wagnerokasaki/E+ via Getty Images

YouTube’s advertising revenue decline last quarter has heightened investors’ concern around its long-term potential amid rising competition. Amazon.com, Inc. (AMZN), in particular, has become a prominent advertising rival. It actually saw advertising revenue increase over the same period, as the e-commerce giant benefits from recurring purchase-minded web visitors. Following YouTube’s disappointing quarter, management tried to offer various reasons to be optimistic about the platform’s growth strategies during Alphabet Inc.’s (NASDAQ:GOOG, NASDAQ:GOOGL) (“Google”) Q3 earnings call.

In a previous article, we discussed the progress YouTube Shorts has made in challenging TikTok. In the same article, we slightly touched upon Google’s initiatives to make YouTube more shoppable to better attract purchase-minded web visitors. Amid live-stream shopping developments across social media platforms, it is worth delving into YouTube’s commerce advancements to better understand how it seeks to enhance competitiveness amid rising advertising rivalries.

Alphabet has been trying to make YouTube more shoppable for a few years now. In 2018, the platform enabled popular content creators to list custom merchandise in a shelf below their videos. In 2020, YouTube advanced its video ads format for a more shoppable experience, allowing advertisers to complement their video ad “with browsable product imagery… and drive traffic to the product pages.” This enhancement essentially aimed to improve conversion rates and Return on Ad Spend (RoAS) for advertisers, and offered D2C merchants an advanced way to improve web traffic to their own websites.

More recently, however, YouTube’s shopping advancements have been more focused on on-site shopping experiences, as opposed to off-site re-directions, to enhance the platform’s ability to attract and retain purchase-minded web visitors, ultimately improving the appeal of its advertising solutions.

Live-stream shopping

In 2021, YouTube launched live-stream shopping, which has been a core element of YouTube’s strategy to make the platform more shoppable, by leveraging content creators’ popularities and loyal follower bases. YouTube Shopping product designer Wendy Yang shared that:

According to a study we ran in partnership with Publicis and TalkShoppe, 89% of viewers agree that YouTube creators give recommendations they can trust… creators can offer their audience live product drops, exclusive discounts, and even poll fans during their shopping livestreams to interact with and get feedback from their fans.

Furthermore, according to the same research, “87% of people say they get the highest quality information about products when shopping or browsing on YouTube.” Given the trust content creators command from their followers, YouTube content creators’ product recommendations and in-stream shopping features pose a notable challenge to Amazon’s marketplace, and more particularly, its questionable product reviews.

Earlier this year, YouTube doubled down on its live-stream shopping feature by partnering with Shopify, allowing popular creators to:

“link their Shopify store to their YouTube channel… [hence] display their products across their channel and benefit from Shopify’s real-time inventory syncing so that viewers are never disappointed to find a product out of stock.”

This partnership offers an efficient access to e-commerce solutions like inventory management to better compete with Amazon. That being said, Shopify Inc. (SHOP) is still in the midst of building its fulfilment network. This may undermine YouTube’s ability to optimally facilitate e-commerce shopping journeys and effectively compete against Amazon worldwide. Hence Alphabet will need to seek advanced solutions for cross-border e-commerce fulfilment to effectively take on Amazon.

Nevertheless, “creators in the United States can now enable onsite checkout to allow viewers to complete their purchases without leaving YouTube.” Moreover, the partnership enables shoppers to complete their purchases using Shopify’s Shop Pay within YouTube. Investors may rightfully question why Alphabet would negotiate a deal with Shopify which allows shoppers to use Shop Pay instead of Google Pay, as YouTube’s shift towards e-commerce opens up lucrative opportunities to cross-sell Google’s own solutions and optimize revenue generation. Keep in mind that YouTube’s overarching goal is to make YouTube a one-stop shop for e-commerce shopping. Hence, Alphabet would rather enable Shop Pay on YouTube than negotiate a deal where shoppers are re-directed off-site to a Shopify-powered website.

Eliminating the need for shoppers to be re-directed off-site to complete their purchases reduces the risk of shoppers discovering alternative e-commerce avenues, and mitigates leaving an impression on shoppers’ minds that YouTube is not a proficient, self-sufficient shopping destination. For example, merchants with Shopify-powered websites may have enabled “Buy with Prime,” an offering from Amazon which extends its e-commerce solutions (including fulfilment and advertising) to external, non-Amazon sellers. If a YouTube web visitor is re-directed towards a Shopify-powered website to complete their purchase, they may encounter “Buy with Prime” logos next to merchants’ products, which could induce shoppers towards Amazon’s e-commerce solutions and platform, as opposed to relying on YouTube as a shopping platform. Hence, Google is wise to mitigate such risks by focusing on on-site retention.

