Carrols Restaurant Group (NASDAQ:TAST) with a market cap of $100 million is one of the largest franchisees in the U.S. operating 1,030 “Burger King” restaurants along with 30 “Popeyes” locations. The company reported 2019 results which showed positive growth in comparable sales but earnings have been pressured from higher operating expenses including rising wages and rents. The stock has been nothing short of a disaster over the past year, down by nearly 80% with concerns over the company’s high debt level and more recently the impact from the ongoing coronavirus outbreak. Management plans to cut back on expansion plans and acquisition activities to support earnings and focus more on long-term sustainability. We are constructive on the turnaround plan and see value in the stock at current levels as the selloff may have already priced in the most bearish scenarios.

(Source: Finviz.com)

Q4 Earnings Recap

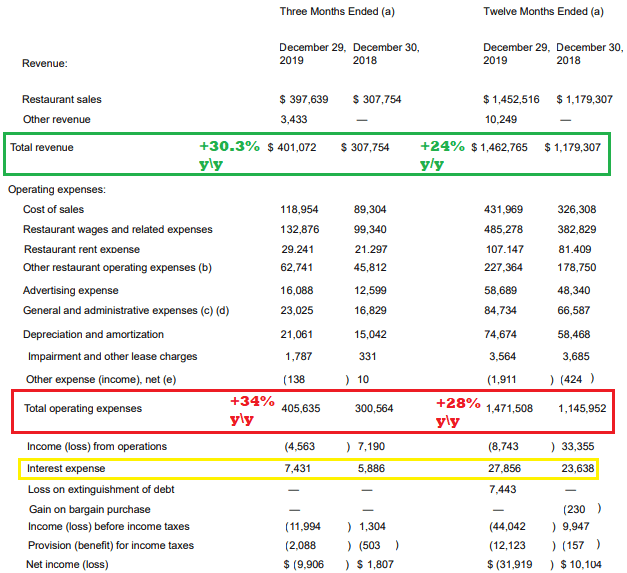

Carrols Restaurant reported its fiscal 2019 Q4 earnings on February 25th with a non-GAAP loss of -$0.12 per share which was $0.07 below expectations. Similarly, negative GAAP EPS of -$0.20 also missed market estimates. Revenue in the quarter at $401.1 million represented an increase of 30.3% year over year although this included the boost from its Q2 acquisition of “Cambridge Restaurant Group” which included 165 Burger King locations and 55 Popeyes restaurants.

Still, the underlying sales growth has been positive on a comparable basis. Burger King comparable restaurant sales increased by 2.0% y/y from Q4 2018. This result was on the lower end of previous guidance that added to bearish sentiment in the stock. The smaller Popeyes business saw a comparable sales increase of 21.2% year over year against results from the previous ownership group. The strength here has benefited from the popularity of its chicken sandwich which crossed over into a pop-culture phenomenon at the end of 2019.

(Source: Company IR/ author annotations)

The bigger picture here is the surge in operating expenses even beyond the acquisition-related revenue boost. Total operating expenses for the year increased by 28% compared to 24% growth in total revenues for 2019. The company faced pressures from a tight labor market pressuring wages, and also rents. The interest expense has also weighed on results given higher levels of debt to fund the Cambridge acquisition. Management explains that some of these trends can moderate with corporate-wide cost synergies of the acquisition materializing going forward. Separately, the company added 31 new restaurants and remodeled 78 locations in 2019.

While the net income loss is ugly, adjusted EBITDA excluding the various charges and non-recurring items was $86.1 million, down from $103 million in 2018. Management is initiating a new growth and capital deployment plan for 2020 with an eye on improving profitability. The key measures are to pull back expansion plans while limiting new restaurant development and remodelings. The effort is expected to save between $30 and $40 million in capital expenditures compared to 2019 which supports cash flows and liquidity measures. Management made the following comments in the conference call:

In summary for 2020, we are laser focused on capital allocation. Our priorities are expediting free cash flow generation and using that free cash flow for deleveraging. We will accomplish this objective through the following strategic steps; first, slowing down the pace of acquisition activity; second, limiting new restaurant development in 2020 to six new Burger King restaurants with attractive expected return on capital.

Weak Balance Sheet – But Stable Liquidity Position

The company ended the fiscal year with a cash position of $3 million and total outstanding debt in finance lease obligations at $472.3 million. The balance sheet position has been pressured from a high level of remodeling activity to end the year. There is also an availability of $57.6 million under its revolving credit facility.

Indeed, the balance sheet position is a weakness in the company’s profile, but we think the liquidity and solvency position is stable in the immediate term given the high levels of cash generation the underlying restaurant business generates. Management notes that the first lien net leverage ratio as defined in its credit facility at 4.11x is under the maximum permitted level of 5.75x. This dynamic explains much of the equity price weakness over the past year and overall bearish sentiment towards the stock.

