JHVEPhoto/iStock Editorial via Getty Images

In this article, we look at the company Church & Dwight (NYSE:CHD). This company is a consumer goods company based in USA, with the original and current business ideas circling around the selling of various forms of sodium bicarbonate, which is also known as baking soda. The company literally began out of the original founder’s kitchen 170+ years ago.

We’ll take a look at what this staple can offer you in a troubled and chaotic environment, and I will show you why, at the right price, this company is an appealing one.

Church & Dwight – Dozens of Products with Baking Soda

The company’s main product lines are based on baking soda, specifically the Arm & Hammer name. The logo and the name go back to the 1860s and is one of the older brands still existing in the US. The company, and the brand, have several firsts under their belt. In the 1970s, the company introduced the nation’s first phosphate-free detergent product – the Arm & Hammer Powder Laundry detergent. At this time, the harmful effects of phosphates were just starting to be known both for humans and for bodies of water – and that’s where the company entered the market.

Today the company manufactures and distributes a variety of consumer household and personal care products as well as specialty end products in the end markets for animal and food production, chemical businesses, and cleaning products.

The company’s primary focus is on its 14 so-called “power brands”, including well-known brand names like Arm & Hammer baking soda, cat litter, detergent, deodorizer, and other soda-based household products.

Church & Dwight Presentation (CHD IR)

The company also owns and distributes:

- TROJAN Condoms, Lubricants, and Vibrators

- OXICLEAN stain removers, cleaning, detergents, and bleach

- SPINBRUSH battery-operated toothbrushes, competing with some of the main brands on the market

- VITAFUSION/L’IL CRITTERS gummy dietary supplements for children as well as adults

Church & Dwight Brands (CHD IR)

…and many others. In short, the company produces several product lines for many different household segments. The company sells under a variety of brands through a broad distribution platform including supermarkets, mass merchandisers, wholesale clubs, common drugstores, convenience stores, home stores, dollar stores and so forth – virtually everywhere they sell household products. The company also sells in bulk/wholesale to industrial customers, livestock producers and other players through distributors. More than 80% of company sales annually are represented by these power brands.

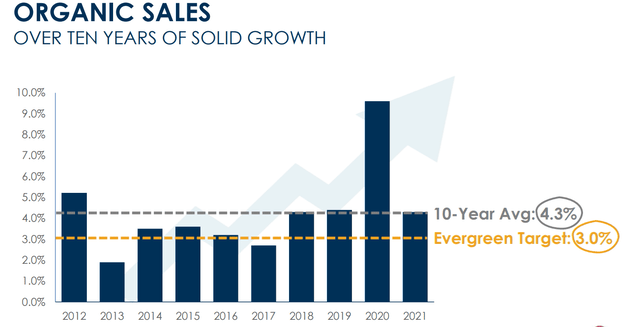

The company practices organic and inorganic growth strategies. The latest inorganic/M&A growth strategy was the acquisition of Dr. Harold Katz/HP-IP International, which contained the entire line of oral care products under the TheraBreath brand. The asking price for CHD was just over half a billion dollars net of acquired cash, which comes to a 5.5X sales revenue multiple based on around $100M in annual sales.

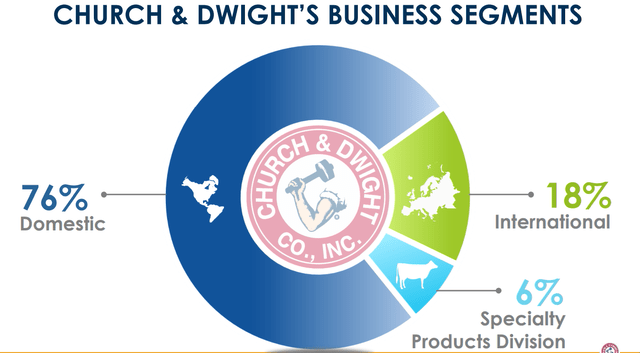

The company’s organizational structure is simple. There’s Consumer Domestic, which is the NA organization, structured into the sub-segments of Household Products and Personal Care products, which come to around a 50/50 split in sales with a slight tilt to Household Products, including detergents, laundries, and the like.

There’s also Consumer International business, which focuses of course on the company’s international business. This focuses on the international sale of personal care, household, and OTC products for the French, Australian, Canadian, German, Mexican, and UK markets, as well as over 130 global export markets including Asia. CHD isn’t a massively international business at around 18% of total sales. The largest of the international businesses are found in Europe, Canada, Australia, and Mexico, which accounted for over 60% of total international sales.

The company also operates a Speciality products (SPD) division, which focuses on animal/food production, specialty chemicals, specialty cleaners, and the like. This is a small segment for the company, with around 6% of total annual revenues.

Competition & peers? The company is in a highly competitive market in the personal care and household segment. This is characterized by a continuous flow of new products to market on an annual basis. Economies of scale are key here – and usually, only the largest players survive consistently. CHD competes on the basis of continued product innovation and sales performance, brand recognition, price performance allowed through economies of scale, and other consumer benefits. The consumer products, with products such as dietary supplements and laundry, are subject to massive price competition on a global basis, and the company needs to continually check its pricing here.

