Maxiphoto/iStock via Getty Images

Presidents are selected, not elected.”― Franklin Delano Roosevelt

We haven’t visited Kura Oncology (NASDAQ:KURA) since 2020 and I receive an inquiry on this name from a Seeking Alpha follower on this small cap oncology concern this week. The company has just posted third quarter results last week Therefore, we will circle back on Kura Oncology via the analysis below.

Company Overview:

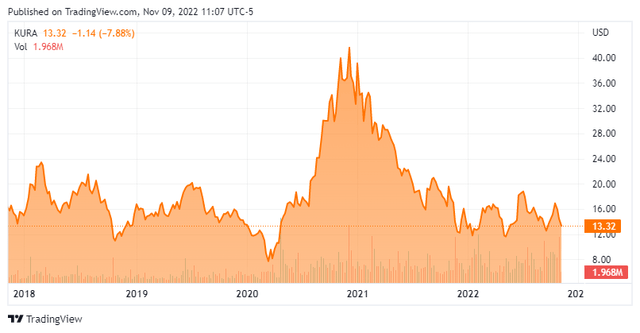

Kura Oncology is based in San Diego, CA. This clinical-stage biopharmaceutical company is focused on developing medicines for the treatment of cancer in the United States. The stock currently trades at just over $13.00 a share and has a market capitalization just north of $1 billion.

