nuchao/iStock via Getty Images

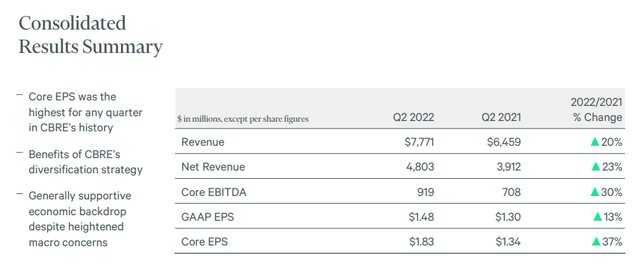

Quarterly results for CBRE (NYSE:CBRE) were strong across the board, with all 3 business segments posting double-digit revenue and operating profit growth, despite the significant currency headwinds that affected US based global companies. Core EPS was the highest for any quarter in CBRE’s history, up 37% from last year’s second quarter, and even slightly higher than last year’s record fourth quarter.

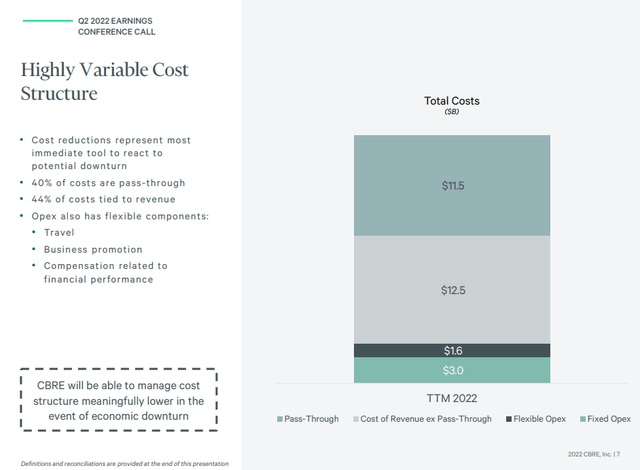

One interesting topic discussed during the earnings call was that of the impact of a downturn on the company’s results. CBRE emphasized the fact that a larger portion of revenue and profits is now generated from businesses that have performed particularly well through downturns. The company also pointed out that its cost structure is inherently variable. Nearly 90% of CBRE’s total cost are either directly tied to revenue, or are highly flexible in nature. The company shared the slide below to illustrate this point.

Q2 2022 Results

Net Income for the quarter was up 10% y/y, and GAAP EPS was up 13% y/y to $1.48. Core Adjusted Net Income was up 33% y/y and Core EPS was up an impressive 37% y/y to $1.83. During the second quarter CBRE completed three bolt-on acquisitions for a total of $42.2 million: a property evaluation and advisory firm in New Zealand, a property advisory consultant in Scotland, and a sustainability advisory specialist in France.

During the second quarter of 2022 the company’s free cash flow was $399.8 million. This reflected cash from operating activities of $454.4 million, less total capital expenditures of $54.7 million.

Financials

Free cash flow increased ~6.8% from $375 million a year prior to ~$400 million during Q2 2022. Revenue and net revenue were both up more than 20%, core EBITDA was up ~30%, and both GAAP and Core EPS were significantly higher as can be seen in the summary table below:

Balance Sheet

CBRE continues to have a very strong balance sheet, which ended Q2 with 0.2x net leverage and $4.2 billion of liquidity. This amount of leverage is substantially below the company’s primary debt covenant of 4.25x. The $4.2 billion of total liquidity consists of approximately $1.2 billion in cash, plus the ability to borrow an aggregate ~$3.0 billion under its revolving credit facilities

Guidance

CBRE now expects to achieve total core EPS growth in the high teens for the full year. Its core EPS guidance takes into account both the impact of FX and the lower share count. Importantly, the company is considering a mild recession in the second half of the year as its base case. We found this question and answer during the earnings call to be particularly interesting:

Anthony Paolone

My first question relates to how you’re thinking about the second half of the year, and you discussed sales and leasing being down. But I was wondering if you can give us some sense as to how you think about the effect of a potential recession on those revenues and what you think of as kind of base cases, in your mind, as to what drawdowns could look like?

Emma Giamartino

Absolutely. So I think what’s important to note is when we’re looking at the second half of the year, our baseline does assume that we enter into a recession in Q4, and we have somewhat of a slowdown in Q3. So our baseline for the next year is that we’ll be in a mild recession. Inflation will start to moderate towards the second half of the year and interest rates will peak early next year and will rebound in the second half of 2023.

