da-kuk

Global X China Consumer ETF (NYSEARCA:NYSEARCA:CHIQ) is an exchange-traded fund with the mandate of investing in Chinese consumer discretionary stocks. The fund is relatively small, with net assets under management of $262 million as of November 16, 2022, as reported by the fund’s creator Global X. The expense ratio is also on the high side, at 0.65%. CHIQ has performed poorly in recent times; I last covered CHIQ as of December 23, 2021, in which I thought the fund was overvalued at the time. Since then, CHIQ has fallen -27.30%, against the S&P 500 U.S. equity index’s comparable move of -17.07%.

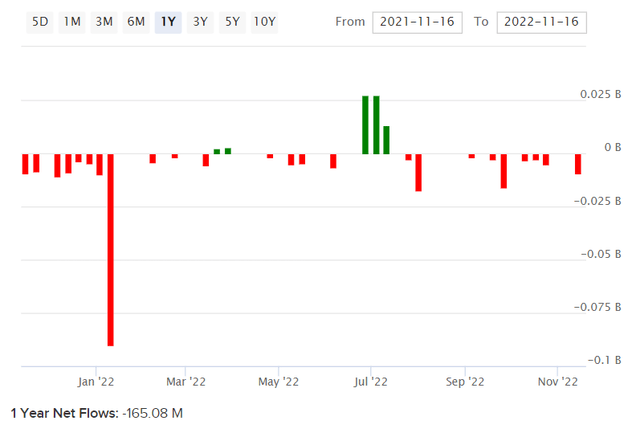

Back in Q4 2021, I thought that CHIQ was overvalued in relation to its expected earnings growth going forward. I also thought that, given that the Chinese economy was slowing, it made sense that consumer discretionary stocks would also under-perform regionally. The combination made CHIQ very unattractive as a short-term investment opportunity. In spite of the already small size of the fund, over the past year or so CHIQ has suffered net fund outflows as illustrated below. Admittedly most of these were front-loaded.

ETFDB.com

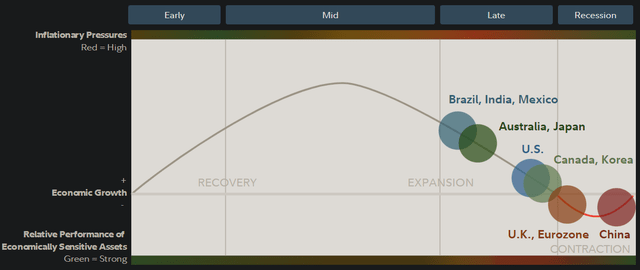

Today, things are possibly different though. CHIQ is no longer as unattractive cyclically. It makes sense firstly that markets will continue to lead the real economy by 6-12 months on average. Based on Fidelity research as illustrated below, the Chinese economy is ahead in its business cycle as compared to other major countries. Therefore, Chinese stocks are (at least in theory) going to be first to bounce back into the next business cycle, provided that China’s recessionary phase is not going to last unduly long.

Fidelity.com

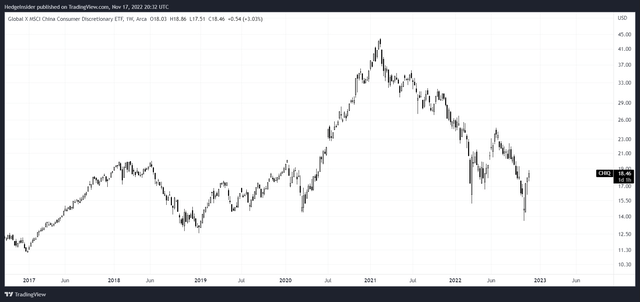

CHIQ has already begun to bounce back in recent weeks, as depicted by the price action in the chart below (weekly candlesticks are used).

TradingView.com

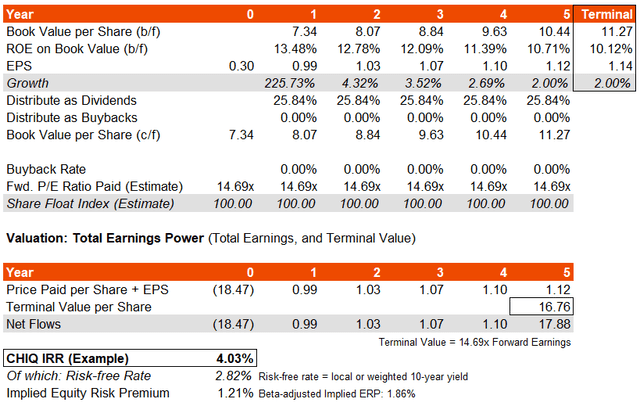

The fund seeks to replicate the performance of its chosen benchmark index, the MSCI China Consumer Discretionary Index. As of October 31, 2022, the index reported trailing and forward price/earnings ratios of 47.85x and 14.69x, respectively, with a price/book ratio of 1.98x and a dividend yield of 0.54%. The trailing price/earnings ratio reflects losses in some significant parts of the portfolio, but normalized earnings on a forward basis. The forward return on equity is implied at 13.48%, which is quite low. The forward three- to five-year earnings growth rate for CHIQ’s portfolio is projected as being 16.00% according to Morningstar; this is high, but probably includes the front-loaded jump in earnings implied given historical losses. At least, that is what I will assume; I will in fact assume that the return on equity drops to 10% by year six with a maturity of CHIQ’s portfolio.

