NotYourAverageBear

All financial numbers in this article are in Canadian dollars unless noted otherwise.

Introduction

Canadian Pacific Railway (NYSE:CP) is my 7th-largest holding and one of my favorite dividend growth stocks despite its low yield. The reason is flawless execution, the pending merger with Kansas City Southern, creating the first railroad connecting all North American nations, and its massive footprint in agriculture – which I wanted to add to my value-focused portfolio. In this article, we will discuss the company’s third-quarter earnings, which came in higher than expected as CP was able to deal with high input costs while improving its operating efficiency. Moreover, the company reported strong growth in key transportation segments while hinting at more strength despite recession fears (a recession is almost certain at this point).

In this article, we’ll discuss all of that and more.

So, let’s get to it!

Why 3Q22 Was Important

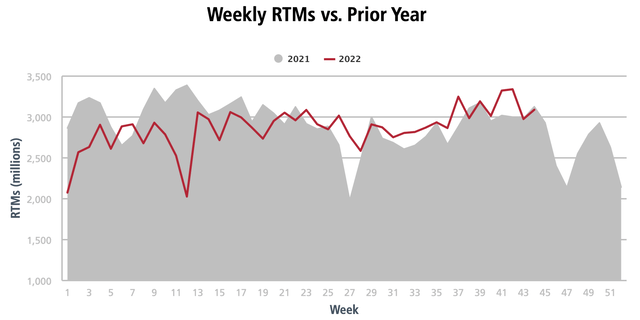

I always say that every quarter is very important because something is always going on. In the third quarter, there are a few things that I’ve been looking for. With economic growth starting to slow quite significantly, all eyes are on transportation volumes.

The chart below displays the ISM manufacturing index. The index is at 50.2, which is barely above the neutral 50.0 level.

Wells Fargo

Moreover, with inflation running hot, most transportation companies are struggling to maintain their margins. Inflation is everywhere. Energy, labor, materials, you name it.

Moreover, as if that isn’t bad enough, most railroads are struggling with the impact of the pandemic. The pandemic caused volumes to implode. Railroads lowered employment and equipment levels. Then, demand came back roaring, causing railroads to struggle to service demand.

Now, railroads need to adjust to higher transportation volumes while also incorporating potential transportation headwinds down the road.

That’s tricky.

3Q22 Volumes Were Great

I bought CP for many reasons. One of them was its excellent management.

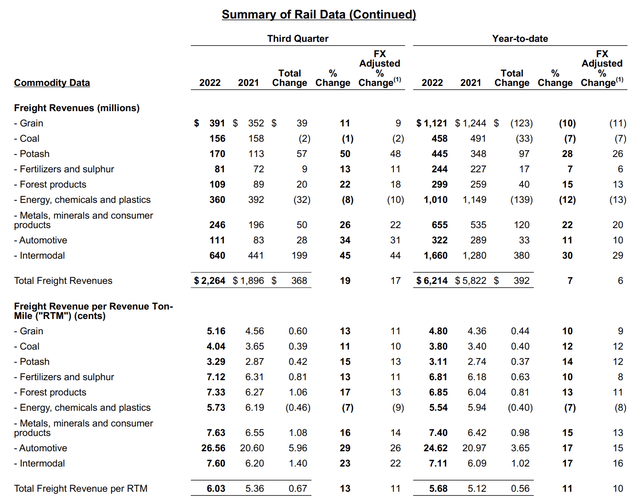

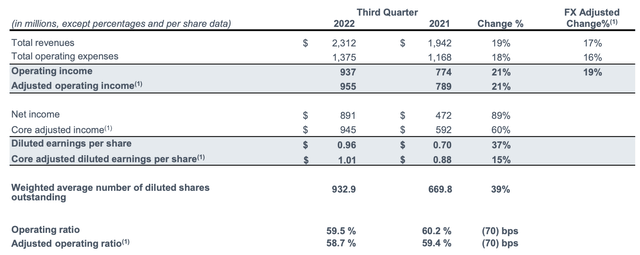

In its third quarter, Canadian Pacific generated $2.31 billion in revenue. That’s $40 million higher than expected and 19.1% higher compared to the prior-year quarter. It caused earnings per share to come in at $1.01, one penny above expectations.