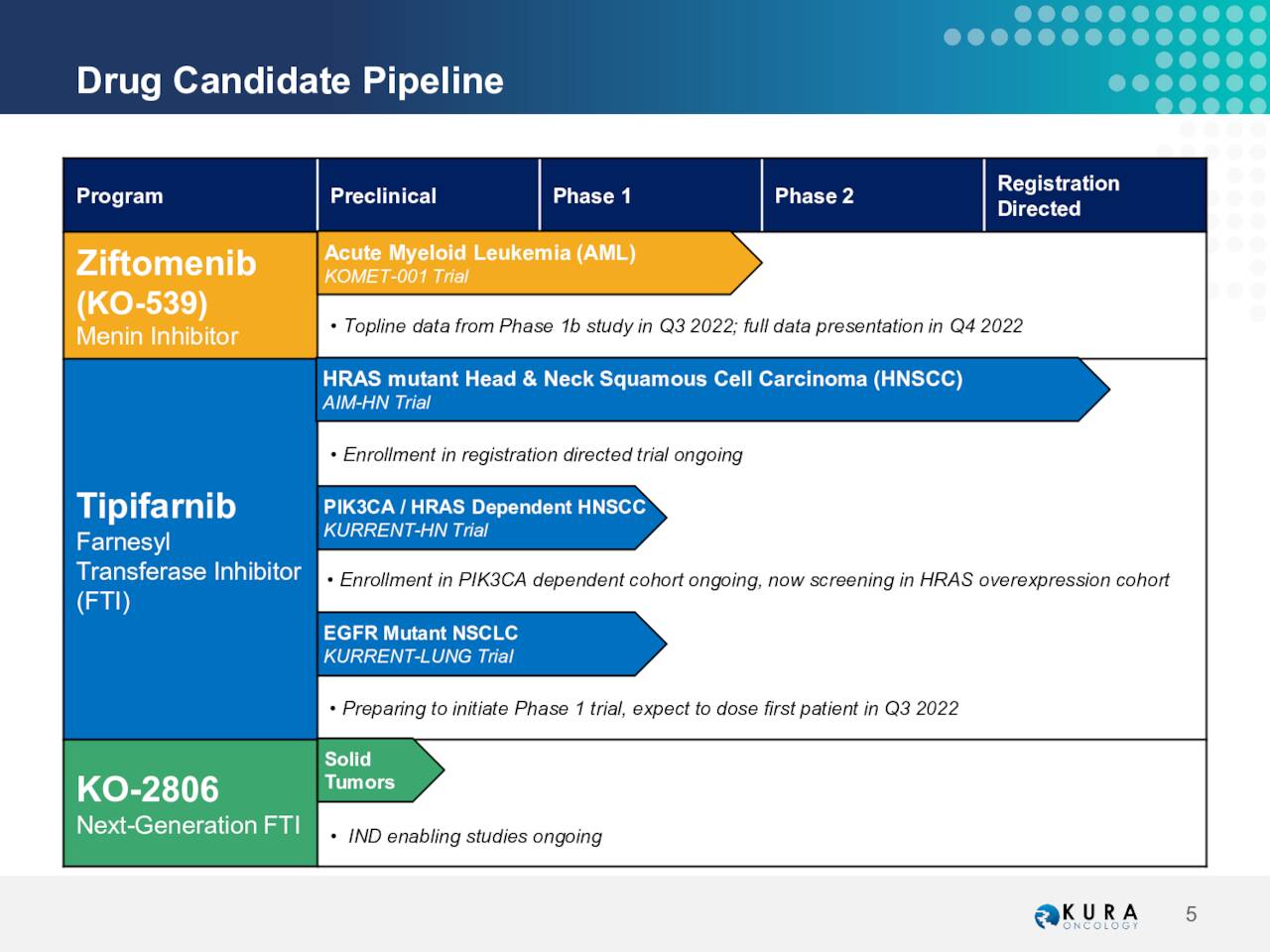

Pipeline:

May Company Presentation

Kura Oncology has several compounds in development. The most advanced of these candidates is Tipifarnib. This is an oral inhibitor of the enzyme farnesyl transferase and in-licensed by Kura from Johnson & Johnson’s (JNJ) Janssen Pharmaceuticals in 2014.