So that’s our baseline. Of course, there’s upside from there. If we’re wrong about what’s going to play out in — with the mild recession and the recession is not as significant as we’re expecting, and then there’s downside if the recession is more severe.

But our guidance, as Bob and I both mentioned, is to high-teens core EPS growth for the full year. Without the impact of FX, that’s in the low 20% EPS growth for the full year, which I think is a really positive outcome for our business. Across the three segments, what we’re expecting is within Advisory, with the impact of sales and leasing, SOP should be down on a local currency basis in the mid-single digits.

GWS, on a local currency basis for the second half of the year, will grow 25% and have a really strong second half. And then as we talked about with REI, we’ve monetized over 75% of our profits in the first half of the year. So we feel very confident about what’s going to happen in the second half.

Valuation

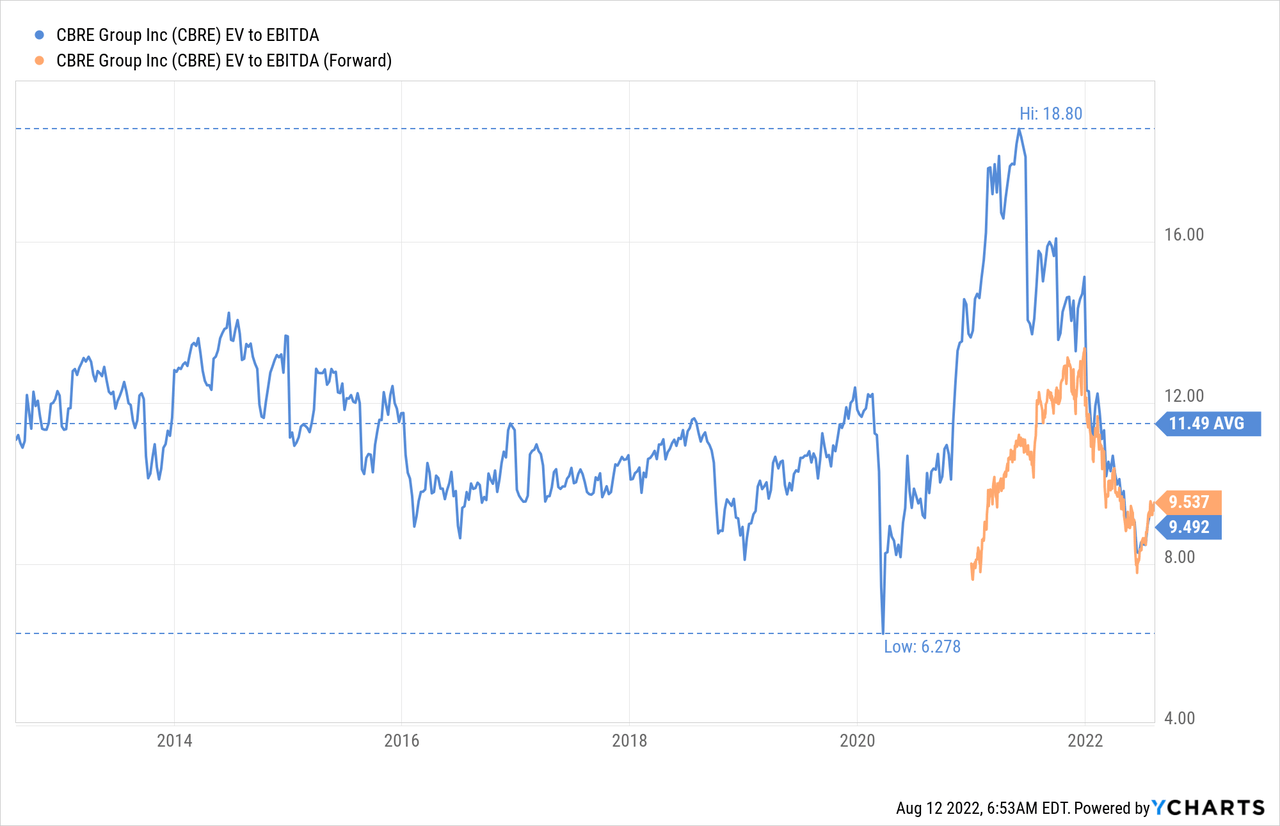

CBRE is trading at a very undemanding valuation of ~9.5x EV/EBITDA, which is significantly below its ten year average of ~11.5x.

