Dmitri Zelenevski

Canada Goose (NYSE:GOOS) has established itself as a global luxury outwear juggernaut with impressive brand momentum over the last several years. On the other hand, the stock has been under pressure amid broader macro headwinds and moderating growth forcing a reset of valuation. Last month the company cut its full-year guidance citing uncertain conditions in China facing ongoing Covid disruptions with the country recognized as one of its most important markets.

Fast forward, the positive development is the latest reports of China moving to ease its Zero Covid policies as the first step towards a broader reopening. The setup here likely provides some upside to Canada Goose earnings estimates and a catalyst for more positive momentum in the stock. We’re bullish on GOOS and expect shares to trend higher going forward.

GOOS Key Metrics

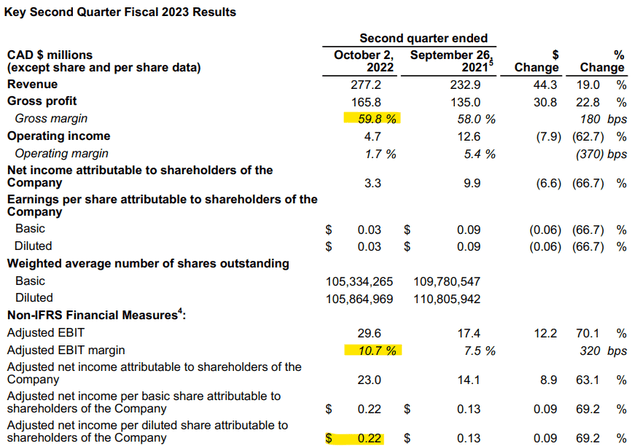

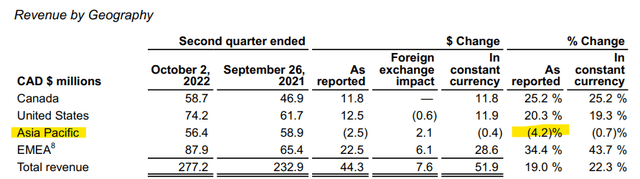

The company last reported its fiscal 2023 Q2 earnings on November 2nd with the headline adjusted EPS of C$0.22 “Canadian Dollars”, up from C$0.13 in the period last year. The result was driven by an impressive improvement in the gross margin, reaching 59.8% from 58% in the year prior. The quarterly revenue of C$277 million climbed by 19% year-over-year, or 23% on a constant currency basis, keeping in mind that the period is seasonally slower capturing the warmer months between the peak winter season.

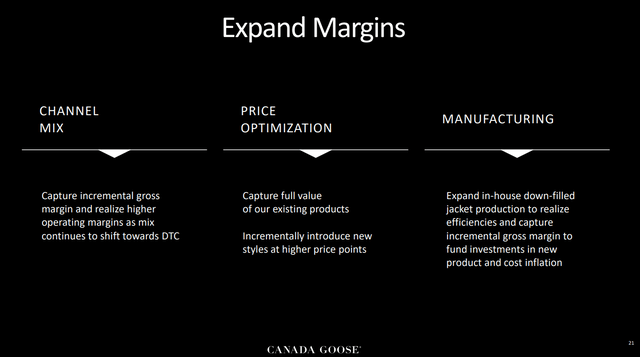

The effort this quarter demonstrates the ongoing success in capturing incremental margin upside with a strategy shift towards more of a direct-to-consumer model. A big part of the story has been an ongoing international expansion with evidence consumers remain willing to pay a premium for the trademark “Made in Canada” authenticity.

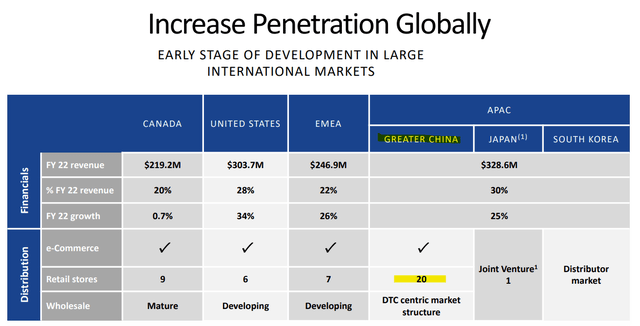

Canada Goose ended the quarter with 45 permanent retail stores compared to 38 last year. That being said, Asia-Pacific including China was impacted by COVID that resulted in some temporary store closures, as the only region presenting a decline in revenue.

This trend continued into Q3 as a theme during the earnings conference call. The key quote is as follows:

Despite our strong performance in the quarter, we are not seeing the level of improvement we had assumed in Mainland China, COVID-related disruption, including mall closures, lockdowns and travel restrictions continue to impact traffic. And as we head into our most meaningful quarter, we are seeing these disruptions affect an increasing number of cities in which we operate. As a result, we have updated our outlook for the year…

Critically, this does not change our confidence in our brand strength globally, nor in our conviction in China as a significant growth market for Canada Goose, especially given how underpenetrated we are.