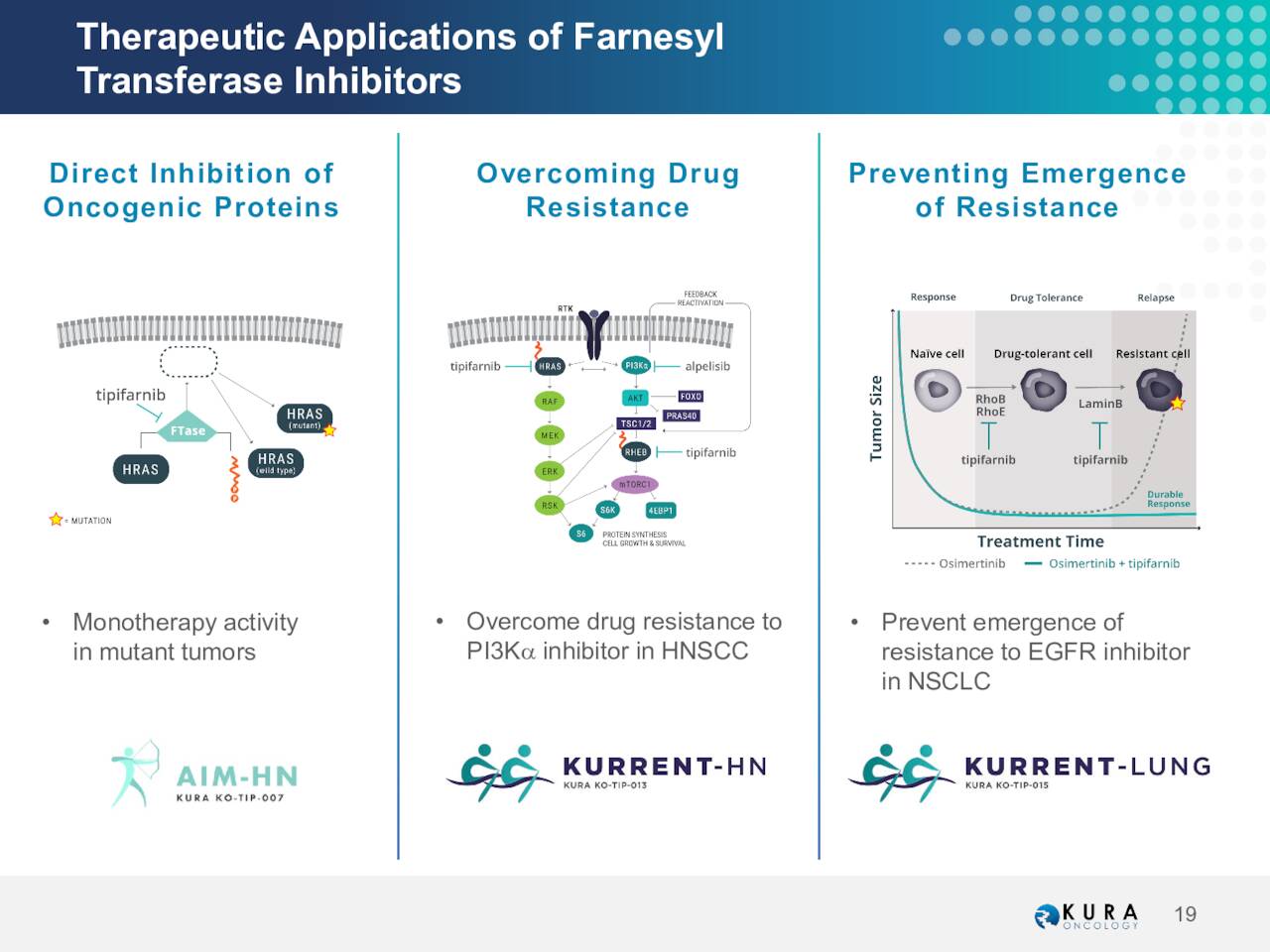

May Company Presentation

Tipifarnib has breakthrough therapy designation as a monotherapy in recurrent and metastatic HRAS mutant head and neck squamous cell carcinoma (HNSCC). A study was initiated late last year to evaluate the combination of tipifarnib and Alpelisib, an inhibitor of PI3 Kinase alpha in selected HNSCC patient cohorts. The initial cohort is comprised of patients with PIK3CA dependent HNSCC. In August, the company announced the first patient was dosed in a second cohort comprised of patients with HRAS overexpression. Currently, Kura Oncology is working to identify a recommended Phase 2 dose and schedule for the combination with a goal of determining the optimum biologically active dose for the PIK3CA cohort in mid-2023.

