Nuthawut Somsuk

By Alex Rosen

Summary

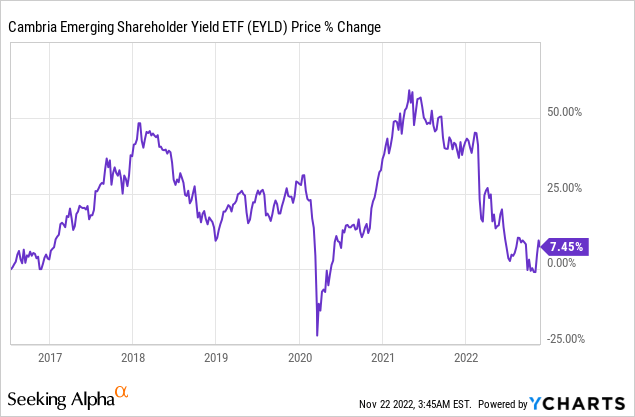

Cambria Emerging Shareholder Yield ETF (BATS:EYLD) focuses on dividend yield as opposed to total return. Similar to a bond fund, where the principle is secondary to the yield, EYLD should be looked at from the perspective of yield. However, unlike a bond, where the underlying bond price never changes, here the dividend is dependent upon the price of the fund. So the 8.47% dividend yield is dependent on the price of the fund. Since EYLD is tied to the emerging markets, the price has seen significant rises and falls over the past decade. However, from point A to point B without looking at the journey, the delta is fairly low. We rate EYLD a hold for now, because of our belief in the stabilization of emerging markets.

Strategy

According to Cambria’s fund prospectus, “The ETF consists of stocks with high cash distribution characteristics. The initial screening universe for this ETF includes stocks in emerging market countries with market capitalizations over US $200 million. EYLD is comprised of the 100 companies with the best combined rank of dividend payments and net stock buybacks, which are the key components of shareholder yield. The ETF also screens for value and quality factors, and for companies that demonstrate low financial leverage”.

Proprietary ETF Grades

-

Offense/Defense: Offense

-

Segment: Emerging Markets

-

Sub-Segment: Dividend yield

-

Correlation (vs. S&P 500): High

-

Expected Volatility (vs. S&P 500): Moderate

Holding Analysis

EYLD holds shares in emerging markets that are focused more on dividend yield than total return. Typically, an investor should expect the holdings to be large-cap blue chip stocks with a low P/E ratio. Additionally, no one holding should be over balanced to severely affect the yield. A close examination of EYLD shows that the top ten holdings constitute less than 17% of the fund, which is right in line with a yield focused fund. Additionally, the top sectors are energy, electronics and finance, also consistent with a yield strategy. Finally, the main country holdings which constitute 60% of the assets are Taiwan, Hong Kong and South Africa. Whether these are all really emerging markets is a discussion for another fund, but they are reasonably stable countries with developed industries, and are capable of weathering market fluctuations fairly well.

Strengths

The reason people typically invest in bonds is because of the steady consistent income it generates regardless of market conditions. Whether the market’s up or down, you get the same yield. Every quarter or month, you know you will get whatever the yield is from that bond for the entire duration.

Emerging markets on the other hand are appealing because of the speculative nature of them. The opportunity for high rewards make them appealing to investors, but also make them a higher risk investment. A look at the chart above demonstrates exactly that. At some points EYLD has soared really high and at other points, like for example March of 2020, the fund plummeted.

However, regardless of up, down or sideways, EYLD is still paying a dividend, and that is comforting.

