Mohammed Haneefa Nizamudeen

Thesis

Good results love appears short-lived in a bear market. After Cardiff Oncology’s (NASDAQ:NASDAQ:CRDF) stock had gained about 10% on Monday September 12, 2022 on excellent data from its trial in KRAS-mutated colorectal cancer, it sold off 41% the day after. At the close of September 13, 2022, its market cap has been reset to $81 million. That is an abominable stock performance given the $122 million cash it holds, which should last it into 2025.

The reason for the drop seems to have been attributed to Cardiff’s trial discontinuation in pancreatic cancer. The data having come out of the prostate cancer trial was actually good, less impressive than that of colorectal cancer but good nonetheless. Cardiff chose to discontinue that trial given the changing treatment paradigm. Given the competitive nature of the pancreatic cancer space, I believe that actually was a smart call, and it is a biotech company’s prerogative to make these decisions once in a while.

The market chose to ignore all the good data that Cardiff had just communicated on metastatic colorectal cancer, and may have failed to connect the dots with the other reportings from Amgen and Mirati Therapeutics that had just been released in colorectal cancer. I am presenting these combined results below, and believe this to be highly relevant and novel information. These results show that Cardiff’s Onvansertib is best-in-class in colorectal cancer. One could even say best-in-KRAS, given its potential across several KRAS-mutations which opens a market ten times the size of the others’ drug candidates.

The market chose to ignore Cardiff’s plans for an accelerated approval of Onvansertib in metastatic colorectal cancer, and I well set out below why Onvansertib is a perfect candidate here.

The market also chose to ignore the announcement of two additional investigator-initiated trials in triple-negative breast cancer and small cell lung cancer.

Cardiff’s market share had moved up quite a bit since my last coverage, but has now again dipped well below enterprise value.

The Pfizer equity investment, paired with a Pfizer-adviser and the agreed-to obligation to communicate scientific reporting to Pfizer two days ahead of publication, make Cardiff a serious buyout candidate. Pfizer has even expressly stated on September 12, 2022 during the Morgan Stanley 20th Annual Global Healthcare Conference that it is looking to buy companies with early scientific programs with compelling science that have breakthrough potential, where Pfizer can add something scientifically and commercially.

I believe the market is overreacting, and/or Cardiff’s shares may be heavily shorted.

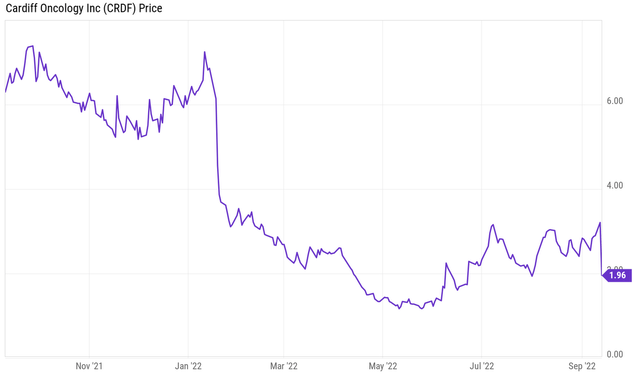

Cardiff Oncology’s share price

I will start with the opportunity here for a change. Since my June 2022 coverage of this little oncology gem, shares of Cardiff had moved up quite a bit on the back of some excitement touted by the company on the September timeframe. That excitement was based in part on a pre-recorded CEO interview in the framework of the William Blair Biotech Focus Conference 2022, as announced on July 5, 2022. In it, Cardiff’s CEO had repeatedly mentioned his excitement for the September timeframe.

Obviously, halfway September 2022, investors no longer share his excitement, as results from the below one-year chart.