Holding most other factors constant, I have produced the following IRR gauge for CHIQ, with the Chinese 10-year yield as a reference risk-free rate. The result is an implied IRR of just 4.03%.

Author’s Calculations

For China, at the very least I would expect an equity risk premium of 4.2-5.5%, and more likely some premium above this range given the investment profile of investing in China (there is geopolitical risk). In my last piece, when CHIQ was trading at $28.24 per share, I thought the net present value of the fund was circa $15.38 per share. Since my last article, the share price has fallen to a low of $13.60 and has since rebounded to $18.46. I like the cyclical attractiveness of CHIQ at this juncture, but as for value: given an implied IRR above of 4.03% using similarly “conservative” approaches as I do with other funds, there is still implied downside.

How much downside is implied? For investing in China, you could argue that a discount rate of at least 8% would be appropriate. That is the result of an equity risk premium of about 4.5%, some allowance for a country risk premium specific to China (say 0.5%), and the local risk-free rate (the current local 10-year is yielding 2.82%). So, our IRR of 4.03% as above would imply downside of some -50% to some $9.20 per share.

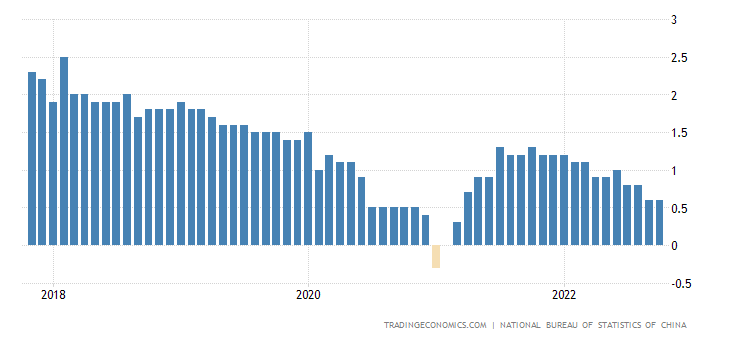

Having said that, my earnings growth estimates are more conservative this time following a Chinese recession. Assuming that the return on equity actually holds constant over the forecast period at 13.48%, which is admittedly on the lower side already, our IRR would rise to 10.72%. However, I am not willing to give CHIQ’s portfolio the benefit of the doubt here; it always makes sense to assume some degree of earnings growth maturation. Bear in mind also that my above model still implies real earnings growth: core Chinese inflation is consistently sub-1.5% (see below).

TradingEconomics.com

So, whereas the rest of the world is facing (hopefully now abating) inflationary pressures, China’s problem has an emerging problem in deflation. Buying consumer discretionary stocks with the expectation of strong and elevated real earnings growth does not make sense, not in this economic environment.

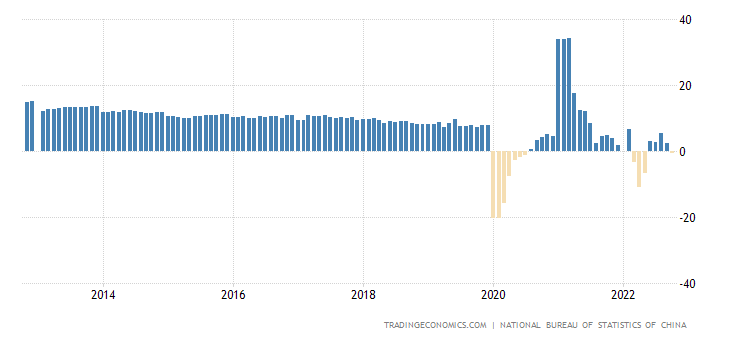

Chinese retail sales declined 0.5% year-over-year in October 2022 (see below). Having said that, retail sales growth was closer to 5-10% before COVID-19.

TradingEconomics.com

You could imagine retail sales growth bouncing back after COVID-19 measures in the country are relaxed, and into a new business cycle. However, the long-term retail sales growth trend is evidently downward. So, sales growth of closer to 5% followed by a maturation in CHIQ’s current portfolio down to sales growth rates more aligned with long-term core inflationary readings makes sense. My initial model with 2-4% growth per year (front-loaded) from year 2 onward is possibly conservative, but I would not want to assume that retail sales growth spikes so suddenly given lacklustre retail sales in recent months and years.

Therefore, a forecast IRR range of around 4-8% makes sense at best, with a bias toward the lower half of this range.

As I said before, I like the cyclical appeal of the Chinese consumer discretionary sector. However, I think the market may get caught off-guard in the medium term. Given the potential for positive earnings surprises in the turn of the cycle, I will take a neutral stance on CHIQ at present, which is an improvement from my previously bearish stance. However, I do think the risk/reward is weak, and I would not be surprised if CHIQ were to revert to the downside and even find new lows. The value is not there.

Be the first to comment