courtneyk/E+ via Getty Images

Thesis

Convertible Opportunities and Income Fund (NASDAQ:CHI) is a closed end fund from the Calamos family. The vehicle follows a rough 60/40 portfolio allocation, with the equity slice done via convertible securities. The fund has a 40% leverage ratio, which adds volatility and magnifies the upside in markets which rally. The CEF is very well managed, with a distribution policy that has allowed it to utilize crystalized capital gains this year rather than utilize return of capital. As per the fund’s literature:

The fund is an enhanced fixed income offering that seeks total return through a combination of capital appreciation and current income by investing in a combination of convertible and high-yield bonds. It provides an alternative to funds investing exclusively in investment-grade fixed-income instruments, and it seeks to be less sensitive to interest rates by investing in lower duration asset classes.

Currently, the fund has a 63% allocation to convertibles, with the rest being held in bonds (overweight high yield). When compared to its peer CCD which contains a larger equity slice, CHI offers less upside in rallying markets but has seen less of a mark-to-market loss as well in 2022. CHI is much more volatile and retains a much higher upside potential in rallying markets than a “traditional” 60/40 portfolio, especially given its leveraged optionality in the underlying convertibles and the overweight high-yield bond positioning.

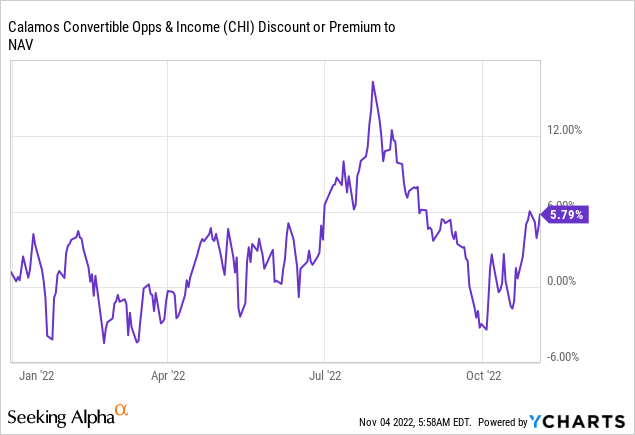

The market likes this fund, with the premium/discount to NAV fluctuating around the 0% mark. The variations are quite stunning in the premium, though, with the fund trading at a 12% premium earlier in the year when the market rallied in July/August. Market participants understand the upside potential obtained via leverage in this fund.

The largest risk factor in this fund is the equity delta, so as the broader market sells off, expect CHI to do so as well. The fund has a lower tech allocation than CCD, which makes it more balanced in our book. The rest of 2022 will be rough for CHI, but the fund retains a significant upside once the market bottoms out.

Holdings

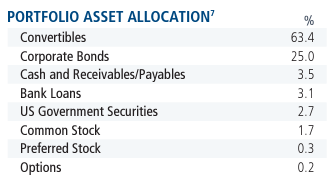

The fund has a 63% allocation to convertibles, with the rest dispersed in pure bonds:

Portfolio Assets (Fund)

We can see the most sizable bucket is for corporate bonds, with small allocations to leveraged loans (“Bank Loans”) and government securities.

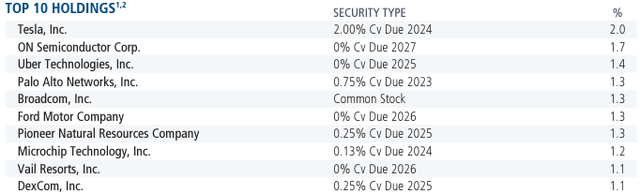

The top names are convertible securities:

We can see the CEF has a composition on the convertibles side quite similar to the Calamos Dynamic Convertible and Income Fund, which we covered here. In that article, we took the 2024 Tesla 2% bond and showed an informed reader why the security now behaves like a pure equity position. We are not going to re-hash the topic, with the link to the prior article provided above. At the end of the day given the quasi 0% coupon features for most of the securities in the portfolio, they are from a market risk standpoint fairly similar to equity positions currently. This means that the delta of the equity is the risk factor that moves the pricing the most.

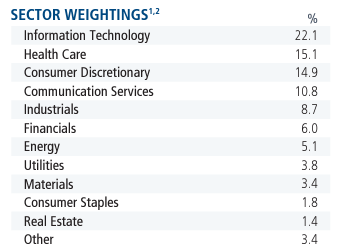

When compared to the CCD portfolio, we can see that CHI has less of a concentration to the technology sector:

Sector Slicing (Fund)

We saw in the other convertibles funds covered that technology accounted for almost 30% of the portfolios. Not here.

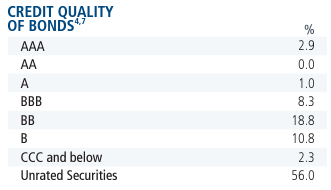

On the fixed income side, the portfolio is overweight high-yield securities:

Ratings (Fund)

This is to be expected given the need for yield from the respective portfolio. In this aspect, the fund is a bit different from a pure 60/40 portfolio given its overweight positioning in high yield.

