Tempura/E+ via Getty Images

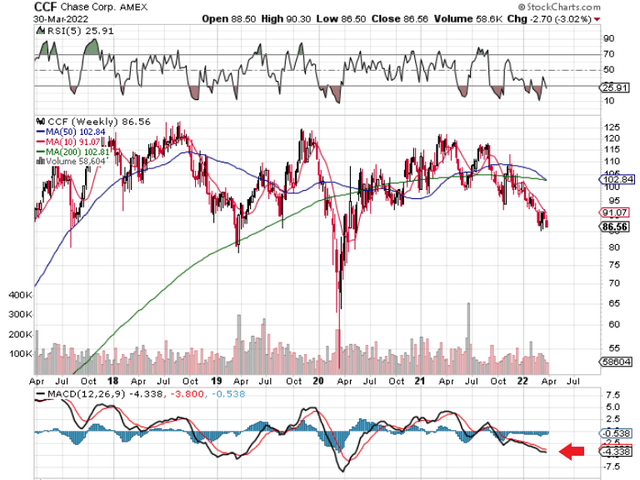

If we pull up a weekly technical chart of Chase Corporation (NYSE:CCF) (Specialty Chemicals Firm), we can see that shares are closing in on a buy signal by means of the MACD indicator. This indicator is noteworthy on long-term charts due to the duality of the indicator (trend & momentum), plus the amount of information that goes into registering the signal. Although shares are currently trading well below their principal moving averages, there is a lot of potential in CCF at the very least for a multi-month swing play. Suffice it to say, we believe that a turn above the stock‘s 10-week moving average would be bullish for Chase for the following reasons.

Weekly Chart Of Chase Corp (Stockcharts.com)

The market many times punishes stocks for poor growth over the short term and rarely takes a long-term view. Over time, however, you can be sure that Chase Corp. will sell for its true value. We evaluate this value mainly by monitoring the company‘s profitability as well as its valuation.

For example, if we first go to CCF‘s fourth-quarter numbers, for fiscal 2021 which were announced in November of last year, management announced sales of $78.1 million which was a 22% increase over the same period of 12 months prior. Concerning the bottom line, a net profit of approximately $10.6 million came in around $1.6 million higher over the fourth quarter of fiscal 2020. Considering the environment Chase had to contend with in 2021 (inflation on the supply side, labor headwinds as well as supply chain constraints), these numbers were quite impressive, to say the least.

Furthermore, from an investors‘ standpoint, it was encouraging to see gross margin increase to 39% in the quarter which brought the full-year number to 40%. This trend demonstrated improving operational efficiencies and the fact that the company‘s sales were steadily incorporating higher-margin products. Shares rallied briefly on the news before turning over once more and resuming their trend of lower lows.

Then, if we fast forward to the company‘s first-quarter numbers of fiscal 2022, we see that sales still increased (though not as much) by 12% over Q1 FY21, but net profit fell by roughly $1.1 million. Furthermore, the contraction in gross margin from 41% to 37% demonstrated that costs on the front end were not being successfully passed on to customers. Shares continued their downward trajectory and have lost roughly 16% of value since the results were announced in January.

However, as mentioned, Chase Corp. still brought in almost $10 million in net profit for the quarter, so bearish investors need to have some perspective to this play. Why? Well, for one, Chase‘s subdued gross margin of 37% in the first quarter is still well ahead of the average in this sector (30.43%) Furthermore, Chase‘s trailing gross margin number of 39.46% is higher than the company‘s average over the past five years (39.04%). Are we going to throw the baby out with the bathwater here for poor short-term profitability?

Furthermore, the first quarter also demonstrated (through backlog growth across all operating segments) that demand has remained buoyant. Management will now increase prices and undergo cost savings initiatives to compensate for recent margin erosion and the poorer sales mix with respect to elevated sales from the below-average Industrial Tapes segment.

Regarding perspective, Chase Corp. over the past four quarters has returned 11.3% in net profit of its assets. Furthermore, these assets are not under threat as Chase has over $120 million in cash on its balance sheet, has no debt, and has a $200 million optional debt facility available if indeed a liquidity issue was to emerge. Suffice it to say, when the lion‘s share of the company‘s cash flow can go back into the company, it greatly improves the odds (through acquisitions & operational efficiencies, etc.) that bottom-line growth will resume sooner rather than later. The recent $1 dividend which was paid to shareholders of record in December of last year for example was easily covered by the firm‘s cash flow as ample cash will still be available to drive the company forward.

On the valuation side, Chase‘s price to earnings ratio (18.8), sales multiple (2.7), book multiple (2.4), and cash-flow multiple (15.4) are all well below the company‘s 5-year averages but yet nothing has changed drastically from a fundamental basis within the firm. In fact, shareholder equity continues to grow and came in at $343 million at the end of the first quarter. Suffice it to say, these are sound foundations for growth and the carrying out of more successful accretive acquisitions like ABchimie in the long run.

Therefore, to sum up, although shares of Chase Corporation remain down close to $40 a share from their 2021 highs, we believe trends with respect to the firm‘s profitability, valuations, and technicals all point to a firm bottom here soon enough. Given the stance Chase has taken with respect to Russia‘s invasion and how Covid cases again are increasing in some parts of the world, investors need to remain patient here by waiting for that swing low. We look forward to continued coverage.

Be the first to comment