KanawatTH/iStock via Getty Images

REIT Rankings: Cell Towers

This is an abridged version of the full report published on Hoya Capital Income Builder Marketplace on October 5th.

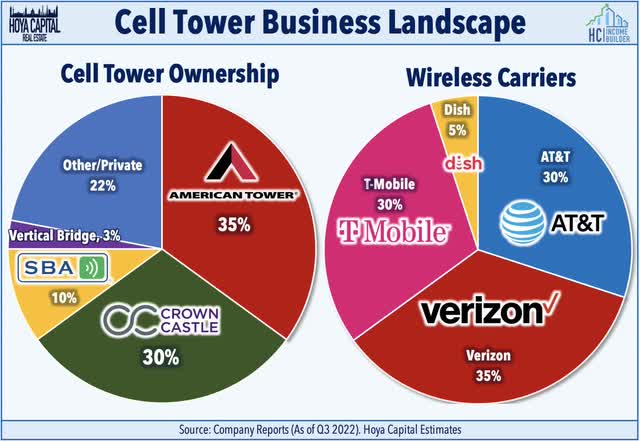

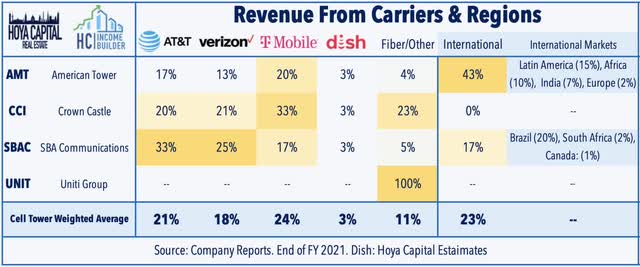

Cell Tower REITs have been a critical growth engine of the REIT industry over the past half-decade, but have been slammed harder than any property sector over the past three months, weighed down by tech-related weakness and disruptive threats to the long-term competitive positioning. Within the Hoya Capital Cell Tower REIT Index, we track the three Cell Tower REITs which account for roughly $225 billion in market value: American Tower (AMT), Crown Castle (CCI), SBA Communications (SBAC). We also track Uniti Group (UNIT), which owns a fiber-optic cable network that connects digital communications infrastructure. DigitalBridge (DBRG) – which we track in the Data Center sector – owns a minority stake in Vertical Bridge, which manages the fourth-largest cell tower portfolio in the United States.

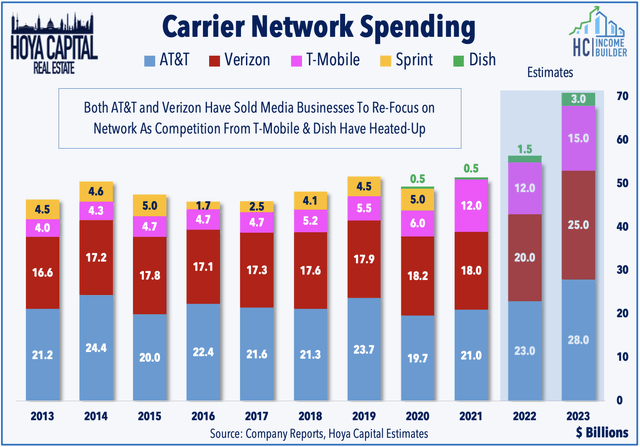

While AMT recently lost its spot as the largest REIT to Prologis (PLD), cell tower REITs still comprise more than 15% of the market capitalization of the REIT sector – the single-largest real estate property sector weight – so their uncharacteristic underperformance over the past quarter has weighed heavily on the cap-weighted REIT Indexes. Cell Tower REITs’ relative dominance over the real estate sector is dwarfed by its even more impressive dominance over the telecommunications sector, as these REITs control nearly 75% of wireless communication infrastructure in the U.S. and more than 50% in several major international markets. These REITs are the landlords to the four nationwide cellular network operators in the U.S.: AT&T (T), Verizon (VZ), T-Mobile (TMUS), and DISH Network (DISH), and own 50-80% of the 100-150k investment-grade macro cell towers in the United States.

