Fahroni

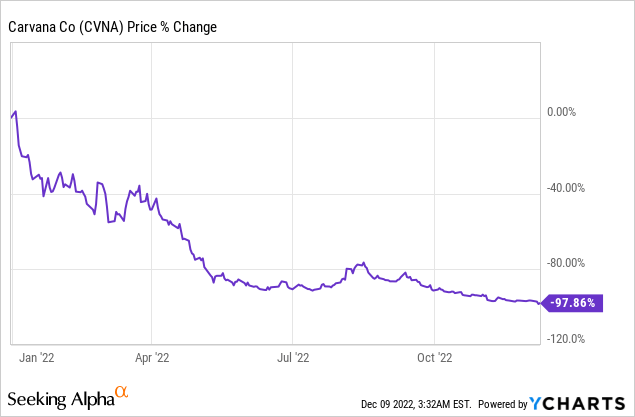

Used-car dealer Carvana (NYSE:CVNA) is nearing a painful debt restructuring that could lead to equity holders getting completely wiped out in the near future. An ill-timed acquisition of auction business ADESA, soaring net debt, high operating costs and deteriorating fundamentals in the used-car market have created a situation in which the company is unlikely to survive. After a 98% move to the downside in 2022, the remaining equity investors may see the value of their shares drop to zero as a bankruptcy seems unavoidable!

Bankruptcy fears

Carvana lost 40% of its value on Wednesday due to heightened fears over a bankruptcy. According to a Bloomberg report, creditors holding a combined $4B of the car-dealer’s unsecured debt are said to be banding together to avoid infighting in the case of a bankruptcy. Although shares of Carvana rebounded 30% on Thursday, the price surge is likely driven by speculators as the company’s fundamentals can be expected to deteriorate in the foreseeable future.

The used-car company is in a perilous situation chiefly because the company acquired an auction house and raised its net debt just before the second-hand vehicle market began showing signs of slowing growth, resulting in escalating margin pressures for Carvana.

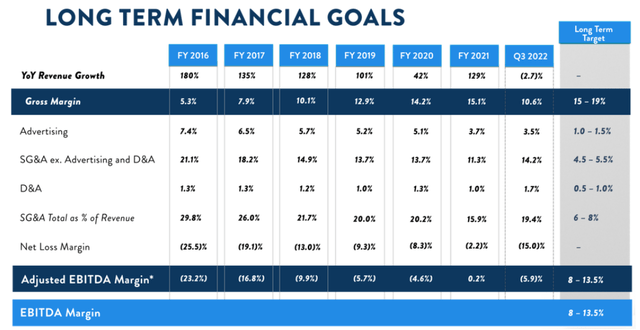

Unfortunately, Carvana has not been able to work towards a sustainable cost structure that would give the used-car dealer hope of working out a turnaround plan. Even during the boom years of FY 2020 and FY 2021 – which is when prices for second-hand cars soared – the used-car dealer was not able to generate positive EBITDA margins. In FY 2021, Carvana only generated a 0.2% (adjusted) EBITDA margin and the company didn’t earn its capital costs.

Although the company has formulated a long term goal to drastically cut its SG&A expenses to 6-8% of revenues, Carvana has consistently spent much more than that on its SG&A in the last six years with costs as a percentage of revenue going as high 30% in FY 2016. The longer term average is closer to 20%. In the third-quarter, Carvana disclosed a net profit margin of (15)% which was largely driven by the company’s SG&A expenses.

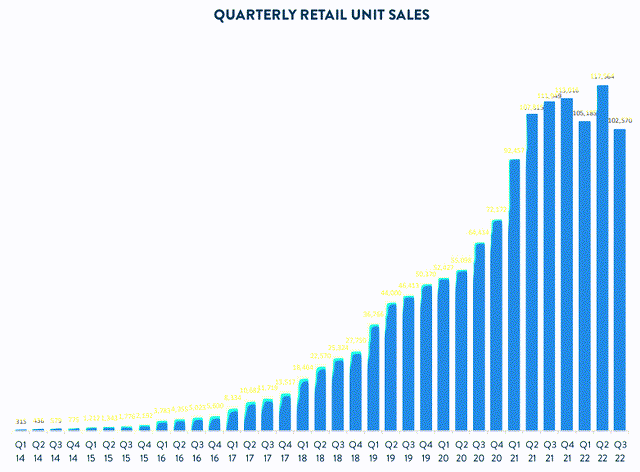

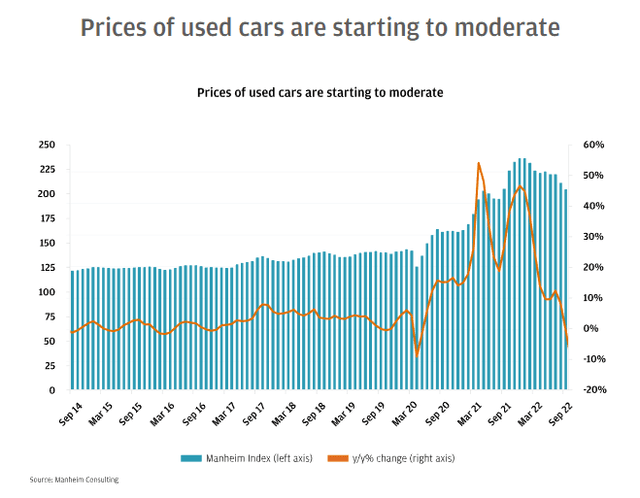

On top of that, fundamentals in the used-card market turned against Carvana in FY 2022 and especially in the second half of the year which is when used-car prices started to drop. In the third-quarter, retail units sold dropped 8% year over year to 102,570 which added to Carvana’s growing losses. The drop in retail volumes has been a key reason behind Carvana’s 3% year over year revenue drop to $3.4B in the third-quarter.

