TennesseePhotographer

Introduction

It’s been a while since I wrote my most recent article covering one of my favorite consumer dividend stocks. The consumer-cyclical Tractor Supply Company (NASDAQ:TSCO) has done tremendously well. Since February, the stock has advanced 4%, while the market has dropped 11%. That’s impressive because consumer weakness has become the core of the ongoing economic decline.

In this article, I will make the case why the Tractor Supply Company is a terrific consumer dividend stock thanks to its ability to use dividend growth, buybacks, and its fantastic business model to generate tremendous long-term shareholder value.

So, let’s get to it!

What’s The Tractor Supply Company?

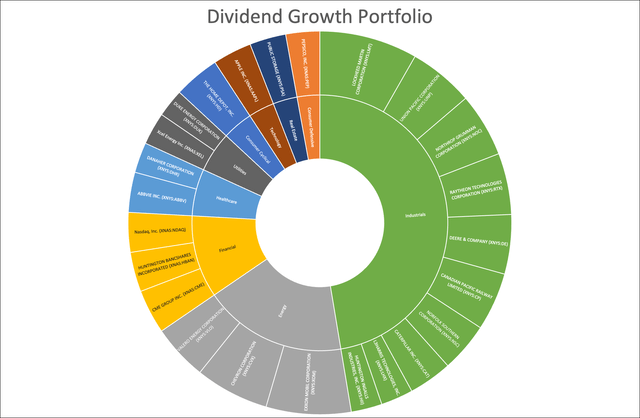

In my long-term portfolio, I own just one consumer cyclical stock. That’s not a bad thing, as there’s no rule of how many cyclical consumer stocks one should own. However, it shows that I am extremely picky. Especially when it comes to consumer stocks, I am not a big fan of often high competition, changing consumer needs, and economic cycles impacting consumer spending.

However, there are some tremendous opportunities in the consumer space. The Tractor Supply Company is one of them.

It’s one of the many companies flying under the radar. In this case, it’s undeserved, as this company has become much more than a niche player.

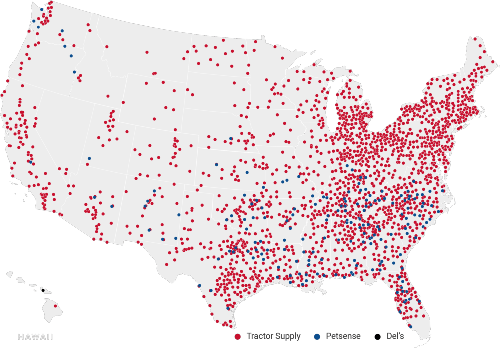

With a market cap of $24.9 billion, the Tractor Supply Company has become one of the biggest players in the specialty retail industry. Located in Brentwood, Tennessee, TSCO is somewhat of a rural Home Depot (HD). In its 2021 fiscal year, the company operated 2,181 stores in 49 states, 2,003 of these stores were Tractor Supply stores. The remaining stores are Del’s and Petsense retail stores.

Tractor Supply Company

The typical store size ranges from 15,000 to 20,000 square feet, with lots of inside and outside selling space. After all, the company isn’t a typical retailer. It focuses on a specific niche: supplying the lifestyle needs of recreational farmers, ranchers, and everyone enjoying the rural lifestyle.

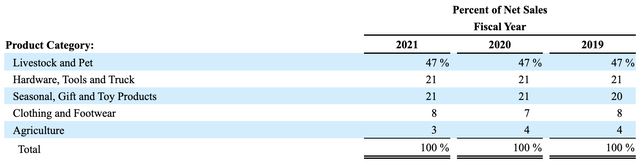

Its products cover all needs of the rural lifestyle, including livestock and pet food and related supplies. Hardware, tools, and truck supplies. Seasonal products, clothing, and agricultural products.

The company uses close to 1,000 vendors to procure its supplies. None of these account for more than 10% of the total purchasing volume. Moreover, the company had no major issues getting access to supply after the pandemic.

