jetcityimage/iStock Editorial via Getty Images

ChargePoint Holdings, Inc. (NYSE:CHPT) is a company that seems well-positioned to make it big in the future with electric vehicles (“EVs”) going mainstream. My previous article discussed why the company’s future is bright despite short-term challenges. The company has lost more than 26% of its market value since that article, which is not a surprise given that it lacks near-term catalysts to drive its stock price higher. With the company set to report fiscal third-quarter earnings tomorrow, now is a good time to revisit the thesis for ChargePoint.

The Earnings Report Will Likely Move CHPT

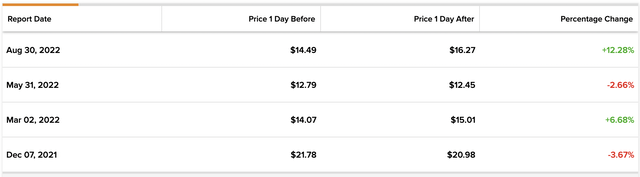

Empirical evidence suggests tomorrow’s earnings will likely move CHPT stock. As illustrated below, ChargePoint stock has moved following the last 4 earnings reports.

Exhibit 1: Earnings-related price movements

These movements, however, had little to do with meaningful earnings surprises. For instance, the company missed analyst estimates for earnings for the fiscal second quarter, but the stock soared as the company management reaffirmed the guidance for the current quarter and the fiscal year. Investors also rewarded the company for guiding for revenue of $475 million for fiscal 2022, substantially higher than the $350 million in revenue projected for fiscal 2022 at the time of its SPAC deal in late 2020.

Investors can use the implied volatility of ChargePoint options to gauge a measure of the magnitude of the move that can be expected following the earnings release. Using options pricing data on Yahoo Finance to create a straddle at a strike price of $12 results in an implied volatility of around 10% today, meaning that CHPT stock could move by around 10% – either up or down – following the earnings report. Investors, however, should keep in mind that this strategy sometimes overestimates the expected price moves.

All The Ingredients Are In Place To Support Exponential Growth

For any company, growth depends on a few major factors, including the demand expectations for its products, policy support, and the competitive advantages enjoyed by the company. As discussed below, ChargePoint benefits from favorable developments on all these fronts.

First, investors should evaluate the demand environment for EV charging infrastructure developers. The demand for EV charging infrastructure is a byproduct of the demand for EVs. There are two major reasons to believe that the demand for EVs will only grow in the coming decade.

- Both developed and emerging nations have unveiled plans to phase out combustion engine vehicles completely in the next few decades. These countries include the United States, China, members of the European Union, and Columbia.

- In response to these favorable policy decisions, automakers have pledged to invest billions of dollars to develop EVs that cater to the demands of both commercial and personal vehicle buyers.

Although EVs account for less than 10% of passenger vehicle sales globally today, the demand for EVs is rising sharply, with stellar growth expected in the coming years as recent investments of automakers finally help consumers get more bang for their buck with EVs. According to data from PwC, the demand for EVs will rise so sharply through 2030 to the extent that EV charging infrastructure would need to grow tenfold to keep up the pace.

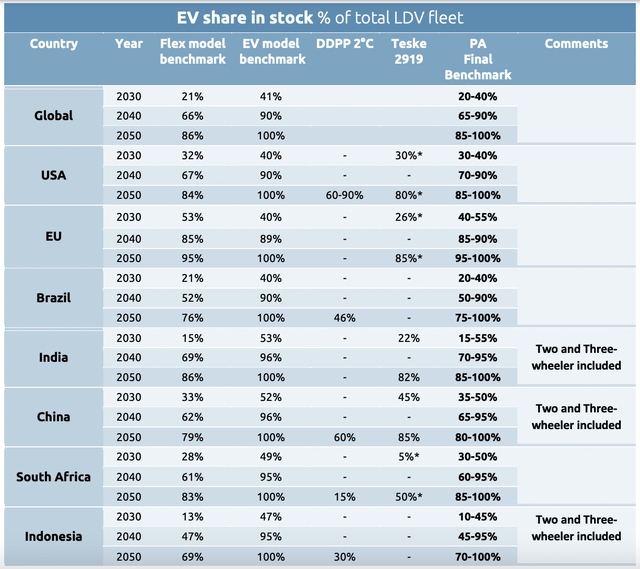

Second, investors should look at policy support for the industry. Regulatory decisions can and will have a massive impact on the growth – or the lack of it – of any business sector. Today, policymakers are aggressively supporting EV adoption. The Infrastructure Investment and Jobs Act of 2021 that funds $7.5 billion in EV charging infrastructure and the recently passed Inflation Reduction Act are two good examples of how regulators are pushing forward with their plans to embrace EVs. Elsewhere in Europe, Asia, and Latin America, governments are supporting the production and use of EVs. Decarbonization by 2050 is one of the main goals of the Paris Agreement as well, and to meet this target, it is estimated that between 75%-95% of passenger vehicle sales will have to be EVs or battery-powered vehicles.

Exhibit 2: Projected share of EV stock in vehicle fleet by country

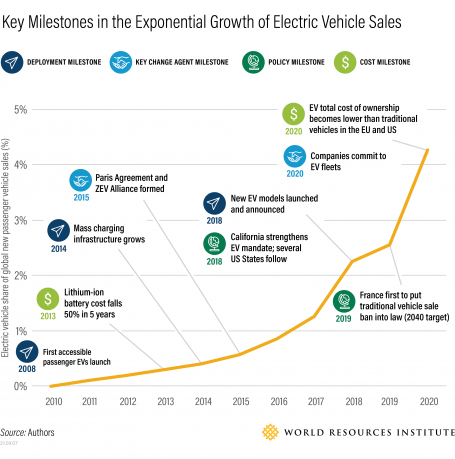

As illustrated below, the adoption of EVs has been boosted by a few key milestones in the last few years.

Exhibit 3: Key milestones in the growth of EV sales

World Resources Institute

With the world still having a long way to go in meeting climate change targets, it is reasonable to expect policymakers to be more aggressive in the coming years in promoting EVs. This should work well for EV charging infrastructure companies.

Third, investors should evaluate the competitive landscape in the EV charging infrastructure sector before investing in a company operating in this space. Not every company operating in high-growth sectors goes on to earn economic profits in the long run, which is why it’s important to differentiate the winners from losers. Although investors do not have a crystal ball to see the future, a good place to start is by understanding the competitive advantages enjoyed by companies. With around 50% market share in the AC charging market in the U.S., ChargePoint is the leading EV charging infrastructure provider in the nation. Elsewhere in Europe, the company was recognized as the Electric Vehicle Charging Market Leader by Frost & Sullivan. Today, the company is expanding into direct current charging that supports faster charging times for EVs in a bid to secure its market leadership. The company is aggressively expanding into Europe and Asia as well, which is a prudent move.

ChargePoint has all the ingredients that are required to grow exponentially in the next decade, which makes it a company worth closely monitoring today.

Takeaway

ChargePoint stock is likely to make some moves tomorrow with the release of quarterly earnings. However, any enthusiasm is not likely to last long, with Mr. Market continuing to punish growth companies in the wake of recession fears and persistent interest rate hikes. At a price-to-sales multiple of 11, ChargePoint is not cheaply valued despite losing 40% of its market value this year. However, growth investors should keep an eye on the company, as ChargePoint seems well-positioned to enjoy healthy growth in the next 10 years.

Be the first to comment