krblokhin/iStock Editorial via Getty Images

Investment Thesis

CH Robinson Worldwide (NASDAQ:CHRW) has some strengths but does not have enough potential upside for me. They reported disappointing third-quarter results and may see further deterioration.

CH Robinson Worldwide

C.H. Robinson Worldwide, Inc. provides freight transportation services and logistics solutions. Its segments include North American Surface Transportation (NAST) and Global Forwarding.

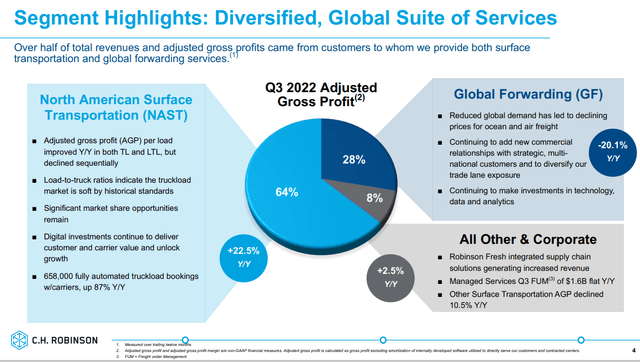

The NAST segment offers freight transportation services across North America through a network of offices in the United States, Canada, and Mexico. The primary services provided by NAST are truckload and less-than-truckload transportation services. NAST freight transportation services account for 64% of the company’s gross profit.

The Global Forwarding segment provides logistics services through an international network of offices in North America, Asia, Europe, Oceania, and South America and also contracts with independent agents worldwide. The primary services provided by Global Forwarding include ocean freight services, air freight services, and customs brokerage. Global Forwarding accounts for 28% of CHRW’s gross profit.

It also provides sourcing services under the trade name Robinson Fresh. Its sourcing services consist of buying, selling, and marketing fresh fruits, vegetables, and other value-added perishable items. All other and corporate accounts for the remaining 8% of CHRW’s gross profit.

Depending on the needs of customers and their supply chain requirements, CHRW selects and hires the appropriate modes of transportation for each shipment. CHRW has an asset-light business model that pays third-party transporters to move its customers’ goods. Although the firm’s variable-cost model provides a partial buffer for profitability, it is not immune to cyclical downturns when economic conditions deteriorate.

The company primarily generates profit by collecting the spread between its customers’ pricing and payments to contract carriers who move the goods. These spreads can widen when rising freight demand allows for increased pricing, while some of CHRW’s third-party carrier rates are fixed for the duration of contracts. But spreads rapidly narrow when customer pricing drops during economic slowdowns, and CHRW is locked into fixed contract rates with third-party carriers.

CHRW operates in highly competitive markets that are very fragmented and historically have few barriers to entry. There are a large number of competing asset-light logistics companies, as well as asset-based carriers that own their trucks and employ their drivers, integrated logistics companies, and third-party freight brokers.

CHRW has annual sales above $26.3B with 17.5K employees. The price-to-book ratio is high, in my opinion, at 6.7.

Disappointing Third Quarter Results

CHRW reported disappointing third-quarter 2022 results on November 2nd. Quarterly earnings of $1.78 per share missed consensus estimates of $2.17 by 18% and declined 3.8% year over year. Total revenues of $6B were below the estimates of $6.4B and declined 4% year over year. The year-over-year downfall was due to the lower ocean and air pricing, partially offset by higher pricing in less-than-truckload and truckload. I expect freight rates to continue declining in the coming months as supply and demand become more balanced.

Bob Biesterfeld, President and Chief Executive Officer of C.H. Robinson, stated in their third-quarter press release.

“On our second-quarter earnings call in late July, I talked about a deceleration in demand that we expected to see in the second half of 2022 in three large verticals for freight, including weakness in the retail market and further slowing in the housing market. We’re now seeing those expectations play out, with slowing freight demand and price declines in the freight forwarding and surface transportation markets.”

“Today, we believe that we are entering a time of slower economic growth where freight markets will continue to cool from their peaks and will operate more reliably and at more normalized rates, with fewer disruptions.”

Income from operations decreased by 7.5% to $287.6M.

North American Surface Transportation’s total revenues were $4B (up 4.9% year over year) in the third quarter. Segmental revenues benefited from higher LTL and truckload pricing.

Total revenues at Global Forwarding were $1.5B, down 23.6% year over year. Results were weighed down by lower pricing and volumes in CHRW’s ocean and air services, reflecting softening market demand.

