JHVEPhoto

I was wrong about Carvana Co. (NYSE:CVNA). Big time. Back in 2022, I thought Carvana was a business about to go bust, and in June 2023, I thought the positive adjusted EBITDA reported by the company was not as attractive as it seemed. Mr. Market has certainly humbled me, with CVNA stock up more than 3,600% since my first bearish piece was published in December 2022.

Around the same time, my long-term friend Charaka Janitha Mahage, who currently works as a buyside analyst for one of the leading private equity firms in Dubai, tried convincing me to invest in Carvana, but his efforts were not successful as I believed Carvana was a ticking time bomb. With his investment decision in Carvana proving to be a major success, I sat down with Charaka over the last weekend to discuss why he went against the grain in December 2022 and what he thinks about Carvana’s future. Although he does not share his investment portfolio/decisions publicly, he agreed to share his views with Seeking Alpha readers upon my request, as I thought his perspective on Carvana would add immense value to Seeking Alpha readers. My perspective on Carvana has changed dramatically in the last 6 months as the company has delivered on most of its promises, and my recent conversation with Charaka gave me even more confidence to believe in Carvana’s business. Although I am not planning to invest in CVNA at the current valuation, I am upgrading CVNA from a sell rating to a hold rating.

At the end of this article, you will find direct social media links to follow Charaka on LinkedIn and X, if you want to reach out to the analyst directly.

Why I Am No Longer A Bear

Before I present a summary of my discussion with Charaka, let me briefly recap why I was bearish on Carvana back then and what changed my stance over the last few months.

In my previous Carvana articles, linked above, I held a bearish view of Carvana’s prospects as I thought the company would fail to see light at the end of the tunnel due to a few main reasons.

- I thought the used car market would slow down considerably in 2023, making it difficult for Carvana and other used car dealers to see any growth.

- In 2022, while Carvana was grappling with liquidity issues, I thought the company would run out of short-term liquidity to survive before its turnaround plan starts delivering results.

- I thought Carvana would fail to materially increase gross profit per unit, given that its operating expenses had shot through the roof during the pandemic.

- I found Carvana’s growth at any cost strategy a huge turnoff and believed the management team would fail to adopt a strategy that would focus on profitability.

All these assumptions proved to be off the mark, and Carvana’s financial performance since 2023 has been one for the history books.

The U.S. used car market remained surprisingly strong in 2023 despite elevated interest rates, as consumers wanted to avoid the high prices of new vehicles amid continued inflationary pressures. Around 36 million used cars were sold last year. This market strength created an opportunity for Carvana to execute its turnaround strategy to perfection, and the company grabbed this opportunity with both hands.

My assumptions for Carvana’s liquidity issues proved to be off the mark too, with the company surviving the initial onslaught through short-term funding and later on improving the balance sheet further through a debt restructuring (more on that later). The company’s massive turnaround from a profitability perspective was what caught me off guard the most. Even on the back of a decline in retail units sold from 412,296 in 2022 to 312,847 in 2023, Carvana recorded a net income of $450 million for 2023, marking the first profitable year for the company. The company also eliminated more than $1 billion in operating expenses, delivering on the promises it gave investors when bankruptcy rumors were haunting both the company and its shareholders.

Another notable change was the management’s strategy shift from a growth at any cost mindset to a profitable growth mindset. By shifting priorities, Carvana has been able to enjoy notable operating efficiencies and improved financial flexibility that would help the company survive an industry downturn.

Given how all my assumptions have been proven wrong in the past 18 months, it no longer makes sense to remain bearish on CVNA. Findings from my conversation with Charaka also reinforce the fact that Carvana is a far better business than I initially thought. However, I do feel that the train has left the station with CVNA stock making a strong comeback, so I will remain on the sidelines now purely based on valuation risks.

The Summary Of The Q&A Session

I have arranged the following segment as a Q&A section to help readers understand his thought process better. The first three questions discuss the thought process that led him to uncover the investment opportunity in Carvana, and the remainder focuses on what the future holds for the company, including his 12-month target price for CVNA. Please note that these answers were derived from his direct responses to my questions.

Q1: What key factors or indicators led you to recommend Carvana at $5 despite the widespread bearish sentiment at the time?

In answering this question, Charaka highlighted four main areas where he disagreed with the market sentiment in December 2022.

- Carvana’s massive addressable market opportunity.

- The long-term value of Carvana’s infrastructure build-up.

- Carvana’s liquidity profile.

- The management’s competency to reduce costs.