Alphabet is seeking to alleviate the risk of shoppers starting their searches for products on alternative e-commerce channels (primarily Amazon) rather than YouTube (or other Google solutions). In essence, focusing on on-site retention improves the stickiness of the platform, inducing visitors to spend more time and consume more content, ultimately enhancing its ability to increase advertising revenue, or sell more products/ services on its platform.

Counter-factors

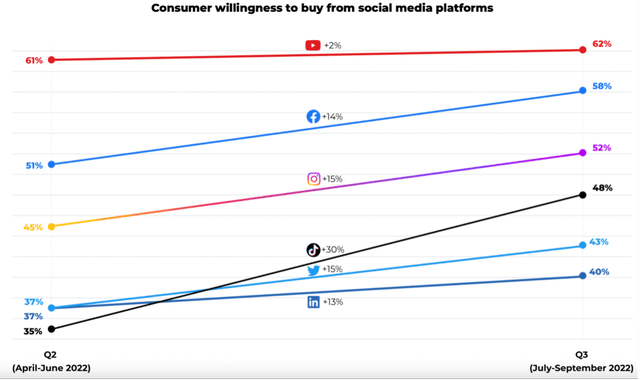

YouTube is certainly moving in the right direction with its on-site shopping enhancements, though competition is intensifying with other social media platforms also making advancements into e-commerce. Meta Platforms (META) has introduced Facebook Shops and Instagram shops to enable merchants to run digital storefronts. Pinterest has also been rolling out its own e-commerce solutions this year, and has been yielding success in driving advertising revenue higher, while YouTube and other social media platforms are suffering. The point is, most social media platforms are advancing into e-commerce functionalities, and the competition to attract daily active users and augment users’ time spent on their platforms will only intensify going forward. Time is a finite resource, and multiple platforms fighting for users’ time simultaneously will subdue the returns on e-commerce investments for platforms like YouTube. That being said, according to research from JungleScout, YouTube remains the most popular social media platform for buying products among consumers, putting it in a stronger position to attract and retain purchase-minded web visitors.

Note: percentage changes reflect changes in absolute terms, not differences in percentage points. (JungleScout)

Furthermore, while live-stream shopping is a popular shopping trend in Asia, and particularly China, a replication in the western world may not necessarily yield long-lasting success. In fact, ByteDance’s attempt to replicate live-stream shopping outside of Asia though TikTok failed to gain traction, while Instagram is also scaling back its own in-stream shopping initiatives amid lackluster demand. While the failures of competitors do not necessarily mean YouTube’s live-stream shopping will also fail, it does give investors reasons to moderate their expectations.

YouTube is also advancing content creators’ ability to tag brands’ products across various video formats. As Philipp Schindler (SVP and Chief Business Officer) mentioned in the Q3 earnings call:

At Adweek last week, not only did we announce that product feeds are coming to discovery, but that creators will soon be able to take products from brands across their videos, Shorts and live streams. This means viewers can shop products seamlessly while they watch their favorite content, while merchants can drive incremental reach and engagement for free listing offers when tagged by creators that viewers love and trust.

Offering advertisers the ability to list their products for free through tags by content creators is a key element in attracting advertisers to the platform and leveraging influencers’ popularity to drive sales. This advertising solutions entails brands only paying influencers when viewers click on the product tags appearing in their videos, implying free impressions. However, despite Schindler’s proclamations, YouTube influencers are unlikely to advertise brands’ products for free. Influencers are well aware of the fact that not all viewers are likely to click on tagged products, while brands would still benefit from deeply-imbedded impressions through influencers’ proclamations of their products, potentially serving as free endorsements for brands over the long-term. Influencers are unlikely to engage in free endorsements, and will inevitably require compensation from brands in addition to paid clicks.

In fact, a study comparing YouTube influencer campaigns to Facebook/Instagram influencer campaigns found that:

“YouTube is the most expensive social network for an influencer campaign…mainly due to the effort required to create video content. Long-videos are on average 2X more expensive than short-videos.”

Hence, influencers are likely to charge brands for product endorsements through product tags as opposed to relying solely on paid clicks, which would undermine the appeal of the free listings that Schindler tried to proclaim during the Q3 earnings call. That being said, YouTube’s shift towards and success with YouTube Shorts could offer more cost-effective influencer video campaigns and improve its advertising competitiveness against other social media platforms.

Summary

YouTube’s shopping advancements offer promising potential, as the firm is well-positioned to capitalize on rising e-commerce trends. The platform is right to focus its efforts on attraction and on-site retention of purchase-minded web visitors, ultimately improving the appeal of its advertising solutions. While intensifying competition is likely to subdue returns on its e-commerce investments and advertising revenue going forward, YouTube’s popularity and trustworthiness among shoppers offer a noteworthy competitive edge among social media platforms. Nevertheless, while YouTube’s shopping solutions are likely to be promising growth drivers going forward, dire macroeconomic conditions are likely to continue pressuring advertising revenue over the near-term, inducing a “hold” rating on Google stock.

Be the first to comment