JIE GAO/E+ via Getty Images

China Automotive Systems, Inc (NASDAQ:CAAS) regained its bullish backing after the share price languished in the $2.60 range since December ’21. Two years ago, we were enthusiastic about China Automotive for those with a high-risk tolerance; we are again bullish today. Three factors undergird our strong buy rating. But first, the backstory.

The Company

China Automotive Systems, Inc designs, manufactures and markets primarily to OEMs. Products include rack and pinion power steering gears for cars and light and heavy-duty vehicles; power steering parts for light-duty vehicles; sensor modules; automobile steering systems and columns; and automobile electronic and hydraulic power steering systems and parts. China Automotive sells automotive parts in North America and Brazil, motors, integrated electromechanical systems, and polymer materials. The company was incorporated in 1999 and is headquartered in Jingzhou, the People’s Republic of China.

The Industry

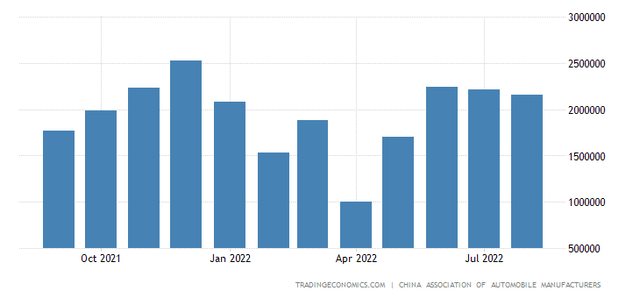

China remains under lockdown threats longer than any other Big Power. The hardnosed response to minimal outbreaks contributed to worldwide supply chain problems and global economic slowdowns China, Russia, America, and Europe are forecast to slow from 6.1% growth last year to 3.2% in 2022. Car production in China tumbled during most months in 2021, exacerbated by the chip shortage. December was strong. The production has been spotty throughout 2022. In August, China’s stocks finished at four-months lows. The Yuan hit 28-months lows. This chart shows China’s car production:

Car Production (Trading Economics)

Three Signs of Recovery

Our first factor for liking China Automotive as a potential investment opportunity is the return to the workplace in China giving their consumers money in their pockets to spend again. There has been some recovery in late 2022 in China’s economy. Lockdowns are sporadic. By August ’22, China’s jobless rate is the lowest in 7 months. Retail sales are up the most and numbers are beating forecasts. China’s consumers might start buying cars again after they return to work and trade with the U.S. is recovering.

Moreover, despite the political tensions, the Office of the U.S. Trade Representative reminds us, “China is currently our largest goods trading partner… The U.S. goods trade deficit with China was +$310B in 2020.” Fitch Ratings reports that Chinese automakers are receiving government stimulus packages to up the production of vehicles and parts and the crisis in chip shortages is easing.

Fitch’s takeaway from all the signs is that vehicle and parts production and sales might improve Y/Y beginning with data coming out in the Fall. It appears as the Chinese government is ready to resume favorable treatment of its auto industry which spurred a 34.2% growth in 2009.

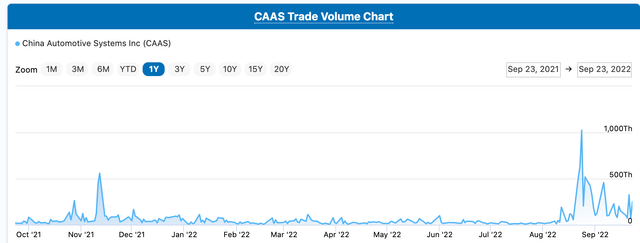

The second factor brightening our outlook is the upward bound movement of CAAS shares. They are up 12.17% for the year. Short interest is 0.52%. Trading volume has taken a healthy bounce:

Trading Volume Spurts (FinanceCharts.com)

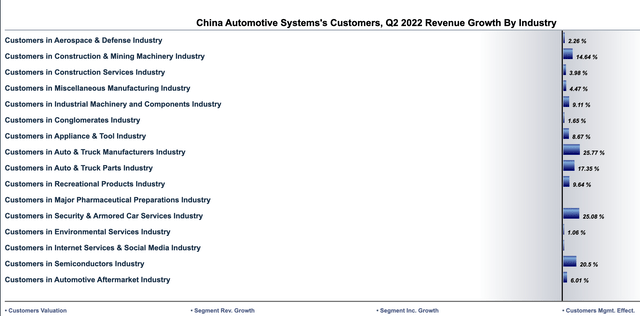

Strong financials reported for the Q2 ’22 earnings report last August is the third contributing factor to our bullish rating. Reported revenue for the quarter was +5.5% Y/Y. The next report date is November 11, ’22, when, in our opinion, the earnings per share will be around five cents compared to -0.01 in Q3 ’21.

