hapabapa

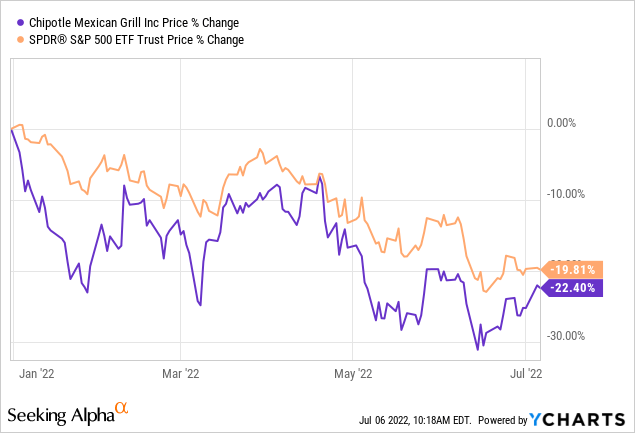

Recently, Chipotle Mexican Grill (NYSE:CMG) has been experiencing major changes due to ongoing developments in a bear market. The company has been greatly impacted from inflation, as menu prices increased by 4% at the end of 1Q22 and have increased by over 7% year-over-year as of April. Its gross margin is solid but is below that of its competition. However, Chipotle does have pricing power which can shield the company from possible continuing inflation. A recession could be on the way; however, the company is taking steps to prepare for this. It did fairly well during the Great Recession, as it was able to increase revenue and net income percentages, while the share price dropped. Chipotle seems to have a bright future as the company plans to open over 4,000 new restaurants in North America, and is planning to grow its international presence as well. Chipotle’s share price has dropped this year and it is currently underperforming the market. Momentum could continue to bring the share price down further. Despite Chipotle having great potential for the future, I believe that investors should wait for a margin of safety, which is why I apply a Hold rating to Chipotle.

Pricing Power Provides Ability To Combat Inflation

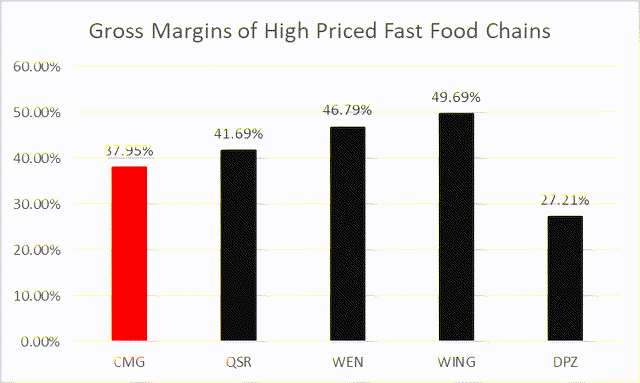

Inflation has been on the rise and is having a direct impact on the restaurant industry. Restaurants are being forced to raise prices in order to keep up with inflation. In April, the restaurant industry had a 7.2% year-over-year increase in menu prices. Chipotle has a solid gross margin; however, the company lacks behind the gross margins of some top competitors such as Restaurant Brands International (QSR), Wendy’s (WEN), and Wingstop (WING). This could mean that Chipotle may not be set up to handle inflation as well as some of its competition.

Gross Margins of CMG and Competitors (Created by Author)

However, Chipotle does have strong pricing power which can protect the company during periods of high inflation. The company has price action plans in order to offset the current levels of inflation which will push its fundamentals higher. Chipotle has recently increased menu prices by 4% at the end of 1Q22. Chipotle’s Chief Financial Officer, Jack Hartung, believed that food costs were the highest that he has seen in a one year span, with costs up 12% to 13%. Chipotle’s CFO also recognized the importance of the pricing power that the company has.

Gosh, I really hope we don’t have to take more pricing… If [inflation] moves and we can’t find efficiencies to offset it, the good news is we have pricing power to make a move.

Chipotle Is Fairly Protected From A Recession

Atlanta’s Federal Reserve Bank has reported that the U.S. is likely already in a recession. GDPNow predicted that 2Q22 output will contract by 2.1%, which would mean that the economy is currently in a technical recession. However, Chipotle and the rest of the economy may not feel the true impacts of a recession until unemployment begins to rise. Chipotle is yet to begin laying off workers; however, the company is aiming to replace workers with robots for certain tasks in its restaurants. Chipotle has tested ‘Chippy’, which is a robot that can cook and season tortilla chips in the restaurants. This could mean that Chipotle is preparing for the possible recession by potentially lowering its future headcount.

