ryasick

Article Thesis

Capital Southwest (NASDAQ:CSWC) has seen its shares come under a lot of pressure in recent months, which also was the case for many of its BDC peers. But rising rates can actually be positive for business development companies such as Capital Southwest, and the stock’s valuation has become very cheap. With a dividend yield of 120% that looks sustainable, Capital Southwest looks like an opportune high-yield pick at current prices.

BDCs Got Crushed

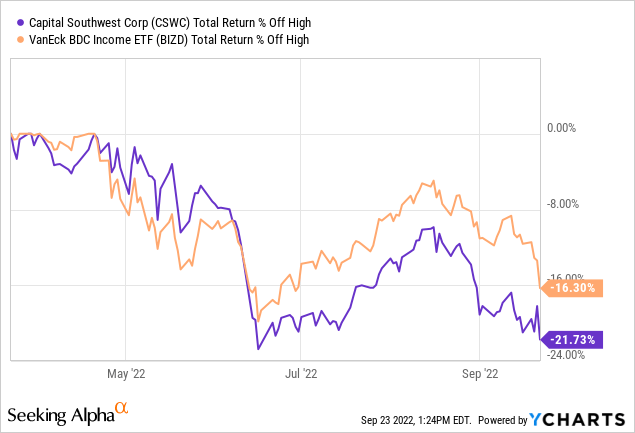

Capital Southwest dropped considerably so far this year, but that was not the impact of company-specific news primarily. Instead, the whole BDC sector has been crushed in 2022:

From the highs seen six months ago, Capital Southwest has dropped 22% — factoring in dividends. The share price performance alone was even worse. Likewise, the VanEck BDC Income ETF (BIZD) has dropped by 16% on a total return basis, i.e. dividends included.

To some degree, this can be explained by the weakness in overall equity markets. When market sentiment is sour and equities are sold, it’s not surprising to see that BDCs get sold as well. On top of that, the market also sold off BDCs specifically due to worries about the impact of the ongoing economic downturn. During a recession, the risk of loans going bad increases, which would impact the book value and income of BDCs negatively, all else equal. That’s not wrong, but we believe that the market might be disregarding another macro item that could be positive for most BDCs — rising interest rates. On top of that, credit losses will not be distributed equally across all BDCs. Instead, expected credit losses depend a lot on the risk these BDCs have taken on. Capital Southwest looks like a relatively safe BDC pick from that perspective, we believe, as we’ll lay out later.

The Positive Impact Of Rising Rates

Rising interest rates mean that loans become more expensive, all else equal. BDCs are exposed in two ways to this theme. First, they have to borrow at higher rates, which increases the interest they have to pay to their lenders. But on the other hand, rising interest rates also mean that BDCs can generate higher yields from the loans they make to the small and medium-sized companies they do business with.

Like most banks, BDCs are generally benefitting from a rising rates environment. Their funding costs grow less than their interest income. That may be somewhat counterintuitive, but this trend has been visible regularly in the past — during times of rising rates, net interest margins of financial corporations expand. They are able to push through higher interest increases to the companies that borrow from them, relative to the higher interest expenses they have to pay themselves.

CSWC and many of its peers operate with rate floors with the loans they make, thus an increase in interest rates does not immediately flow through to variable-rate loan yields immediately. But once those rate floors have been breached, rising interest rates lead to growing yields on the loans that CSWC and other BDCs have made. At Cash Flow Club, we have estimated that a 100 base point increase in interest rates leads to a low double-digit increase in Capital Southwest’s value due to the added income for the company. This, in turn, could allow Capital Southwest to increase its dividend in the future as rising interest rates lead to growing profits that can be shared with the company’s owners.

Of course, this beneficial impact of rising rates needs to be weighed against potential risks from a recession or economic downturn that could lead to higher credit losses. Capital Southwest looks like a BDC with below-average risk levels to me. 95% of the company’s loans consist of 1st lien debt, meaning even in case one of the portfolio companies gets into trouble, Capital Southwest will be paid before other lenders. Even if a portfolio company were to default, risks could thus be limited, as Capital Southwest would be the first lender to get paid from what remains following the liquidation of the portfolio company.

