jetcityimage

Thesis

ChargePoint Holdings, Inc. (NYSE:CHPT) is scheduled to report its highly anticipated FQ2’22 earnings release on August 30. The company has been beset with supply chain challenges that significantly impacted its gross margins in Q1. Coupled with the COVID lockdowns in China in Q2, we postulate that ChargePoint’s Q2 card should also be affected. However, it’s critical for investors to note that China has emerged from the worst of its lockdowns (so far). As such, we are confident that the supply chain disruptions emanating from China should improve through H2’22.

Furthermore, global freight costs have also continued to fall further through August, continuing a declining trend over the last three months. Coupled with a worsening semi downturn which should help abate some of the inventory challenges seen over the past year, it should improve ChargePoint’s margins profile through H2’22.

Our price action analysis indicates that CHPT staged a higher low in July after its medium-term bottom in May. Therefore, we are increasingly confident that the market is likely to re-rate CHPT higher moving forward.

As such, we postulate that the recent significant pullback from the market’s fervor over the tailwinds from the passing of the Inflation Reduction Act represents an opportunity for investors to add exposure.

Accordingly, we revise our rating on CHPT from Hold to Speculative Buy as we head into its Q2 release.

ChargePoint’s Gross Margins Should Improve In H2’22

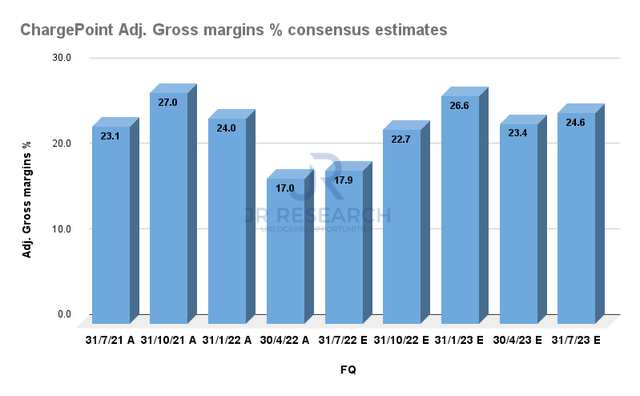

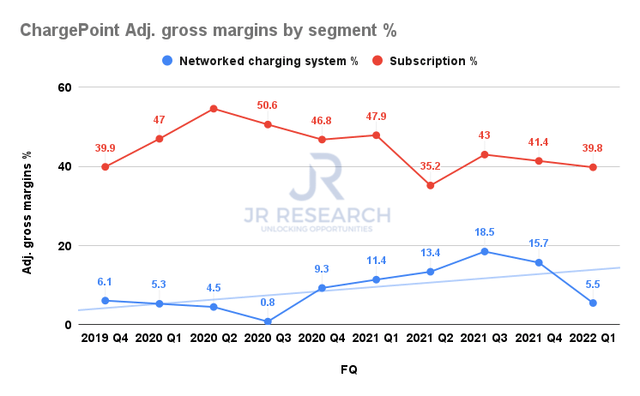

ChargePoint adjusted gross margins % consensus estimates (S&P Cap IQ) ChargePoint adjusted gross margins by segment % (Company filings)

As seen above, ChargePoint’s overall gross margins have been impacted significantly by the deterioration in the adjusted gross margins of its networked charging systems. The company posted an adjusted gross margin of 5.5% for its networked charging systems in Q1, well below its trend.

However, the consensus estimates (bullish) suggest that ChargePoint’s overall adjusted gross margins should have bottomed out in Q1. Therefore, investors should expect significant improvement in its gross margins profile in H2’22, which would be critical to its operating leverage improvement.

Given the improvement in China’s COVID lockdowns situation and the continued normalization of freight costs, we are confident that the estimates are credible. Notwithstanding, the semi supply chain remains tight for automotive components, even though consumer electronics have seen worsening end demand. Therefore, it demonstrates that the automotive semi supply chain remains resilient despite worsening macros, which corroborates management’s view of overcoming near-term recessionary headwinds. CEO Pasquale Romano articulated:

Now, this is the one time in my 33-year career where a downturn doesn’t look so scary to me. And the reason a downturn doesn’t look so scary to me is the following: the demand relative to supply of electric vehicles largely due to production capacity constraints. It’s not battery limited yet. It might go there, but it’s not battery limited yet. The production constraints will likely dominate and there’s enough EV demand so that even in a downturn, we’ll still see quite healthy growth. (Fox Advisors’ Transportation Technology Conference)