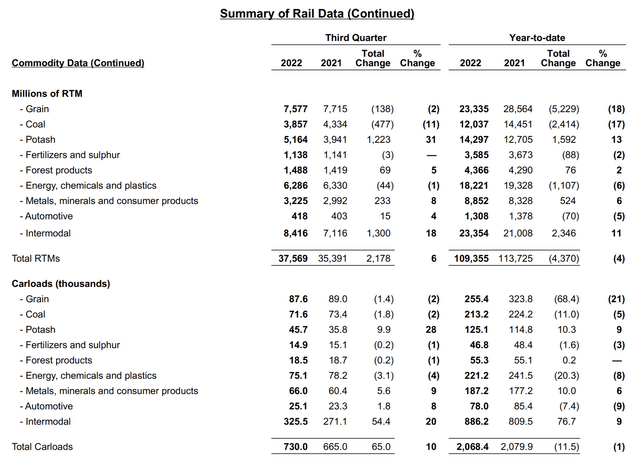

With that said, let’s take a step back and look at freight numbers. After all, that’s where it all starts. In the third quarter, total carloads were up 10%. Revenue ton-miles (“RTM”) were up 6%. RTM is carloads adjusted for distance.

Or as Investopedia puts it:

A revenue ton mile is a metric used in the transportation industry. One revenue ton-mile is the revenue earned for transporting one ton of freight across one mile. Revenue ton-miles are used primarily by railroad companies.

RTMs were weak in grains, coal, and energy. Potash (a fertilizer), forest products, metals, automotive, and intermodal were strong.

In this case, we can ignore grain weakness. It’s just timing. The company has frequently made the case that last year’s poor harvests had a lasting effect. That is ending now as harvests are back in full force.

According to the company:

We saw this year’s grain harvest really start to begin the last couple of weeks of the quarter, and volumes have quickly now ramped up as we move into Q4. The most recent expectation for the Canadian grain crop size is around 75 million metric tons. This would make it a top-five all-time crop and about 7% better than the five-year average.

The timing could not be better as CP will receive the last of the 5,900 new high-capacity grain cars it ordered in 2018. These hoppers allow the average grain train to ship 15,000 tons of wheat, up from 10,400 when the company used smaller hoppers and shorter trains. Moreover, in 2017, the company serviced 12 8,500-foot capable grain elevators. This year, it could be 47. In 2024, that number is likely to be 55.

In other words, these new hoppers will be put to work.

Also, grains usually make up 20% of Canadian Pacific’s business, which is why the comeback of agriculture is so important.

Speaking of agriculture, potash volumes were up 31%, delivering a record-breaking quarter for the company. International demand remains high, domestic producers are boosting output, and pricing allowed potash revenues to rise by 48%.

Coal was down because of an outage at a major mine. This is expected to impact fourth-quarter volumes as well.

On the automotive front, the company saw 31% higher revenues on 4% higher volumes. Although volumes were a bit lower than expected, the company sees that manufacturers are benefiting from easing supply chains, allowing them to turn backlog into finished products. Moreover, the company signed a long-term agreement with Ford (F).

Moreover, in intermodal, the company reported numbers way higher than I expected. Intermodal, which consists of containers and trailers, saw 18% higher volumes. Revenue was up 44%. Both numbers are a record. The intermodal franchise benefited from both international and domestic growth as a result of organic growth, the expansions at the Port of Saint John, and the CMQ acquisition of 2020.

With that said, there’s more good news.

CP’s Operations Improved, Boosting Margins

So far, I haven’t seen a single railroad earnings report that showed weak earnings growth. However, CP has proven that revenue growth of 19% was the result of both higher volumes and strong prices.

Moreover, it’s one of the few railroads that reported underperforming total expenses growth. In the third quarter, expenses rose by 18%. This was the result of 80% growth in fuel expenses, 29% higher material costs, and sub-10% higher costs in all other segments, including labor, which saw costs rise by 3%. However, forex and fuel costs were still a tailwind of 13% as the company was able to use fuel surcharges to more than offset these costs. That’s a big deal. It’s likely the result of surcharges lagging the price of fuel. Railroads cannot charge for higher fuel costs in real time. It tends to lag by a few weeks. While this creates headwinds every now and then, it is now a tailwind as fuel prices have come down from recent highs.

