Avalon_Studio

Investment thesis: Caterpillar Inc. (NYSE:CAT) is a solid industrial establishment with a strong global position in the industrial machinery market. It features a solid product lineup, solid finances, a solid dividend, and a long-established history of perseverance under various strenuous economic headwinds. While it is a solid company, it is nowhere near being priced for the economic & geopolitical headwinds that the world is facing, which we are likely to feel in the form of reduced demand abroad as well as domestically.

In Europe, there is an increasingly real prospect of economic implosion, with a colder-than-average winter in the U.S., in Europe, or in both regions possibly being all that it would take to throw the global economy into a severe, catastrophic crisis. In Asia, barriers may start to go up, as the U.S. and China are increasingly locking horns. Domestically, higher interest rates are set to kill demand for home construction and other infrastructure projects. Caterpillar is going into this challenging period in solid shape, but its stock is currently priced for a stellar 2023 global economy, even though most of the risk to that already bleak outlook is to the downside.

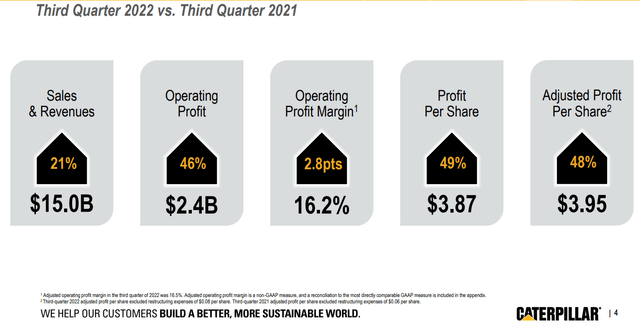

Caterpillar’s latest financial results are the rearview-mirror facts that keep the stock on a stellar performance path compared with the overall market

Looking at fresh numbers released for Q3 of this year, Caterpillar saw an across-the-board improvement in its financial performance, and it also beat market expectations.

Aside from stellar revenue and profit growth, Caterpillar also saw an improvement in other measures, such as the order backlog, which went up by $9.4 billion. Long-term debt declined, and so did interest costs. Interest costs are something I tend to watch closely as a decent gauge in regard to a company’s overall financial health. Caterpillar’s interest costs for the first nine months of this year totaled $326 million, which amounts to less than 1% of revenues. This is a solid situation in this respect. I tend to worry when this ratio gets closer to 5%.

Caterpillar’s foreign exposure can lead to further revenue and profit deterioration.

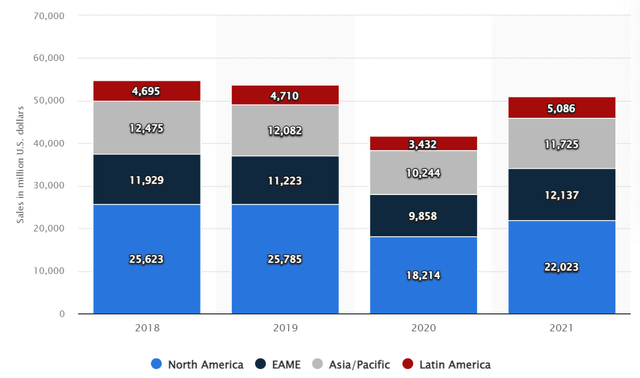

Caterpillar sales by region (Statista)

As we can see, Caterpillar is very broadly diversified in terms of sales by geographic region. North America is by far its most important market, but Europe, Asia, and to a lesser extent South America are also collectively very important to Caterpillar’s prospects going forward.

In the shorter term, we have the strong dollar effect, which is detrimental to most U.S. companies that, like Caterpillar, source half or more of their revenues (and presumably profits) from foreign markets. Beyond the short-term effects of a stronger dollar, we have questionable economic prospects in certain markets where Caterpillar operates. Europe, in particular, which is the company’s second most important market, is looking increasingly wobbly from an economic point of view. There is already an economic slowdown on the horizon, and things could potentially get particularly rough next year.

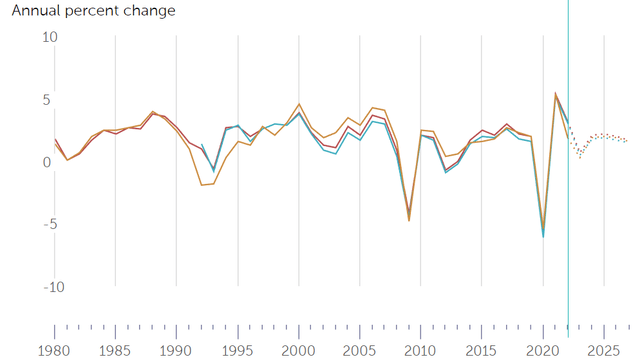

As we can see, the IMF now believes that the EU economy will not expand at all next year. As bad as that may seem, it only tells a partial story. In USD terms, the EU economy is forecast to shrink by about $1 trillion this year, mostly due to the euro currency losing its value. As I pointed out in a recent article, this is not just an abstract concept, but rather a real shrinkage of the EU economy, with many industrial activities starting to cease operations. Next year might be worse than this year, and far worse than the IMF chart above suggests because industrial activity closures will likely be in full swing if the current energy crisis will persist.