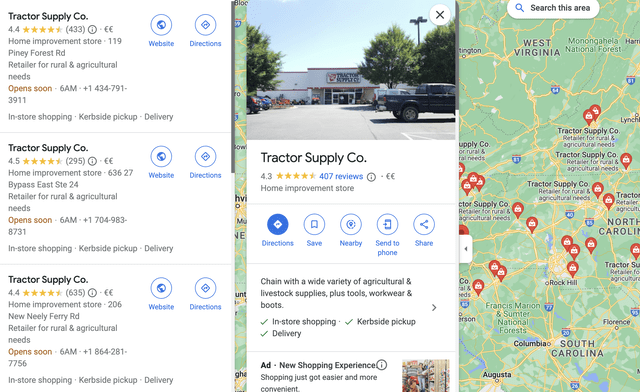

Spending close to 30 minutes going through various stores in different states on Google Maps, I have to say that the reviews are fantastic.

While my findings are in no way anywhere close to scientific, I found that customers liked the personal and friendly touch of very experienced employees, the wide variety of products and competitive prices, and the strategic locations outside of major cities (and small cities).

The pandemic also benefited the company as it put the rural lifestyle back into the spotlight.

Moreover, the company has good management as it uses happy customers to create happy shareholders.

A big part of this is the company’s dividend.

The TSCO Dividend

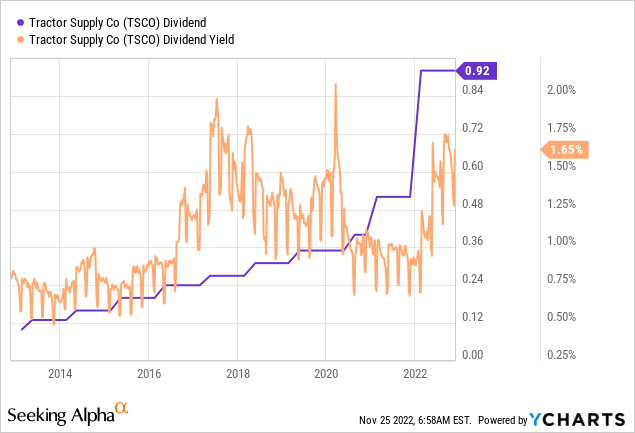

Let’s start with the worst part of this segment. TSCO shares are not high-yielding. The company pays a $0.92 per share per quarter dividend. That’s 1.6% of its stock price.

It’s not by any means a high yield. To get $1,000 in annual pre-tax income from the stock, one needs to invest close to $63,000.

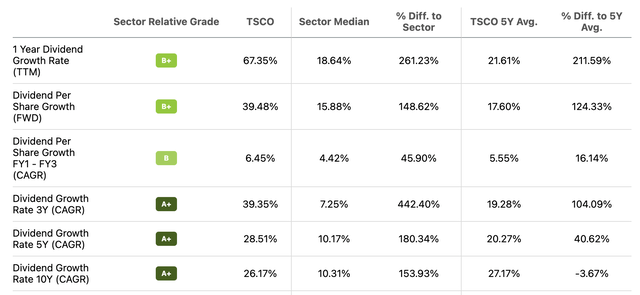

However, dividend growth is fantastic and backed by great financials. This has provided its investors with high outperforming returns.

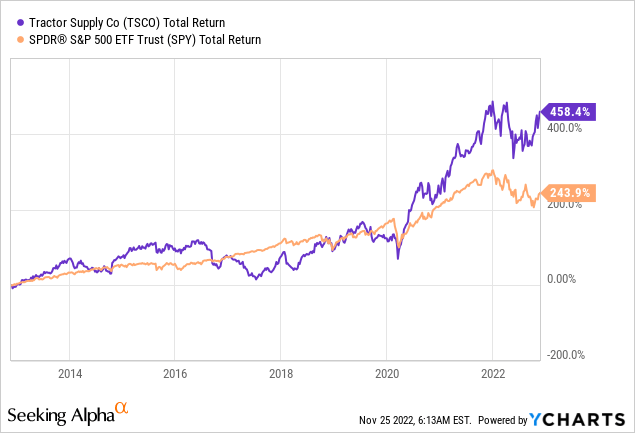

Over the past ten years, TSCO shares have returned close to 460%, beating the S&P 500 by more than 200 points.

Over the past ten years, TSCO shares have returned close to 18% per year, beating the S&P 500 by more than 500 basis points. The standard deviation was a bit elevated at 28%. Yet, that standard deviation is not unusual or above average in the industry.

