Joe Raedle

After the bell on Thursday, we received third quarter results from Carvana (NYSE:CVNA). The online vehicle retailer announced another bad quarter as used car prices have dropped, making the company’s already poor financial situation even worse. Even though shares that peaked around $370 are now trading for just $13, there still seems to be the potential for meaningful downside ahead.

For Q3, the company reported revenues of $3.386 billion, or a decline of 2.7% over the prior year period. This number was about $300 million below street estimates, as analysts were actually looking for a more than 6.1% increase. While the company was able to record a 2.6% increase in retail average selling prices over Q3 2021 on the backs of last year’s used car price surge, retail units sold dropped more than 8%.

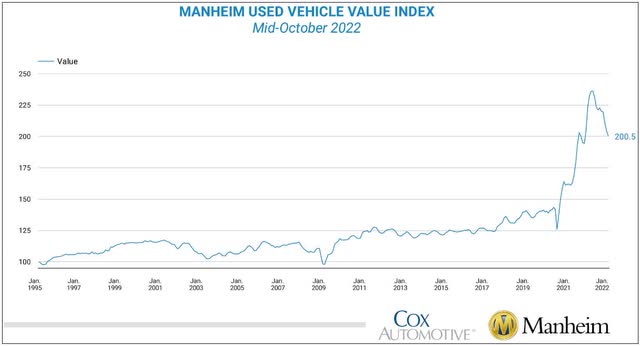

Management has stated that retail units sold will decline in Q4 along with gross profits per unit. Analysts were actually looking for an increase in total revenue to $3.76 billion, so guidance implies that will not happen. Just as fast as used car prices soared, they are now on the decline, with the Manheim used vehicle value index down more than 30 points from its peak as seen below. We’ll get the full October update from Manheim next week.

Used Vehicle Value Index (Manheim)

While Carvana management has been restructuring its operations after its Adesa acquisition to cut costs, it still is losing a lot of money. The total loss was over half a billion dollars in Q3, although $225 million of that was attributable to non-controlling interests. The net loss to Carvana was $283 million, up a bit from Q2’s $238 million, and much worse than the $32 million that was lost in Q3 2021.

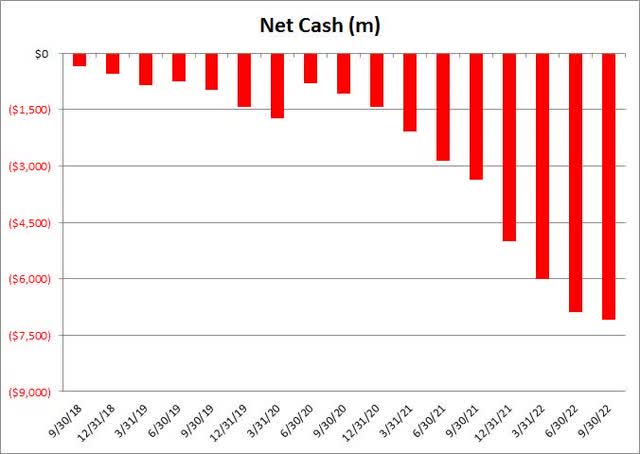

The main problem for the company that I’ve detailed over the years is its poor balance sheet. Massive losses have led to tremendous cash burn over time, and despite numerous stock sales that have resulted in significant dilution, things now are perhaps even worse than ever. As the chart below shows, the net debt position has grown to more than $7 billion at the end of Q3.

Carvana Net Cash (Company Filings)

The company has burned over $1.03 billion of cash through the first nine months of 2022. This includes the fact that the reduction of inventory has been a tailwind of $638 million. While inventory was bloated earlier this year, future sales growth won’t occur unless the company continues to purchase vehicles. Thus, inventory could return to being neutral or even a large cash flow headwind as it has been in the past, which might offset any potential cash flow gains coming from reduced losses if management can tighten its belt enough.

Carvana’s total liquidity reserves declined by $340 million in Q3 to less than $4.4 billion. Nearly half of that is unpledged real estate and vehicle inventory, and a good portion of the rest is borrowing capacity that would add interest expenses if tapped. So far this year, the number of Class A shares, those that trade in the market, has gone from just under 90 million to almost 106 million. Selling more stock would certainly help the balance sheet here, but dilution would have to be quite significant to raise any meaningful funds at this point.

Despite all of the economic uncertainty out there, analysts have been very positive on this name overall. The average price target going into earnings was almost $44 per share, meaning the street thought this stock could triple. I expect a lot of target cuts coming after Thursday’s report, and don’t forget that the street just a year ago thought this name was worth almost $400 per share. The technical picture isn’t great either, as the 50-day moving average at nearly $25 currently is set to continue falling, which would provide some potential upside resistance.

In the end, Carvana announced a miserable set of Q3 results, potentially setting the stock up to see single digits in the near future. Revenues badly missed street estimates, with another large loss reported along with more cash burn. Q4 guidance implies things are only going to get worse, especially as used car prices continue to drop over time. With the balance sheet weakening further, more debt or equity could be needed, but that’s not an appetizing thought at this point. Unless the overall market rebounds from here or we get a major Fed pivot soon, Carvana shares could go quite a bit lower moving forward.

Be the first to comment