VelhoJunior

Campbell Soup Company (NYSE:CPB) has returned an astounding 33.5% in the past year, while the Vanguard S&P 500 Index ETF (VOO) returned a negative 11%. Even the Vanguard Consumer Staples ETF (VDC) has underperformed Campbell Soup with a mediocre return of 8.3%. But beneath the covers, the company has no structural change to justify its current lofty valuation.

Investors have sought refuge in consumer staples companies such as Campbell Soup, given the market turmoil. When this current bear market ends, investors will be more willing to take risks, and that change in investor behavior will lead to a pullback in Campbell Soup and the consumer staples sector. That pullback will allow investors to buy Campbell Soup Company at a lower valuation and a higher dividend yield. It is not worth buying Campbell Soup at today’s lofty valuation of 18.9x forward PE.

Weak Revenue Growth and Declining Volumes

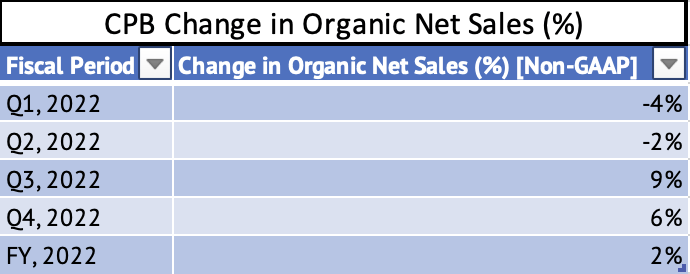

The company has seen middling sales growth [Exhibit 1]. In Q4 2022, Campbell Soup Company’s organic sales growth was 6% to $2 billion, and in Q3, the company saw organic sales growth of 9% [non-GAAP]. But, in Q2, the company saw a negative 2% organic sales growth, and in Q1 organic net sales were negative 4%. For the fiscal year 2022, the company saw total sales growth of just 2%.

Exhibit 1:

Campbell Soup Change in Organic Net Sales (%) (Campbell Soup Investor Presentation, Seeking Alpha, Author Compilation)

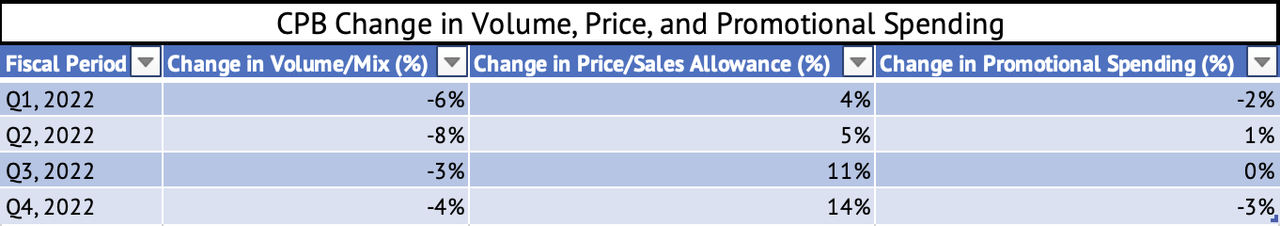

The company consistently sees lower sales volumes [Exhibit 2], some of which it blames on supply constraints. The company’s supply constraints led to its spending less on promotions, thus helping moderate the sales decline. The company had good pricing power in 2022, which helped cushion some of the headwinds from volume declines.

Exhibit 2:

Campbell Soup Change in Volume, Price, and Promotional Spending (Campbell Soup Investor Presentation, Seeking Alpha, Author Compilation)

Given the purchasing power and clout of Campbell’s customers, such as Wal-Mart, the company may not be able to continue increasing prices. The company’s five largest customers accounted for 47% of net sales in 2022. The company has to start showing growth in overall sales volumes. But, volume growth can be challenging in a high inflationary environment with consumers becoming pickier on how and where they spend their money. The US consumer is also facing dwindling savings, which could further pressure organic sales growth.

Declining Profitability

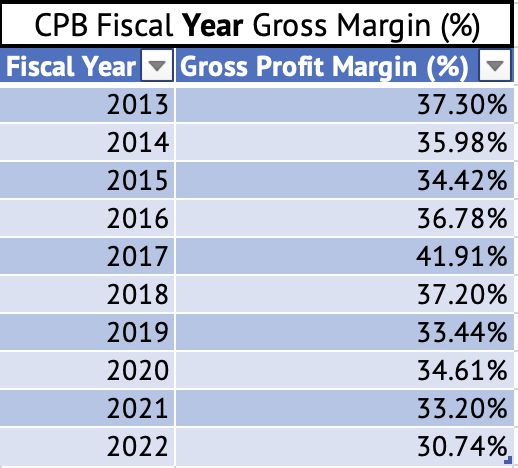

In the last couple of years, the company saw peak gross margins during the height of the pandemic [Exhibit 3], but the gross margin has declined substantially, and its annual gross margin now stands at 30.7%, a decline of 387 basis points since 2020. Its gross margin for the quarter ending July 2022 was well below 30% [Exhibit 4].

