FreezeFrames

So the big news surrounding Chesapeake Energy (NASDAQ:CHK) recently is that the company is now in the process of divesting their Eagle Ford assets in order to transition back to a natural gas play. We have followed Chesapeake for years, and actually looked forward to the company’s conference calls back when Aubrey McClendon was running them and introducing new plays while educating the market on the various plays’ geology and plans to ramp up production across the country. Back then Chesapeake was a mostly dry gas play, which then pivoted to wanting more NGLs (and they invested heavily in land in the Utica for that specific reason) and then later realized they needed oil to help balance out production. It took years, but Chesapeake transitioned to a diversified E&P play and frankly that is one of the reasons we really liked the stock ‘off and on’ over the years.

Some Recent History On Chesapeake’s Eagle Ford Assets

This is not the first time that the company has discussed selling the Eagle Ford, in fact they looked at doing a transaction recently but ultimately opted not to pursue a deal that was estimated to be able to bring in as much as $2 billion in proceeds. While the company elected to retain the assets, management has been discussing how their drilling plans in 2022 were structured to give them an idea of the long-term suitability of the Eagle Ford assets within Chesapeake’s portfolio and that management would ultimately make a decision once they had enough data.

How The Auction Could Work

So news came out Tuesday night that Chesapeake had hired Evercore to conduct an auction of the Eagle Ford assets after the holiday weekend. Management assured investors on the quarterly results conference call that this would be a well thought out process and would not result in a fire sale, nor would it be rushed. We think that is the appropriate attitude to have, because for once Chesapeake is not a forced seller but rather an opportunistic one. We suspect that Evercore will go out and field interest from various parties and see where the interest lies with buyers regarding various pieces of the assets or the entire package.

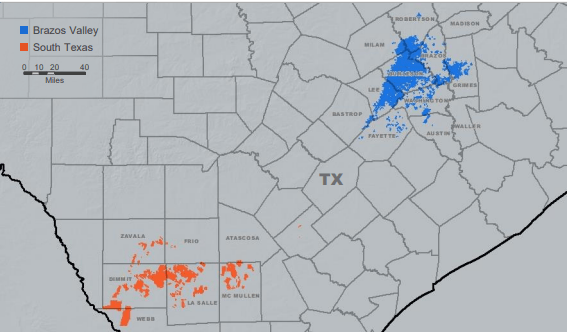

We suspect various types of offers will come in, but we think Chesapeake might have the best success by looking at their Eagle Ford assets as two distinct offerings (much like Chesapeake already breaks them out to discuss in presentations and at events; the Brazos Valley and South Texas – see image below) and marketing the assets that way. This will draw interest from more potential buyers and could enable as few as two transactions to close the divestiture but should have the added benefit of allowing Chesapeake to get the maximum return for shareholders by motivating a larger pool of bidders to make offers.

Chesapeake will probably have the most success in drawing bids by breaking out their assets into two groups, Brazos Valley and South Texas, and then taking offers. (Chesapeake Energy 2022 Q2 Investor Presentation)

We doubt that this sale gets done in a couple of deals, as we think that the company may be able to break the holdings up and sell a few large pieces to a number of purchasers with interest in the Eagle Ford in general, and then the smaller leftover acreage would be best suited for strategic buyers. The question is what the strategic buyers are willing to pay for that acreage, and whether a non-strategic buyer wants that acreage included in a package they are interested in buying.

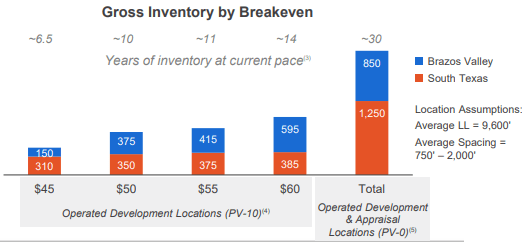

Chesapeake’s Eagle Ford assets have attractive drilling locations. (Chesapeake Energy Investor Presentation)

The acreage holds plenty of drilling locations between the Brazos Valley and South Texas, as can be seen by the above graph. Better still, there are a number of high quality locations available which will be attractive for buyers, especially as they look at exploration/drilling plans and the economics around the payback on their investment.

