CHUNYIP WONG

Investment Thesis

Cheniere Energy (NYSE:LNG) is well positioned for the secular growth story that is afoot for US-based natural gas. As Europe and Asia scramble for natural gas, Cheniere is well placed to satisfy this demand.

Despite Cheniere’s shares increasing 60% since the start of 2022, this run is far from over. As we look ahead to 2023, there’s every reason to believe that the good times are here to stay.

I argue that paying 5x this year’s distributable cash flows, a proxy for free cash flows, is very cheap when all is considered.

What’s Happening Right Now?

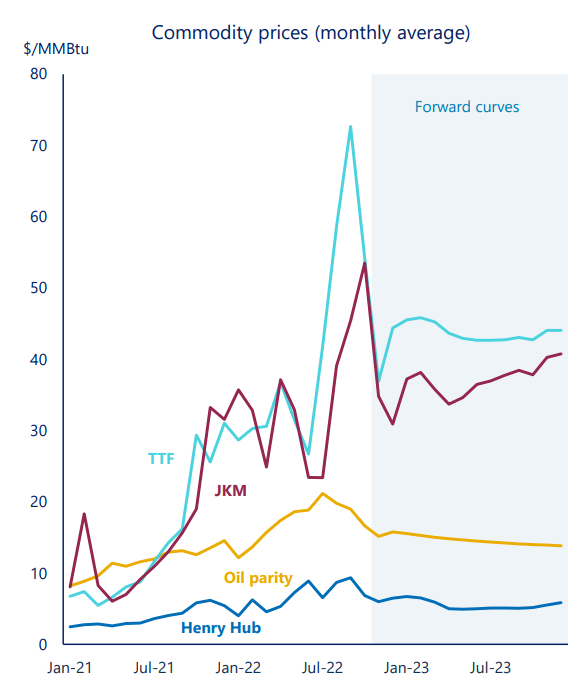

Natural gas prices around the world have been extremely volatile in the past few weeks. Could we say that the past few weeks have been more volatile than throughout 2022? Perhaps not.

Nonetheless, the fact is that natural gas prices absolutely continue to be volatile. On the one hand, unseasonably warm weather has led to inventory building in Europe, which has dampened demand for US-based natural gas.

On the other hand, commentaries coming out of COP27 allow for natural gas to remain an acceptable transition fuel in the fight against climate change.

So, one can conclude the following. One way or another, there’s going to be a very long-term growth story for US-based natural gas.

Consequently, given that US-based natural gas is around 5x to 7x cheaper than prices in Europe and Asia, the demand for US-based natural gas is likely going to remain elevated for the foreseeable future.

Cheniere Q3 2022 presentation

Therefore, I believe that it’s reasonable to conclude that Cheniere will benefit over the short, medium, and long term from demand for US-based natural gas.

With this in mind, let’s dig into Cheniere’s Q3 results.

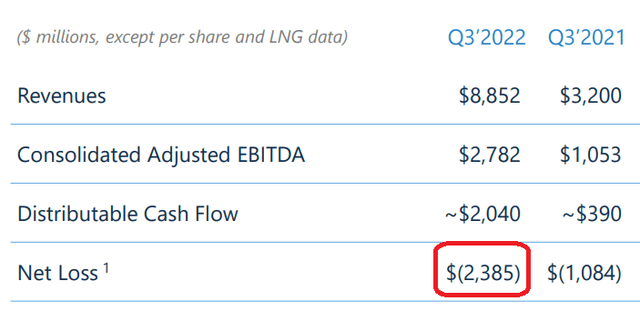

Cheniere’s Hedged Book

The one thing that sticks out from these results is Cheniere’s net loss. These losses are brought about by its derivatives losses. Substantially all these losses, are derivatives losses that are replaced with volumes of natural gas, rather than cash losses.

This is what Cheniere stated on the call, with regard to these derivative losses

Because GAAP requires mark-to-market accounting of these long-term gas supply agreements, but does not permit the mark-to-market of the associated and offsetting sale of LNG, it results in a mismatch of accounting methodology for the purchase of natural gas and the corresponding sale of LNG, which drives this quarterly variability in net income from period to period.