Exhibit 3:

Campbell Soup Annual Gross Margin (%) (Seeking Alpha, Author Compilation)

Exhibit 4:

Campbell Soup Quarter Gross Profit Margin (%) [Jan 2020 – Jul 2022] (Seeking Alpha, Author Compilation)![Campbell Soup Quarter Gross Profit Margin (%) [Jan 2020 - Jul 2022]](https://static.seekingalpha.com/uploads/2022/12/3/28462683-16701120033396482.png)

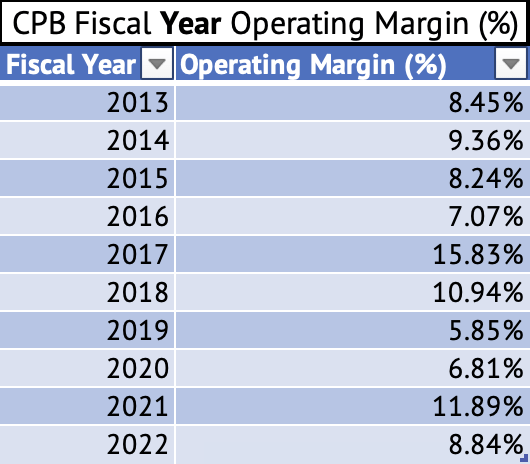

Its operating margin has slid below 10% and has been uneven over the years [Exhibit 5].

Exhibit 5:

Campbell Soup Annual Operating Margin (%) (Seeking Alpha, Author Compilation)

Increase In Inventory Reduces Operating Cash Flow

The company also sees an increase in its inventory levels. This increase in inventory may cause sales headwinds in the coming quarters. Seasonally, fall and winter are its best sales quarters, so the company may be building up inventory to meet the demand during the next two quarters. But if the prices increases and inflation force shoppers to switch to lower-priced store brands, the company may have to resort to promotions to sell its inventory, thus hurting sales growth and profit margins.

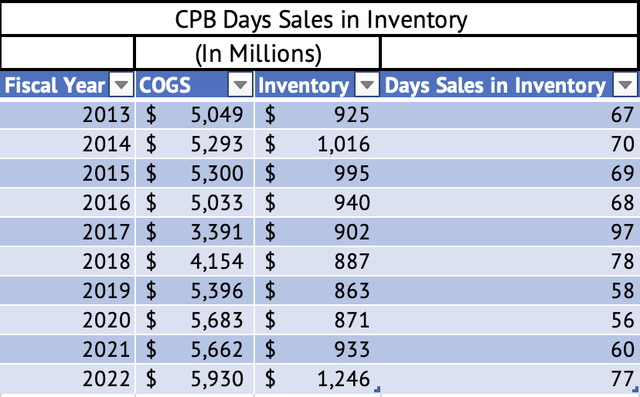

The company’s days sales in inventory are the highest since 2018 and the third highest in the past decade. At the end of the fiscal year 2022, the company has nearly 77 days’ worth of sales in its inventory [Exhibit 6]. On an absolute basis, the company has $1.246 billion in stock at the end of the quarter ending July 2022, its highest inventory level since January 2020 and an increase of 33% from the same quarter in 2021.

These are worrying inventory levels for the company. This change in inventory levels had a massive negative impact on operating cash flows. The company’s operating cash flow was a paltry $80 million for the quarter ending July 2022, compared to $154 million for the same quarter in 2021 and $271 million for the same quarter in 2020.

Exhibit 6:

Campbell Soup Days Sales in Inventory (Seeking Alpha, Author Calculations)

Company is Repaying Debt

The company is in the process of reducing its debt load and has repaid $3.7 billion in debt since the quarter of January 2020 [Exhibit 7]. The company still had $4.97 billion in short-term and long-term outstanding debt. The company’s debt-to-EBITDA ratio of 3.3x is high, and, given the current high-interest rate environment, it would be wise for the company to prioritize debt repayments. The quick ratio is a very low 0.22 and had a low current ratio of just 0.68.

Exhibit 7:

Campbell Soup Debt Reduction [Jan 2020 – Jul -2022] (Seeking Alpha, Author Compilation)![Campbell Soup Debt Reduction [Jan 2020 - Jul -2022]](https://static.seekingalpha.com/uploads/2022/12/3/28462683-16701128668723814.png)

It is common among most US companies to maintain very little cash on their balance sheets, and that may hurt both their quick and current ratios. In this era, where the world is in a permacrisis, these low cash and liquidity levels may haunt companies like Campbell Soup. The Economist recently discussed that humans were facing a permacrisis in this decade due to energy insecurity, geopolitical tensions, and economic instability caused by inflation and high-interest rates. When things change on a dime, individuals and corporations need to have a good level of liquidity to endure shocks.

Campbell Soup Has Not Increased its Dividend Payout

The company pays a dividend of $1.48 per share annually. That works out to a dividend yield of 2.74%. Even the 2-year US Treasury Note has a yield higher than Campbell Soup, with a yield of 4.2%. The company has no history of increasing its dividend payout, and its payout ratio is 52%. The consumer staples sector’s median payout ratio is 46%. The dividend coverage ratio for Campbell Soup is 1.9 compared to the consumer staples sector median of 2.08. It may be best for investors to wait for a pullback in the stock that would push up the dividend yield, given that the company has not increased its dividend and offers a low dividend yield compared to other safe investment options.

Conclusion

The consumer staples sector has become a market darling during these turbulent times. This factor has pushed up the valuation of many companies in the consumer staples sector. These high levels of valuations can last until investors are risk-averse. Campbell Soup is richly valued at a forward GAAP PE of 18x, and it has high debt levels, low cash, no dividend growth, and a low dividend yield. I rate this company’s stock a hold at this time, given these factors. Investors may have to wait patiently for a pullback before a buying opportunity emerges for this stock.

Be the first to comment