Analysts on the quarterly conference call seemed concerned that CHRW increased its headcount by 100 during the quarter as the business saw declines. CHRW explained they got ahead of things and employment offers were already in progress. They will make the necessary cost reductions going forward. Analysts were also concerned that CHRW’s attempt to generate $175M of gross cost savings by the fourth quarter of 2023 would take a full year to implement. The $175M will be offset by $25M in headwinds such as inflation and annual pay increases.

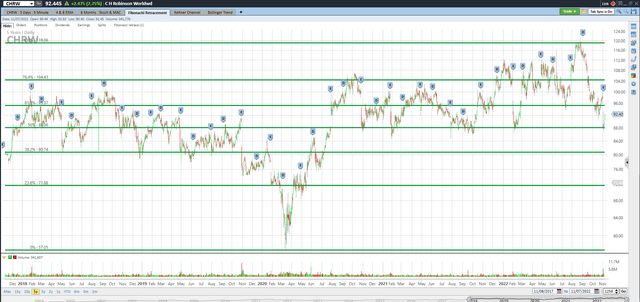

Fibonacci Retracement Levels

I’ve added the green Fibonacci lines, using the high and low of the past five years for CHRW. It’s interesting to note how the market pauses or bounces off these Fibonacci lines. They can be one clue as to where the stock price may be headed. The price is currently between the 50% and 61.8% Fibonacci retracement level but could go lower. I don’t see enough upside potential for me to buy CHRW based on the reasons in this article.

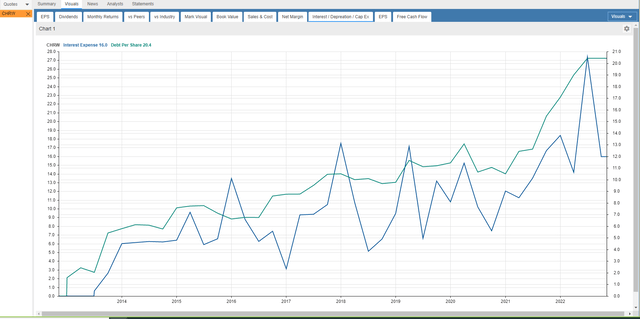

Trend in Earnings Per Share, P/E Ratio, Net Operating Margin, Interest Expense, and Debt per Share

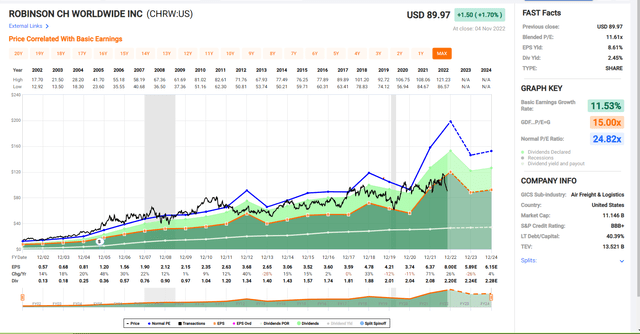

The black line shows CHRW’s stock price for the past twenty years. Look at the chart of numbers below the graph to see CHRW’s volatile earnings were $4.21 in 2019, down to $3.74 in 2020, and $6.37 in 2021, and they are projected to earn $8.00 in 2022 and $5.89 in 2023.

The P/E ratio for CHRW is currently above 11, but the average ratio over the past ten years is 20. I don’t think the P/E will rally back to 20 anytime soon. If CHRW earns $5.89 in 2023, the market would have to assign a P/E ratio of 16 to get a stock price of $94.24. That’s only $2 higher than the November 4th trading price of $92.24.

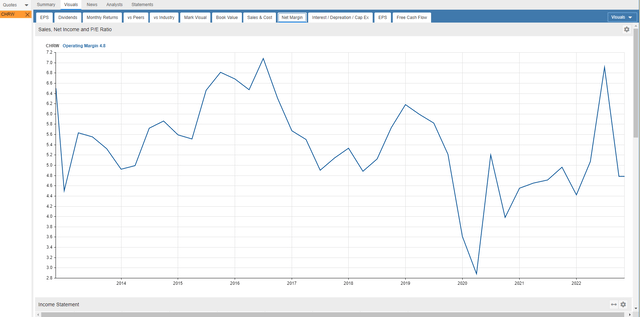

The net operating margin trend ranged between 3% and 7% for the past decade. This is a low-margin business and has not shown improvement in recent years.

You can see in the chart below that interest expense, and debt per share have been growing since 2013. Their forward net-debt-to-EBITDA ratio is 2.0.

Takeaway

CHRW has some strengths but does not have enough potential upside for me. They reported disappointing third-quarter results and may see further deterioration. More attractive risk-to-reward investments are available elsewhere.

Be the first to comment