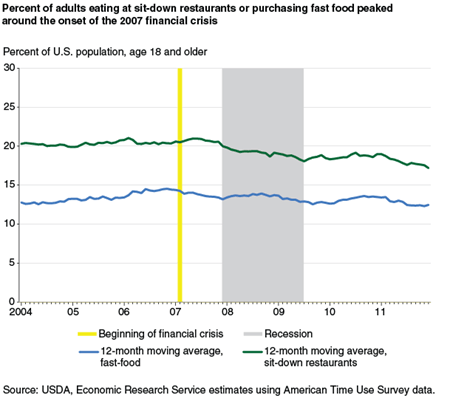

Fast food chains can survive and outperform more expensive restaurants during recessions, as people are trying to save money anywhere they could and look for the best deals available. The percent of adults eating fast food during the Great Recession was pretty consistent and did not drop too much, while sit-down restaurants suffered a much greater decline. This can be attributed to the difference in price from fast food restaurants to sit down restaurants.

Sit-Down Restaurants vs. Fast Food During Great Recession (USDA)

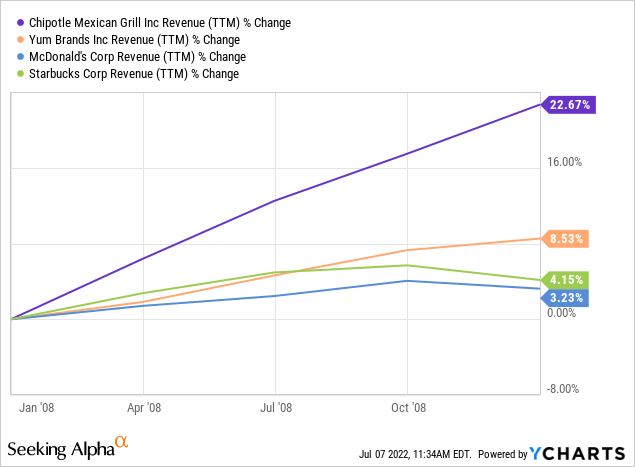

This could be troubling for a company like Chipotle, as the company has cheaper options than traditional sit down restaurants, but is more expensive than most of the other fast food options. Despite its higher prices, Chipotle was still able to generate higher revenue during the Great Recession. People were still willing to buy food from Chipotle during this period, as the company outperformed competitors such as Yum Brands (YUM), McDonald’s (MCD), and Starbucks (SBUX) in terms of revenue growth.

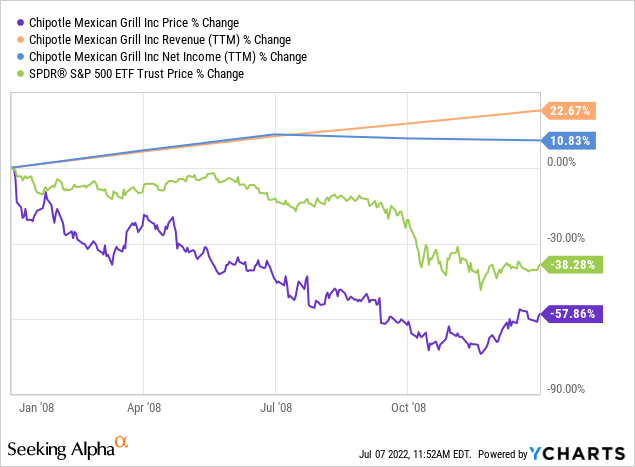

Despite Chipotle’s improving fundamentals, its stock still saw huge declines during the Great Recession. During this span, the company increased its net income by nearly 11% and increased its revenue by almost 23%. This proves that Chipotle was successfully able to navigate the 2008 recession, and could potentially do the same thing with another possible recession coming.

Upcoming Expansion and ‘Chipotlanes’

Chipotle is looking to expand its operations in the coming future, as the company expects to open between 235 and 250 new restaurants in 2022. At least 80% of these stores will include a Chipotlane, one of the company’s newest initiatives. In this initiative customers will be able to place a mobile order and then use the drive-thru or walk up window, also known as the Chipotlane, to pick up the order. CEO, Brian Niccol, has a plan for the company’s expansion which includes 8% to 10% new restaurants per year, which requires more workers, general managers, and field leadership. Earlier this year, Chipotle opened its 3000th restaurant which was a key milestone for the company. The 3000th restaurant brought high hopes for the future expansion of the company, as Brian Niccol believes there is a lot more growth coming for the company.