One year price chart (Ycharts)

Company and pipeline

Cardiff has one lead asset, Onvansertib. Onvansertib is a PLK1-inhibitor. PLK1 inhibitors have been a target of oncology drug candidates and big pharma drug development for several years. PLK1 is part of the cell-replication cycle or mitosis. PLK1 expression on tumors is considered to allow the cell to disregard the fact that it is multiplying excessively, essentially allowing for uninhibited proliferation. That makes PLK1 inhibition a target for oncology drugs. Previous PLK1 inhibitors have all systematically failed, either because they did not work or because their toxicity levels were too high. Cardiff’s drug candidate works and has a good safety profile. Cardiff has been testing it in three indications: namely a Phase 1b/2 trial in second-line KRAS-mutated metastatic colorectal cancer (mCRC), a Phase 2 trial in Zytiga-resistant second-line metastatic pancreatic ductal adenocarcinoma (mPDAC), and a Phase 2 trial metastatic castration-resistant prostate cancer (mCRPC) showing resistance to abiraterone. Results have been consistently good. Mostly the first two of these cancers are historically hard to treat, with high morbidity rates and very inefficacious response to therapy. My previous coverage sets this out in detail.

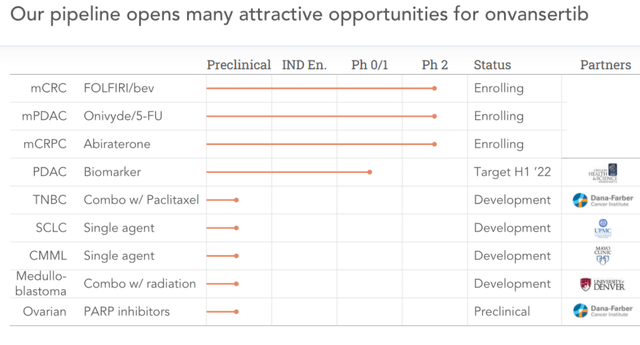

This is Cardiff’s old pipeline:

Old pipeline (Corporate presentation)

This is Cardiff’s updated pipeline:

Update pipeline (Presentation for September 12, 2022)

As one sees, the mCRC trial moved up to the level of a Phase 2/3 study, and has been named Onsemble, which seems to be a combination of ‘on’ of Onvansertib and the French word ‘ensemble’ or together.

Whereas the mCRPC trial has been dropped from Cardiff’s pipeline, two trials have been added to it, namely one in triple-negative breast cancer in combination with paclitaxel and a monotherapy trial in small-cell lung cancer.

As such, such a change does not vouch for a massive share price drop to me. For me, given the high competitiveness in the prostate cancer space and the fact that it was never a lead indication for Cardiff, the call was prudent, citing a highly competitive future environment with treatment modalities, such as PARP inhibitor Lynparza and radioligand therapy Pluvicto.

Given the competitive nature of the pancreatic cancer space, I believe that actually was a smart call, and it is a biotech company’s prerogative to make these decisions once in a while.

Biotech companies sometimes end trials to focus on more promising activities. One always judge those calls and consider them faulty, or punish them like the market did. But probably money will be deployed in a smart way to get to approval as fast as possible. This is obviously the case here, looking at the data having come out of the colorectal cancer trial. That data produced good results, with 31% of patients achieving disease control, 54% achieving stable disease, and 31% having durable stable disease of over 7 months. Moreover, disease control increased with higher dosing of Onvansertib. In his latest update, an analyst from William Blair also considered the discontinuation of the trial in pancreatic cancer a prudent call by Cardiff Oncology. But the market nonetheless started selling off, slowly at first, but then picking up pace with hotter-than-expected inflation data coming in. It seemed like the perfect storm that set aside any positive sentiment for a day. That’s what one can get in a bear market. Apart from that, I don’t believe anybody took an investment in Cardiff for the pancreatic data it had presented so far. In my previous coverage, I had mentioned that the great results in colorectal cancer results are worth the investment alone, irrespective of what onvansertib could be doing in other indications. I still stand by that statement, certainly with Cardiff approaching territory where it can buy itself back again and still have $40 million left in the bank.

Even if a drop were warranted, I believe investor’s focus here is totally off-target, as I will set out below.

