Biletskiy_Evgeniy/iStock via Getty Images

Editor’s note: Seeking Alpha is proud to welcome Manika Premsingh as a new contributor. It’s easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

Shares of Carnival Corporation (NYSE:CCL)(NYSE:CUK) have seen an impressive rise of almost 9% up to Aug. 26, compared to where it was at the end of July. This appears to be a good sign for the hotels, holidays and cruise lines company, whose share price, unsurprisingly, took a big hit during the pandemic. With the worst quite likely over for COVID-19, it appears tempting to buy the stock while it is still way below its pre-pandemic levels. On balance, the following analysis reveals that the risks are too high to make it a sure investment bet.

Improving revenues, shrinking losses

The company is not without merit, though. For the six months ending May 31, 2022, Carnival reported revenues of $4,042 million, which is an over 54x increase over the $75 million reported during the same period of 2021. Its net loss has declined too, albeit moderately, by 7.9% to $3,726 million from $4,045 million for the six months ended May 31, 2021. The improvement in its financials is driven by the normalization of conditions post-pandemic, with 86% of its cruise fleet back in operation at the end of the said period.

Continued growth expected

Looking ahead, Seeking Alpha’s analyst projections show that its numbers for the full year ending Nov. 30, 2022, are expected to improve further. Revenues are expected to be at $13.5 billion, a 7.1% growth over the $1.91 billion revenues seen in 2021.

By 2023, at least in terms of revenues, the company expects to finally put the pandemic impact behind it. In its latest results statement, Carnival said it expects revenues in the year on a per-passenger basis to increase from 2019, the last pre-pandemic year. This is corroborated by analysts’ views as well. Seeking Alpha’s projections expect a 5.5% increase in revenues in 2023 to almost $22 billion from 2019 levels.

Favorable market valuations

In terms of its market valuations, there are positives to the Carnival Corporation stock as well. The popular price-to-earnings (P/E) ratio is not applicable in this case because it is loss-making right now. Instead, the alternative price-to-sales (P/S) ratio is considered instead against the company’s peers. Two peer categories have been considered here. The first is its direct peers, which looks at other cruise providers. The second is a more broad comparison across companies in the travel industry.

It has a P/S ratio of 1.6x, which makes it quite attractive. It is the lowest among its direct peers – Norwegian Cruise Line Holdings (NYSE:NCLH) and Royal Caribbean Cruises (NYSE:RCL). Even among travel industry peers, its P/S is higher only than online travel stock Expedia (NASDAQ:EXPE), which stands at 1.5x. Its low P/S is most stark compared with Hotel group H World Group (NASDAQ:HTHT), which is at 6.3x. This indicates that the stock can continue to rise further, as it is relatively undervalued.

| Comparison of market valuations across peers | ||

| Direct Peers – Cruise providers | ||

| Stock | P/S | EV/R |

| Carnival Corporation |

1.67 |

6.63 |

| Norwegian Cruise Line Holdings | 2.37 | 7.33 |

| Royal Caribbean Cruises |

2.12 |

6.77 |

|

Travel Industry Peers |

||

| H World Group |

6.29 |

1.37 |

| Intercontinental Hotels Group |

3.11 |

3.51 |

| Hyatt Hotels Corporation |

2.13 |

2.60 |

| Expedia Group |

1.50 |

1.66 |

|

Sources: Seeking Alpha, Yahoo Finance. Note: All figures are as of the close on Aug. 26, 2022. |

||

Consider alternative valuations as well

But this is only one side of the story. Another way to look at the company’s valuation is by comparing the enterprise value-to-revenue (EV/R) ratio with peers. EV gives a more comprehensive picture, which indicates the value a company would be sold at if it comes to that.

It is not an entirely farfetched idea. Companies that suffered setbacks because of the pandemic are vulnerable because of their debt situation. For instance, Cineworld (OTCPK:CNNWF) is considering filing for bankruptcy because of its huge debts. While it is in a different sector, cinemas, it is still under the bigger ambit of recreation and entertainment, of which Carnival is also a part. It too suffered a big setback because of the lockdown effect, which has resulted in its current state of financial difficulties.

Keeping debts in mind, EV/R is a particularly significant ratio in the context of Carnival, which also acquired massive debts during the pandemic years. Between 2019 and 2021 its debt rose by 3x to $33 billion. Its EV/R now sits at 6.6x. There is some solace to be taken from the fact that among its direct peers, it is the lowest ratio (see table above). At the same time, Carnival’s EV/R does not compare favorably to the broader travel industry. It is way higher than that for H World Group and Expedia, which are at 1.4x and 1.7x, respectively.

Recession sensitive stock

The high EV/R might not have been that big of a consideration if the broader macroeconomic conditions were firmly improving. Right now, we are seeing quite the opposite. The U.S. economy is, at least according to one measure, in a technical recession, considering that it has shrunk for the last two consecutive quarters.

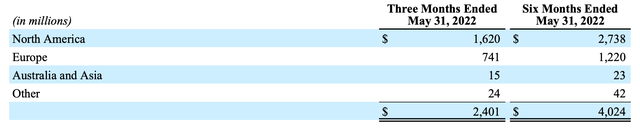

Carnival Corporation’s Revenue by Geography

Carnival Corporation Quarterly Report

This is bad news for cyclical stocks like Carnival, which thrive in robust economic conditions. A recession in the U.S. is particularly bad news right now for the company as it’s still trying to get back on its feet because North America is its biggest geographic revenue source. More than half its revenues come from there.

Only for risk-tolerant investors

In sum, we are looking at a company that has shown some improvement in its financials since the pandemic ended, but the road ahead doesn’t look smooth at all. So there could be a bigger risk to financial projections than during more predictable times. Still, a comparison of market valuations across its direct peers, which are also cruise providers, reveals that Carnival Corporation is relatively favorably priced. Unfortunately, in the context of the broader travel industry, it still looks overvalued.

Ultimately, the decision to buy the stock or not rests on an individual investor’s perspective on the big-picture outlook. If the U.S. economy can ride out of hard times sooner rather than later, this cyclical stock has more than a fair chance of getting back on track. But with inflation at multi-decade highs and rising interest rates, that appears doubtful, making its huge debts a bigger risk than usual. Carnival Corporation is a buy only for very risk-tolerant investors.

Be the first to comment