Joe Raedle/Getty Images News

Investing Based On Macro Trends

Wall Street and media outlets like to bet on the current trends. Over the past few years, media outlets like CNBC have been hyping trends like “stay-at-home,” “re-opening,” and “the inflation trade.” Macroeconomic trends come and go. As long-term investors, we like to invest in businesses that can survive and thrive in any environment. These businesses are what famed value investor Li Lu calls “Anti-fragile.”

Druckenmiller’s Warning

If you’re a trader, perhaps you’d prefer the advice of Stanley Druckenmiller:

“Never think in the present, that’s a good way to lose money. If you’re buying things that are popular and have great current earnings, you’ll tend to lose money when things change because everyone else is long them too.”

Druckenmiller, who started buying Chevron in 2020 and continued buying last quarter, had this to say about the oil trade (June 10th, 2022):

“We’re there, I mean it’s been widely publicized, people looking at 13F’s. By the way, which I would caution against because that’s old data. And, in this case with us, it’s true. [We’re] very nervous because it’s not the unique thesis it was 6 months ago in terms of looking out 18 months where these companies might be.”

In this first snippet, it seems Druckenmiller slipped up and admitted he’s selling, but he later reversed course:

“The big problem would obviously be if you have a horrendous worldwide recession… we’re looking for demand destruction, but so far we don’t see it.”

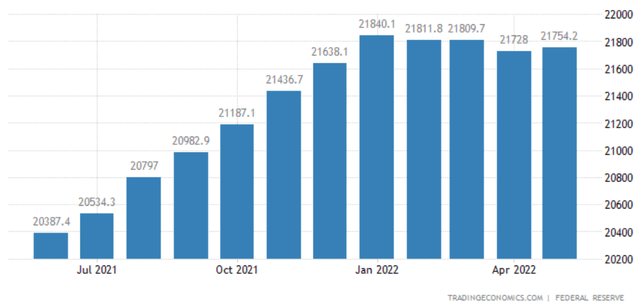

As Druckenmiller said, he tries to envision a world 12-18 months in the future and how different it might be. So how different could it be? We think inflation has peaked. The money supply has actually declined of late:

U.S. M2 Money Supply (Trading Economics)

Then you look around the world at all of the government and household debt. We believe we’re closer to austerity than persistent, 1970s’ style, inflation. Speaking of Stanley Druckenmiller, he recently said he’s not sure if we’re headed for inflation or deflation. Our advice, be anti-fragile.

The Thesis

As Chevron (NYSE:CVX) gains popularity and its valuation gains against global peers, we project returns of 7% per annum with dividends reinvested. Let’s take a look at management, comparative valuations, and what will drive Chevron’s long-term returns.

Takeaways From The 2022 Investor Day

The Good Stuff

First, the good stuff. Chevron’s management discussed acquisitions, saying they’re not looking to buy whatever’s trending. Instead, they’re hunting for value in all fields. This is a core principle to investment success. Often, buying unpopular assets and going against the crowd can yield higher returns. We like Chevron’s strategy here. We also like that the company is so shareholder centric. Management repeatedly discussed cutting costs, increasing the dividend, and buying back shares. This isn’t a bad mix for short-term returns, and the stock has thus far been sent soaring.

What Worries Us

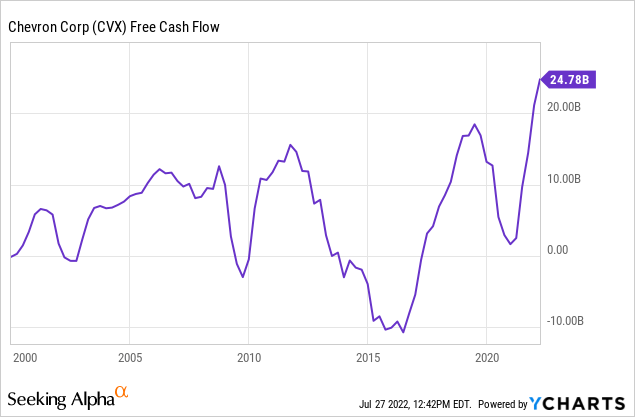

Chevron’s management seems to be singularly focused on how the company will perform at $50-75 Brent Crude prices. We’d prefer management focus on preparing the company for any price environment. Chevron has a relatively weak downstream business. Had Chevron not cut their capital expenditures drastically, they would have had deeply negative free cash flow in 2020. The business also struggled in 2015 and 2016. Despite this, management is hyping the stock with lofty guidance, saying they plan to grow cash flow at 10% per annum over the next five years. The reality is, Chevron’s cash flow will depend on where the price of oil goes from here.

