johnkellerman

This article is part of a series that provides an ongoing analysis of the changes made to TCI Fund Management’s 13F portfolio on a quarterly basis. It is based on their regulatory 13F Form filed on 8/15/2022. Please visit our Tracking Chris Hohn’s TCI Fund Management 13F Portfolio article for an idea on their investment philosophy and for the fund’s moves during Q1 2022.

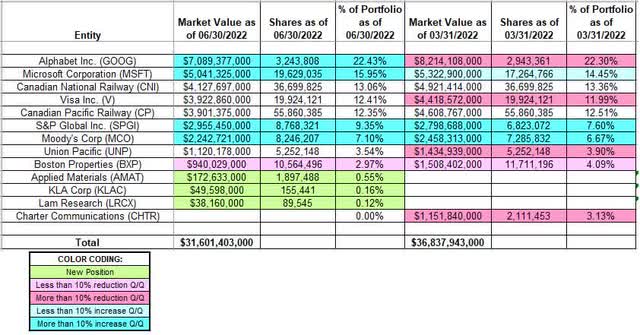

This quarter, TCI Fund Management’s 13F portfolio value decreased ~14% from $36.84B to $31.60B. The number of positions increased from 10 to 12. The top three holdings are at ~52% while the top five are close to ~76% of the 13F assets: Alphabet, Microsoft, Canadian National Railway, Visa, and Canadian Pacific Railway.

New Stakes:

Applied Materials (AMAT), KLA Corp. (KLAC), and Lam Research (LRCX): These are very small (less than ~0.55% of the portfolio each) new stakes purchased this quarter.

Stake Disposals:

Charter Communications (CHTR): A large stake in CHTR was established in 2016 at prices between ~$165 and ~$300. The position had wavered. Recent activity follows. There was a ~80% selling over the last three quarters at prices between ~$426 and ~$821. The disposal this quarter was at prices between ~$415 and ~$562. The stock currently trades at ~$439.

Stake Increases:

Alphabet Inc. (GOOG) (GOOGL): GOOG is by far the largest position at ~22% of the portfolio. It was first purchased in 2017 at prices between ~$40 and ~$55. Next year saw the stake built at prices between ~$49 and ~$62. There was a ~18% selling last quarter while this quarter there was a ~10% increase. The stock currently trades at ~$118.

Microsoft Corporation (MSFT): MSFT is the second-largest position at ~16% of the portfolio. It was built in the 2017-18 timeframe at prices between ~$60 and ~$115. There was a ~50% selling in 2019 at prices between ~$100 and ~$160. Recent activity follows: Q1 2021 saw a ~45% increase at prices between ~$213 and ~$245 while in Q3 2021 there was a ~20% selling at prices between ~$275 and ~$304. This quarter saw a ~14% increase at prices between ~$242 and ~$315. The stock currently trades at ~$279.

S&P Global Inc. (SPGI): The 9.35% of the portfolio SPGI stake was first purchased in 2017 and built in 2019 at prices up to ~$275. Q1 2021 saw a ~150% stake increase at prices between ~$306 and ~$362 while in H2 2021 there was a ~37% selling at prices between ~$415 and ~$475. There was a ~80% stake increase last quarter at prices between ~$373 and ~$461. That was followed with another ~30% increase this quarter at prices between ~$316 and ~$415. The stock currently trades at ~$380.

Moody’s Corp. (MCO): MCO is a 7.10% position that has been in the portfolio since their first 13F filing in Q2 2015. At the time, the stake was already fairly large at 3.9M shares. The position has wavered. The stake was almost sold out in 2016 at prices between ~$80 and ~$110. The 2017-2018 timeframe saw the position rebuilt at prices between ~$98 and ~$185. Last two quarters have seen a ~25% stake increase at prices between ~$254 and ~$386. The stock currently trades at ~$306.

Stake Decreases:

Boston Properties (BXP): BXP is a ~3% of the portfolio position established during Q2-Q4 2020 at prices between ~$31 and ~$42. Q2 & Q3 2021 saw a ~48% stake increase at prices between ~$39 and ~$46. Last three quarters have seen a ~18% selling at prices between ~$86 and ~$133. The stock currently trades at ~$84. They are harvesting gains.

Note: they have a ~6.7% ownership stake in the business.

Kept Steady:

Canadian National Railway (CNI): CNI is a top-three ~13% of the portfolio position built in the 2018-19 timeframe at prices between ~$71 and ~$95. Q2 & Q3 2021 saw a ~75% stake increase at prices between ~$104 and ~$127. The stock currently trades at ~$126.

Note: they have a ~5.2% ownership stake in the business.

Visa Inc. (V): The ~12% of the portfolio stake in Visa was built in 2020 at prices between ~$147 and ~$219. H2 2021 had seen a ~64% stake increase at prices between ~$196 and ~$249 while last quarter there was a ~14% reduction at prices between ~$191 and ~$235. The stock is now at ~$210.

Canadian Pacific (CP): The ~12% CP stake was purchased during 2018-19 at prices between ~$34 and ~$51. There was a minor increase next year but since then the position has been kept steady. The stock currently trades at $81.38.

Note: they have a ~6% ownership stake in the business.

Union Pacific (UNP): The 3.54% UNP stake was purchased in 2018 at prices between ~$127 and ~$165. Next year saw a roughly one-third selling at prices between ~$138 and ~$181. 2020 saw a ~20% stake increase at prices between ~$118 and ~$210. There was a ~15% trimming last quarter at prices between ~$238 and ~$277. The stock currently trades at ~$239.

The spreadsheet below highlights changes to TCI Fund Management’s 13F holdings in Q2 2022:

Chris Hohn – TCI Fund Management’s Q2 2022 13F Report Q/Q Comparison (John Vincent (author))

Be the first to comment