Onvansertib is best-in-class in KRAS-mutated cancer

Context

I am going to give a little bit of context here on the difficult targets Cardiff is pursuing, as I believe this gets lost to many investors.

Solid tumors, most certainly those presenting KRAS-mutations, are historically hard to treat. KRAS is one of three human RAS genes (KRAS, NRAS and HRAS) which are the most mutated oncogenes. KRAS-mutated cancer have for a long time been considered undruggable. Whereas KRAS-mutated cancers present about 25% of normal cancers, that number is about 45% in colorectal cancer, making it a particularly hard-to-treat indication. About 95% of pancreatic cancers have KRAS-mutations. Obviously, with such a high incidence of RAS- and particularly KRAS-mutations in these cancers, patients diagnosed receive dire prognostics and any improvement to existing therapy is considered major.

Results in colorectal cancer compared to competitors

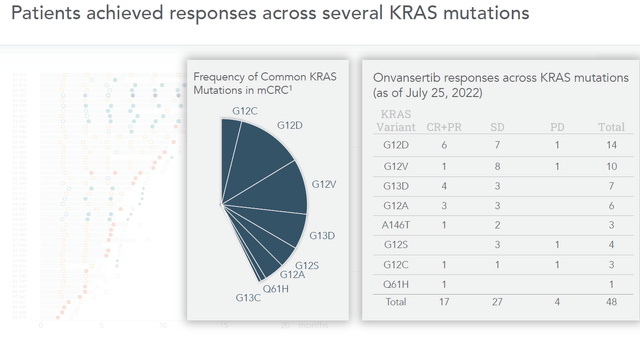

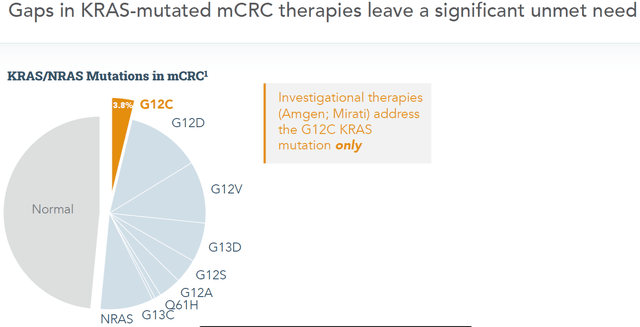

In metastatic colorectal cancer, Onvansertib can best compare with two other therapy candidates, namely Amgen’s Lumakras and Mirati Therapeutics’ adagrasib. Lumakras has been approved, but not for colorecal cancer. Adagrasib has not been approved. Both are currently also in trials for colorectal cancer, but both only target one KRAS-mutation, namely KRAS-G12C. However, there are many more of these mutations, and all of them are expressed in metastatic colorectal cancer.

KRAS-expression in mCRC (Presentation September 12, 2022)

On September 7, 2022, Mirati Therapeutics has reported its dataset in mCRC. On September 8, 20222, Cardiff has reported its dataset in the same, and on September 12, 2022, Amgen has reported its too. Cardiff’s presentation on the matter can be found here.

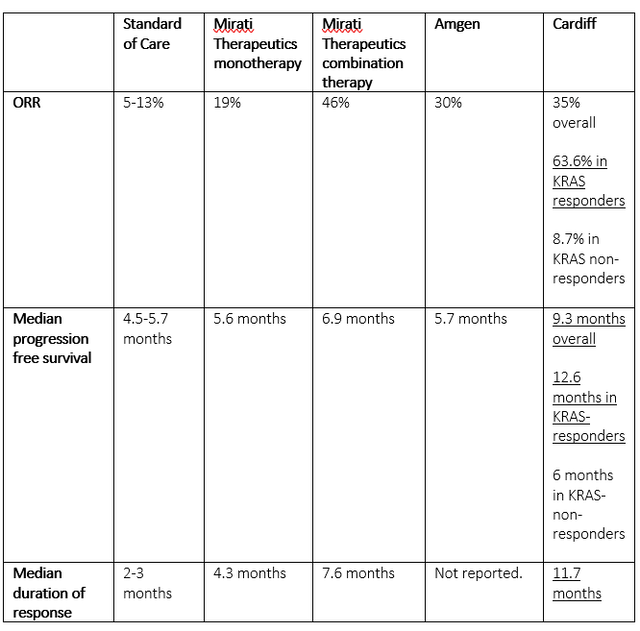

With all competitors now having reported in the same cancer, it is time to compare the data. I have included that data in the chart below. I have also underlined what I consider most relevant.