Due to the high concentration of ownership and significant barriers to entry in the United States related to restrictive zoning and the favorable economics of colocation, cell tower REITs are perhaps the only real estate sector that could be classified as true price makers rather than price takers. Cell carriers sold off their tower assets beginning in the mid-2000s to de-lever their balance sheet and free up capital to expand their networks. Supply growth is almost non-existent in the US, and the relative scarcity of cell towers, combined with the absolute necessity of these towers for cell networks, has given these REITs substantial pricing power even as the number of potential tenants has dwindled down to just four national carriers over the last two decades.

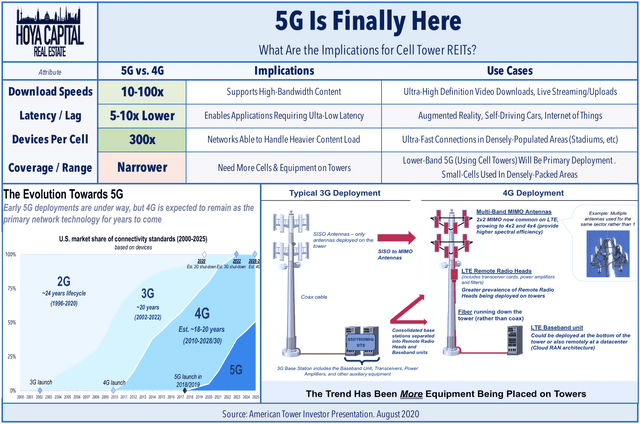

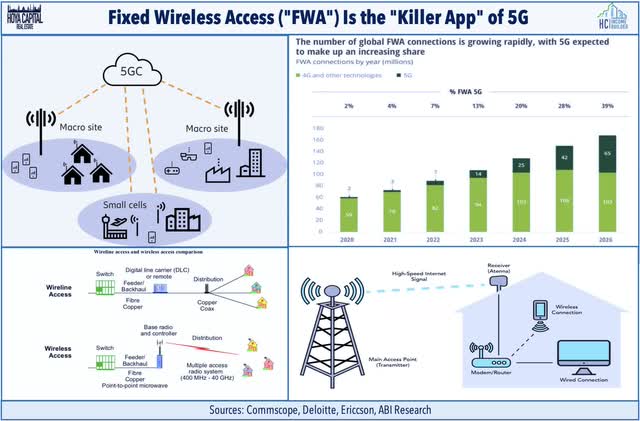

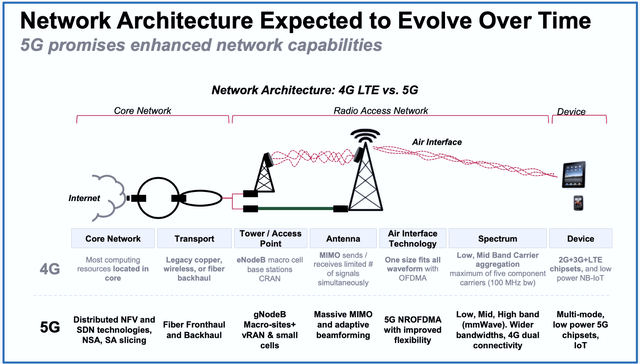

This commanding competitive positioning has given these REITs substantial pricing power amid the roll-out of 3G, 4G, and 5G wireless networks, which has translated into enviable shareholder returns. While 4G networks gave us the “streaming” and “e-commerce” age, pioneered by Amazon (AMZN) and apps like Uber (UBER) and Spotify (SPOT), 5G networks are expected to spur a new wave of technological innovation fueled by “fiber-like” speeds and ultra-low latency over wireless nodes. 5G adoption in mobile devices has been propelled by the success of Apple’s (AAPL) lineup of 5G iPhones. Nearly 60% of smartphones in the U.S. now have 5G capability, and as we’ll discuss throughout this report, we continue to believe that home wireless broadband – called “Fixed Wireless Access” or “FWA” in the industry – is the true “killer app” of 5G and will significantly disrupt the traditional wireline broadband industry.