2020 Guidance

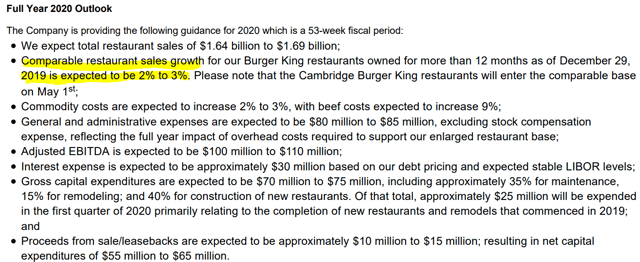

For 2020, the company sees continued growth momentum from the acquisitions while targeting a 2% to 3% gain in comparable sales. Total revenue target between $1.64 billion and $1.69 billion at the midpoint represents an increase of 15% year over year with the comparable base period from the acquisition through May 1st. An adjusted EBITDA estimate of ~$105 million represents a 22% increase from 2019.

(Source: Company IR)

Analysis and Forward-Looking Commentary

The white elephant in the room is the ongoing coronavirus pandemic which was not part of the discussion during the last conference call and earnings release in February. It’s unclear how much the business and the broader food industry is being impacted at the present time.

Our sense is that an establishment like Burger King is more isolated from trends facing general retail as people still need to eat. Many of Carrols’ restaurants feature drive-through and third-party delivery options that could even benefit if other casual and fine dining options close. The possibility of widespread Burger King locations closure is not currently being discussed.

To be clear, there is likely an impact at the margin of lower traffic over the near term, but the consensus is that the virus will eventually be contained and business can return to normal. By this measure, we think the long-term operating outlook for Carrols is positive and management’s financial turnaround plan seems feasible. By cutting CAPEX for 2020, the company can use cash for deleveraging.

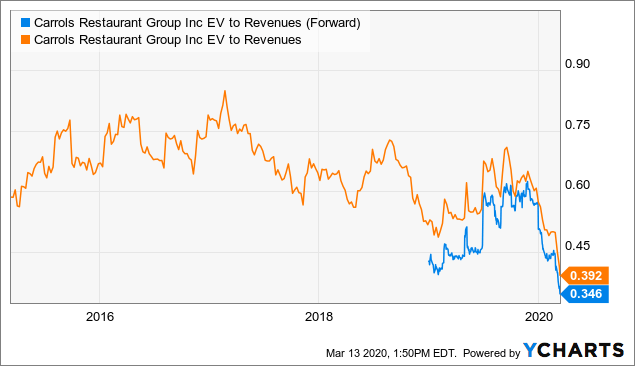

In terms of valuation, considering and a current enterprise value of approximately $575 million and adjusted EBITDA guidance of $105 million for the year ahead, the stock is trading at an EV to forward EBITDA multiple of 5.5x. Keep in mind these figures are in the context of positive comparable restaurant sales growth and momentum from new openings. The stock is trading at an EV to Revenue multiple of just 0.35x on 2020 estimates.

Data by YCharts

Data by YCharts

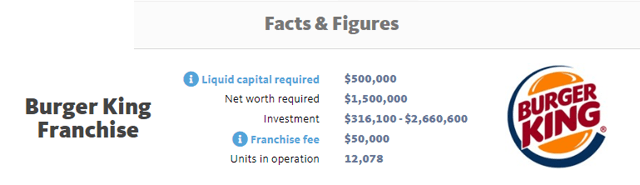

Financially, the company is weak, but there is no solvency or liquidity concern in our opinion. At the current enterprise value, investors are essentially paying $550,000 per each of Carrols’ 1,030 Burger King franchise locations. This compares to some market estimates suggesting an entrepreneur would need to spend upwards of $2.7 million to open a single Burger King restaurant franchise from scratch. The advantage here for an equity investor in TAST is that the company will manage the operation.

(Source: FranchiseHelp.com)

Verdict

Carrols Restaurant Group as a micro-cap stock has some financial weaknesses given its high debt level and poor earnings, but benefits from a credible business with recent operating momentum. We are cautiously bullish on the stock based on its deep discounted valuation. This is a speculative opportunity with material risks, but we see upside in the stock based on management’s turnaround plan to deleverage the balance sheet and focus on sustainability.

Investors who are interested in this stock should consider only a small position allocated over days and weeks to average a lower cost basis. The risk here beyond the near-term coronavirus disruptions are that the Burger King brand loses traction in the fast-food industry further pressuring trends in margins. Monitoring points going forward include comparable store sales and efforts at debt repayment.

Build a Stronger Portfolio With The Core-Satellite Dossier

Are you interested to learn how this idea can fit within a diversified portfolio?

With the Core-Satellite Dossier, we sort through +4,000 ETFs/CEFs along with +16,000 U.S. stocks / ADRs to find the best trade ideas.

Get access to all our exclusive features including:

- Model portfolios built around different strategies.

- A tracked watchlist of our top picks.

- A weekly “dossier” with an updated market outlook.

- Access to analysts with a live chat

- Exclusive research covering all asset classes and market segments.

Click here for a two-week free trial and explore our content.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Be the first to comment