What This Means For Chesapeake Shareholders

The big question surrounding the divestiture is going to be how tax efficient Chesapeake can be. Selling for cash could very well generate a decent sized tax bill, and any large tax bills will reduce the amount of cash that is left over for further drilling or share repurchases. Ideally Chesapeake could find a buyer who was interested in trading assets in the Marcellus or Haynesville areas that were of interest to Chesapeake, or a mix of those types of assets with cash. This would solve a number of issues for Chesapeake other than just taxes; specifically it would provide a clearer path for how this transaction could be accretive to shareholders and would enable the company to replace some of the production it is selling.

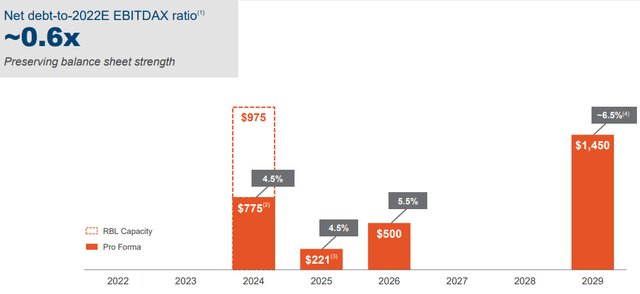

No matter how a deal is structured, we suspect cash will make up a decent portion of what Chesapeake receives for its Eagle Ford assets. In order to make the deal accretive for shareholders, as management has discussed, they will most likely have to focus first on share buybacks as it will be the cheapest and fastest way to add EPS. Expect a tender offer for shares while management also ramps up drilling programs to help bridge any gap. Debt reduction sounds nice, but in this environment, and with the low coupons that Chesapeake’s debt carries, all of those transactions would fail at being accretive.

Our guess is that the vast majority of the incoming funds will go towards share repurchases as they will offer the biggest EPS boost. We think that expanded drilling might be the next focus simply because management will need to boost FCF and EBITDAX after the asset sales and expanded production does more to help those numbers than debt repurchases.

Chesapeake’s debt has relatively low coupons, so we suspect that management will focus on share repurchases and further drilling with the vast majority of proceeds from a divestiture of the Eagle Ford assets. (Chesapeake Energy Q2 2022 Investor Presentation)

Our Take

With energy prices higher now than they were when management previously entertained the idea of selling the Eagle Ford assets, we suspect that management will be able to get a significantly higher figure, however we hesitate to put out a number right now as we do not have the slightest idea of how a deal will be structured. Once whispers start to come out about those who are interested in the acreage, then it will be easier to model out likely scenarios for the interested parties and place probabilities on the likely outcomes and potential cash flows.

However, looking at what we know to be fact today, we think that moving forward Chesapeake Energy is going to have a higher degree of risk associated with the stock as management will have a lot of execution risk (based on having to buy back a ton of stock and simultaneously ramp up drilling) in order to make the deal accretive to earnings, while also increasing leverage in the short-term as overall EBITDAX will likely be lower and debt reduction will not be an accretive transaction whereas drilling will be. The good news is that we are talking about shale wells, so fewer wells need to be drilled upfront to generate cash flows – although drilling programs will need to be maintained moving forward and we suspect rig count will need to increase in order to make the math work moving forward.

Do we like Chesapeake Energy more after a divestiture of the Eagle Ford assets? Well, as a pureplay in some of the best gas plays, we like it as a name to trade for nat gas leverage, especially as the economics today are attractive on a relative basis. But as a long-term investment we think that the lack of diversification leaves one exposed to a very volatile market (nat gas prices can swing drastically as can production and storage figures). While we like nat gas and have exposure ourselves, we do like balance and prefer to have a heavy weighting towards “wet” production (NGLs and oil). This time may very well be different, but having NGLs and oil exposure has always served us well.

It appears that management is intent on making this accretive, which means that the company will be doing a major share repurchase in the future to spread their remaining earnings out over fewer shares – so that is a catalyst at some point down the road. The dividend helps support shares now, but again, without the diversified production base we do think that some risk has been added here.