Additionally, rapidly rising interest rates have made it more difficult for used-car buyers to afford car payments, even on lower-priced used vehicles. According to Carvana’s third-quarter shareholder letter, the monthly car payment for a typical purchase increased 57% since 2019 and 22% since 2021, which is largely attributable to the rise in interest rates that is making auto loans more expensive for buyers.

It doesn’t make it easier for Carvana that used-car prices have started to decline from their August peak which appears set to add additional margin pressure on the company going forward. J.P. Morgan is projecting that the down-trend in used-car prices will continue in FY 2023 with used-car prices expected to decline between 10-20%.

Bloated balance sheet and soaring interest expenses

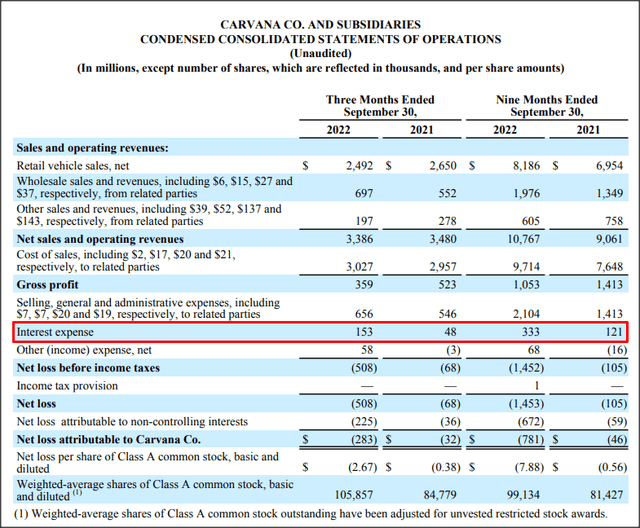

Carvana acquired auction house ADESA for $2.2B this year, just before the used-car market peaked in August. To finance its operations and the acquisition, Carvana increased its debt. At the end of the September-quarter, Carvana’s net debt had soared to $6.5B, up 120% since the end of FY 2021. As a result, Carvana’s interest expenses also soared and increased from $121M in the first nine months of FY 2021 to $333M in the same period in FY 2022, showing a massive increase of 175% year over year. With total losses of $781M year to date, it appears unlikely that the company can continue to support its cost structure.

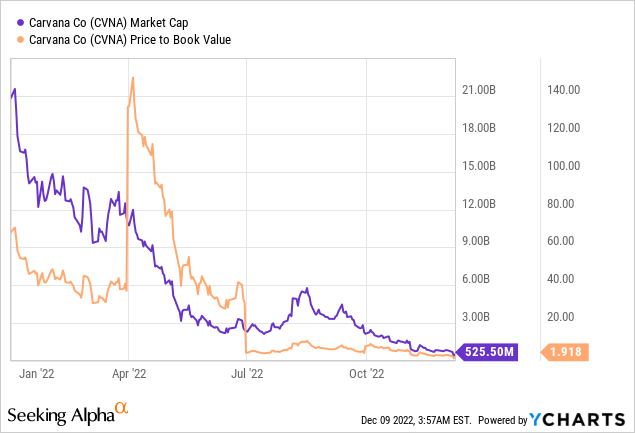

P/B ratio

Carvana generates no profits, so a P/E ratio can’t be used to value the company. The P/B ratio could be used to see how much investors still value the firm’s equity at which in this case is 1.9 X. However, with odds of a possible restructuring decreasing lately and market pressures mounting, I don’t believe any valuation measure can be trusted right now.

Risks with Carvana

The biggest and most immediate risk for Carvana is that the company is falling into bankruptcy which most likely would result in shares of the used-car dealer becoming worthless. Even if the company were to secure a major debt restructuring, I believe the writing for Carvana is already on the wall: higher interest rates, declining retail unit sales and high operating costs are all risks for used-car dealers, but especially for those companies (like Carvana) that have ramped up their leverage profiles just before a cyclical market downturn.

Final thoughts

Carvana has very high bankruptcy risk and this means that there is a very high chance that equity holders are set to get wiped out. I don’t believe Carvana has a sustainable business model given its inflated cost structure, negative margins and bloated balance sheet. Weakening fundamentals in the used-car market and higher interest rates imply that the risk of losing capital far outweighs the potential chance of a major value recovery here!

Be the first to comment