Overview of reporting competitors (Own work)

What I see here is very clear: Cardiff’s Onvansertib outperforms the drugs of both other companies. Cardiff triples the overall response rate compared to standard of care. In KRAS-responders, it even brings it to 63.6%, which is an impressively high number given historical response rates were 1-2% and current standard of care has a response rate of 5-13%.

The median progression free survival is impressive. Even in KRAS non-responders, it is almost as high as Mirati’s targeted combination therapy, bringing it to 6 months. In KRAS responders, it more than doubles progression free survival compared to standard of care, bringing it to 12.6 months. That adds 5 months to what Mirati Therapeutics has reported. The 9.3 months overall survival is also much higher than what the other have reported.

The median duration of response of 11.7 months again largely outperforms standard of care and what Mirati Therapeutics has reported. There are no data from Amgen out here yet.

There has been some discussion about results being better in patients who did not have prior treatment with bevacizumab. They seem to be, but results are good in both patient groups, so there is no need to only enroll patients who have not been treated with bevacizumab. Cardiff has got this covered as it will provide for patient stratification between bevacizumab-naïve and bevacizumab-exposed patients in the Onsemble trial.

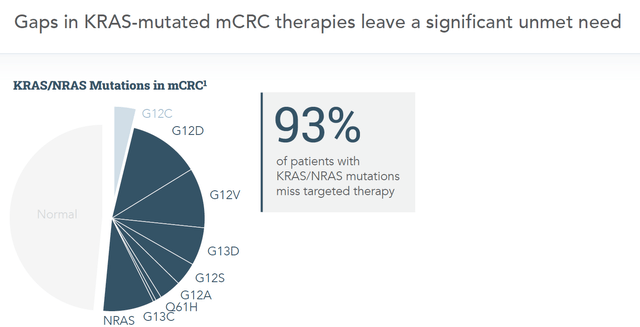

KRAS-G12C vs. all KRAS-mutated cancers: a sizeable market difference

The above comparison with competitors is literally one tenth of the story, as markets targeted by Amgen’s Lumakras and Mirati’s Lumakras are less than one tenth the size of the market Onvansertib can address.

This is the market Amgen and Mirati are addressing:

KRAS-mutations targeted by competitors (Corporate presentation)

This is the market Cardiff’s Onvansertib can address:

KRAS-mutations targeted by Cardiff (Corporate presentation)

Basically, Cardiff’s Onvansertib has shown effect in several KRAS-mutated cancers, and even in light of that, its efficacy results are better than those of Amgen and Mirati Therapeutics.

A best-in-class drug candidate should be awarded some value. Targeting different KRAS-mutations opens doors to large patient populations.

Colorectal cancer is the fourth most common cancer, with 150,000 patients annually in the US alone. About 42% of those patients have KRAS-mutations. That gives an addressable market in the US alone of about 63,000 patients. At market penetration of 30%, with an annual cost of $15,000 per therapy, that would lead to annual sales for the US alone of $945 million. In Europe, 450,000 patients per year are diagnosed with colorectal cancer. Again taking 42% of that number, the total addressable market for colorectal cancer for Europe is 189,000. At an annual costs of €10,000 per therapy, that gives €1.89 billion in annual sales. For pancreatic cancer, the global market is estimated at $2.59 billion.