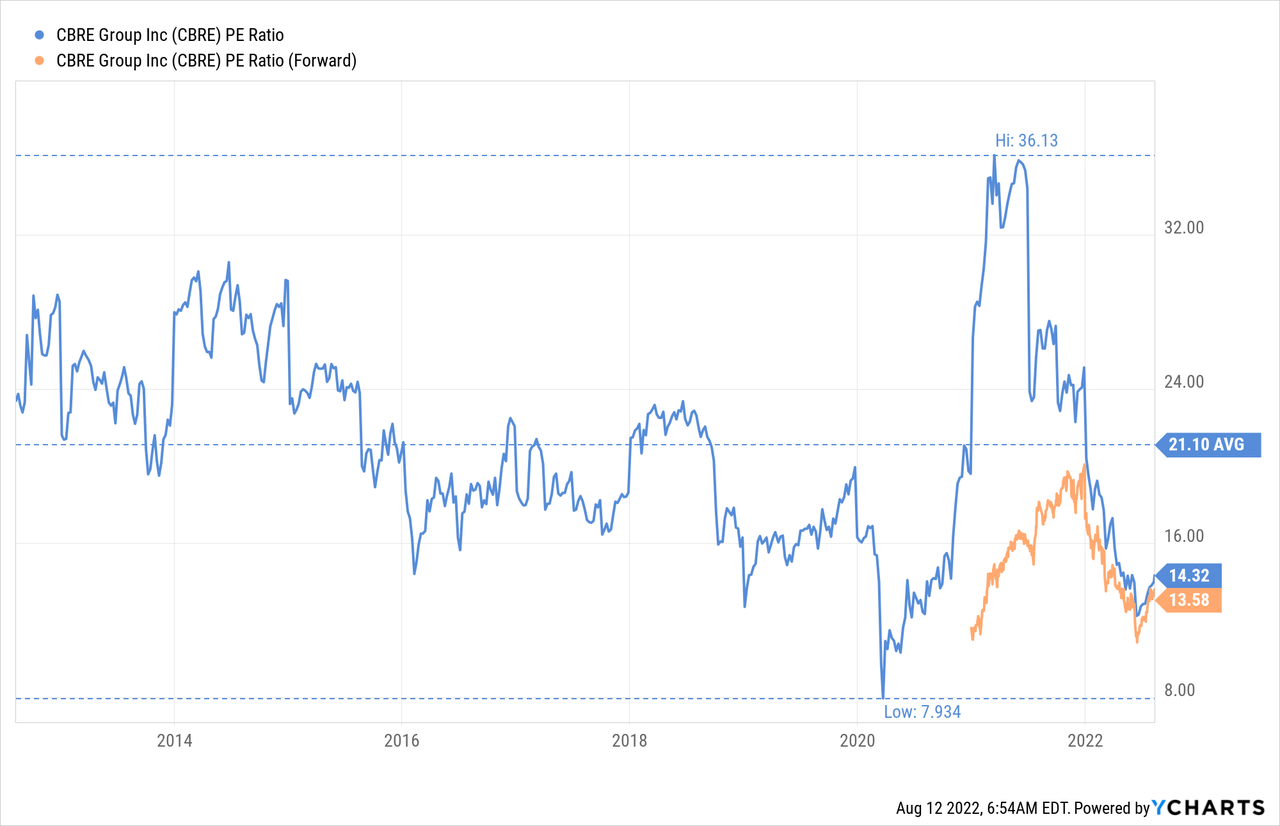

Its price/earnings ratio is also significantly below its ten year average of ~21x, at a modest 14x, and 13x based on forward estimates.

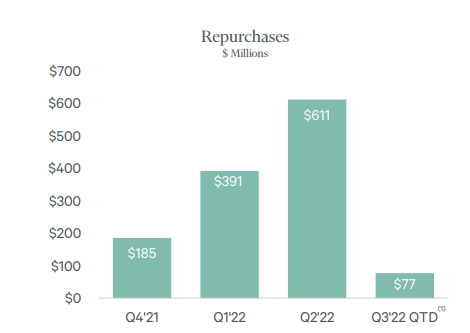

The company seems to agree that its shares are too cheap given that it has repurchased more than $600 million worth of its shares in the quarter, the most ever in any quarter, bringing year to date share repurchases through July to nearly $1.1 billion.