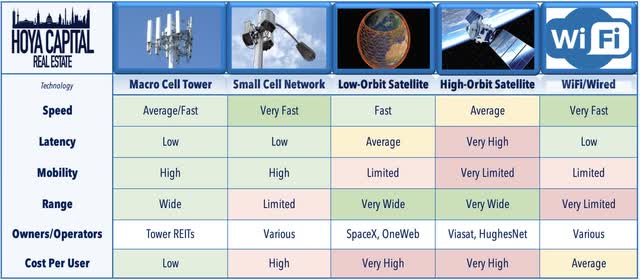

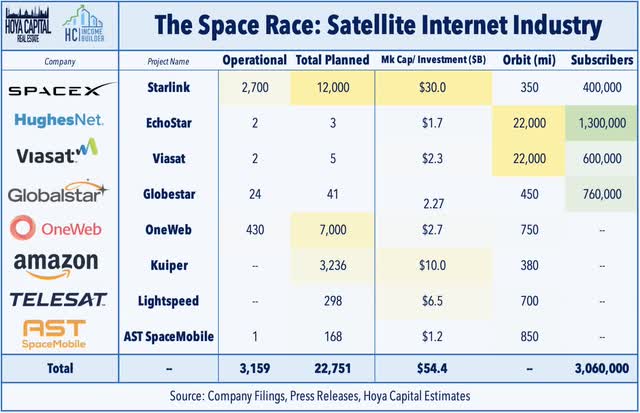

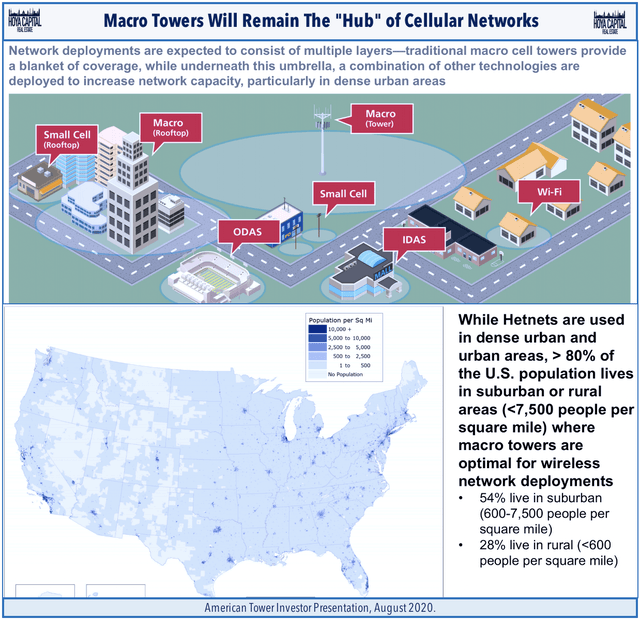

The recent sell-off has come amid concerns over emerging – and potentially competing – satellite technologies, which came to a head when Apple announced that its new iPhone lineup would be capable of sending “emergency” text messages over satellite networks – a feature rumored for several years – and was preceded by an announced partnership between T-Mobile and Starlink and between AT&T and AST SpaceMobile. We continue to be impressed by the pace of Low Earth Orbit satellite service deployment, but while there is some risk of disintermediation to towers if the mobility and power efficiency of satellite connections improve considerably, these LEO networks continue to face unavoidable physical and technical limitations which will continue to constrain the addressable market primarily to low-bandwidth mobile and rural home broadband applications where superior ground-based networks with superior capacity and latency are otherwise unavailable.

Satellite internet has been around for decades through providers including EchoStar’s (SATS) HughesNet and Viasat (VSAT) that use geostationary satellites that are roughly 20k miles from earth, but LEO systems can theoretically provide broadband-like speeds through “constellations” of satellites that are several hundred miles above Earth. Starlink – which has already deployed roughly 3,000 LEO satellites and recently surpassed 500k subscribers – is one of a handful of companies working on LEO broadband and related technologies. American Tower itself has made strategic investments in the LEO space through a partnership with AST SpaceMobile (ASTS), which seeks to provide satellite connectivity through traditional cell phone antenna systems. We see a higher likelihood that LEO networks will be customers or perhaps partners rather than competitors to tower REITs with satellite networks providing backhaul connectivity between towers while ground-based 5G networks facilitate the “last-mile” connectivity.

Awed by impressive rocket launches, we believe the market has overlooked a more meaningful industry dynamic that has played out over the last several months – the accelerated rollout of fixed wireless access (“FWA”) – which has further solidified the competitive positioning of land-based wireless networks – a market that is effectively “cornered” by the three cell tower REITs. We’ve long-viewed FWA – home broadband provided by cell carriers through mobile networks – as the true “killer app” of 5G wireless networks. Using a mix of traditional 4G LTE served from macro towers – and increasingly by small-cell 5G notes – wireless carriers are now competing directly with “wired” home internet providers with comparable speed and service offering – without the service appointments for “last mile” wiring into the home.