Moreover, the wage and compensation inflation rate of 3% includes new employees. This year, the company has hired 1,500 new conductors. The company has also invested in physical assets, equipment, and other network-related things allowing it to be well-prepared for the aforementioned surge in grain demand – as well as high potash and intermodal demand. That’s a big win for the company and its customers.

As a result of underperforming expenses growth, the company lowered its adjusted operating ratio by 70 basis points to 58.7%. This is 100 basis points better compared to the prior quarter.

According to CEO Keith Creel, the railroad is on pace to report an exit operating in the mid-50s at the end of this year, which would be absolutely terrific news if they can pull that off in this environment.

Moreover, with regard to company operations, the train accident frequency improved by 76%, which is good news for obvious reasons. However, it also shows that the company can maintain one of the safest operators while consistently improving operating efficiencies. That is not necessarily a given.

Now What?

The good news is that 3Q22 was truly a fantastic quarter.

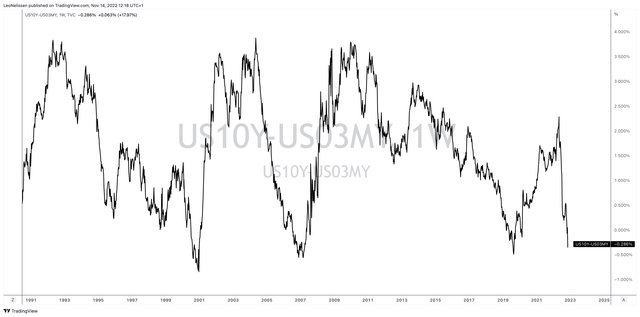

The bad news is that the economy isn’t looking so good. For example, the Fed’s favorite yield curve (10-year minus 3 months rates) is now inverted, indicating an almost 100% recession probability.

TradingView (10Y-3M Yield Curve)

This is what the company commented:

[…] while we are all still watching the broader macro environment, my team is staying close to the customers and our operating team and will navigate any changes appropriately. We remain laser-focused on executing our playbooks and making our own luck through delivering our unique self-health initiatives. As you think about it, with our strong bulk franchise, a pipeline of new growth opportunities and CP-KC only gaining momentum, we believe we have a truly unique position as you look to 2023.

Even if economic growth continues to slow (which is likely), it looks almost like a done deal that both grain and potash volumes continue to grow. Moreover, intermodal is much stronger than it usually is going into a recession.

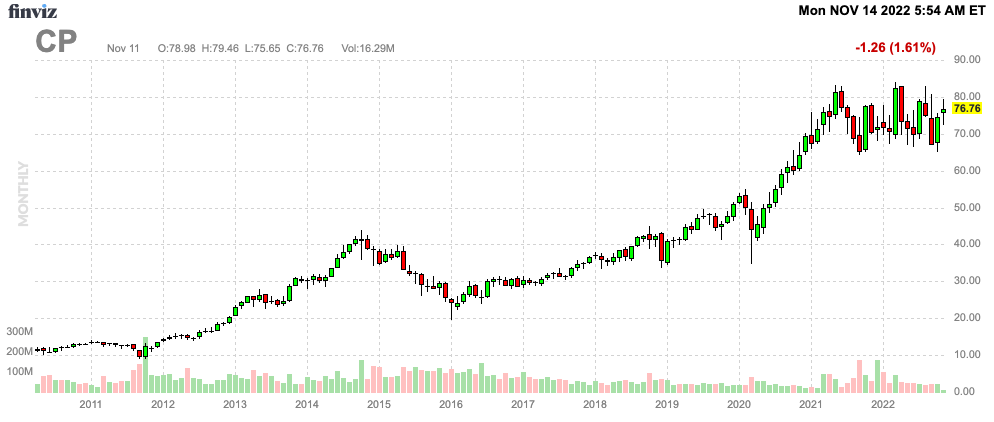

These are all factors that contribute to the fact that (New York-listed) CP shares are trading just 9% below their 52-week-high.