During the earnings call they mentioned that they would not be able to purchase a company near the quality of CBRE at the valuation they currently see for the shares.

CBRE Investor Presentation

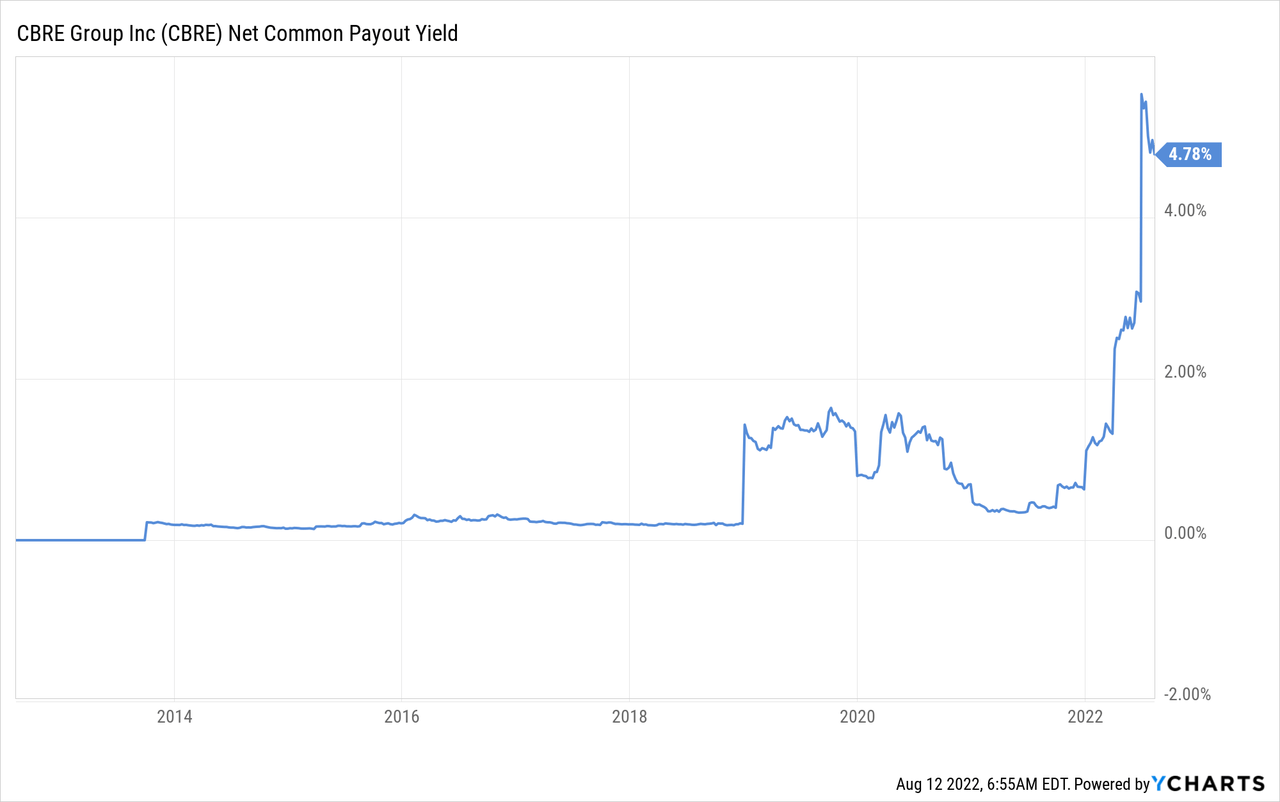

While the company does not currently pay a dividend, given the significant share repurchases the Net Common Payout Yield, which is the sum of the dividend and net share repurchases yield, is near a record.

Risks

The main risk we see with an investment in CBRE is that many of its earnings streams are affected by the performance of the economy, and even the base case for the company is that of a mild recession for the second half of the year. If the US economy does enter a recession, we would not be surprised to see CBRE’s results deteriorate significantly.

Conclusion

CBRE reported record second quarter results, with all segments performing well. We believe shares are significantly undervalued, and the company appears to agree given their comments during the earnings call, and the significant amount of share repurchases they have been doing. We believe a ~9.5x EV/EBITDA multiple is too low for a quality company like CBRE that still has significant growth potential.

Be the first to comment