Verizon and T-Mobile each reported impressive FWA subscriber additions in Q2 and remarkably, while the overall US broadband industry has added a total of 3.3 million net broadband customers over the past year – 56% of those subscribed to fixed wireless access. FWA is now forecasted to rise from 7.1 million total subscribers at the end of 2021 to 17.6 million in 2027 – growth that will come largely at the expense of traditional cable operators. Interestingly, the “counterpunch” strategy used by Comcast (CMCSA), Charter (CHTR), and Altice (ATUS) is to get into the wireless carrier business themselves, offering bundled wireless services options at steep discounts to existing subscribers. While these “mobile virtual network operators” (MVNO) networks have traditionally “rented” capacity from existing cell carriers, Comcast recently begun deploying their own 5G radios on cell towers – opening the door to the dynamic that these wireline cable operators will increasingly become more active “customers” of cell tower REITs.

Speaking of potential new customers, this past quarter also saw the launch of DISH Network’s 5G service. DISH – which acquired Boost Mobile as part of the T-Mobile/Sprint merger – plans to compete as a low-cost provider by leveraging its existing satellite subscriber base and its network sharing agreement with T-Mobile and AT&T to provide immediate nationwide services as it deploys its 5G network, which currently covers 20% of the U.S. population is obligated to cover at least 50% of the population by mid-2023 under its agreement with the DOJ. Given the industry skepticism over DISH’s viability, any level of success is incremental for tower REITs and not “baked in” to the numbers or guidance. The 5G “arms race” between these traditional cell carriers – and the new entrants – has driven record levels of leasing activity over the past 12 months, an “arms race” that is expected to continue over the next several years regardless of the macroeconomic environment.

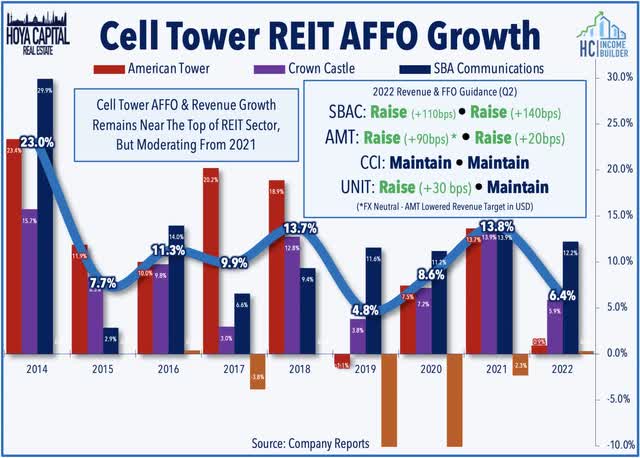

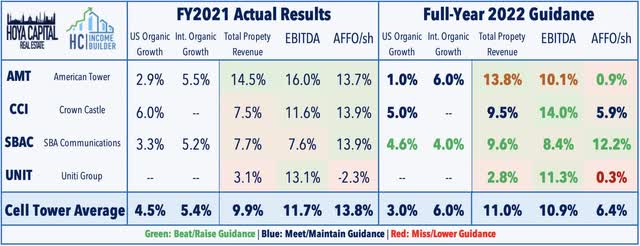

Cell Tower REIT Earnings

As discussed in our REIT Earnings Recap, second-quarter results from the two largest tower REITs were roughly in-line with expectations. Crown Castle maintained its full-year outlook calling for FFO growth of 5.9% and revenue growth of 9.5%. Of note, CCI reiterated its belief that the “U.S. represents the highest growth and lowest risk market in the world for communications infrastructure ownership” and has dropped the “International” from its company name. The strong dollar took a bite out of American Tower’s revenue and FFO, but AMT raised its full-year outlook on a constant-currency basis, citing “unabated demand for our communications assets.” Results from SBA Communications were the strongest of the bunch – driving a 140 basis point boost to its full-year FFO growth target – benefiting from impressive growth in its Latin and South American markets.