Over the long term, we now believe we can operate at least 7,000 Chipotle restaurants in North America, up from our prior goal of 6,000… The Chipotle brand is really strong, and the economics are really strong.

Chipotle has a bright future, especially if the company is aiming to open at least 4,000 new restaurants in North America. As of 2018, Chipotle had 37 international locations outside of the United States. Over the past couple years, Chipotle has been testing new locations in the U.K. and France, showing its efforts to expand internationally. With expansion on the radar for Chipotle, there is plenty of room for growth for the company.

Valuation

The share price is underperforming the market this year, but it is fairly on track. With the price down, some may believe that it would be a good time to jump into the stock; however, momentum could bring it down even further. It could be valuable to wait for a margin of safety before getting involved with Chipotle.

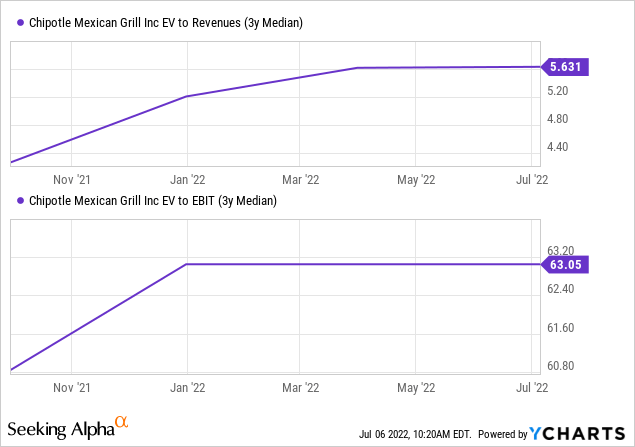

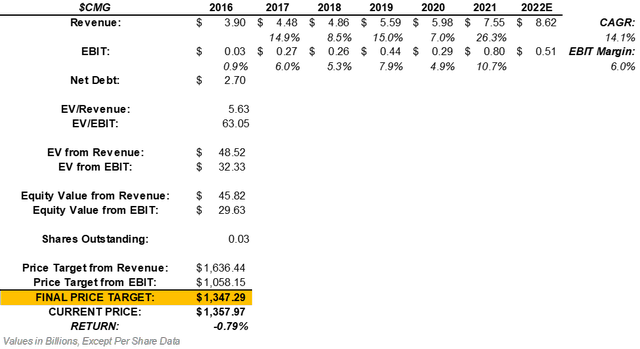

Over the last 6 years Chipotle increased its revenue from $3.9 billion to $7.55 billion. This reflects a CAGR of 14.1% which can be applied into the company’s next fiscal year. This projects the company to generate $8.62 billion in revenue in 2022. Additionally, Chipotle has seen an average EBIT margin of 6.0%. Multiplying this margin by the estimated revenue of $8.62 billion will project the company to produce $510 million in EBIT in the upcoming fiscal year. After multiplying these projections by its 3 year medians for EV/Revenue and EV/EBIT multiples, we can come to the company’s expected enterprise value.

After adjusting the company’s estimated enterprise values for net debt, we can find Chipotle’s projected equity value from revenue and EBIT. Dividing the equity values by the current number of shares outstanding and averaging the price targets bring us to a final price target of $1,347.29. This means that CMG stock could return a downside of 0.79%.

Valuation of CMG (Created By Author)

The Takeaway For Investors

Chipotle has been forced to rise menu prices due to inflation and has a gross margin that is solid but lags behind competitors. However, the company has pricing power to address these issues during times of uncertainty. With a possible recession coming, Chipotle is preparing to combat potential unemployment and other issues that may arise. The company was able to endure the Great Recession by increasing revenue and net income percentages, while the share price fell with the market. Expansion is on the horizon for Chipotle as it plans to reach 7,000 restaurants in North America and extend its international markets in the future as well. With the share price down below the market this year, momentum can continue to drop the price further. Getting into the stock at the right price is crucial, and is why I believe that investors should wait for a margin of safety before getting in. Therefore, despite a bright future, I will apply a Hold rating to CMG stock.

Be the first to comment