JHVEPhoto/iStock Editorial via Getty Images

Introduction

CEO Bill Nash explained CarMax’s (NYSE:KMX) positioning in his April 2022 letter to shareholders that was included in the fiscal year (“FY”) 2022 annual report:

CarMax is well positioned to drive profitable market share gains in any environment and compete across the larger used auto ecosystem because of our exceptional associates, unparalleled omni-channel experience, diversified business model, strategic investments, and relentless innovation.

Similar to what he said in the FY22 letter, CEO Nash said the following in the 4Q22 call:

We believe we are well positioned to deliver profitable market share gains in any environment.

I agree with this view from CEO Nash and my thesis is that CarMax has the right business model for any environment.

The fiscal year for CarMax goes through February so adjustments are made when comparing them to companies like Carvana (CVNA) and AutoZone (AZO) whose fiscal years coincide with calendar years.

Exceptional Associates

One of the reasons CarMax has exceptional associates is because the business model incentivizes them to do the right thing for customers. Unlike other dealers who have vacillated with different pricing systems, CarMax has always had a no-haggle approach. Also, CarMax has always been transparent on the financing side such that associates are not incentivized to manipulate customers. Noting the way that the COVID pandemic changed the world, CEO Nash talked about two constants at CarMax in his April 2021 letter to shareholders from the FY21 annual report:

(1) our purpose: to drive integrity by being honest and transparent in every interaction; and, (2) our core values that inform everything we do: do the right thing, put people first, win together and go for greatness.

Unlike associates at other dealerships, CarMax associates are not incentivized to prey on “hot buttons” like the total price, the monthly payment, the interest rate or the trade-in value. The July 2003 background paper explains how incentives can bring about unscrupulous behavior for associates at legacy auto dealers:

They have a strong incentive to negotiate the highest profit spread possible on each element of the transaction. They also search for customer “hot buttons” (total price, monthly payment, interest rate, trade-in value) and shift margin to other elements of the deal. This is why most offers at traditional dealerships are package deals…

Unparalleled Omni-Channel Experience

A September 2020 news release revealed the national rollout of CarMax’s omni-channel system which gives customers the ability to do transactions online, in-store or combined. Given the flexibility of the omni-channel system, CarMax is in better shape than other dealers when exogenous factors like pandemics enter and exit the world such that customers want to spend more or less time doing pieces of transactions online. The April 2021 letter to shareholders talked about the digital improvements:

All the work we have done to achieve the digital transformation of our business has placed CarMax in an incredibly strong position.

The April 2022 letter to shareholders reveals that half of their retail sales now leverage the omni-channel experience and that online self-progression capabilities are enabled for 90% of customers.

Market Share

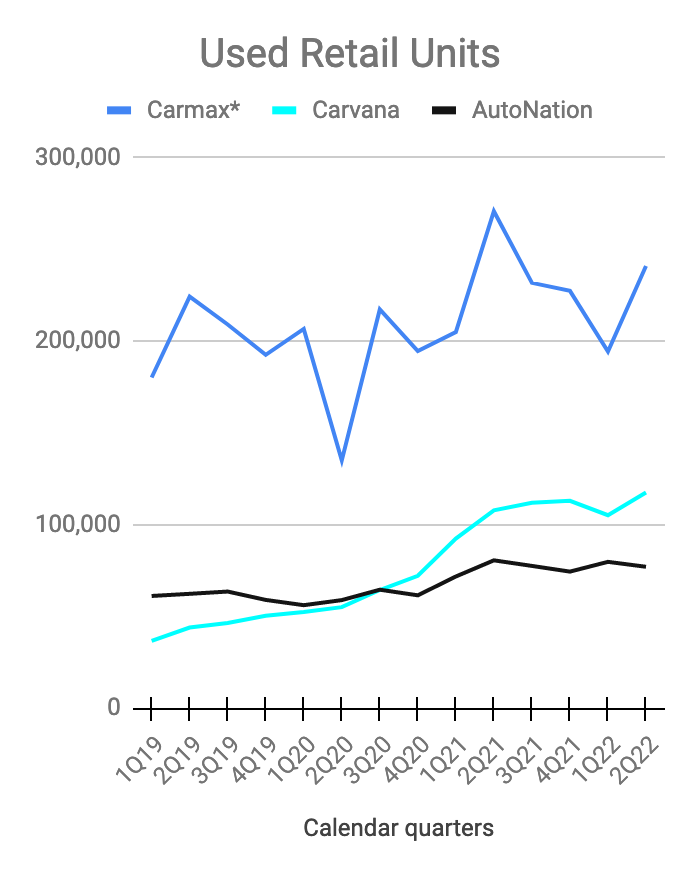

CarMax is the biggest used car dealer in the fragmented U.S. market but their share is in the low single digits. CEO Bill Nash’s letter to shareholders in the 2022 annual report says that during the 2021 calendar year, CarMax’s nationwide share of 0-10 year vehicles grew from 3.5% to 4%. Market share continued to climb from January to April of 2022, the last month they had external data available. Continuing his statements in the 2022 annual report, CEO Nash went on to say that he is confident their share will expand to 5% by the end of calendar 2025. Here is a look at the 3 of the biggest retailers of used cars in the U.S. market:

Used retail vehicles (Author’s spreadsheet)

*Carmax ends its FY in February. As such, I put their 1st fiscal quarter in the 2nd calendar quarter, their 2nd fiscal quarter in the calendar 3rd quarter and so on. It means its numbers end 1 month early.

Carvana and CarMax have the best online offerings and I expect them to continue taking market share from legacy dealers. I’m excited for the future and confident that CarMax has a good chance to expand their share beyond 5% by the end of calendar 2025.