While cell tower REITs are seeing the effects of churn related to the T-Mobile/Sprint merger, earnings call commentary suggests that these REITs remain confident that incremental revenues from Dish and other emerging players will offset the drag following an initial moderation. AMT reiterated that it expects the effects of the churn to continue “out to 2024” with the biggest impact being in 2022, resulting in a 4% drag to full-year AFFO this year. CCI provided updates to its plans for small-cell deployment, noting that it expects to double the rate of new small cells in its portfolio in 2023. Small-cell co-location is expected to be the driving force behind the faster roll-out- consistent with our long-held belief that municipalities and zoning authorities would be reluctant to approve single-tenant “mini-cell towers.”

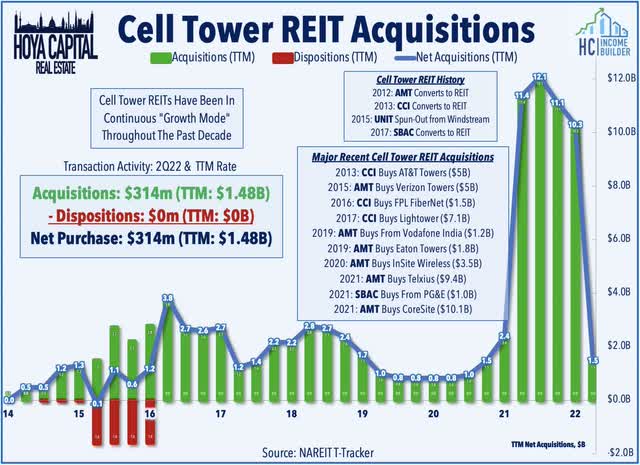

The major deal over the past quarter was American Tower’s $2.5B sale of a 29% state in its data center business to Stonepeak, an alternative investment firm. AMT’s data center business is primarily comprised of its interests in CoreSite, which it acquired last year for $10B and consists of 27 data centers in 10 U.S. markets. Under the terms of the deal – which is expected to close in the third quarter – American Tower will retain managerial and operational control, as well as day-to-day oversight of its U.S. data center business. Strategically-located network-dense data centers have been a recent focus for cell tower REITs amid a push to build out “Edge” network capabilities – the concept that many cell tower sites will soon be hosting “mini data centers” on the “edge” of communications networks in order to reduce latency for ultra-time-sensitive applications like self-driving vehicles.

Cell Tower REIT Stock Performance

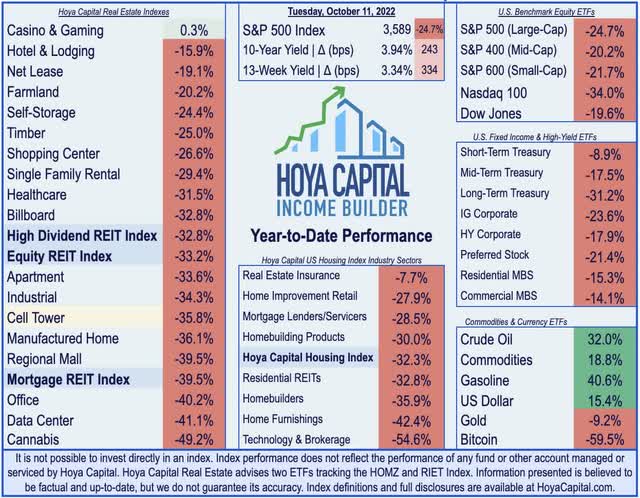

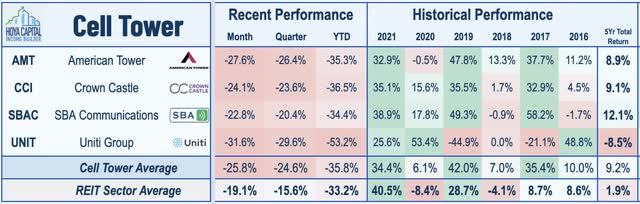

Cell Tower REITs delivered a strong rebound early in the third quarter, but have been slammed harder than any property sector over the subsequent three months, weighed down by tech-related weakness and the aforementioned concerns over their long-term competitive positioning. The Hoya Capital Cell Tower REIT Index is lower by over 35% in 2022, underperforming the broad-based Vanguard Real Estate ETF (VNQ), which has declined by 33%, and the S&P 500 ETF (SPY) which has declined by 25%.