May Company Presentation

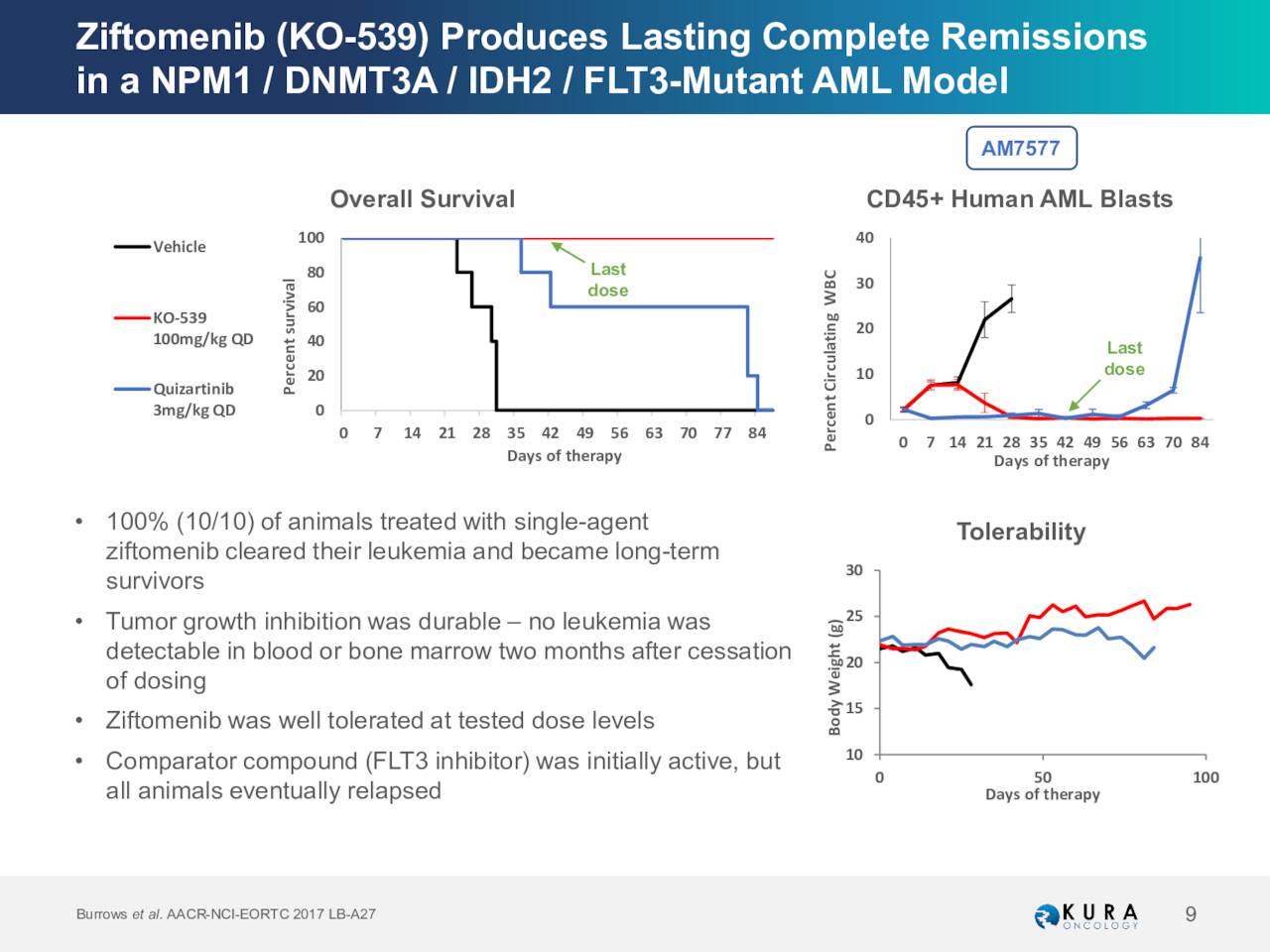

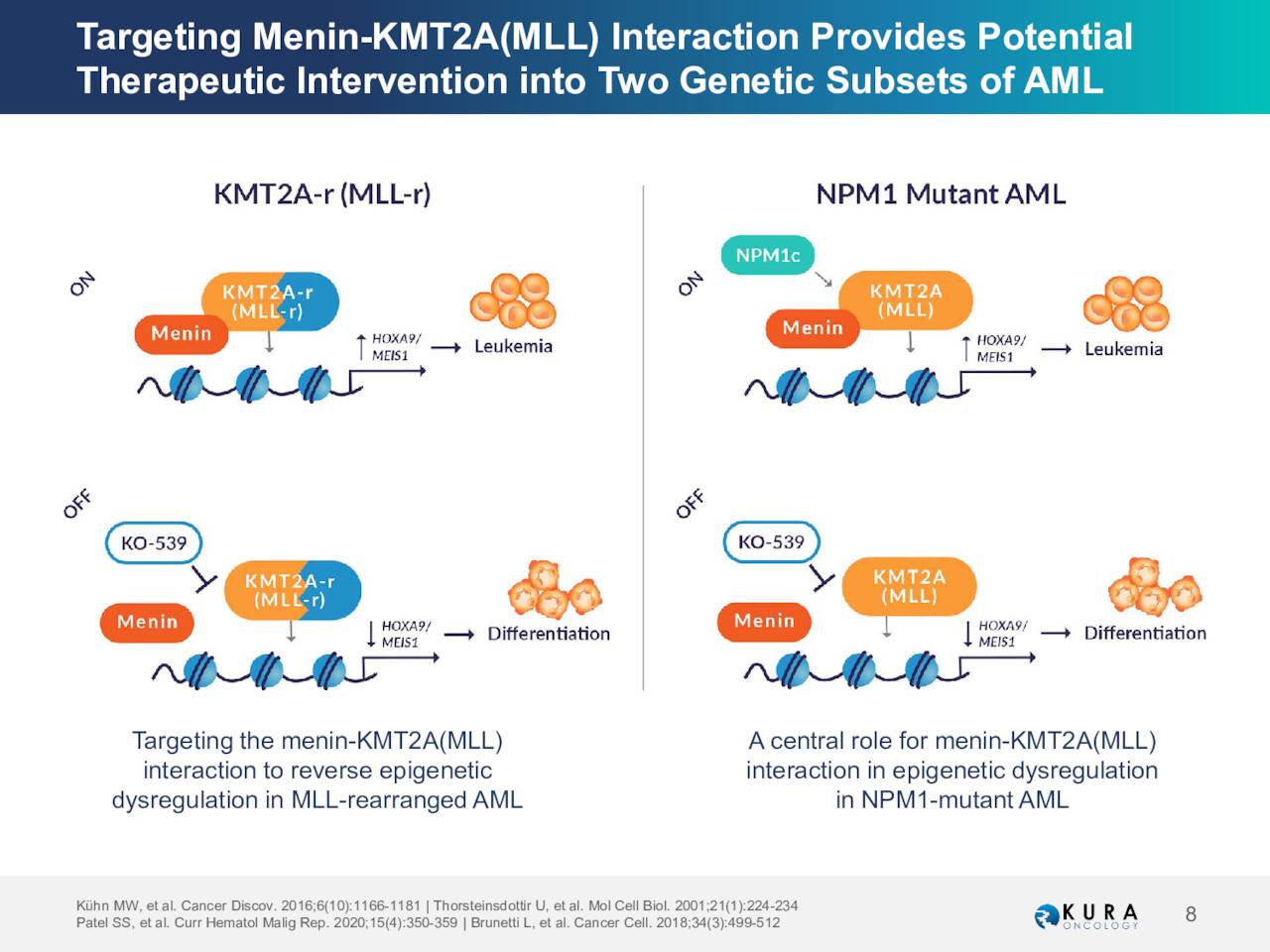

The second compound the company has gotten out of the clinic is Ziftomenib. This compound is a selective, small molecule inhibitor that blocks the interaction of two proteins menin and the protein expressed by the KMT2A gene. Ziftomenib had very encouraging pre-clinical data around targeting acute myeloid leukemia or AML.

May Company Presentation

The company will present a Phase 1 ‘KOMET-001’ data abstract around this inhibitor targeting AML at the American Society of Hematology or ASH meeting this year. This takes place in December in New Orleans. This data will include the Phase 1a dose escalation portion of KOMET-001 and 24 NPM1 mutant or KMT2A rearranged AML patients from the Phase 1b portion. Kura is currently awaiting feedback from FDA on the recommended Phase 2 dose for Ziftomenib as well as the protocol for the Phase 2 registration directed portion of KOMET-001. An article in July here on Seeking Alpha went into this ongoing study in more details.

Analyst Commentary & Balance Sheet:

Over the past two weeks, five analyst firms including Wedbush and Brookline Capital have reissued Buy/Outperform ratings on Kura Oncology. Price targets proffered range from $22 to $40 a share. Here is the commentary from JMP Securities which reiterated their Outperform rating and $22 price target on Monday.

Recently, Kura presented 3Q22 financial results, and provided a pipeline update including the discontinuation of the AIM-HN Phase 3 study. With ziftomenib (zifto, previously KO-539) accepted for an oral presentation at the 2022 ASH conference, early clinical activity seen in the tipi and alpelisib combination trial, plans to dose the first patient of tipi and osimertinib in 4Q22, the potential for a next-generation FTI to enter the clinic, and a strong cash position of $462.8MM (pro forma), we believe Kura represents an attractive opportunity, with an ~34% potential downside (bear case is $9) and ~142% potential upside (bull case is $33).”