Performance

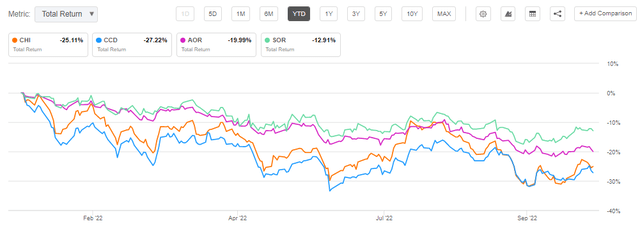

The fund is down over -25% year to date:

YTD Total Return (Seeking Alpha)

We can see the other offering from Calamos, namely CCD, which is tilted more towards pure convertibles, is down more as expected. The Source Capital (SOR) CEF which we covered here, and the iShares Core Growth Allocation ETF (AOR) which we covered here, are the other presented comparison points. SOR, which benefits from active management and lack of leverage is the outperformer, with the Calamos funds at the bottom of the cohort. We have CCD just as a pure convertibles fund here to benchmark against.

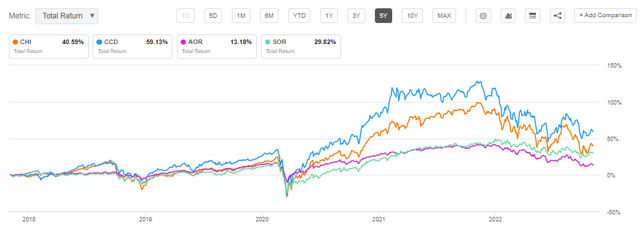

On a 5-year time frame, the total return graph paints an eloquent picture:

5Y Total Return (Seeking Alpha)

Up to Covid, all of the funds had a similar performance, with CCD, the overweight equity one, outperforming. After Covid and zero rates, CCD and CHI outperformed due to their technology bucketing and leverage. CCD was clearly the outperformer, as expected, given its convertibles/equities weighting.

Premium/Discount to NAV

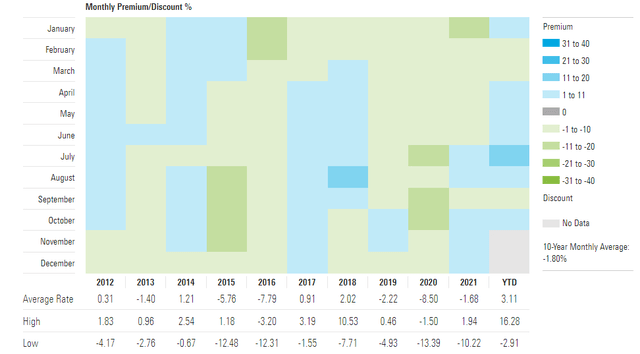

CHI usually trades around its net asset value:

Premium/Discount to NAV (Morningstar)

We can see a fairly tight range for the fund’s discount/premium throughout the years.

In 2022 CHI has presented a significant beta to risk-on/risk-off environments:

The fund rallied to an unwarranted premium to NAV during the July/August rally but has retraced its position since.

Distributions

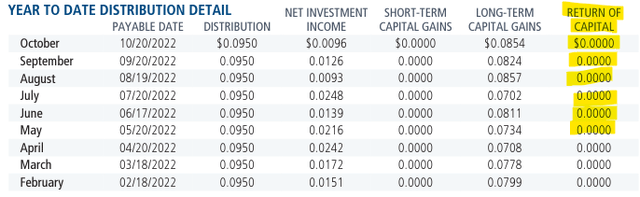

Just like the rest of the Calamos funds, the CEF is well-managed. The fund did not distribute via one-off payments the large gains crystalized in 2020/2021, and has managed to fully cover its dividend in 2022:

We like to see this type of behavior in a CEF. Ultimately, a true buy-and-hold investor should expect a constant return profile, not high peaks and deep valleys.

Conclusion

CHI is a convertibles fund from the Calamos family. The CEF has a rough 60/40 structure, with 63% of the fund in convertibles and the rest in outright bonds. We consider the convertibles slice “equity like” due to many zero coupon securities where the market vector is pure equity delta. On the bond side, the fund is overweight high yield, thus more risky than a true 60/40 blend. The vehicle has a 40% leverage ratio on top, which helps it capture the upside in rallying markets, but makes it much more volatile than a traditional 60/40 portfolio. The fund is well managed, with the distribution fully covered from past crystalized gains. Long term, CHI has more of a “subdued” return profile when compared to some of its pure converts peers, but at the same time, it is down less in 2022. Expect volatility from this CEF, but also substantial upside when the market turns. The investor community is aware of this return profile, with the fund having jumped to an astounding 12% premium to NAV during the July/August bear market rally.

Be the first to comment