ipopba/iStock via Getty Images

With the stock market’s recent volatility, I’ve been focused on companies that are likely to hold up better than the averages given the risks of inflation and a possible recession within the next year. Chubb Limited (NYSE:CB) has many qualities that should allow the company and the stock to hold up well in this uncertain environment. Chubb provides insurance and reinsurance on a global basis, which is needed regardless of inflation and economic conditions.

Chubb specifically handles commercial and consumer property and casualty [P&C] insurance, reinsurance, personal accident insurance, supplemental health insurance, and life insurance. The P&C insurance that Chubb offers is something that businesses and consumers need to have regardless of how the economy is faring. Therefore, the company and the stock is likely to hold up better than companies with businesses that are considered discretionary.

Chubb’s main strength is its focus on quality underwriting over volume of business. This strategy minimizes risk as the company insures businesses and consumers with low-risk characteristics.

Positive Performance

Chubb achieved record results in Q1 2022. The company had $1.28 billion in underwriting income in Q1 2022, which doubled from Q1 2021. Another record was a combined ratio of 84.3%. This ratio is calculated as incurred losses plus expenses divided by earned premiums. The combined ratio was 91.8% in Q1 2021, reflecting a higher loss to income ratio.

Global P&C premiums increased 10.7% in Q1 2022. The commercial premiums increased 12% while consumer premiums increased 8%. These results demonstrate Chubb’s ability to grow effectively. Chubb has a good chance to continue its success going forward by applying effective growth strategies.

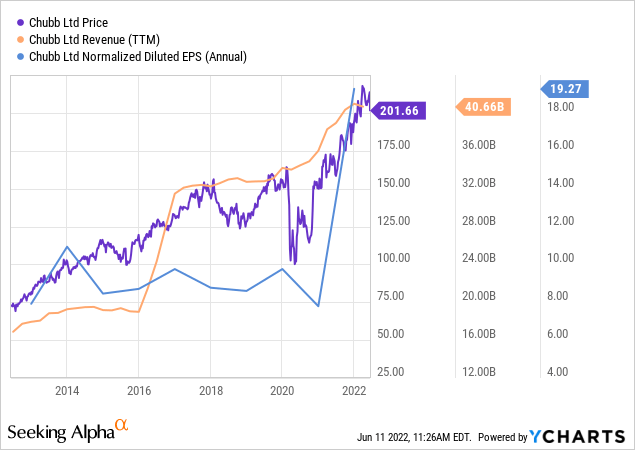

The company has a great track record of increasing revenue and earnings every year as seen in the chart below:

Of course, Chubb’s stock price tends to trend upward along with the revenue and earnings growth. Chubb’s continued strong growth is likely to allow the stock to hold up well even in the face of high inflation and a possible recession. The stock could still experience declines, but probably not as drastic as other companies that are more sensitive to these conditions.

Strategies for Sustainable Growth

Chubb has effective strategies for increasing premium and annuity revenue. The company targets and attracts quality underwriting over volume of business to minimize risk. This ensures that Chubb maintains high-quality client and investment portfolios.

On the business side, Chubb seeks out businesses of all sizes from small to multi-national corporations for P&C and risk engineering services. The company also targets high-net worth individuals with significant assets to protect with a variety of insurance products.

On the investment side, Chubb invests primarily into a fixed-income portfolio along with a modest amount of higher-risk selections. The company puts about 82% of its fixed-income portfolio into investment-grade fixed-income securities as measured by the major ratings agencies. The remaining 18% is placed in below investment grade securities.

Chubb’s strategies led to a steady track record of revenue and earnings growth. Continued future growth is likely in my opinion as Chubb has proven strategies with a comprehensive understanding of the market dynamics of insurance risk management. Analysts are expecting Chubb to achieve 8% to 9% revenue growth in 2022 and about 7% revenue growth in 2023. Earnings are expected to increase by about 20% in 2022 and 12% in 2023.

This strong growth is likely to drive the stock to outperform the S&P 500 (SPY) over the next year. The S&P 500 is likely to experience lower earnings in 2023 as compared to 2022 as interest rate increases slow lending and demand in many areas of the economy. Another source (Henry McVey of KKR) agrees with the idea of lower growth for the S&P 500 next year. McVey expects that earnings for the S&P 500 will decline about 5% in 2023.

Positive Effect of Rising Interest Rates

Chubb is likely to benefit from the current interest rate increase cycle. The reason for that is because the company invests in fixed-income. These investments are poised to experience increased yields as the Federal Reserve continues to increase interest rates. Chubb has over $120 billion in investments to benefit from rising interest rates. This is likely to result in increased profitability for Chubb.

Valuation

The recent pullback in the stock has Chubb trading with a forward PE of 13 and a PEG ratio of only 0.72. The S&P 500 is trading at higher valuation levels with a forward PE of 16.7 and a PEG of 1.31. So, Chubb looks attractive as compared to the broader market.

The property and casualty industry is also trading with a forward PE of 13, but a higher PEG of 0.87. The industry’s PEG is 21% higher than Chubb’s PEG. Therefore, Chubb has a valuation advantage over its industry and the broader market. This puts the stock in a good position to increase as revenue and earnings continue to grow.

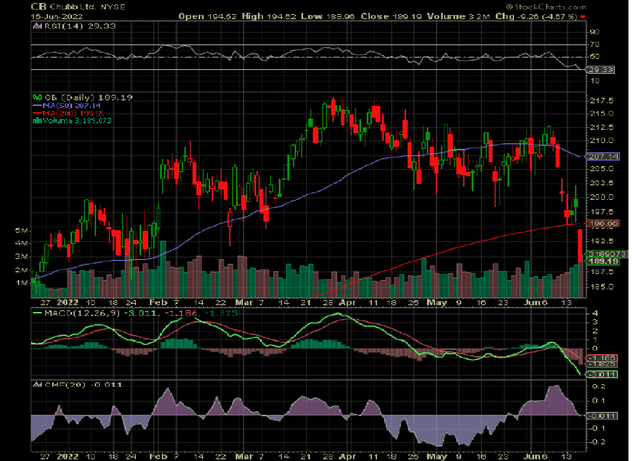

The daily chart above shows how Chubb’s recent sharp pullback brought the stock to an oversold condition on the RSI. The current price action is still bearish as the RSI and MACD are in decline. The money flow [CMF] is also looking bearish as it could drop further below the zero line. I would keep an eye on the price action and look for a change in trend such as the green MACD line rising above the red signal line before entering the stock.

Chubb’s Long-Term Outlook

Chubb has solid proven strategies to sustain growth over the long-term. The company’s insurance products are likely to see continued demand over multiple years. The property and casualty insurance market’s projected growth of 6% per year through 2027 should help provide a steady tailwind for Chubb.

While the recent pullback has the stock at an oversold level and the valuation at an attractive level, the selling could continue. Therefore, it would be wise for investors to be patient and consider putting Chubb on a watchlist. Better entry opportunities could occur over the next year, especially if we experience a recession.

Chubb’s below market valuation and above-average expected growth should allow the stock to hold up better than the S&P 500 even in the face of high inflation and the possibility of a recession.

Be the first to comment