Andrii Yalanskyi

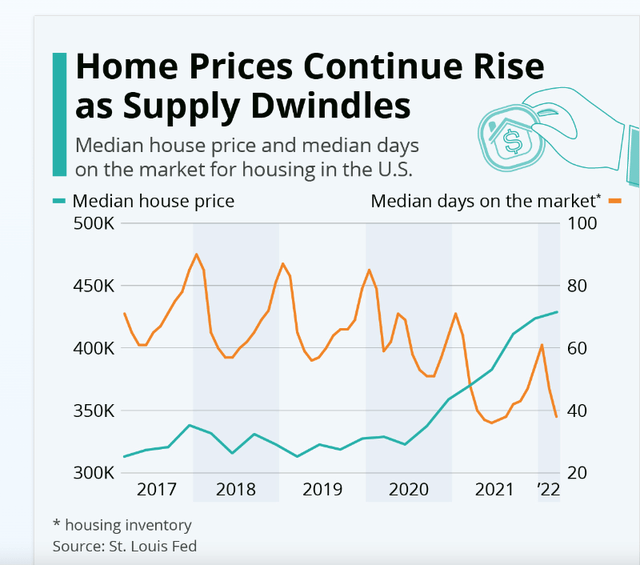

There is an increasingly negative sentiment towards homebuilding stocks, and rightly so in a challenging market facing rising interest rates, inflation and residential slowdown as the economy head into a forecasted recession while facing labour shortages and increased material costs. However, we must recognize the severe tailwind of a substantial nationwide housing shortage predicted only to grow in the coming years.

With this as a backdrop, I believe Cavco Industries, Inc. (NASDAQ:CVCO), a producer of cheap manufactured housing with a market cap of $2.03 billion, will play a critical role in providing a solution to affordable housing across the USA. However, it is experiencing the short-term impact of a slowdown in buying behavior, with fewer new orders and decreased backlog. In the mid to long term, the demand is undeniable, as it provides a much cheaper housing solution than a traditional building. Although the stock has delivered negative returns year to date, in the last six months, it has rewarded investors with 23.75% in returns and is priced well below its one-year analyst target of $341.67 per share. From a long-term perspective, it has rewarded shareholders with a generous 55.57% in returns over the last five years.

Five-year stock trend (SeekingAlpha.com)

CVCO is one of the cheapest housing options. It’s growing through M&As, benefiting from economies of scale, has a healthy balance sheet and sturdy cash generation and may benefit from housing shortage government initiatives in the future. The manufactured housing industry is expected to grow at 5.3% CAGR from now until 2027. Therefore investors may want to take a long-term bullish stance on this company.

Overview

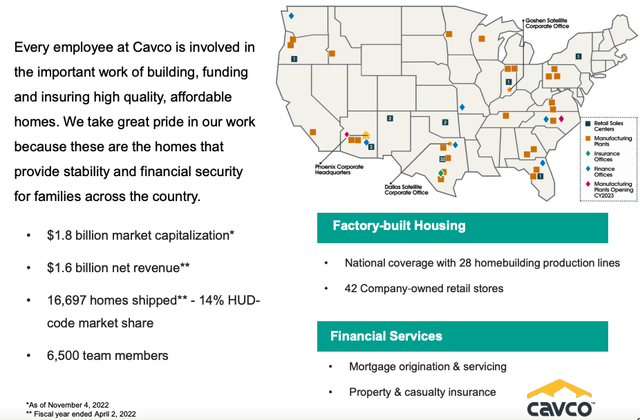

CVCO has two business segments, its factory-built housing segment, which accounted for 96.91% of total revenue last quarter, and its financial service segment, which is significantly smaller but growing year on year. It produces manufactured homes; it was founded in 1965 and has been public since 2003. It generates revenue by creating and selling factory-built homes to a lower-income market. By 1973 the company focused solely on mobile home production. Today it constructs various buildings, from manufactured and modular homes to commercial buildings, park model RVs and holiday cabins throughout the USA.

Company overview (Investor Presentation 2022)

The houses are built with minimal material waste and require less labour than traditional homes. These cost advantages have also made the company less impacted by rising interest rates. There has been a negative public opinion around the idea of manufactured homes that has impacted potential customers. However, this is starting to change if we look at recent survey opinions. In the image below, we see the different types of models; HUD-code Homes are the most significant source of revenue for the company.