Results in pancreatic cancer

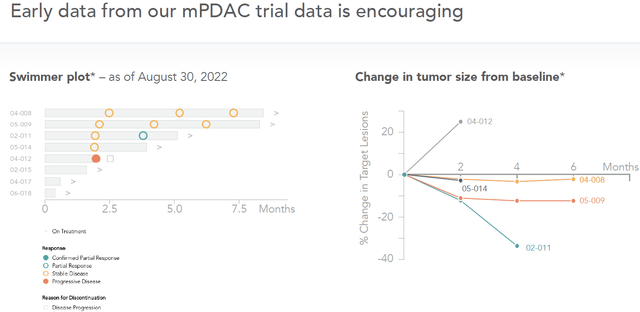

Cardiff’s results reported in pancreatic cancer are earlier-stage, but show that the drug is effective in that indication too.

Pancreatic cancer results (September 12, 2022 slideshow)

Pancreatic cancer has a high morbidity rate, with a historical overall response rate of 7.7% and median progression free survival of 3.1 months. Many patients can barely be treated in time given the fast-evolving nature of the disease. One sees that four patients on treatment have now already meaningfully passed that survival period, with two patients past the 7.5 month time point. One patient has progressive disease, and three others had not yet reached that treatment period. Meaningful and ongoing changes in tumor size from baseline are also being established, with one patient reaching almost 40% reduction in tumor size at four months.

As mentioned before, pretty much all pancreatic cancers are KRAS-mutated, so there is no necessity to specify.

However, the same goes for Amgen or Mirati Therapeutics, if they would be pursuing this indication. Cardiff can target any KRAS-mutation.

At this point, it is obvious that the drug will be effective in any indication, the question is rather to which degree and how it relates to the competitive environment.

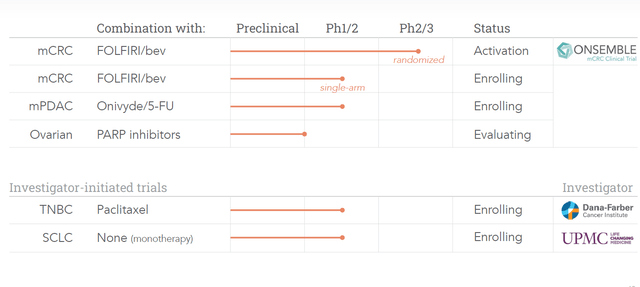

Accelerated approval pathway for lead indication

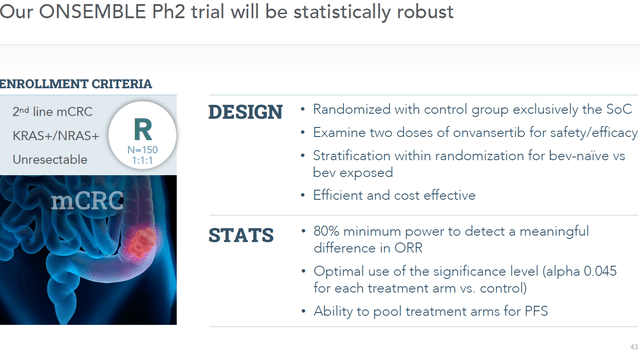

In its September 12, 2022 announcement, Cardiff expressly mentions that it will be initiating a randomized placebo-controlled Phase 2 trial in metastatic colorectal cancer. The goal of this trial will be to go for accelerated approval.

Design of Onsemble (Presentation September 12, 2022)

Accelerated approval is a manner of receiving approval from the FDA for a drug for a serious conditions that fill and unmet medical need, with approval being based on a surrogate endpoint. With Onvansertib showing best-in-class results in a large patient population that has historically been hard-to-treat, the drug candidate seems to fit the bill perfectly.

The FDA has established a list of surrogate endpoints which have in the past led to approval via the accelerated approval pathway. One sees that for colorectal cancer, Onvansertib could apply both on the surrogate endpoint of progression free survival as well as durable response rate. Hence, Onvansertib is a perfect candidate for accelerated approval.

