JHVEPhoto/iStock Editorial via Getty Images

Dear readers/followers,

We’ll revisit one of my previous targets of writing and buying – and a company I actually bought a small position in, and intend to buy more in. I’m talking about Canon (NYSE:CAJ). Canon is a solid, Japanese company that, in my opinion, is very much worth owning and looking at.

My ambition to work and own an internationally diversified portfolio of dividend-paying stocks is the sole reason I am still in the positive for the year – far in the green, in fact. And I view Canon as one of the reasons for this, or at least a potential component for someone to stay relatively safe.

Let’s review Canon again.

Canon – An update

This is a company that is an entrenched part of the optical imaging market. Optical imaging products are used in most every segment of our society, and Canon’s products are found in segments such as…

- Compact Digital

- Video Cameras/Film and digital SLRs

- Camcorders

- Lenses

- Broadcasting equipment, including Free Viewpoint solutions

- Professional displays

- Projectors

- Photolithography equipment

- Scanners, Printers, microfilm scanners

- Binoculars

- Microscopes, including diagnostic systems such as ultrasound/x-ray

- CCTV solutions

- Rotary encoders

While most consumers may know Canon for its consumer-grade cameras, the fact is that the company’s main markets are commercial and B2B. Canon operates 4 relatively simple segments, and the biggest segments aren’t cameras or video – but printing. Over 55% of the company’s annual expected revenue comes from printing operations.

The geographic mix is more as would be expected. Japan still accounts for more than a fifth of sales, with NA/SA coming in at around 30%, with Europe at 25%. The rest is APAC.

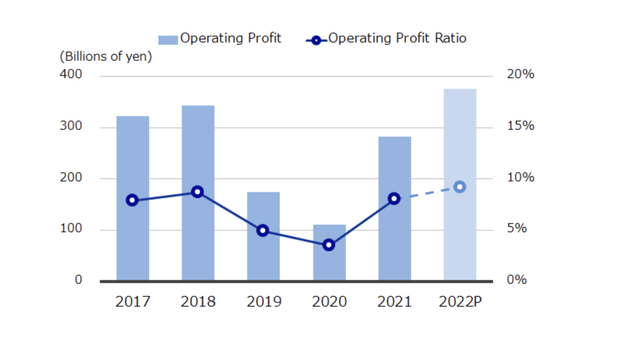

Recent-term company results over the past 5 years have been so-so. COVID took a major bite out of the company, and this needs to be considered when we invest. The fact that the company is on a path to recovery that’s been ongoing since 2020, but likely this year is finally set to restore the company’s operating profit to a normalized level above 300M Yen.

While I lauded the dividend, it cannot rightly be called stable over time. What can be said is that I view the dividend as likely to stay between 3-4% overall, and that it should not be your primary focus at this time. The company’s financial health should be, because that is actually superb.

Canon remains A rated, and almost entirely lacks debt. It’s like many Japanese companies in this way, where debt is something not to be considered until no other options are available. The company expects to end the fiscal with a debt ratio that’s below 7% in terms of its overall assets. Based on that view, Canon is certainly an overall safe investment.

Of course, we don’t just want safety – we want growth and returns. In order for the company to get that, we need operational improvements and clarity.

Do we have this?

I would argue that we do, despite not investing in many Japanese businesses over the past 5 years.

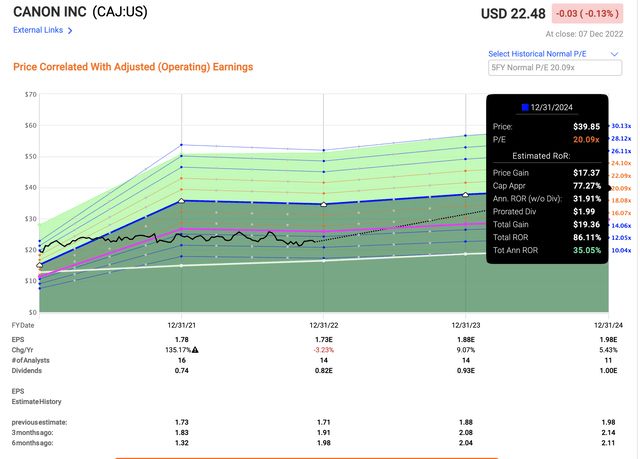

Canon has an interesting trading history. It traded at a premium for close to 10 years – upwards of 20x P/E. But COVID caused it to drop below that premium, and it has actually stayed far below it for some time at this point.