House models (Investor Presentation 2022)

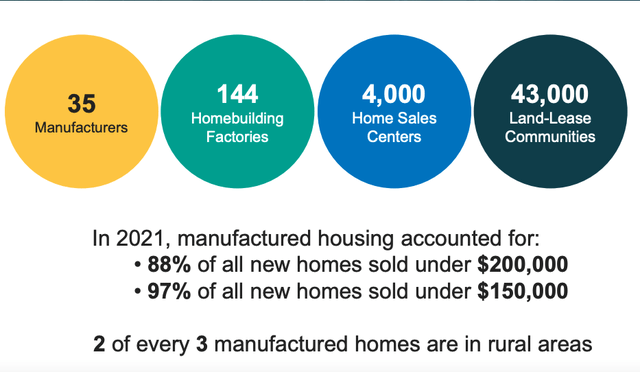

Furthermore, we see some exciting numbers whereby manufactured housing accounts for the most significant affordable housing options under $200,000, with the greatest adoption in rural areas. Manufactured homes are the cheapest form of home ownership, with an average retail sale of approximately $111,900, in 2021 without including location costs.

Industry overview (Investor Presentation)

The company has a solid free cash flow generation and has been expanding its reach through significant acquisitions. Its largest acquisition has been The Commodore for $153 million in 2021. Commodore has increased its market share in the NorthEast and grown capacity by 25%. Earlier this year, the company signed to acquire Solitaire Homes for $93 million in cash. The new acquisition will increase the current manufacturing capacity by 10% in addition to the increase of 22 new retail stores.

Headwinds in the industry are potential tailwinds for manufactured housing, as the competitive pricing and speed at which manufactured houses can be built. The average cost of a HUD-code home costs $125,000, which is well below the pricing of traditional homes. Furthermore, the industry will likely benefit from government initiatives to improve the growing housing shortage issues.

Median price for housing trend (Statista.com)

Financials and Valuation

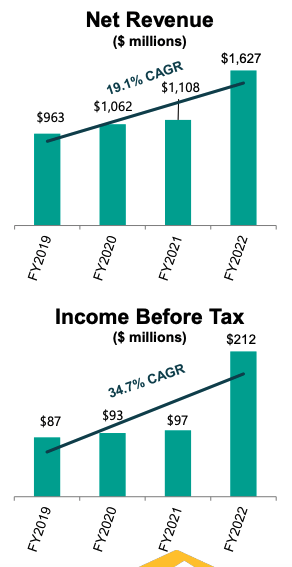

CVCO has had twelve straight years of growing revenues and profits. Its Q2 of 2023 fiscal year showed ongoing upward results with year-on-year revenue increases of 60 .6% to $577.4 million. The Commodore Home acquisition played a significant role in the rise and the increase in pricing. High production capacity of around 80% and net income nearly doubled to $74 million. In an industry experiencing labour and supply challenges, it has increased its production per plant up to 10% Same-plant production is up 10%. Its gross profit margin for its factory-built housing segment increased year-on-year to 26.7%, connected to a decrease in lumber material costs.

Financial growth year on year (Investor Presentation 2022)

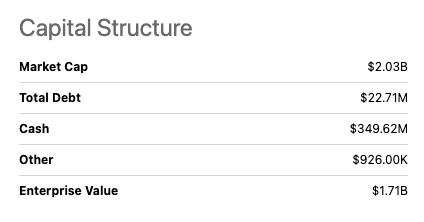

A slowdown in consumer demand has impacted the company. The backlog is down 35% year on year to $651 million. The company has a healthy balance sheet, and an improvement from last year’s Q2, with a cash balance increase to $349.62 million. Although the company does not have a dividend program, it has returned just under $39 million to shareholders through stock repurchases. The board has approved $100 million towards a new repurchase program.

Capital Structure (SeekingAlpha.com)

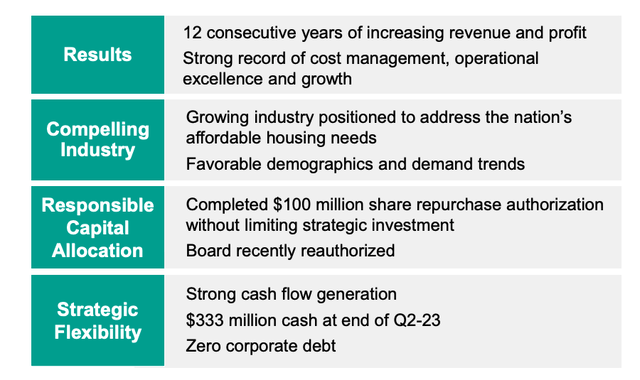

Below is a breakdown of the financially attractive position as highlighted in their Investor Presentation of November 2022.

