BalkansCat

Shares of Estee Lauder (NYSE:EL) have been hard hit this year as hopes of a post-reopening bounce quickly faded as China persisted in its COVID-zero policy. EL is among the companies most exposed to activity in China and Europe, which has created many years of growth but is a significant headwind now. Consequently when its reports fiscal Q1 earnings on November 2nd, I see risk of a downside surprise as guidance appears optimistic. While shares are down, at an over 28x, EL is not yet a cheap stock.

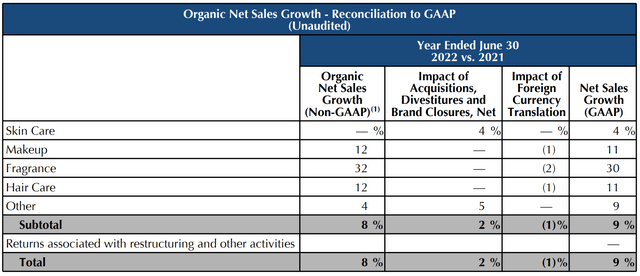

In fiscal 2022 (which ended June 30), Estee Lauder grew sales by 9% to $17.7 billion. Organic sales rose 8%. Acquisitions added 2% and currency took off 1%. As a consequence, adjusted EPS was $7.20, up 12% from $6.45 last year with currency a 0.6% headwind. On paper, those are solid numbers, but it was a tale of two years.

From July 2021 through February 2022, the company was benefitting tremendously from the economic reopening. When you are working remotely, there is a lot less need to put make-up on then when you are going into the office or travelling on vacation. As people began to move around, demand for EL’s products naturally rose. As you can see below, while all of EL’s segments saw sales growth, the most travel-exposed (make-up and fragrances) outpaced the least travel-exposed (skincare).

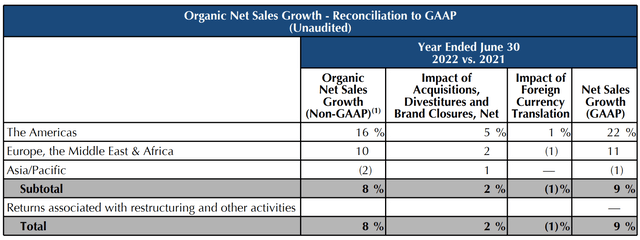

I would note that skincare is the driving force behind the company. It accounts for a significant 60% of sales, but an even more important 80% of operating income, and with net acquisitions in the segment, its important to the company has grown relative to a couple of years ago. Across Europe and the United States, sales and volume growth were strong, and management cited a strong rebound in brick-and-mortar sales as the driving force in these markets.

It could have been a banner year, but then on March 14th, China locked down Shanghai, which was a massive hit to the company as tailwinds in Europe and the US were overwhelmed by the massive headwind in China. As such in Q4 (April 1-June 30), organic sales fell 8%. Adjusted EPS was just $0.42 down from $0.78 last year. Because of how hard China fell in the quarter, full year Asia Pacific sales went negative, even though the majority of Asian markets reported sales growth.

On the bright side, after supply disruptions caused by these lockdowns, production capacity is back at 100% in China, but travel activity there remains below normal levels. While major cities are operating now, President Xi has reiterated that COVID-zero remains the company’s policies, so future lockdowns are an ever-present threat. While the situation for EL (or other consumer products companies in the Chinese market) is unlikely to be as bad as it was during fiscal Q4, the rebound in my view is unlikely to be full as consumers are likely to remain somewhat more cautious with their spending when they fear potential lockdowns could loom.

So while the Chinese headwind is not as bad as it was is, it still remains a challenging market to operate in. Unfortunately, the situation in Europe continues to deteriorate as a recession there is all but inevitable in my view, if it has not begun already. Extremely elevated natural gas prices are creating a larger inflation problem in Europe than we have in the United States, squeezing consumers’ real incomes and capacity to travel. A pullback in discretionary purchases for items like make-up, apparel, and fragances is likely. It will be very difficult to generate volume growth in Europe over this winter relative to last year.