A Comparative Analysis

Excluding Saudi Aramco (ARMCO), these are the world’s largest oil and gas companies by market cap:

| As of July 27, 2022 | Shell (SHEL) | Chevron (CVX) | Exxon (XOM) | PetroChina (PTR) |

| Forward P/E | 4.9 | 8.3 | 7.4 | 4.8 |

| Price to Book | 1.1 | 2.0 | 2.2 | 0.4 |

| Free Cash Flow Yield | 17.2% | 8.5% | 10.5% | 15.8% |

| Dividend Yield | 3.6% | 3.9% | 3.9% | 7.6% |

| Working Capital | $39 Billion | $13.5 Billion | $5 Billion | $0 |

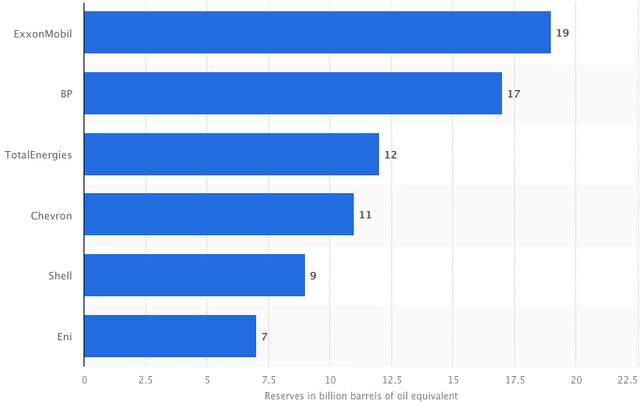

As you can see, you have to pay a premium to own the U.S. companies. However, Exxon and Chevron carry less long-term debt on their balance sheets. They also have more proven oil reserves than Shell and PetroChina:

Proven Oil Reserves By Company (Statista)

These oil reserves represent the longevity of each company’s current upstream business. However, this is not the be-all and end-all of an oil and gas company as it does not include the downstream side of the business, nor its energy transition initiatives.

Long-term Returns

As Chevron underspends on capital expenditures (CapEx), its net income is a better representation of its true earnings power. The company spent only $8 billion on CapEx over the past year, but is now guiding towards $15-17 billion.

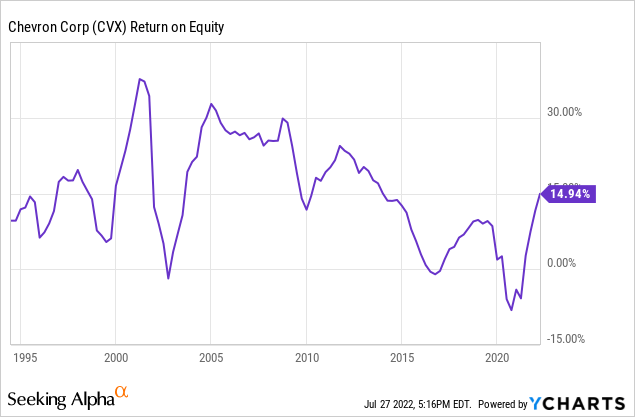

Chevron’s ROE is hovering around its 30-year average:

We believe Chevron’s normalized earnings are around $20.5 billion, which is a 14% return on its current equity. The company’s paying out $10.5 billion in dividends. Management also said they’ll spend $5-10 billion per year on share buybacks. We think they’ll come in on the low end of that range as the price of oil fluctuates. Oil demand is projected to peak somewhere between 2025 and 2035.

Our 2032 price target for Chevron is $207 per share, implying returns of 7% per annum with dividends re-invested.

We believe Chevron can earn $18 per share in 2032. We’ve applied a terminal multiple of 11.5x. This projection is based on a 2032 Brent Crude price of $95, in-line with The Balance’s projections. Chevron should be able to buy back shares at 2% per annum. We expect growth from acquisitions and cost-reductions to be minimal for the following reasons:

- Chevron is tasked with de-carbonizing its operation.

- The industry is facing long-term secular decline.

- Chevron has little cash leftover after buybacks and dividends.

What To Do About It

We urge investors not to get caught up in the macro trends, but to fundamentally assess businesses. Look for businesses that are anti-fragile. And in oil, anti-fragile means a strong integrated model with both upstream and downstream strength, as well as a viable long-term plan. While rah-rah management can make for a good trade, it often doesn’t help the long-term investor. We have a “hold” rating on CVX, which is a good portfolio diversifier. That said, we prefer to hunt for value globally and would consider selling if Chevron rallies further. As Druckenmiller says, “things change.”

Be the first to comment