Performance highlights (Investor Presentation 2022)

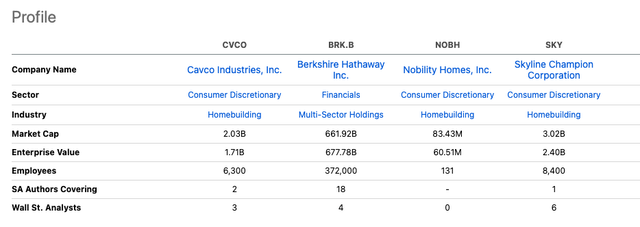

I have compared CVCO to publicly traded peer construction companies that compete in the manufactured house building industry, although it must be noted that many are privately owned. CVCO is seen as a Buy to Strong Buy by various analyst recommendations. Seeking Alpha’s Quant rating system gives it a 4.63 Strong Buy, similar to Wallstreet analysts with a rating of 4.66 Strong Buy. Below we’ll be able to take a look at the profiles of CVCO and its peers.

Peer Comparison (SeekingAlpha.com)

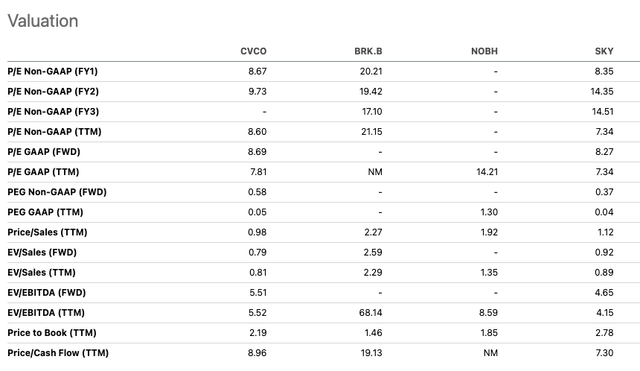

Let’s look at the different valuation ratios. We see that CVCO and SKY are the most attractive, with low price-to-earnings ratios and CVCO with a price-to-sales ratio of less than one at 0.98, indicating that it may be undervalued. However, it has a high price-to-book ratio of 2.19, which is less attractive.

Peer Valuation (SeekingAlpha.com)

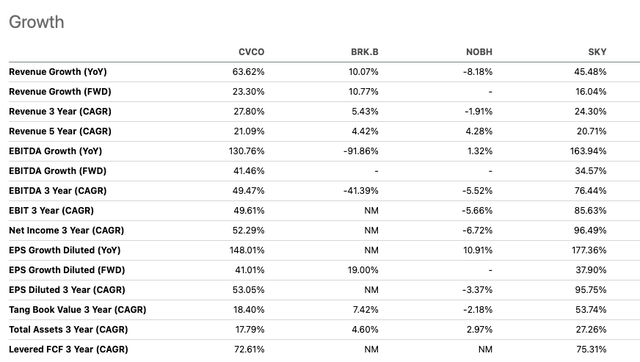

CVCO has a desirable revenue growth rate of 63.62% and an impressive forward-looking EBITDA of 41.46%.

Peer Comparison (SeekingAlpha.com)

Risks

Although CVCO may be one of the companies providing the cheapest housing solutions in the market, the increase in interest rates, inflation and the loom of recession have impacted people’s buying decisions. However, this is short-term, as the pressure to find suitable accommodation pushes more customers to look for affordable solutions. Another aspect is the negative perception that surrounds manufactured housing. Potential consumers would pay above their price to not be associated with the negative stigma around this type of housing. Although this, too, is changing as the market understands that it is a suitable housing option for a broad target audience. Furthermore, natural disasters, such as Hurricane Ian, could have an impact on the production facilities as well as the retail locations.

Final thoughts

Investors are not particularly excited by this market due to the stiflingly high mortgage rates. While we can see that the company has been impacted by the general industry headwinds, in the long run, there is a lot to gain as it is one of the cheapest alternatives in a market experiencing a massive supply shortage. As the company continues to grow, it can benefit further from economies of scale, and it may have financial benefits through government initiatives looking to address the housing shortage quickly and cheaply. For this reason, investors may want to take a long-term bullish stance on this company.

Be the first to comment