Approximately 15% of the overall float is currently held short. There has been no insider activity in these shares since March of 2021. The company ended the third quarter with just over $425 million in cash and marketable securities against no long-term debt. The company had a net loss of $35.5 million during the quarter.

Concurrent to its earnings release, management disclosed that it has received a $25 million equity investment from Bristol Myers Squibb (BMY) at $18.25 a share and a term loan facility up to $125M from Hercules Capital (HTGC). Bristol Myers will appoint a member to Kura’s Global Steering Committee. Kura will maintain full ownership and control of its programs and operations. With this transaction, the company now has funding in place to fund all planned activities into 2026.

Verdict:

The company has several positive attributes. Kura has several ‘shots on goal’ Kura Oncology has put funding in place for the foreseeable future and enjoys solid analyst firm support as well. Insiders have not sold a share in over a year and a half. The percentage of shares short is somewhat concerning, but biotech has become a favorite short target given the poor performance of the overall sector since the beginning of 2021.

Given all the above, KURA seems to merit a small ‘watch item‘ position within a well-diversified biotech portfolio. I would prefer to establish an initial holding in the stock via covered call orders. Unfortunately, liquidity in the options against the equity is not enough to make this strategy viable. Therefore, I have picked up a few shares in KURA at an approximate 20% discount to what Bristol Myers just paid for their equity stake pending further developments at the company.

A writer must always tell the truth (unless he’s a journalist)“― Gore Vidal, The American Presidency

Be the first to comment