There may have been some frustration with Cardiff establishing another trial, but this was inevitable, really. Approval would never have occurred on the basis of a non-randomized study. A well-controlled study would always have been necessary. The accelerated approval pathway should allow Cardiff to get to approval faster.

Cardiff is Pfizer’s ideal buyout candidate

In my previous coverage, I have set out how Pfizer has by way of a $15 million equity investment, managed to obtain a first look at Cardiff’s data before it is published. Of course, Pfizer can only act on that data once it has been published. I had also pointed out that Pfizer’s Adam Schayowitz, Pfizer’s vice president and development head of the departments of breast cancer, colorectal cancer and melanoma, had been appointed to advise Cardiff Oncology.

And I had considered how, in the past, Pfizer has more than once followed up on such an equity investment with a buyout. And Pfizer’s Breakthrough Growth Initiative has a rigorous screening method. The best proof of the rigorousness of that investment program has just been confirmed with excellent results Akero (AKRO) presented on September 13, 2022. Akero had received a $25 million equity investment from Pfizer. For me, that makes Akero a possible buyout target at this point, but not a cheap one as its price just went up over 100%.

A buyout generally only happens after negotiations have taken place with multiple partners over months already. Several months of due diligence and insight in existing data precede that moment. Sometimes companies may play out different parties against each other, and may offer more insight into the company’s data at selected moments in time. It is not impossible that Cardiff has been in discussions with such other partners for months. Amgen will have known for a while that its data from Lumakras does not compare to Cardiff’s. Plus, Amgen’s drug may be suboptimal for future use in my eyes, as it may lead to liver toxicity in combination with immunotherapy.

On September 12, 2022, the same day of the announcement of Cardiff’s corporate update, Pfizer was speaking at the Morgan Stanley Annual Global Health Conference. Aamir Malik, Pfizer’s Executive Vice President and Chief Business Innovation Officer, said the following about upcoming deals:

Number one, if you look at our balance sheet right now, and the cash flow that we’re going to generate, it gives us a lot of financial flexibility to deploy that capital. And beyond growing our dividend, we think that the best place to put that capital is on internal R&D and sourcing external science. The second reason is, when you look outside, we’re actually very compelled by the external scientific substrate that exists right now, whether it’s in academia venture, big biotech, small biotech, there’s a lot that we think is very complementary to what we’re doing inside. So we think the substrate is there. And the third reason we have confidence behind that is that we feel very strongly that we have a robust and clear process on how we’re going to prosecute these deals. There’s a lot of rigor that goes into it. […]

And that is a set of deals that comes on the back of what was a very active 2021, where we had Trillium, as well as Arena and Arena, we think also has multi-billion dollar potential. So it’s a number that we have confidence in, it focuses us to action, and we think we’re making very good progress against that. But there’s still more to go. […]

I would say that those deals represent a portion of what we’re going to do, but not exclusively, what we’re going to do. So if I take a step back, what is the criteria for the business development that we’re pursuing? The criteria is, first and foremost, is it compelling science? And does it potentially have breakthrough versus standard of care? That’s the most important thing to us. The second is, is there something that we can do, scientifically, commercially, to add value to that science. And thirdly, we have to feel confident that it’s going to generate revenues in that [20]25 to [20]30 period. Now, through that prism, there’s a lot of opportunities that fit certainly these types of later stage, early commercial opportunities fit. But there’s a lot of early scientific programs where we have the potential to de-risk the science or accelerate the science in ways that William was describing that also fit.

Pfizer mentions Trillium Therapeutics, which was an immuno-oncology player with a best-in-class drug profile. As mentioned in my previous coverage, the $2.2 billion acquisition of Trillium Therapeutics had been preceded by a $25 million equity investment. And there was another precedent with Pfizer having taken an investment in Amplyx. That acquisition happened right after Amplyx had presented Phase 2 data. That’s where we’re at with Cardiff now. In my eyes, when Pfizer’s Aamar Malik is referring to Trillium Therapeutics and the rigorousness that goes into prosecuting these deals, he is referring to the work of Pfizer’s Breakthrough Growth Initiative.

