratios as most of their assets are quoted and traded. Additionally, the stock’s price-to-earnings ratio is at a 40.97% sector discount, suggesting that we could be looking at a “best in class” banking stock here.

Please note that these metrics could be value traps if economic circumstances continue to worsen.

| Price-to-Book | 0.55x |

| Price-to-Earnings | 6.39x |

| Dividend Yield | 4.03% |

Source: Seeking Alpha

I’d also like to run through Citi’s dividend prospects because at a dividend yield of 4.03%, I can imagine that most of the bank’s investors are concerned with total returns instead of price returns.

The two most critical aspects to look at when you’re analyzing dividends are 1) cash flow from operations and 2) coverage ratios. Citi’s cash flow from operations remains resilient at $34.42 billion, which is 1.83x higher than its 5-year mean. Also, the stock’s dividend coverage ratio of 3.56x is simply magnificent. Thus, I’d conclude that Citi’s dividend prospects are sound and that it would take a significant systemic shock to alter proceedings.

Concluding Thoughts

Key metrics imply that Citi stock is undervalued, leading us to assign a buy rating. Furthermore, the stock’s dividend profile remains lucrative, making its total return prospects attractive.

Even though we’re bullish, we’re keeping a close eye on geopolitical and macroeconomic events as we believe the global systemic risk is still underestimated.

If you’re interested in more advanced analysis, be sure to keep an eye out for our marketplace program, “the factor investing hub”, which launches soon. FIH is an AI-driven “smart beta/factor investing” portfolio management concept with the goal of balancing long-term portfolios relative to “factors”.

Additional features will include emerging market risk discussions, earnings previews, and Q&A sessions.

The program will be available on Seeking Alpha’s marketplace starting October 6th, with a 14-day free trial.

Be the first to comment