ChargePoint Should See Continued Improvement In Operating Leverage

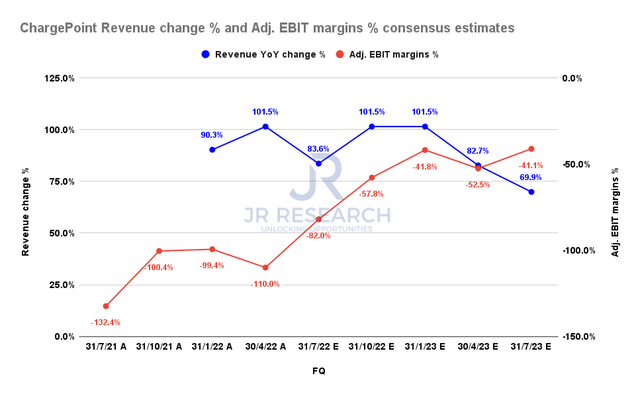

ChargePoint revenue change % and adjusted EBIT change % consensus estimates (S&P Cap IQ)

Investors should assess any potential updates to management’s revenue guidance for FY22. As a reminder, management guided to revenue of $475M (midpoint) in revenue for the full year, implying YoY growth of 96%. The consensus estimates suggest a 94.4% growth rate, which lowers the bar slightly for management to clear.

Notably, we posit that the likely improvement in its gross margins and massive revenue growth should help ChargePoint to continue gaining operating leverage, moving it closer to adjusted EBIT profitability.

CHPT’s Valuation Has Been De-Risked

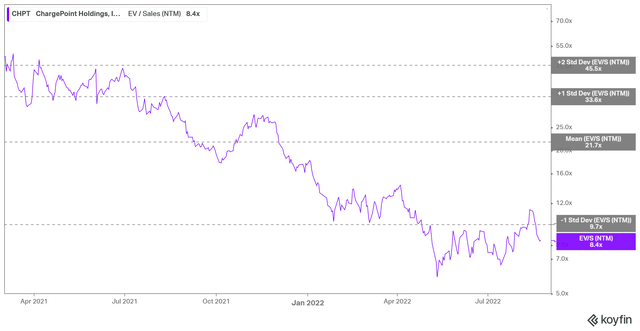

CHPT NTM EV/Revenue valuation trend (koyfin)

CHPT last traded at an NTM revenue multiple of 8.36x. It places CHPT under the one standard deviation zone below its mean multiple. We posit that the market has de-risked CHPT’s valuation significantly over the past year. Therefore, we are confident an improvement in ChargePoint’s operating performance should help spur a re-rating moving ahead.

Is CHPT Stock A Buy, Sell, Or Hold?

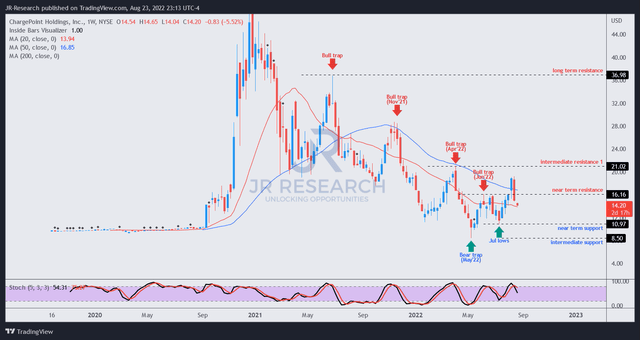

CHPT price chart (weekly) (TradingView)

We observed that CHPT formed a higher low in July, which is constructive as buying upside returned to support it before the passing of the Inflation Reduction Act.

It also corroborates the sustainability of its medium-term bottom in May, helping lift buying sentiments further.

Therefore, we view the recent pullback following the rapid surge in reaction to the Inflation Reduction Act as meaningful for investors to add exposure. Notwithstanding, we still expect near-term downside volatility until we observe a bottoming process in August/September. However, we are confident that its May and July lows should hold resiliently. Therefore, investors are encouraged to layer in over time as CHPT pulls back to form a new bottom.

Accordingly, we revise our rating on CHPT from Hold to Speculative Buy, with a medium-term price target of $19 (implying a potential upside of 34%).

Be the first to comment