For Caterpillar, this could mean that European sales will plunge next year. EU-wide government deficit spending will be very high, but it will mostly be focused on helping households and companies cope with energy price inflation. Public infrastructure spending will most likely head in the opposite direction in an effort to preserve money as well as energy. Fewer construction projects will probably mean fewer companies will be willing to purchase equipment next year, and perhaps beyond.

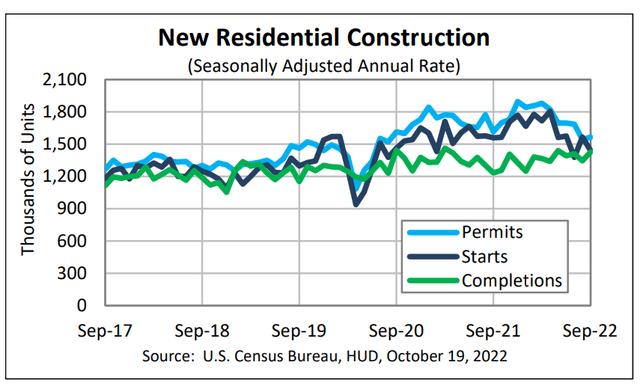

As far as the domestic market, there is a very real prospect of a slowdown in sales next year, especially if interest rates will remain high for the foreseeable future. Mining, infrastructure construction, and new home construction are all economic activities that Caterpillar sales depend on, and all these have the potential to see a dramatic slowdown within the context of a prolonged period of higher interest rates.

As we can see, there is starting to be a significant decline in housing starts, coinciding with the effects of higher interest rates.

We also see a lack of oil & gas drilling activity growth, despite much higher oil & gas prices this year compared with last year. Based on the Baker Hughes rig activity data, drilling in the U.S. has more or less stagnated after an initial post-COVID recovery, despite what one might expect given the price signal. Again, the cost of capital comes into play. Shale producers have had a hard time last decade, during the ramp-up phase, even as capital was cheap to access relative to the current interest rates environment. I doubt that they will pick up the pace now that borrowing costs are rising, their prime drilling acreage availability is shrinking and investors are still reeling from the heavy losses that many suffered last decade. With residential housing construction headed for a potential slowdown, and industrial projects also unlikely to thrive within the current economic context, Caterpillar may experience a significant slowdown in the North American market.

The Asian market is a bit of a wildcard. On one hand, Asia’s long-term trend of economic ascendance is set to continue. On the other hand, Caterpillar has already been seeing softening demand in key markets like China, already in the second quarter, mostly due to China’s economic issues. If the economic conflict between the US & China continues to escalate, companies like Caterpillar could potentially see their China sales targeted in retaliation by the Chinese government. At the same time, if China moves away from its Zero-COVID policies and introduces economic stimulus measures, it could greatly benefit a company like Caterpillar, especially if further infrastructure projects will be initiated as part of the stimulus.

As things stand right now, Caterpillar is already seeing some first signs of softening demand in places like Europe. For instance, even as Caterpillar’s overall construction equipment sales increased by 19% since the same period of last year, in the European space, it only increased by 1%. I expect that sales will decline next year, as the EU will enter a prolonged period of extreme economic hardship. There are also risks in the domestic market, as well as the Asian situation, which could break either way going forward. The dollar exchange issues may also start having a more profound impact in coming quarters and perhaps in the years going forward.

Investment implications:

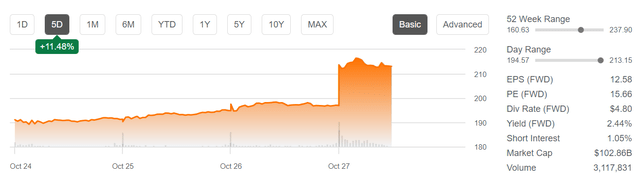

As should be expected, the markets reacted very positively to the release of the Q3 results.

The upward momentum in its stock is fully justified, and in the shorter term Caterpillar stock might even reach new all-time highs this year or early next year, depending on broader market conditions. Beyond the next few months, however, I do expect to see a deterioration in its quarterly returns, mostly due to a deteriorating global economic environment, with some important markets such as the Europe region taking a particularly hard beating as the continent seems poised to de-industrialize.

Caterpillar’s results might be somewhat insulated from a general global slowdown in industrial and construction activities, given that it does have a growing backlog of orders to fill, as I pointed out. Having said that, I expect coming quarterly results to provide a much better entry point for long-term investors, most likely next year. Investors should not expect a very significant bargain, given that this is a solid company that long-term investors are not likely to rush to part with, but I do see Caterpillar stock going below this year’s lows sometime next year if I am right about the difficult global economic situation that awaits us.

Be the first to comment