Dimensions/E+ via Getty Images

The opportunity

Chipotle (NYSE:CMG) has had a great decade. Since IPO, the stock has rewarded investors with a >3000% return and a market cap that exceeded $50B last year. But the ride to stardom has not always been smooth. The stock has had its own share of troubles and has been able to emerge stronger each time. This has given investors increased confidence in its growth abilities, and results from the most recent quarters have taken this even a step further. But what if the stock is priced for perfection and it can’t deliver? If a stock has a high beta, how will it behave during market shocks? Have we seen this story before? How can we benefit from a potential reset in its valuation?

A growth darling

Chipotle’s growth story has been quite breathtaking. It had close to 500 stores in 20 states when it went public in 2006 and in 16 years it has expanded to 5 countries with more than 3000 locations. For Q2 of 2022 alone they opened 42 new restaurants with a plan to open up to 250 locations for the full calendar year.

When looking at average 12-month restaurant sales it was $1.4M in 2005 compared to $2.7M (12 months preceding the latest quarter) with a restaurant-level operating margin coming in at 25.2%. Revenues for the FY 2021 came in at $7.5B (YoY increase of 26%) and the latest quarter revenues came in at $2.2B (QoQ increase of 17%). Barring a few bumpy years, Chipotle’s meteoric rise in its stock price is justified by its growth, and it’s quite clear that the market expects this growth to continue into the future as well.

In terms of future growth, the belief is that the company can rely on greater penetration in its local market (US) and increase footprint in other international markets. Market has further supplemented this belief with its ability to rely on its brand for pricing power and banking on consumers to absorb the increase in prices. However, to continue in the same growth trajectory, its sales and earnings should far outstrip expectations, which would then translate to above-market returns.

Spanner in the works

Rising inflation and declining economic growth can hurt restaurant business in multiple ways:

- Consumers are cutting back from their restaurant visits as rising prices mean bigger impacts on their wallets from fewer visits. A recent survey mentioned about 55% of the consumers in US is cutting back on their dining out spend.

- Food prices have increased and the inflation over the past year has turned out to be sticky. Cost of food in the US alone has increased by 11.2% from the latest September data and has consistently seen double-digit percentage increases in the last several months. Increased input costs will force Chipotle to further increase its prices, which underscores the first point. There is further proof that while prices at home slowed down by 0.5%, food away from home increased by 0.5% MoM.

- There are multiple long-term reasons for the increase in food prices to continue – pandemic disruptions, war in Ukraine and sanctions on Russia.

It is hard to imagine a scenario where the future is perfect only for Chipotle and dire for other restaurant businesses.

Valuation

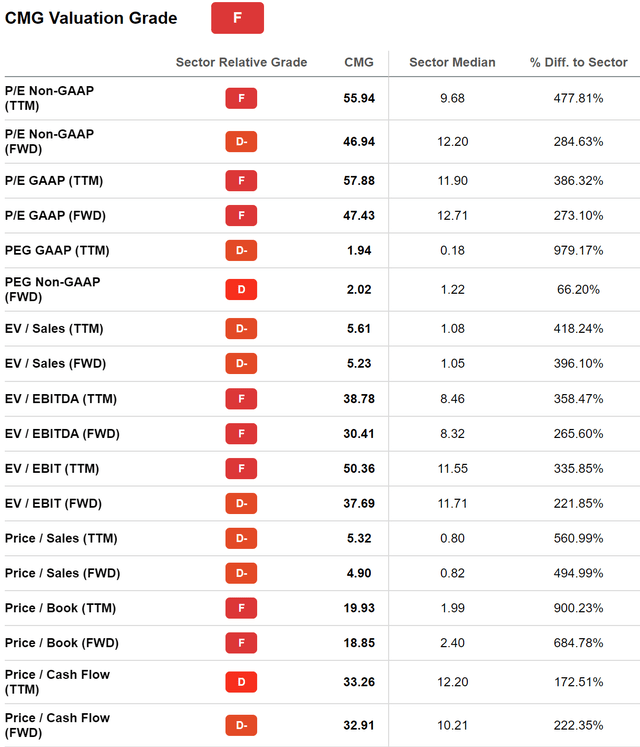

The stock is overvalued and even after you factor in its future growth, it trades at almost 47 times its earnings and 5 times its sales. When you consider this against its sector median (Consumer Cyclicals) of P/E at 12 and P/S at 0.8, the differential is too large to be ignored. Zooming in further on an Industry level (Restaurants) average P/E and P/S holds at 28 and 3 both of which are low compared to Chipotle. Below is a helpful snapshot from Seeking Alpha Quant Rating Valuation page, which shows Chipotle having an overall valuation grade at F (lowest grade). This is because when comparing Chipotle against its peers in the Consumer Discretionary sector, it shows that it is richly valued and scores a grade of D or lower irrespective of the valuation metric used.

Valuation Grade and Underlying Metrics (Seeking Alpha Webpage)

We have seen this story before

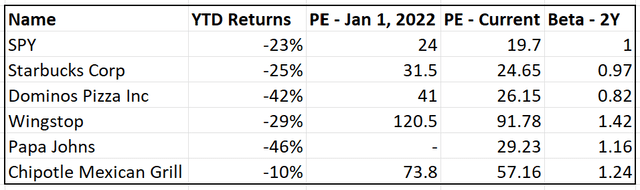

Historically, what happens when a stock is priced for perfection? We don’t even have to look too far into history. One of the interesting things about the last two years is that it has shown how out of touch things can get and how fast reality sets in. In a general sense, outside of Chipotle, most high beta stocks have behaved as expected in a declining market. Zooming in a little further, we see that companies that haven’t turned a profit or haven’t shown consistent earnings/cash flows, have seen their returns decimated when reality didn’t meet expectations. Chipotle’s case is slightly different as it has not only grown but also managed to show profitability. But even in these situations, the judgement has been swift.

In the above table, I have included comparables only within the same industry. From a pure valuation standpoint, the reader can easily extend this to overvalued companies from other industries and arrive at similar results. Key takeaways from the above table:

- Profitable, relatively fair/lower valued Starbucks with a Beta value of 1 has seen its stock drop as much as the index.

- Profitable but overvalued Dominoes has seen its returns dip much below the index.

- Profitable but overvalued Wingstop, with a high beta value, has seen its returns dip below the index.

- Papa Johns, with a few unprofitable quarters, has greatly underperformed the market.

- Chipotle being overvalued, and high beta has been able to escape this fate so far. The stock did drop as much as 30% YTD at one point, but it quickly recovered as the market is quite optimistic about this stock. But how long can this continue?

At this point, we can make two arguments.

Chipotle will continue to outperform the industry and the market. Its margins, pricing power and brand are so superior that it will come out of this unscathed. Even if this argument is made, with a market cap of $40B and high valuation, it’s hard to see a lot of upside. The risk to reward seems equal.

The other argument is the one that I have been trying to make throughout this article. I think Chipotle will follow the trend and the fate seen by other high beta/high-valued stocks and see a significant downside. This skepticism is completely missed by the market, and the risk-to-reward ratio seems to be high.

The play

Investors can choose to either be short on the stock directly or through the use of far OTM put options for an asymmetric gain. When buying far OTM put options, however, an investor has to be careful, further evaluate it for liquidity and give enough time for expiry as the downward movement is not something that can be predicted in the immediate time frame. Also, this play has to take up an extremely small percentage of your portfolio as it has the potential of losing your whole investment in a small duration. Executing this play would not only allow you to benefit from a potential fall in its stock price but also serve as a hedge in a falling market.

Be the first to comment