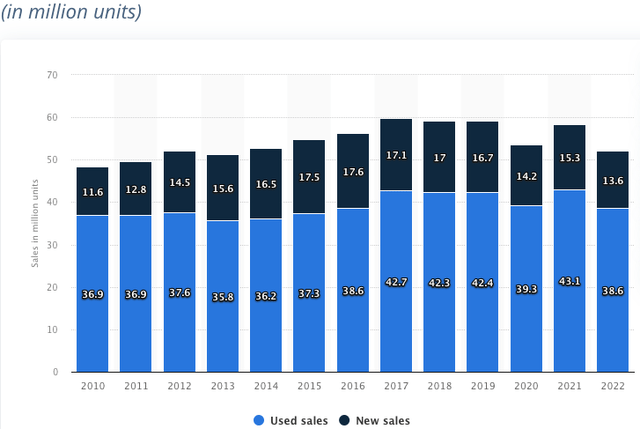

Carvana, which operates in the used car market in the United States, had a market share of just over 1% in 2022. According to Statista, used light vehicle sales in the U.S. reached 38.6 million units in 2022 while Carvana sold just 412,296 units in total.

Exhibit 1: Used and new light vehicle sales in the U.S.

Statista

Although traditional players who prioritized regional business opportunities dominate the used vehicle market today, Charaka believes Carvana’s national strategy will enable the company to aggressively capture market share in the long term, leading to robust revenue and earnings growth. This assumption played a key role in his investment in CVNA in December 2022. Carvana, despite financial struggles in 2022, has remained true to its infrastructure-expanding strategy to power this national approach. According to Charaka, the market was under-appreciating the lucrative long-term ROIs of this strategy when he made his first investment in the company.

He also believes that many investors – including yours truly – miscalculated the liquidity risk facing the company back when bankruptcy rumors were ripe in 2022. He believes the market was missing the availability of working capital loans and the potential for a debt restructuring. Not even a year later, Carvana completed a debt restructuring, reducing its debt burden by $1.3 billion and improving the short-term liquidity profile meaningfully.

Charaka also believes that the market sentiment toward the competency of the management team, led by Ernest C. Garcia III, was too bearish in December 2022 as investors overlooked Carvana’s potential to save substantial costs by slashing marketing expenses and other variable costs. This is another area in which Carvana has excelled in the last 18 months.

Q2: How did you assess Carvana’s financial stability and future growth prospects when the stock was at such a low point?

Charaka’s assessment of Carvana’s financial stability revealed an opportunity the market was missing at the time. According to the analyst, Carvana was well-positioned to survive at least a year from December 2022 while the market was expecting the bankruptcy risk to materialize within weeks. The company had access to $750 million in cash and short-term investments by the end of Q4 2022 and also had access to short-term loans and high-quality real estate.

At a depressed stock price, Charaka thought he was getting a bargain as he believed in the company’s potential to break even at a much lower unit base given the room for a substantial reduction in costs. Given that insiders were controlling the business at the time, he thought there was little incentive for the management to choose the path of bankruptcy as the first choice, given the long runway for growth.

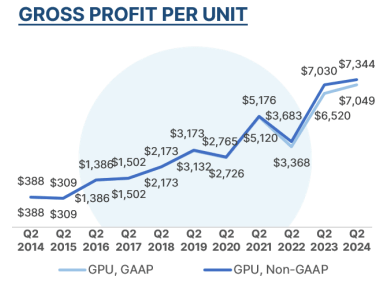

Carvana has delivered on most of these fronts, with the company seeing a notable rise in gross profit per unit in the last 18 months, aided by a favorable shift in spreads between wholesale and retail market prices and lower reconditioning costs.

Exhibit 2: Carvana’s gross profit per unit

Q2 2024 shareholder letter

Q3: Since your recommendation, Carvana stock has surged. What do you believe were the key drivers behind this remarkable recovery?

Many Seeking Alpha readers are aware of Carvana’s stellar recovery. When I asked this question from Charaka, he highlighted three interesting characteristics and developments that not only explain the resurgence of the company but also point to robust growth in the future.

- The execution of the management team to cut costs and show better unit economics while shrinking the business.

- The company’s access to Adesa assets, which should bring down logistics costs over time.

- The integrated business model, which generates better unit economics, data, and the ability to write better loans over time.

Q4: Looking ahead, what are your expectations for Carvana’s performance, and what should investors be mindful of in the coming months?

Charaka, despite trimming his stake in Carvana in the last couple of months, remains invested in the company with a portfolio allocation that exceeds 10%. Although he is optimistic about the long-term outlook for Carvana, he believes investors should factor in several risks that are looming on the horizon.

First, in the short term, there is a risk of the spread between wholesale and retail market prices shrinking, which may lead to a reduction in gross profit per unit. The question he needs investors to answer is whether Carvana is over-earning due to favorable macroeconomic conditions. It would take real-world data to assess this risk fully, so he recommends keeping a close eye on the macro conditions and how they impact Carvana to gauge a measure of the quality of the underlying business.