This is particularly important for Estee Lauder, as it generates just 26% of its revenue in the Americas vs 44% from Europe, Middle East, and Africa, 30% from Asia. Europe and China drive this company’s results, and at least for the next 12 months, these will be very difficult markets to operate in.

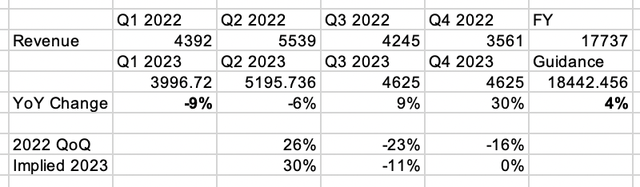

Management recognizes this in the near term. In Q1 of fiscal 2023 (the quarter that just ended 9/30), management expects a reported sales decline of 8-10% from last year. Currency is about a 4% headwind, so organic sales are down just about 4-6%. With the company pushing up prices mid-to-high-single digits to fully pass on higher input costs, volume declines will likely be over 10%. As a consequence, I expect EPS to be in the $0.10-$0.35 area. This guidance strikes me as realistic as there will be some bounce in Q123 vs Q422 in China as the Shanghai lockdown is over, but headwinds from Europe likely worsened throughout the quarter. My concern is that the outlook for the rest of the year appears too positive, and that makes EL a likely guidance cutter.

Over the entirety of fiscal 2023, the company expects “more balanced growth across categories” and continued resumption of global travel, alongside an ability to pass on increased input costs. Assuming that happens, it would grow organic sales by 7-9%. With currency a 4% headwind, reported sales growth will be up 3-5%. This would translate to adjusted EPS ex restructuring charges of $7.39-7.54 with currency a 6% hit. At the mid-point of the range, EL would generate about 2-3% profit growth. Last year, the company generated about $2.6 billion in free cash flow (holding working capital constant) while this guidance implies about $2 billion in free cash flow.

Generating 3-5% sales growth for the full year when the first quarter is down 8-10% is going to be a difficult task. At the mid-point, it implies about $18.44 billion of sales. Assuming Q1 is down 9% (midpoint of the range), the below table shows what Q2-Q4 would have to do. Now, Q4’s YoY growth will be strong as it will be compared to the Shanghai lockdown quarter, but still the company needs to see better sequential Q2 and Q3 revenue performance than it did last year to meet these numbers. With Europe retrenching, I fear the winter quarters of Q2 and Q3 will disappoint to the downside.

I would emphasize this guidance was given when there was still hope China would inch back from its COVID-zero policy. It was also given before Nordstream 1 gas flows were shut down and the pipeline was blown up. Three months ago, the outlook for European growth was not as dire as it is today, so I am not saying EL’s guidance was necessarily too optimistic when it was last given. Rather, a series of things have gone wrong since guidance was released, and that leaves the guidance too bullish relative to the current fundamentals, making a cut likely necessary.

Now since this guidance was given, shares have dropped from $273 to $209, so the market is also likely pricing in some prospects of a downside surprise. While the stock is down, the valuation is still high. Shares are still trading at 38x free cash flow after all. At the midpoint of guidance, shares are 28x earnings. If we assume Q2 growth sequential revenue growth is slower than last year’s 26% rise as Europe moves into a recession, full year revenue is likely to be no better than flat on a reported basis (up about 5% ex-currency). That leaves me with $7-$7.2 in EPS or a nearly 30x earnings multiple.

Estee Lauder is not alone in having woes in Europe and China, but its outsized weight to these markets exacerbates the headwinds. There are plenty of stocks who face these challenges that trade at P/Es closer to 20x than 30x. I believe shares could trade down to $175 or a 25x multiple off of what should be trough $7 earning. That is about 20% further downside. The primary upside risk I see would be China walking away from COVID-zero or a deal in Ukraine that brings back Russian gas exports. Neither strike me as likely, and as such, I see further downside and would be a seller of EL shares into their Q1 earnings release when guidance may be cut by more than the market appears to be pricing.

Be the first to comment