We expect the average price target to top $5.50 over the next 12 months if political and public health issues no longer disrupt economic activity; that is more than a 30% increase from the current share price. The PE is 9.45 since the recent runup in the share price; it was over 12 on September 21 and as high as 19 during the year. 54% of the shares are reportedly held by insiders; that is a big amount but not unusual for Chinese companies.

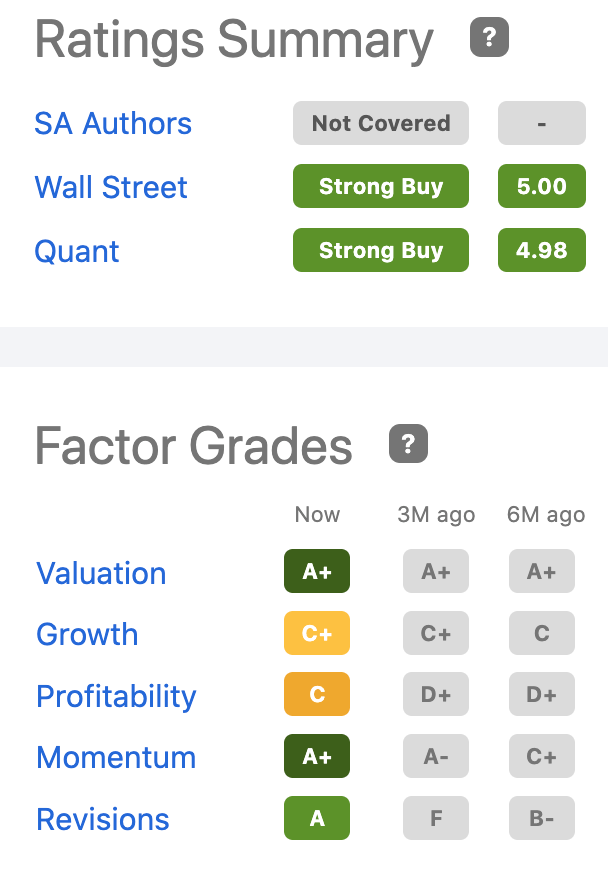

Quant & Factor Ratings (Seeking Alpha)

China Automotive Systems has a small debt-to-equity ratio of 14.6%, down from 20.6% over five years. Its debt is $48.5M and its equity is $329.7M. The debt is covered by operating cash flow. Cash and investments totaled $112.4M; receivables top $203M.

Debt is no problem with the company being highly liquid. Management announced in April ’22 the approval for the repurchase of up to $5M of outstanding shares through April ’23 up to $4 per share. 200K were repurchased by the time of the Q2 earnings report release. Meanwhile, the company cut real estate holdings by 5.4% because of underperformance. Gross margin popped to ~18% from 13.1% because higher margin products sold more this past quarter.

The CEO told shareholders that:

For the second quarter of 2022, while net sales of our advanced hydraulic steering products in parts were 2.6% lower year-over-year, net sales of our electric power steering, EPS products, rose 39.7% year-over-year and represented 25.5% of the total net sales. And export net sales to our Tier 1 North American customers rose year-over-year in the second quarter of 2022.

Downsides

The greatest threats to investors in China Automotive Systems generate from extrinsic conditions. For instance, the stock might stumble or tumble if China’s leadership maintains frequent lockdowns as new variants of the Corona Virus appear. Increasing tensions between the U.S., Taiwan, and China might affect imports/exports and the production and availability of chips

While passenger vehicle production and sales increased, the CEO reported for the second quarter that “the truck market declined by 42.2% year-over-year and bus sales were down 30.5% year-over-year.” These figures may be ominous portents that the economic turnaround is not as robust as hoped nor as timely. Commercial companies purchasing trucks and buses might be conserving cash pending economic forecasts.

Power in the Driveaway

The stock is a high-risk investment for retail value investors. There is no dividend to cushion investors if headwinds to economic development and consumer spending resurge. The better-than-expected second quarter 2022 financial report invigorated investors. Between August 1st and September 6th, they rose from ~$2.75 to $4.79 then fell back about 20%. The fragility of the share price suggests a deep recession, mounting inflation, and heightening political tensions will depress the stock, but another healthy quarterly report will drive up the share price. With insiders holding shares valued at over $66M at the current share price investors can be assured managers steering the company want no accidents or detours. Overall we are comfortable feeling bullish about the stock.

Be the first to comment