Church & Dwight has a long history of compounding value over time. 13 of its so-called power brands are former M&As, which means the company is one of the best M&A’ers and brand managers in the entire market. The company acquired Trojan, Xtra, First Response, Nair in -01, Spinbrush in -05, Oxiclean in -06, and the like.

Unlike other peers, Church & Dwight isn’t only a superb brand manager – it’s a brand builder and manager with a history unlike really any other. One of the company’s advantages in terms of its product and sales mix is that the cash flows are virtually immune to recessions and downturns. It performs well in either environment – up and down. The company is a market leader in fundamental categories required in households and fundamental industries – like litter, flossing, shampoo, toothpaste, baking soda, laundry, hair growth, pregnancy test kits, stain fighters, condoms, and the like. It’s a very appealing product portfolio.

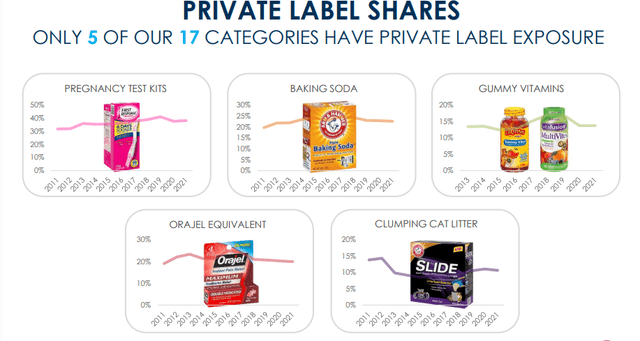

One of the main problems for companies like this is the influx of private label products and deals that dilute margin and the sales mix. However, CHD has remained consistently low in terms of private label exposure, with only 5 of the company’s categories having private label exposures. This is an additional safety for CHD.

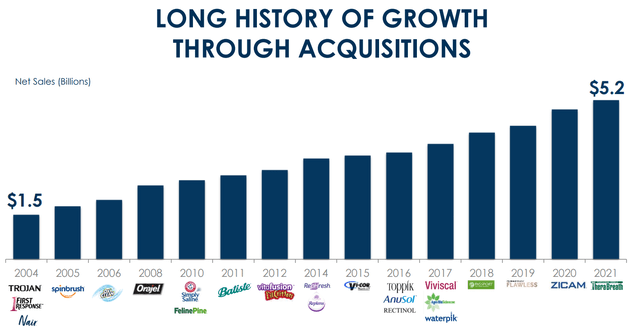

The company has a decades-old M&A strategy that’s proven to work, and there’s plenty of room for the company to grow internationally. International sales have been growing, and they will continue to grow – almost doubling in 5 years. The company is also expanding into some excellent verticals and new growth segments, such as the animal segment, that’s well-positioned for continued organic growth.

CHD is an asset-light, quality-heavy experienced M&A’er and one of the best value compounders on the market, turning good into great shareholder returns with an almost tripling of net sales in 19 years. The company expects a minimum of 2% CapEx investment as a percentage of sales in order to improve its products and its portfolio.

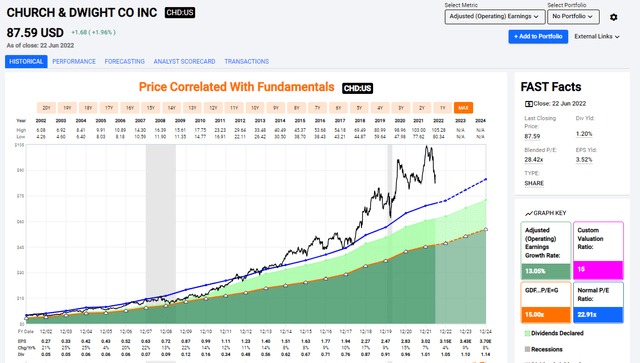

This makes the company appealing – and recent results have been good enough, even if the company’s valuation has been changing. CHD is a ridiculously stable generator of earnings, with a 20-year average EPS growth rate of 13.05% – incredibly good.

That means that usually, this company is at a significant overvaluation. You haven’t been able to pick up CHD below 20X for many, many years.

Let’s look at that valuation.

Church & Dwight’s Valuation

As mentioned, Church & Dwight isn’t exactly the sort of company that’s cheap all that often. The history shows what’s happened to the company since around 2017.

CHD Valuation (F.A.S.T Graphs)

It’s a stretch to call CHD any sort of undervalued here. The company still has a long way to go to below 20X P/E. However, it’s currently dropped below the 10-year average of 28X, which is the first time in over 6 months.

Valuing this company, you have to look at premiums unless you want to wait for the company to drop well below 20X P/E, which it might do eventually now that we’re in a downturn – but it will take time. Given this company’s typical historical beta, the market would have to drop significantly for this company too, if the beta is retained, drop below 20X P/E.

That means you’re left with two choices – wait or invest at 27X+ P/E.