Thus, these large losses should reduce over time, as the difference between when the contract is drawn up and the contract is supplied evens out.

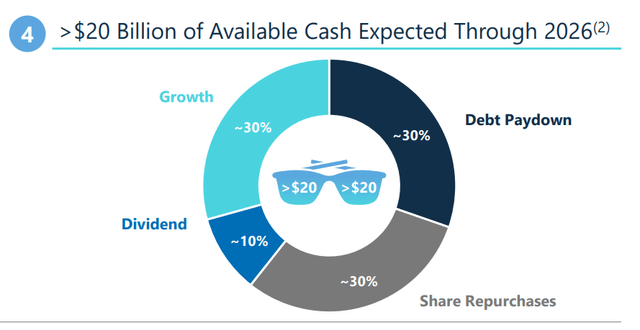

Capital Allocation Policy, 19% Total Return

Cheniere September presentation

What you see above, is Cheniere’s capital allocation policy. Cheniere’s focus is spread across its growth operations, debt paydown, and share repurchases.

So, when Cheniere discusses its $20 billion cash available, this means $8 billion will come back to shareholders via share repurchases and dividends.

For a company valued at approximately $42 billion market cap, this equals a 19% combined yield.

LNG Stock Valuation — 5x 2022 Distributable Cash Flows

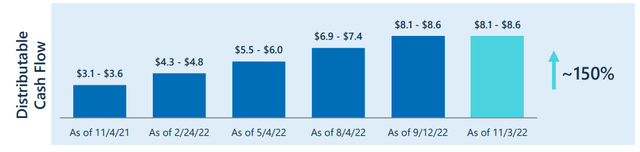

The graphic that follows illustrates the progression in Cheniere’s distributable cash flow in the past 12 months.

What you see above is that the midpoint of Cheniere’s distributable cash flows points to approximately $8.5 billion. That puts the stock at less than 5x this year’s distributable cash flows. This figure is a rough proxy for free cash flows.

Indeed, for the trailing 9 months of this year, on a GAAP basis, Cheniere’s free cash flows are at approximately $6 billion. Thereby illustrating that it’s entirely possible that Cheniere’s distributable cash flows could reach $8.5 billion this year.

Cheniere Q3 2022 presentation

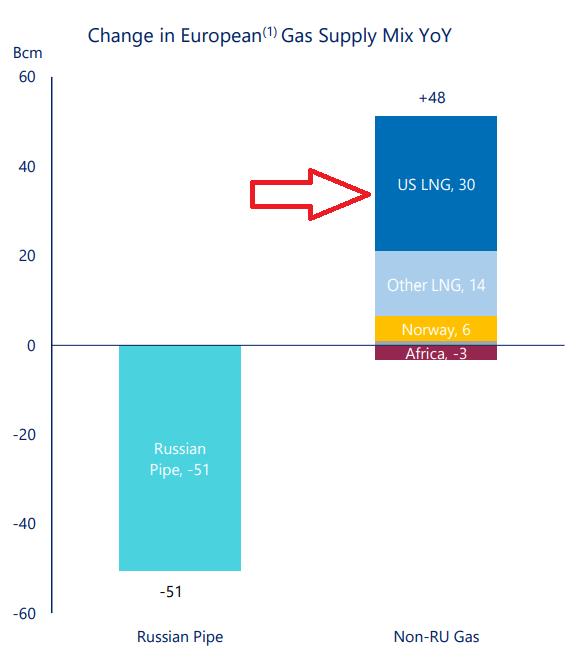

If one believes that in 2023 US-based natural gas will be even higher than in 2022, as Russian flows close up, this is supportive of Cheniere’s cash flows remaining strong in 2023.

The Bottom Line

I find it surprising that even at this stage of 2022 when we know that natural gas demand is going to remain elevated for the foreseeable future, a company, such as Cheniere, that ensures the flow of liquified natural gas out of the US to Europe and Asia is still being priced at approximately 5x free cash flows.

Be the first to comment