In my opinion, Cardiff fits the bill perfectly. It is a cheaply-priced early-stage company with a lead asset with best-in-class data so far, that may not see immediate commercialization yet. With additional cash, Pfizer could help the trial and approval process abundantly here. The science is compelling, and with the first PLK1 inhibitor ever to show efficacy combined with a good safety profile, it has breakthrough potential. It also substantially improves the current standard of care, on any measure. One can sit on the sidelines and divert attention away from this oncology gem, but I will sit tight. The investors in Trillium Therapeutics have also had to go through a great deal of patience and pain, but eventually did get rewarded.

Financials

At market close on September 13, 2022, Cardiff has an $81 million market cap.

On June 30, 2022, it had cash and cash equivalents of $122 million. Its net cash used in operations was $16.9 for the rolling two-quarter period ending June 30, 2022. Cardiff seems sufficiently funded to continue operations without needing additional cash into 2024.

Risks

A 41% share price drop being the main object of this article, investing in biotech, and most especially in a bear market, may seem hazardous at times. Swings in the share price are customary, and something one should get acquainted with. Regulatory uncertainty is always prevalent, and the incidence of a trial discontinuation on the share price cannot be predicted. Add to that, the highly competitive nature of the oncology space.

Conclusion

On the basis of results so far, including those of competitors as just reported, Onvansertib is the best drug candidate there is for treatment of patients with metastatic colorectal cancer. The market may not have combined the datasets of all these competitors yet, which is why I have done so above.

That makes Onvansertib best-in-class, and also best in KRAS-mutated cancers, as its competitors in metastatic colorectal cancer only target less than one tenth of the KRAS-mutated cancers Onvansertib is efficacious in. Onvansertib substantially increases objective response rates, median progression-free survival and median duration of response compared to standard of care.

On the back of those good results, Cardiff is now moving forward with a placebo-controlled randomized trial which should ease its way to accelerated approval. I have set out above why I believe the current data shows high promise of success for Onvansertib.

On that basis, I believe Cardiff deserves a far higher market cap than the one it is currently sitting on, namely about $40 million under its cash value. Given the large addressable markets with unmet needs Cardiff targets, the de-risking data of competitors and the strong data of Onvansertib itself, Cardiff should start commanding a market cap that is in line with its best-in-class potential and soon-to-start potentially pivotal trial initiation. I have set out above how I see Onvansertib perfectly matching at least two surrogate endpoints that are frequently used by the FDA in the framework of accelerated approval.

Cardiff has shifted gears somewhat in its peripheral trials, discontinuing a trial in prostate cancer in light of a changing treatment environment, and announcing the start of two others in triple negative breast cancer and small cell lung cancer. Contrary to the market, I believe that discontinuation may actually have been a good call. As an investor in biotech companies, I see these companies focusing their efforts on what they believe to be the best use of their money all the time, and it is their prerogative to do so.

Given the addition of two trials, the drop seems totally unwarranted from a valuation perspective.

I have set out above why I believe that the best-performing results of Onvansertib in metastatic colorectal cancer will not go unnoticed at Pfizer and others. That may hold true as well for other big pharma companies such as Amgen. For me, given the equity investment of Pfizer, the fact that Pfizer got to see the data two days ahead of publication, and Pfizer’s history of buying companies it took a stake in, Cardiff remains a high-potential buyout candidate. This is all the more so given Pfizer’s express confirmation that it may be looking to do deals with companies that have drug candidates the likes of Onvansertib.

I believe a 41% drop was totally unwarranted. It may have even coincided with a considerable amount of shares being shorted.

A negative enterprise value of more than $40 million in light of the above results, which had in first instance led to an increase in the share price, makes very little sense to me.

I therefore reiterate my rating of Cardiff Oncology as a Strong Buy, even more so than before in light of recent data of competitors.

Be the first to comment