It also happens that I’m not the only one who’s bullish. J.P. Morgan came out the other day naming CP a top pick in the transport and logistics sector. As reported by Seeking Alpha:

“We could see further upside to our 4Q22 growth target of 15.5% at the current grain run-rate and with CP’s 8,500ft hopper car fleet investment fully in place. CP also expects the current pricing momentum will continue, putting renewals on pace to exceed +5-6% reached at the prior cycle peak”

Notably, the step up in labor costs confronting U.S. rail peers under new labor agreements will not affect CP directly, although incentive compensation headwinds will persist in Q4 could impact the operating ratio.

Looking ahead, Canadian Pacific is expected to benefit from a new investment in a hopper car fleet. Ossenbeck also reminded that the Canadian Pacific-Kansas City Southern is progressing into the final stages alongside positive momentum on KSU refined products and the second bridge to Laredo is coming to fruition faster than expected.

The KSU merger is expected to be approved in early 2023.

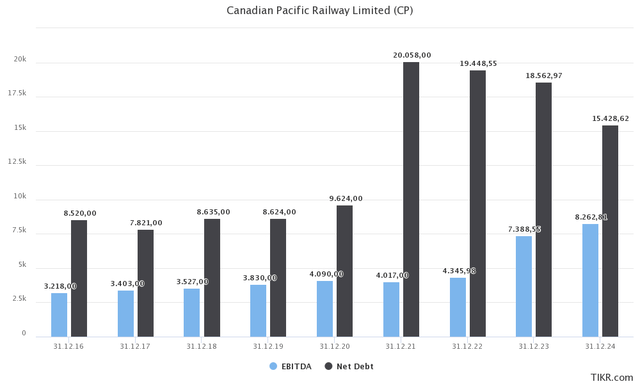

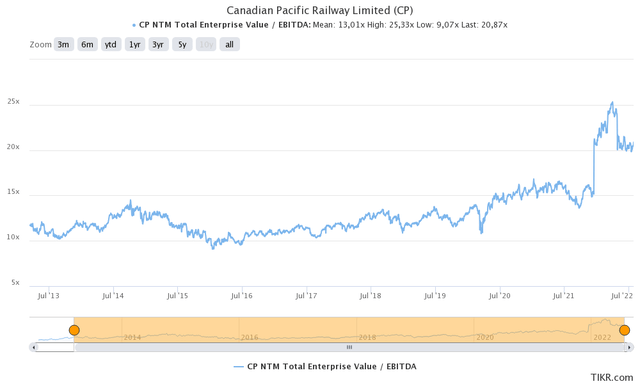

With that said, the company is trading at 15.4x 2023E EBITDA. That is based on the 2023 numbers below and its $94.7 billion market cap. Moreover, I added $700 million in pension-related obligations.

That valuation is not at all cheap. Or to put it differently, it doesn’t look cheap. After all, the market has started to price in the merger benefits. Hence, when using 2024 numbers, the valuation drops to 13.3x EBITDA. That is more in line with historic valuations as it incorporates an EBITDA surge to $8.3 billion.

Nonetheless, despite all the good news, it would be foolish to make the case that everything is fine. That is truly not the case. As well as CP is operating its railroad, economic conditions are an issue.

As I already have a significant CP position, I’m looking to add close to $65 per share (New York-listed). I wouldn’t be surprised if the economic growth slowing trend would cause stocks to drop again.

FINVIZ

If it happens, I happily add to my CP exposure as I believe that CP will be the best-performing Class I railroad going forward.

Takeaway

In this article, we discussed Canadian Pacific’s third-quarter earnings. The company benefited from strong top-line growth, underperforming growth in expenses, a lower operating ratio (higher efficiencies), and strength in all major areas.

While grains were weak, it’s expected to turn into a strong tailwind in the fourth quarter and beyond. The same goes for fertilizers, rebounding coal shipments, and continuing strength in intermodal.

Moreover, we’re just a few months away from what is very likely going to be an STB merger approval.

The only thing that bothers me a bit is the valuation in light of the bigger economic picture. If the economy were in an uptrend, CP would be a no-brainer buy. While I remain bullish, I’m looking to add to my position at a price below $70 to account for what I believe are elevated economic risks.

(Dis)agree? Let me know in the comments!

Be the first to comment