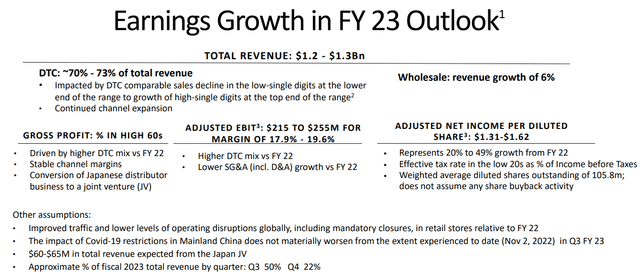

The company now expects full-year revenue between C$1.2 and C$1.3 billion, down from a previous midpoint target of C$1.35 billion. On the profitability side, the current full-year adjusted EPS target between $C1.31 to $C1.62 compares to the previous outlook of around C$1.70, through a hit to the operating margin based on the impact from China. Nevertheless, the earnings growth is between 20% and 49% from fiscal 2022 highlighting the more positive structural momentum.

Ending Covid Zero in China

We mentioned the update with headlines out of China moving to remove many Covid restrictions, placing its official health policies closer in line with other global markets. The understanding is that the government facing pressures against widespread protests and also recognizing the negative impact on local economic conditions is attempting to transition to a post-pandemic reality. A big change is the end of testing requirements and quarantine policies.

Again, all this is positive as it relates to the outlook for retail, with consumers more freely able to travel, and presumably shop at one of Canada Goose’s 20 stores in the country. To be clear, restrictions are still in place but the developments are clearly a step in the right direction and an encouraging turn of events compared to the baseline for Canada Goose considered when it revised its full-year outlook.

GOOS Stock Price Forecast

Connecting the dots, the path now is a greater probability of Canada Goose coming in at the top end or even exceeding the guidance range as traffic trends at malls in the region improve through the rest of the fiscal year. A big beat to earnings when the company reports its Q3 results in early February could be the catalyst for shares to take a leg higher.

From a high-level perspective, another dynamic we’re watching is the recent pullback in the Dollar strength which is positive for Canada Goose’s international exposure outside North America, representing more than 50% of the business. In a scenario where macro conditions evolve more favorably into 2023, the bullish case for the stock is that the company sees a re-acceleration of growth into more positive consumer spending trends.

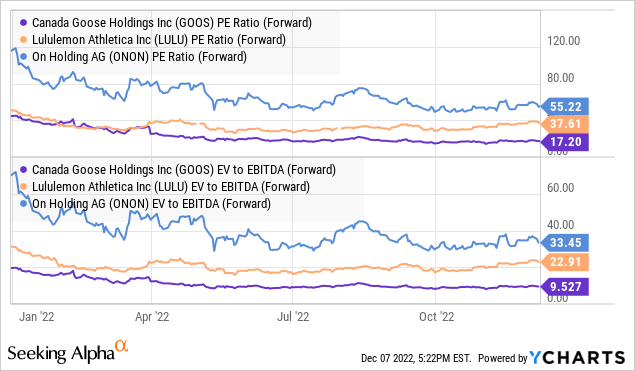

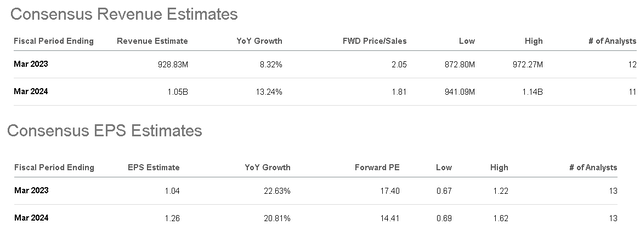

As it relates to valuation, we believe the current forward P/E of 17.5x is compelling in this market segment considering the outlook for double-digit top-line growth over the next few years and EPS climbing more than 20% into fiscal 2024. GOOS compares favorably to other “premium apparel names” like Lululemon Athletica Inc. (LULU) or emerging specialty sports brand On Holding AG (ONON) trading at nearly twice the earnings multiple.

The attraction of Canada Goose is its unique leadership in the outwear segment with multiple growth drivers between the global expansion and push into new product categories.

The opportunity here is to pick up shares that are still trading near their cycle low under $18.00. We rate GOOS as a buy with an initial price target of $24.00 implying a forward P/E multiple of 22.5x which beings to narrow the spread to other high-end specialty retail brands.

In terms of risks, a deterioration of the global macro-outlook defined by a slowdown in consumer spending would undermine the bullish case for the stock. Monitoring points over the next few quarters include the trends in financial margins and updates on new store openings.

Be the first to comment