Valuation

Per the FY22 annual report, we know CarMax sold 1.6 million vehicles from March 2021 to February 2022 and they had net sales of $31.9 billion for the year. The breakdown was 924,338 used vehicles at retail plus 706,212 wholesale vehicles. In his letter to shareholders in the FY22 annual report, CEO Nash said they have raised long-term targets for FY26 such that they are targeting unit sales of 2 to 2.4 million and revenue between $33 and $45 billion.

The 1Q23 quarter through May 2022 gives us a glimpse into the future as we get past the pull-forward numbers experienced during the COVID pandemic. Per the 1Q23 call, 11% of retail sales were online and 54% of retail sales were omni-channel in the quarter; both percentages should rise in the long run. Relative to 1Q22, 1Q23 sales were down 11% and unit comps were 12.7% lower. The 1Q22 quarter was a tough comp as there were substantial stimulus benefits in the prior year including the biggest stimulus checks in March 2021. Despite challenges in 1Q23, CEO Nash said the following in the earnings call:

Based on external data, we gained share each month from January through April, the latest period for which title data is available. We believe this share gain reflects the strength of our business model and omnichannel platform, which gives us the ability to successfully manage through cycles like this one.

CarMax continues to prosper even as inflation drives up prices such that customers have been buying more vehicles that are 5 to 7 years old and fewer vehicles that are 0 to 4 years old. CEO Nash said that 70% of inventory was under $25,000 in 1Q22 but it fell to a range of 43% to 45% in 1Q23 as inflation took hold. 2/3rds of retail sales were 0 to 4-year-old vehicles in 1Q22 but this slipped to about half of retail sales in 1Q23. 5 to 7-year-old vehicles went from 20 to 25% in 1Q22 to 30 to 35% in 1Q23. 8-year-old and older vehicles held steady at 15%.

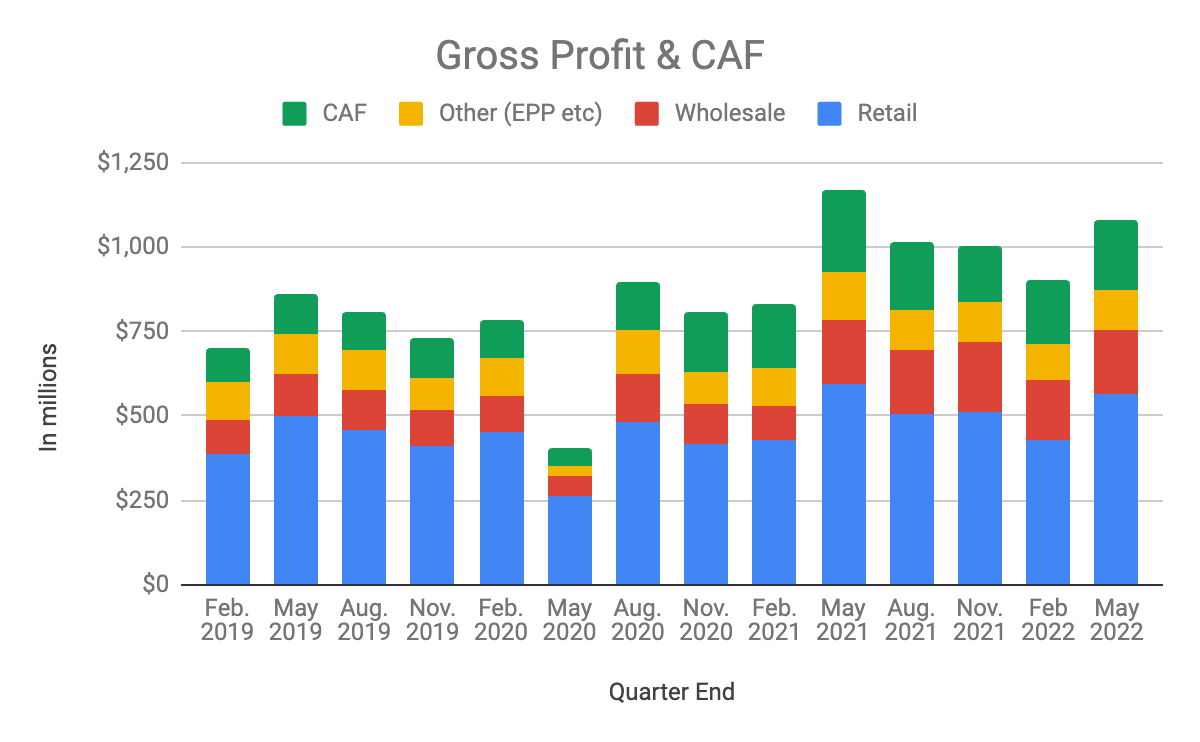

It hasn’t been a smooth road, but gross profit is now significantly higher than it was before the COVID pandemic. The increase in gross profit is easier to visualizing when ignoring the apotheosis we saw in the May 2021 quarter and the low point we saw in the May 2020 period:

Gross profit and CAF (Author’s spreadsheet)

Much of the gross profit makes its way to the bottom line. Trailing-twelve-month (“TTM”) net income through May 2022 was $966.8 million or $252,265 thousand + $1,151,297 thousand – $436,756 thousand. Adjusted TTM free cash flow (“FCF”) is negative due to inventory considerations. Note that I add 2 CAF lines from the “Finance Activities” section of the cash flow statement to the “Operating Activities” section when thinking about FCF. Interest rates have gone up but they are still fairly low from a historical standpoint and I believe an earnings multiple of 16 to 17x is reasonable such that CarMax is worth about $15.5 billion to $16.4 billion.

There were 159,165,992 shares outstanding as of June 23rd per the 1Q23 10-Q. The market cap is $13.5 billion based on the September 6th share price of $85.13.

The market cap is below my valuation range, so I think the stock is undervalued.

Be the first to comment