grandriver

I now expect Callon Petroleum (NYSE:CPE) to generate close to $1 billion in positive cash flow by the end of 2023 at current strip prices. Callon’s projected cash flow has gone down due to weaker commodity prices (with the majority of its 2023 hedges have a floor around $70), but it still looks capable of reducing its leverage below 1.0x by the end of 2023. Callon also got its credit facility maturity extended to October 2027, and it looks to be in good shape to deal with it various debt maturities (with $508 million in notes maturing in 2025 and 2026).

In a scenario where commodity prices follow current strip until the end of 2023 and then WTI oil averages $70 after that, I now estimate Callon’s value as being in the low-to-mid $60s per share. This is a bit lower than what I estimated Callon’s value at in August, due to the reduction in near-term cash flow estimates. However, I still believe Callon has around 40% to 45% upside in a long-term $70 WTI oil scenario.

2H 2022 Outlook

Callon expects to average a bit over 105,000 BOEPD (64% oil) in production during the second half of 2022, based on the midpoint of its full year guidance. The current strip for the second half of the year is close to $90 WTI oil.

At that commodity price, Callon is expected to generate $1.145 billion after hedges.

| Type | Barrels/Mcf | $ Per Barrel/Mcf (Realized) | $ Million |

| Oil | 12,364,825 | $88.00 | $1,088 |

| NGLs | 3,616,425 | $34.00 | $123 |

| Natural Gas | 20,372,700 | $4.50 | $92 |

| Hedge Value | -$158 | ||

| Total Revenue | $1,145 |

Callon is thus expected to generate around $347 million in positive cash flow in the second half of 2022. Callon generated $309 million in positive cash flow in the first half of the year.

| $ Million | |

| Lease Operating Expense | $145 |

| Gathering, Processing, and Transportation | $45 |

| Production and Ad Valorem Taxes | $78 |

| G&A and Other (Cash Basis) | $45 |

| Cash Interest | $80 |

| Operational Capital Expenditures | $405 |

| Total Expenses | $798 |

Potential 2023 Outlook

At current 2023 strip of roughly $79 WTI oil, Callon would be projected to generate $2.227 billion in revenues after hedges if it keeps production flat at 103,500 BOEPD (midpoint of its 2022 guidance). Callon’s hedges are very close to neutral value at current strip.

| Type | Barrels/Mcf | $ Per Barrel/Mcf (Realized) | $ Million |

| Oil | 23,799,825 | $77.50 | $1,844 |

| NGLs | 7,177,425 | $30.00 | $215 |

| Natural Gas | 40,799,700 | $4.10 | $167 |

| Hedge Value | $1 | ||

| Total Revenue | $2,227 |

I’ve assumed that Callon’s operational capex is around $850 million in 2023, a modest increase from its roughly $800 million budget for 2022. In general, operators are expecting around 10% to 15% cost inflation in 2023, but Callon added to its DUCs in 2022. It is drilling around 12 more wells than it is completing in 2022, and its 2023 budget will likely benefit in comparison assuming that it does not increase its DUCs further.

| $ Million | |

| Lease Operating Expense | $285 |

| Gathering, Processing, and Transportation | $80 |

| Production and Ad Valorem Taxes | $134 |

| G&A and Other (Cash Basis) | $90 |

| Cash Interest | $160 |

| Operational Capital Expenditures | $850 |

| Total Expenses | $1,599 |

Callon is thus projected to generate $628 million in positive cash flow at high-$70s WTI oil in 2023.

Debt Situation And Valuation

Callon had $2.531 billion in net debt at the end of Q2 2022 and now looks capable of reducing this to around $2.184 billion by the end of 2022 and $1.556 billion by the end of 2023 at current strip prices. The latter would be around 0.95x Callon’s projected 2023 EBITDAX.

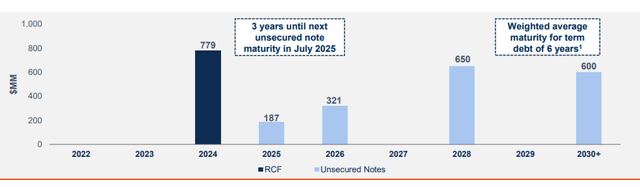

Callon’s Debt Maturities (Callon Petroleum Company)

Callon recently extended its credit facility maturity to October 2027, nearly three years later than its previous December 2024 credit facility maturity date. It looks to have a solid path to dealing with its various maturities (with $508 million in note maturities in 2025 and 2026 now).

I now estimate Callon’s value at approximately $63 to $64 per share in a scenario where commodity prices follow strip until the end of 2023 and then average $70 WTI oil after that. This has been reduced a bit due to weaker near-term commodity prices, but I still believe Callon has a significant amount of upside potential as it pays down its debt.

Conclusion

At current strip prices, I now expect Callon to generate close to $1 billion in positive cash flow by the end of 2023. This would reduce its leverage below 1.0x and leave it with a clear path for dealing with its debt maturities. I believe that Callon’s stock is worth in the low-to-mid $60s in a long-term (after 2023) $70 WTI oil scenario if it can successfully reduce its leverage to around 1.0x by the end of 2023.

Be the first to comment