It’s no surprise that the stock is doing so well, as it has all the qualities of a fantastic dividend growth stock.

The company’s dividend scores are extremely high. Over the past ten years, the average annual dividend growth rate was 26.2%. That’s almost three times the sector median.

The three-year average is almost 40%. These are the most recent dividend hikes:

- January 2022: +76.9%

- January 2021: +30.0%

- August 2020: +14.3%

- May 2019: +12.9%

Thanks to these aggressive hikes, the dividend yield has consistently been close to 1.6% over the past few years – ignoring the period between the 2020 stock price take-off and accelerating dividend hikes in 2021.

It also helps that these dividends are backed by fantastic financials.

The Value Of TSCO

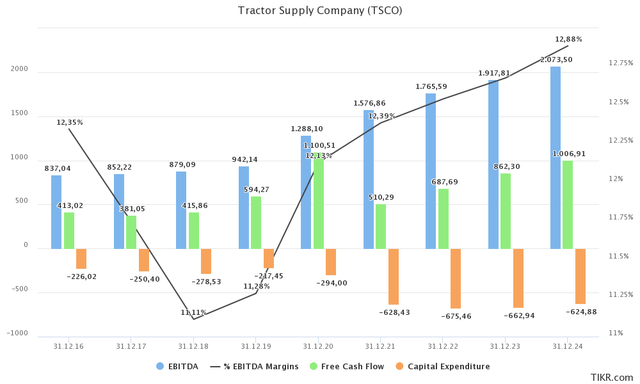

TSCO has consistently grown the financials that matter most. Between 2016 and 2024E, the company is set to grow EBITDA from $840 million to more than $2.0 billion. This is supported by a consistent surge in profitability after 2018, resulting in 12.9% adjusted EBITDA margins in 2024E.

During this period, free cash flow is set to cross $1.0 billion in 2024. That would imply a 4.0% free cash flow yield. It would indicate a lot of upside for the current 1.6% dividend yield.

Moreover, the long-term FCF uptrend is remarkable. In 2016, the company generated $413 million in free cash flow. In 2020, the company did $1.1 billion in FCF. That was the result of the pandemic when the rural lifestyle became trendy. People were bored at home, working on projects and related things.

After 2020, FCF took a big hit as it fell to $510 million. Now, we’re in a new uptrend.

The reason why the 2021 FCF was down is because of the pandemic and because the company more than doubled its investments in its business. Looking at CapEx in the chart above, the company is now spending more than twice as much on capital goods.

Between 2020 and 2021, CapEx soared from $294 million to $628 million. Almost the entire surge was caused by investments in existing stores as the company is working on strategic initiatives related to store remodels, including internal space productivity, and outside side lot improvements.

In addition to high free cash flow growth expectations (25.4% in 2023, 17% in 2024), the company is getting good feedback:

[…] our customers are taking note of these remodels. We’re seeing on our customer satisfaction surveys, we’re seeing overall increases after the remodel. We’re seeing kind of questions like the condition of the store, the appearance of the store, many of our customers qualitative will ask if we’ve updated the store and they notice it. And the same thing on the garden centers. We’re seeing many new customers shop our business once we roll out a garden center, much higher female penetration, much higher millennial penetration.

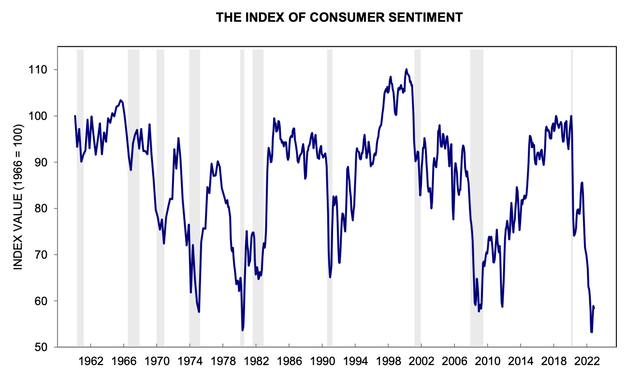

Even in 2022, the company is doing well. This is happening despite an implosion in consumer sentiment, significantly weakening home sales, peaking home prices, and high rates.

On a full-year basis, the company expects to grow comparable store sales by 5.4% to 5.8%. The prior guidance was 5.2% to 5.8%. CapEx is expected to come in between $650 and $700 million, including the opening of 60 to 70 new TSCO stores and 10 new Petsense stores.