Second, there is a risk of a sharp slowdown for used cars, which would impact Carvana’s profitability and liquidity given that the company is expanding its inventory base while its largest competitors are shrinking their inventory levels. Although there is no immediate liquidity risk, Carvana’s strategy may backfire if the used car market slows down at a faster pace than anticipated.

There are some early signs of cooling in the used car market. According to Cox Automotive, the second half of this year will see a slowdown in used car sales, with the bulk of growth coming from less profitable commercial sales rather than highly profitable retail sales. Speaking to CNBC, Cox Automotive Chief Economist Jonathan Smoke said:

Overall, we’re expecting some weakness in the coming few months. We basically are making some assumptions that we can’t quite hold the pace that we’ve been seeing. But we’re not expecting a collapse either.

Inventory levels seem to be increasing gradually and the interest-rate environment is not conducive for car shopping either, elevating the risk of a slowdown in used car sales by the end of the year.

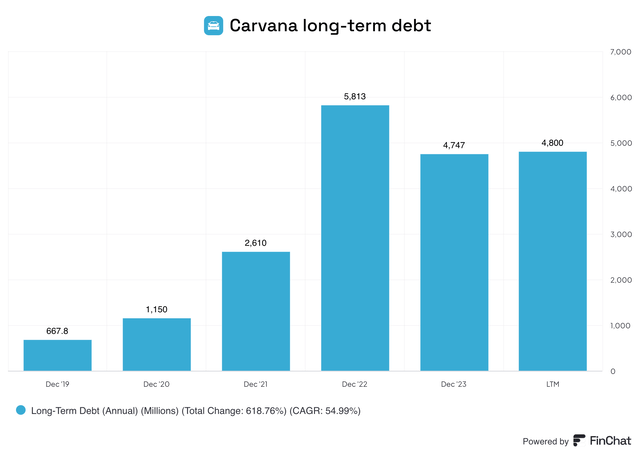

Third, investors should evaluate how quickly Carvana can reduce its debt burden, reducing its terminal risk for long-term shareholders. As illustrated below, the company has done a reasonable job of reducing its debt burden since 2022 but remains highly indebted with almost $5 billion in long-term debt.

Exhibit 3: Carvana long-term debt

FinChat.io

Next, the analyst believes investors need to be careful of Carvana’s unit economics hitting a ceiling as the number of units sold increases. The company has expanded its capacity to cater to around 3 million units today, and the expected growth in units might contribute to profitability to a lesser degree if gross profit per unit declines sharply. Such a development is likely to reset the market valuation for Carvana, which highlights the near-term valuation risk faced by investors.

Q5: Do you have a 12-month price target for Carvana stock?

Charaka is not adding to his long position today despite believing that CVNA may trade around $190 in the foreseeable future given the decent prospects for the next 12 months. He believes the company is well on track to generate $1 billion in EBITDA, but the company seems fairly valued at a forward EBITDA multiple of around 30. He believes the most important determinant of CVNA stock price in the next 12 months will be the macro environment facing the company.

Q6: Can you list down the reasons behind your long-term bullish stance on Carvana?

- The vertically integrated business model, which improves operational efficiency, paving the way for enhanced customer satisfaction and a differentiated competitive offering.

- The company’s access to invaluable customer data, which allows it to cater to customer requirements better than most of its competitors, as evidenced by the market share gains Carvana has enjoyed in the last 12 months.

- The substantial unutilized infrastructure, which allows the company to aggressively expand its market footprint when the time is right.

Overall, Charaka believes Carvana will be a very difficult company to compete with once its capital structure is in a better place.

Q7: What are the resources you recommend for Carvana investors?

In addition to Seeking Alpha, which is home to some of the best investor-driven research on Carvana, Charaka recommends a few other sources that would be helpful for Carvana investors.

- Primary research on InPractice (interview transcripts with suppliers and market researchers, etc.).

- The Alternative Alpha Newsletter.

- IndraStocks account on X.

- Investor letters published by Saga Partners.

That wraps up the Q&A summary. Although Charaka does not share his investment research on Carvana publicly – he is fully authorized to do so if he wishes to – you can reach out to him directly or follow him on LinkedIn and X for any questions regarding his stance on Carvana.

Takeaway

I was wrong about Carvana, and even my very knowledgeable friend Charaka Mahage could not change my opinion about investing in CVNA when the stock was trading at depressed prices in December 2022. Carvana has proved all my assumptions wrong in the past 18 months, forcing me to withdraw my bearish stance on the company. I will follow the company closely to identify a potential entry point in the future and share my findings on Seeking Alpha.

Be the first to comment