Recent operational results and forecasts do not support this somewhat negative view. Why do I say this?

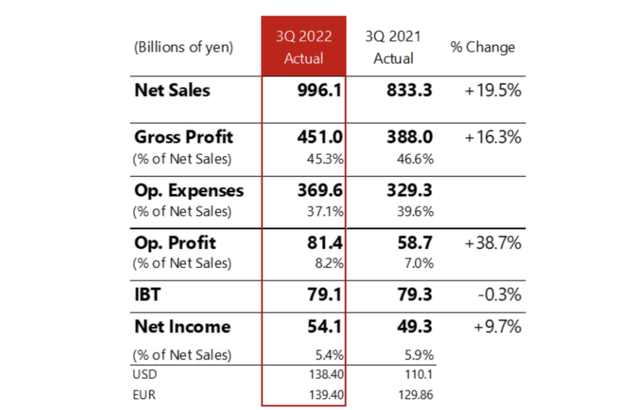

Because 3Q22 results were absolutely solid on both a top-level view and a bottom-line perspective.

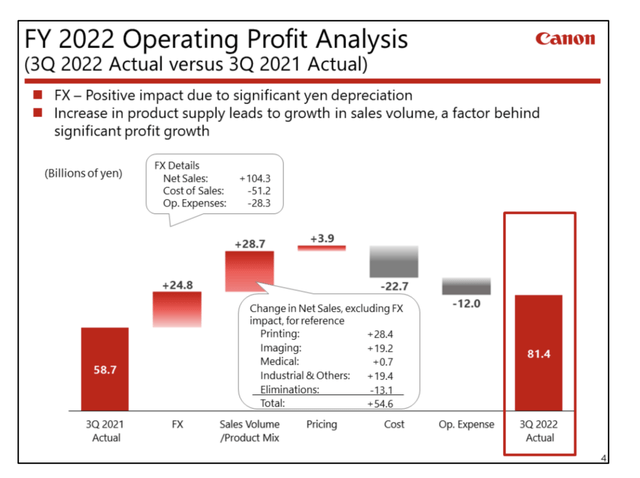

The company was able to record the 7th consecutive quarter of top-line sales growth, with significant increases in every relevant metric despite overall costs, thanks to increased demand, price adjustment and some FX.

The simple fact is, Canon was unable to supply the product that the market demanded, in part due to semi shortage, but other parts as well (such as the Shanghai lockdowns). 3Q22 saw improvements here though, and the company was able to on a quarterly basis operate relatively normally, which is part of what led to sales increases – because Canon was more or less able to supply the demand.

This led to significant improvements in operating profit and net income as well, because the company obviously adjusted some pricing. The interest was especially massive for imaging, which saw YoY improvements of 100%+ in operating profit, and over 30% in sales. This came from sales in interchangeable lens cameras – but every single company segment saw growth, even medical.

Here is some of the breakdown of YoY operating profit.

Canon is doing what most companies are doing. It’s adjusting and working what it can in order to keep its profitability. Many of its products are not consumer-grade stuff, but things that are harder to replace and with higher “stickiness” in their customer base. This is another positive.

The full-year projections are very much intact. We have sales and profit increases of over 14-15% with operating profit improvements of 35%+ for the year, leading to net income improvements of over 15%. Because of this, I view the company’s dividend as likely being solid and safe.

Demand for company products is excellent. The company’s order book is well-filled, and the company has increased production. The problem here is a part shortage, and the company is diversifying suppliers and searching for alternative part solutions.

Canon is, as I said, primarily a printing company. Its high-speed cut-sheet inkjets, large formats, “Prosumer”, and Office products are where Canon generates most of its sales. As for current trends, its sales are actually up, and the company is increasing its output – while also increasing prices.