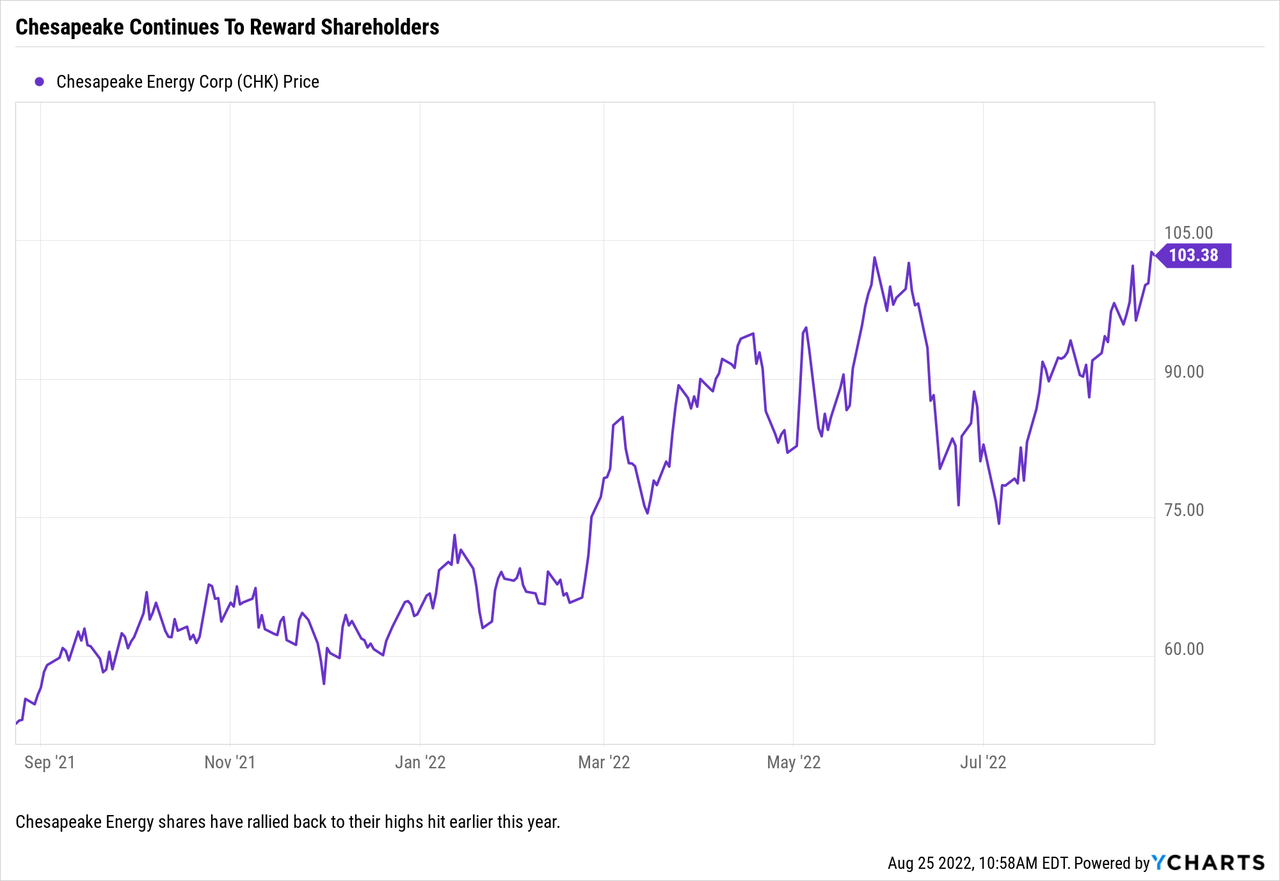

We no longer think that this name is a ‘Buy’ after its move higher, instead believing it to be a ‘Hold’ as investors wait on information from management regarding the sales process and potential deal structures/amounts that could result from a transaction. We do not mind waiting around to see management’s plan for pulling this off, but will not be allocating capital to this name moving forward until we have some actionable data.

Be the first to comment