It’s clear to me, based on company fundamentals, forecasts, management, and company plans, that this company is set to continue compounding value. Its M&A of oral care will likely add yet another feather in its cap. This is because of CHD only M&A’s potential, or the already-existing market leaders. I believe there’s a small chance the company would fail to realize the potential in such a business, once acquired.

What I am saying with this is that investing at a 10-year P/E premium might not be a bad choice.

CHD is a BBB+ rated stalwart with a significant dividend tradition, decent DGR, and a growth trajectory, both historical and forecasted, matched by almost none.

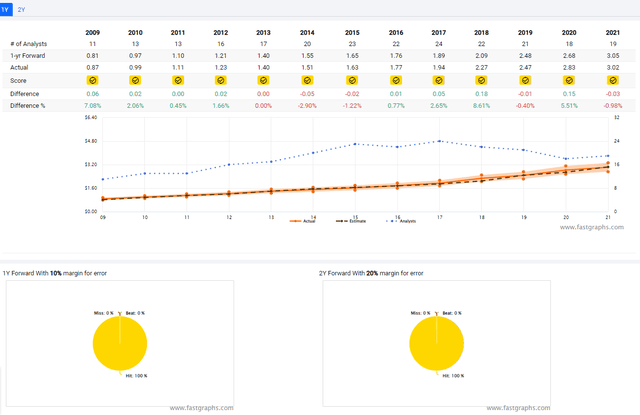

Analysts never miss forecasts. Not on a 1-year or 2-year basis. Oh, they miss by between 0-8% – but this is something we can consider truly minor, and in context, this is like almost having a crystal ball for the company, knowing it will advance.

CHD Analyst Scorecard (CHD IR)

Your upside is relatively small. Considering a 28X 5-10 year P/E average, the upside is less than 10% at 7.29% annually, or 19.44% total RoR until 2024. This is pretty much right on the fence between unacceptable and barely acceptable returns in my book, even considering this chaotic market. Combine this with the modest yield of 1.16%, and as current figures stand, you’re barely beating inflation with that investment.

The difference is that this company’s fortress-type safety virtually/almost guarantees you protection against capital destruction. Investors that have gone deep into CHD have, over the past 20 years, been able to compound their returns at a rate of 16.5% annually, or 2,158%. That’s more than twice the rate of most indexes – and the company started out at a 20X P/E rate.

That is why I say that if this company ever drops down to 20X P/E again, I will be loading the truck to the tune of several percent worth of allocation in my core portfolios. A true long-term holding that will appreciate, I believe, over time the next 50-100 years as it has over the past 100.

However, it’s a tough call to make that investment argument at 27-28X P/E. Yes, capital appreciation and EPS increases alone, if you had invested at 27X in 2017, would have generated outsized returns of 13% annually until today. Based on such math, we can make an argument for investing at the premium here.

The flip-side risk is that a downturn could kill or dilute large parts of those returns in the medium term. The company’s EPS growth rate is expected to slow down somewhat in the coming years, and this could continue to weigh on CHD.

The frank truth I see here is that CHD is on the cusp of buyability. I can’t fault you for staking out a position at 27-28X P/E after the drop, because there are scenarios where this would be very profitable indeed. However, I believe that there are better, if not safer, alternatives out there for investing. When I see alternatives that give me opportunities of 15-30% annual CAGR until 2024E, it sticks in my craw to put that cash to work at 7-8%. that’s just the way it is.

I am personally willing to take on the risk of more volatility in exchange for higher, eventual RoR and higher yield. And that is something I believe I can get at this time.

S&P Global targets actually mostly agree with this assessment. The average of 18 analysts following the company find us at an upside of a mere 4-5%, with only 4 analysts at a “BUY” with 14 on the fence, either at “HOLD” or “SELL”. I wouldn’t sell CHD here, but I’d be more inclined to “HOLD” than I would to sell.

Price targets are hard to put on CHD, because every single sawbuck this stock declines from here on out, increases the relative annual upside we can get. Once it rises to 10-12%, this becomes a serious contender.

Once it goes to 15%, it becomes hard to ignore.

Once it goes above 17-18%, I would view CHD as a “Must-buy” for conservative investors.

Today though, we’re at 7-8%. Despite this being a great company, the market situation calls for this being a “HOLD”. I want a higher upside, and therefore give the company an $80/share PT.

Thesis

This is my current thesis for Church & Dwight:

- Church & Dwight is a superb business in the consumer goods space, with a multitude of well-known brands both domestically and internationally that have guaranteed growing earnings for decades.

- The company is one of the best value compounders in the world, its M&A strategy is solid, and its business shows no signs of a massive slowdown or decline. At the right price, this company is a no-nonsense “BUY”.

- This is not that time. Because of a price that indicates an upside of around 7-9% conservatively, I’m at a “HOLD”.

- My current Price target for CHD is a conservative $80/share.

Remember, I’m all about :

1. Buying undervalued – even if that undervaluation is slight, and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

2. If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

3. If the company doesn’t go into overvaluation, but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

4. I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them.

This company is overall qualitative. This company is fundamentally safe/conservative & well-run. This company pays a well-covered dividend. This company is currently cheap. This company has realistic upside based on earnings growth or multiple expansion/reversion.

Be the first to comment