It’s still fair to say that Canon is doing quite well. Company cash flow is expected to be up for the full year, and order and sales trends show promise and confirm the longer-term positive for the business.

I expect continued positivity for the company’s operations going forward, and this together with the company’s fundamentals forms the basis for my positive thesis for Canon.

Canon’s Valuation

Of course, there’s also valuation – and a very solid valuation at that. As mentioned, Canon’s typical valuation range is closer to 18-20x P/E over time, as evidenced by its 5-year average. However, the current valuation is 12-13x P/E depending on what year you’re looking at. This is a significant break in the trend that we’ve seen in Canon over the past 20-or-so-years., and this is despite earnings and result improvements expected over the next couple of years. The company has not, as of yet, recovered to any significant degree here.

This is the actual upside that I am seeing for Canon. The company will, as I see it, at some point normalize to its trading average due to good results. The company is also not as impacted as some European counterparts by interest costs due to its extremely limited use of debt.

Even in the case of only relatively flat development for 14-15x P/E, your returns would still be double digits here, and always with that normalization potential. Remember also, the company is A-rated and isn’t going anywhere.

Canon’s upside comes from several perspectives. For one, we have a clear dividend upside, with prospective payout growth. That’s going to be pretty major going forward, and important in the current environment.

Secondly, you can’t overstate the fundamentals of Canon. This is a well-entrenched company with boundless expertise in several fields. Their products aren’t impossible to replace, but they’re a hard company to switch from if you’ve built your portfolio or office around their products. Switching costs/issues are there.

Unlike other Japanese businesses, I do see a realistic prospect for the company achieving its forecasted, near-double-digit annual rates of growth for the foreseeable future – and this is key here.

I don’t see the company trading significantly below the lower 12-13x P/E ranges for extended periods of time.

Canon is too good to be ignored. The growth pathways and fundamentals include both time-tested segments like Medtech, printing, and photography – but also future growth potentials, such as a nearly-untapped VR/AR industry that’s valued in the 10s of billions of dollars.

A company like Canon will be a major player in such an industry, unless they sleep through it, which Canon has never done.

Also, as icing on the cake, Canon is the 3rd-largest owner worldwide of active patents, and generates over 2,500 new patents, on average, every year. This company is a serious contender in everything having to do with imaging and similar technologies.

My current DCF and valuation-oriented models of determining share price and growth call for a continuing EBITDA growth of around 2-4% – and most analysts following the company for the longer term are in agreement with this. The native Canon ticker is known as 7751. I already said in my last article that analysts consider this company to be undervalued here. Current native pricing for the company is at 3,086 Yen per share, with an average target from 15 analysts of 3,560, which now implies an upside of 15.5% for the company.

What it boils down to is essentially if it’s too early to invest in Canon – if the company has further to fall.

I say that at this valuation, the company is actually attractive. I’m starting coverage of Canon, and I call this one a “Buy” with a native share price of 3,500Y, which comes to around $24.5 for the ADR CAJ – and I’ve expanded my position in the company at this time, buying more before the company might hit that really low valuation target.

Thesis

My thesis for Canon is as follows:

- Canon is one of the premier imaging, camera, and printing companies on the planet. It has a solid foundation as well as excellent growth prospects. At the right valuation, this company goes from being a possible buy to being a very compelling prospect for long-term investing.

- At a conservative 12-13x P/E, I not only consider the company somewhat attractive but a definite “Buy”. I’ve established a starter position – my first position in a native Japanese ticker.

- I start following Canon with a $24.5 ADR price target, or 3,500Y for the native Tokyo ticker.

Remember, I’m all about:

- Buying undervalued – even if that undervaluation is slight and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

- If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

- If the company doesn’t go into overvaluation but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

- I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them (italicized).

- This company is overall qualitative.

- This company is fundamentally safe/conservative & well-run.

- This company pays a well-covered dividend.

- This company is currently cheap.

- This company has a realistic upside based on earnings growth or multiple expansion/reversion.

This company fulfills all of my valuation criteria for investing – it’s therefore a “Buy” here.

Be the first to comment