Growth is mainly provided by pricing as transactions are down. In the September quarter, transactions were down 1.3%. I believe that pricing will continue to offset transaction volume as TSCO is in a good spot to benefit from secular growth and a unique product offering.

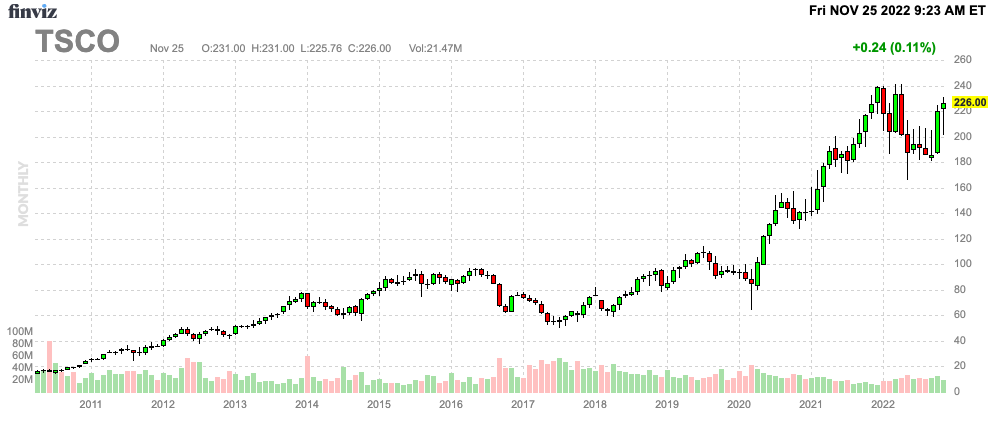

Investors know that. Hence, TSCO shares are down less than 7% from their 52-week high. This performance is 10 full points better than the S&P 500 performance. That’s truly remarkable.

FINVIZ

This brings me to the valuation.

Valuation

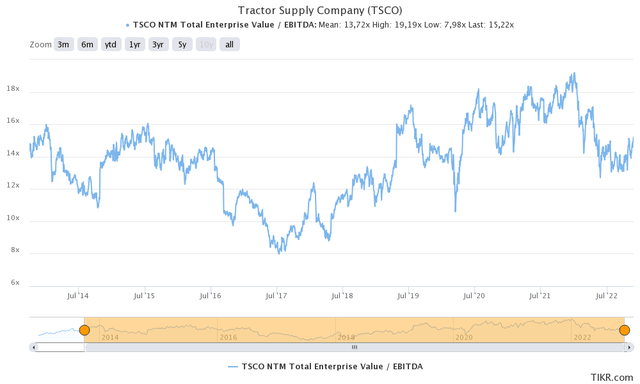

TSCO shares are trading at 13.5x 2023E EBITDA of $1.9 billion. That’s based on its $25.7 billion enterprise value, consisting of its $24.9 billion market cap, and just $830 million in net debt. Net debt is BBB-rated and just 0.5x EBITDA.

This valuation is fair and I believe that TSCO should be trading at no less than $260 per share.

However, I prefer to wait for a lower stock price. My view is that the market will give us a new opportunity to buy at better prices. The Fed is not done hiking and it may take longer than expected to boost inflation.

Also, the housing market comes with risks that should not be overlooked.

I believe that a price of $190 makes for a good initial entry. The problem is that the stock may not get there if I’m wrong. Hence, if you believe that TSCO is right for you, but you’re not willing to risk missing upside, a good strategy is to buy in steps. Buy a few shares now. Add gradually over time. If the stock takes off, investors have a foot in the door. If the stock weakens, investors can average down.

Takeaway

In this article, we discussed the Tractor Supply Company. A great dividend growth stock that offers long-term opportunities for every single investor who’s not dependent on a high cash flow from his or her investments.

The company has a 1.6% yield and high dividend growth, supported by a fast-growing business model in the consumer space. The company targets an attractive customer group, it has successful stores with a fantastic remodeling program.

Even the valuation is good.

However, due to macroeconomic circumstances, I believe it’s better to wait for more stock price weakness before buying.

(Dis)agree? Let me know in the comments!

Be the first to comment