Weaknesses

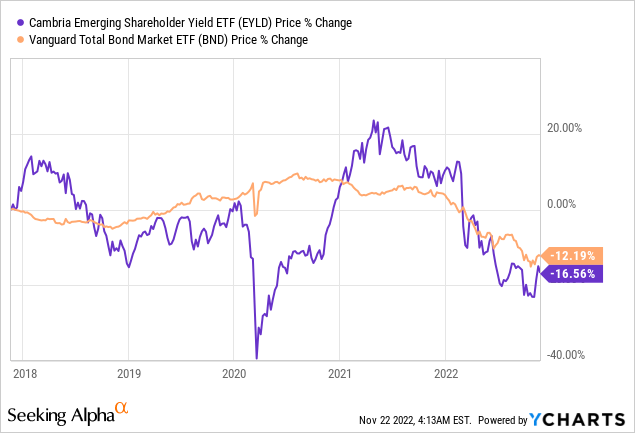

Unlike a bond fund, EYLD’s dividend is subject to the market fluctuations. In an emerging market those fluctuations can be felt much more precipitously than in an established market. The chart below really captures that difference. Even though the final destination is the same, one fund went through the mountain on a straight line, and the other went up and down and up and down.

Opportunities

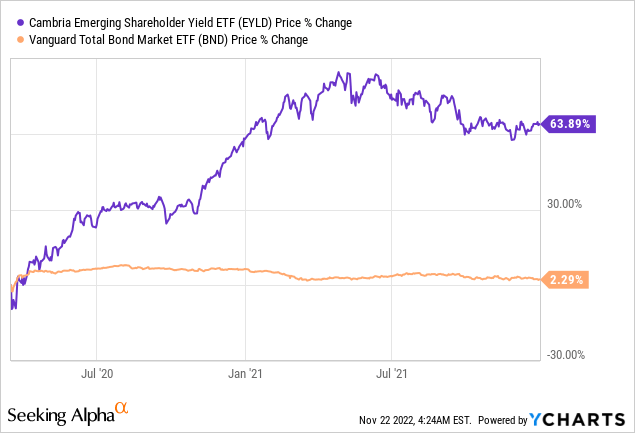

The combination of yield focus and the high variances in emerging markets mean that when timed right, the opportunity for very high yields is there. Market timing is not an exact science, and is extremely speculative, but what the chart below does show is that opportunities certainly exist, and there is room here to capture upside gain that does not exist in a bond portfolio.

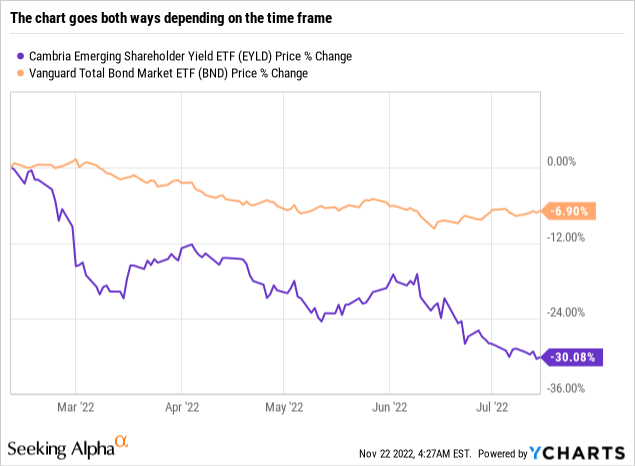

Threats

The chart above was cherry picked for a time frame where emerging markets really ascended, but the complete opposite can be demonstrated as well. Emerging markets are subject to a level of exogenous threats that bonds will never see. Riding high in April, shot down in May, but maybe it will be back on top in June. That’s life in the emerging market world.

Proprietary Technical Ratings

-

Short-Term Rating (next 3 months): Hold

-

Long-Term Rating (next 12 months): Hold

Conclusions

ETF Quality Opinion

EYLD has the challenging task of trying to provide consistency in an inconsistent sector. While it has its ups and downs, it does what it sets out to do. The ride may not be for everyone, but it certainly is as advertised.

ETF Investment Opinion

We rate EYLD a hold. If you have ridden out 2022, and are still holding, good news is on the way. Since October 25th, emerging markets have seen a pleasant rebound. That auspicious date is the day that China, the leading emerging market, made clear its path moving forward. They have solidified their leadership and are choosing a path forward. This has been reflected in emerging market funds and should continue at least for the short term.

Be the first to comment