Right now, 1.6% of Capital Southwest’s loan portfolio is on non-accrual today. With CSWC generating an average portfolio yield of 9%, even a complete, 100% loss on these loans would be equal to the interest income CSWC generates in just 2 months. And since a 100% loss on one of CSWC’s loans is pretty unlikely due to the nature of these loans, investors can expect that losses on loans that are currently on non-accrual will be very limited unless we get into an ultra-deep 1929-style recession with massive defaults.

Capital Southwest Is Very Cheap And Offers A Hefty Yield

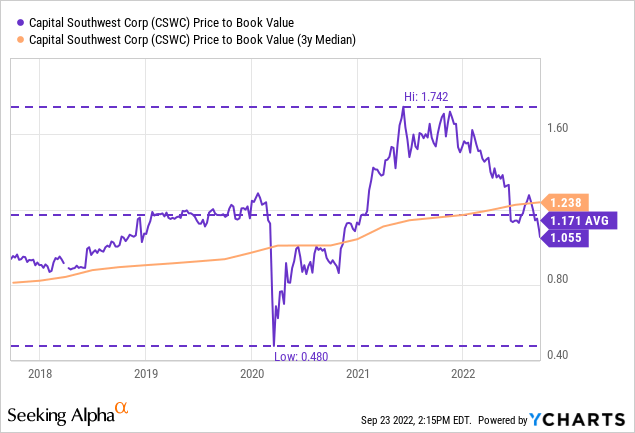

The sell-off in recent months has made CSWC trade down to just $17.40 at the time of writing. That’s down more than 30% over the last twelve months, and it has made Capital Southwest’s valuation drop to a rather low level:

At the current price, Capital Southwest trades at 1.05x book value. That’s around 10% below the 5-year average, even though that average was distorted downwards by the very steep selloff that Capital Southwest experienced during the initial phase of the pandemic.

Based on its book value multiple, Capital Southwest also looks cheap versus the longer-term median, as that stands at 1.24 — implying a discount of close to 20% at current prices. When we consider that Capital Southwest should see a boost to its profitability over the coming year thanks to the impact of rising interest rates, that’s a meaningful price deviation from the norm. CSWC could thus be pretty attractive from a value perspective at current prices.

Capital Southwest also looks pretty inexpensive on an earnings basis. During the current year, CSWC is forecasted to earn $2.10 on a per-share basis. That means that, based on current prices, Capital Southwest is valued at just 8.3x net profits, which pencils out to an earnings yield that is easily in the double-digits. Capital Southwest decides to share that hefty earnings yield with its owners by offering a huge dividend yield of 12%.

The company increased its dividend by 4% in September, just a couple of days ago. To me, this suggests that the risk of a dividend cut is very unlikely. After all, raising the dividend when you have doubts about the sustainability of said dividend would not make a lot of sense. Management’s actions thus imply that CSWC’s executives do not worry about the company’s future, I believe.

This is also highlighted by what analysts believe Capital Southwest’s profits will look like in the foreseeable future. Based on current estimates, CSWC will grow its earnings per share by 5% next year. That’s pretty solid in absolute terms, as many other companies will have a hard time growing their profits next year in the middle of an economic downturn. But the 5% growth rate is even more compelling when we consider that CSWC’s 12% dividend yield would make the company an attractive investment even in a no-growth scenario.

In fact, even if Capital Southwest were to cut its dividend by one-third and if the company never grew its profit or dividend ever again, CSWC would make for a reasonable investment at current prices — investors could expect 8% annual returns in that scenario. There thus is a pretty wide margin of safety when investing in Capital Southwest at current prices, as even a pretty bearish scenario with underperformance versus estimates and a serious dividend cut would not be a disaster at all for someone buying CSWC at current levels.

Takeaway

The macro outlook for BDCs is far from bad. It’s true that a recession could lead to some loan losses, but rising interest rates will be a considerable tailwind going forward. CSWC’s mostly first lien loans are not very risky, and analysts agree that the impact of rising rates will allow the company to grow its profits next year.

With CSWC stock trading at a discount compared to how the company was, on average, valued in the past, and with the dividend offering a hefty return even without any share price appreciation, I do believe that Capital Southwest is attractive at current prices. The margin of safety seems pretty sizeable due to the market indiscriminately selling every stock in the current environment — even ones that don’t have a bad outlook at all.

Be the first to comment