Cell Tower REITs snapped a six-year streak of outperformance in 2021 with total returns of 34%, trailing the 41% total returns on the Equity REIT Index, a streak of outperformance that was the second-longest in the REIT sector behind the Manufactured Housing REIT sector. Over the past five years, SBAC has delivered the highest average annual total return at 12.1% followed by CCI at 9.1% and AMT at 8.9%. Small-cap Uniti Group has been a laggard this year – and over the past half-decade – as it continues to work through legal issues with its largest tenant, Windstream Holdings.

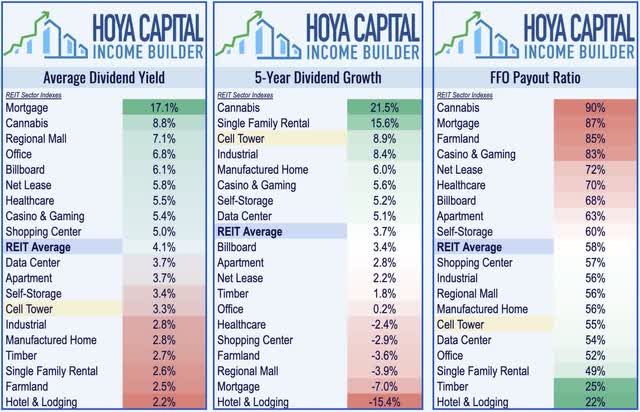

Cell Tower REIT Dividend Yields

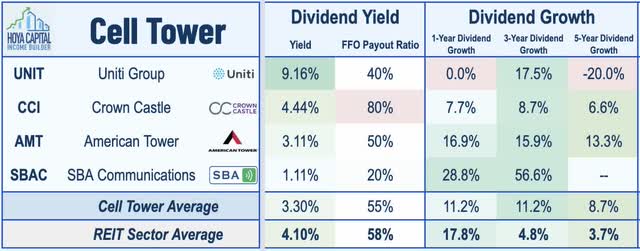

Cell Tower REITs pay an average dividend yield of 3.3%, below the market-cap-weighted REIT sector average of roughly 4.1%, but have been among the leaders in dividend growth throughout their history. Cell towers were one of the few property sectors that were untouched by the wave of dividend cuts and suspensions that hit the REIT sector in 2020 and have delivered robust annual dividend growth averaging over 8% over the past five years. Cell Tower REITs retain roughly half of their free cash flow leaving ample free cash flow for external growth and additional dividend growth.

Among the three larger cell tower REITs, we note that only Crown Castle acts like a “typical REIT” when it comes to distributions, paying a relatively healthy 4.5% dividend yield, which is roughly 80% of its available cash flow. American Tower, meanwhile, pays a relatively lower 3.2% yield, while SBA Communications pays a yield of roughly 1.1%. Uniti Group pays a yield of 9.2%, but has lagged behind its peers when it comes to dividend growth.

Takeaways: 5G’s Killer App Beats Satellite

Cell Tower REITs have been slammed harder than any property sector over the past three months, weighed down by tech-related weakness and disruptive threats from satellite networks, which we continue to believe are more likely to be partners or customers rather than direct competitors. The more relevant recent industry dynamic has been the accelerated rollout of fixed wireless access (“FWA”) – home broadband provided by cell carriers through mobile networks – which we’ve long viewed as the true “killer app” of 5G wireless networks along with the recent acceleration in “bundled” wireless services offered by cable companies which opens the door to the potential that these operators will increasingly become active tenants of cell tower REITs as well. Awed by impressive rocket launches, the market has overlooked these more meaningful industry dynamics which have further solidified the competitive positioning of land-based wireless networks – a market that is effectively “cornered” by the three cell tower REITs.

For an in-depth analysis of all real estate sectors, be sure to check out all of our quarterly reports: Apartments, Homebuilders, Manufactured Housing, Student Housing, Single-Family Rentals, Cell Towers, Casinos, Industrial, Data Center, Malls, Healthcare, Net Lease, Shopping Centers, Hotels, Billboards, Office, Farmland, Storage, Timber, Mortgage, and Cannabis.

Disclosure: Hoya Capital Real Estate advises two Exchange-Traded Funds listed on the NYSE. In addition to any long positions listed below, Hoya Capital is long all components in the Hoya Capital Housing 100 Index and in the Hoya Capital High Dividend Yield Index. Index definitions and a complete list of holdings are available on our website.

Be the first to comment