DedMityay/iStock via Getty Images

Even though Calumet Specialty Products (NASDAQ:CLMT) smashed earnings at its most recent report, the stock price sold off precipitously. We strongly believe that this generates a buying opportunity for those with resources to do so. In the earnings presentation portion of the call, management also offered insight into its operations and vision. Let’s pick up that hammer and smash our way through to the core issues impacting the business.

The Quarter

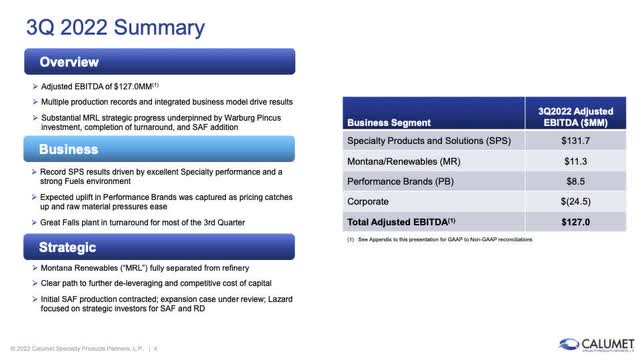

The first blow opens our view into the reported financial results. The following slide summarizes the report.

Calumet Presentations

Of note from the slide and call:

- Reported total EBITDA was $127 million.

- MRL EBITDA equaled $11 million down from near $70 million in the last quarter. (Great Falls operation was idled for most of the quarter because of the conversion/turnaround.)

- Company paid $35 million toward extinguishing some of the 11.5% 2025 bonds.

- WCS/WTI spread at Great Falls equaled $20.

- MRL began operation at low rates.

- Company discussed the cost and production advantage it has for the even more lucrative SAF.

- Shreveport processed 51,000 barrels of feed per day, 40% higher than 2021 and 10% more than the previous record. Impressive understates the result.

A few notes: From our own data collected using EIA data, we had the average Gulf Coast 2-1-1 spread at $40, down $10 from the June quarter. In our last article, Calumet Specialty Products: Benefiting From Tight Crack Spreads, we estimated the EBITDA for the quarter at $130 million plus with MRL (Great Falls) operating for at least one or more months. It didn’t; it was basically off line. The remaining business performed excellently.

The Calumet Execution Advantage

In our view, successful companies show stellar vision coupled with solid and predictable execution. During the call, a detailed discussion occurred during the Q&A demonstrating these concept for success; predictable execution and vision. Amit Dayal of H.C. Wainwright, asked about timing for monetizing MRL, Bruce Fleming, Calumet’s, EVP Montana/Renewables and Corporate Development, answered,

We need to focus on getting this up safely and delivering what we’ve promised to the market. But at that point, Montana Renewables is standalone itself, funding all of the things that we talked about for future growth expansion SAF. Montana Renewables can do that on its own.

Calumet had carefully planned, rolled when it was needed, and created a vision in the proper order with each piece carefully executed on-time. The execution of the vision leaves the company completely in the driver’s seat when it comes time to monetize assets. Under Steve Mawer, vision and execution took on a new, higher level of performance.

Continuing, Todd Borgmann, CEO, added about the record EBITDA being achieved:

This is a combination of a favorable market, a competitively advantaged business and a step change in execution across the board. When [] our ops and commercial teams have maximized the value of optionality[,] that sets our integrated platform apart.

That comment also refers to the impeccable achievement in operating excellence set in place under Tim Go. He may have struggled with other issues, but it was clear that during his tenure, operational excellence appeared. Calumet operations, visions and execution align together creating a synergy for success. Investors take note.

Was It Sell the News or?

So why the big sell-off after earnings? For investors, understanding the probable reason helps in purchasing at more advantageous prices. Several factors came to bear after the call. A review follows:

- The stock was overbought and had been since the middle of October. Any negative comments will be treated harshly.

- Management discussed the lag time for positive cash flow from MRL. Scaling is needed with the startup of the hydrogen unit and pretreatment units coming later this year and next. (The plant is operating at low rates using higher cost treated feed-stocks.)

- The comment by Fleming on timing for monetizing MRL also added uncertainty. The company was/is in no hurry unless a “can’t refuse” offer comes along.

- A large block of $8 options that were to expire in November were being rolled contributing to stock selling.

Finally perhaps, the market was just selling the news after the long period of buying the rumor. But the overbought nature of the stock did drive us to sell off a few $8 calls due to expire in November. We plan to buy stock instead. Nothing in the results or plans changed the long-term vision and likely significantly higher price for the stock.

Risks & Rewards

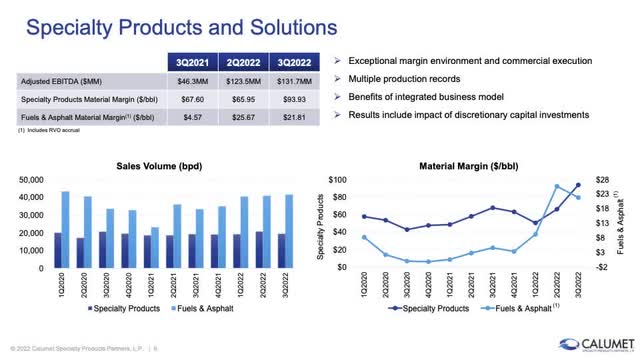

Looking forward, there are several issues that should be discussed. First, in the slide deck, Calumet offered us great insight when showing the relative hedge that each of the two businesses provide, fuels and specialty. In uncertain markets, this natural hedge proves valuable. On the lower right, a graph of material margins for the two businesses shows that in times of rising crude prices, speciality margins drop while fuel margins increase. The opposite is also true.

Calumet Presentations

This effective hedge approach has some level of bias in both directions with margins on specialty more valuable, but still offsetting. The margin on specialty, in this case, jumped $16 while the margin on the fuels dropped $4. But if you look closely, fuel’s volumes generally exceed specialty by a factor of 2. Certainly, numbers and differences can change depending on the circumstances, but the idea doesn’t. We have pointed this out several times over the years when writing on Calumet.

Continuing, into the next few quarters, management stated that demand is strong, though seasonally weaker, while margins are likely to return to more normal values. What is more normal margins appears to be significantly higher than in the past. Manage added a comment:

our specialty business continues to generate a lot of cash and it looks like for the foreseeable future, that continues to be the case. And, we’ll manage it accordingly.

Our own crack spread numbers for the December quarter are similar with prior quarters.

In this article, we have focused more on the underlining critical corporate cultures necessary for a business to perform lucrative returns to investors. And yes, there are risks. Economic softening stands at the forefront from worldwide recessions. Our nation is heading into a deeper recession induced by the Federal Reserve. Demand may slip. The Shreveport refinery could find itself shutdown for significant repairs. Investing is always risky, but Calumet showed its true colors and potential during the last two years. Driven by vision, ordered execution and operational excellence, this is a growth company bound for the stratosphere. The products match future demands and needs. We are holding our shares and manipulating options in a judicious fashion. This is a buy on weakness. Our smasher opened doors into important investment issues for investors to follow and found pay dirt. We are at a buy.

Be the first to comment