vitapix

Dear readers/followers,

I do enjoy working on water companies such as York Water (YORW), which I recently wrote about and own shares in. California Water Service (NYSE:CWT) is another company I’ve written about but do not yet own. It yields a similar dividend, it operates in very similar areas, but at a higher scale, and it shares some, but not all of the characteristics of YORW.

Let me show you why I prefer YORW, and why I still don’t consider CWT to be a “BUY” here – but at what price I would be willing to invest in this business.

California Water Service – Revisiting the thesis

In my earlier article on the company, I presented CWT as an investment. It delivers water to both private and commercial customers across its service area, which comes to around half a million connections across the state. Not the biggest company, but still a solid business.

Areas the company covers include Dixon, East Los Angeles, Bakersfield, Travis, Stockton, and areas in the vicinity. Structurally speaking, CWT is a holding company with seven specific subsidiaries – California Water Service Company (Cal Water), New Mexico Water Service Company (New Mexico Water), Washington Water Service Company (Washington Water), Hawaii Water Service Company, Inc. (Hawaii Water), TWSC, Inc. (Texas Water), and CWS Utility Services and HWS Utility Services LLC (CWS Utility Services and HWS Utility Services LLC being referred to collectively in this annual report as Utility Services). So, plenty of geographies – despite the name.

One of the core concepts you have to understand when you invest in water, your yields and your dividend growth are going to be very low. These companies have low, single-digit yields and they’re not usually bumping those yields that quickly.

What’s more, they tend to trade at extreme sort of valuation multiples, YORW and CWT trade at averages of 30-35x P/E, and can sometimes even go beyond that to 40-45x. This is due to the inherent regulation and safety for water – investing in these companies is some of the safest placements of money you can make on the market.

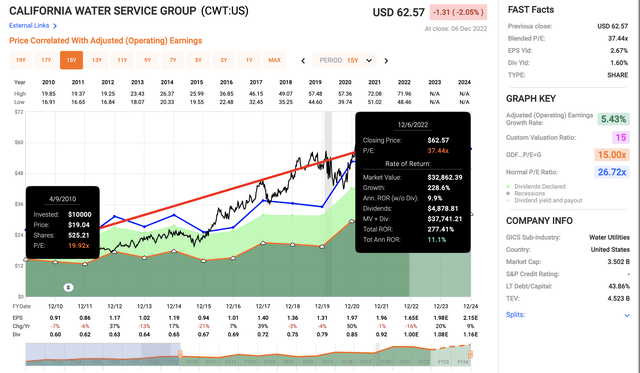

Of course, safety doesn’t do much if it doesn’t generate any sort of impressive RoR. Historically speaking, these companies have gone from being less-than-massive premiums of 20-25x to massive premiums of 30x+ back in 2014-2015. Had you invested in 2010 and until now, your returns would have been extremely impressive – not just for CWT, but for other water companies as well.

But the likelihood of history repeating itself here is something I view as being essentially zero in likelihood. That’s why I tend to be pretty clear in wanting to at least buy the company at some sort of recent-fair value discount.

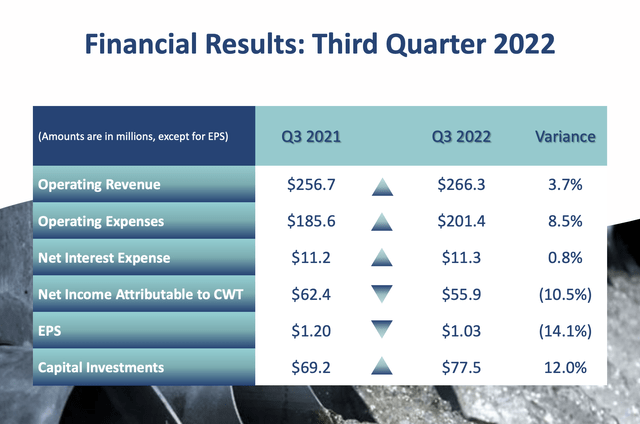

This is not a bad company in the least. CWT is very solid – and recent operating results confirm some of these solid trends, with 3.7% quarterly YoY top-line growth – but like all companies, they’re under pressure from inputs. I would say that CWT is actually more under input pressure than is YORW, owing to an 8.5% OpEx increase, and a resulting significantly lower EPS here as well.

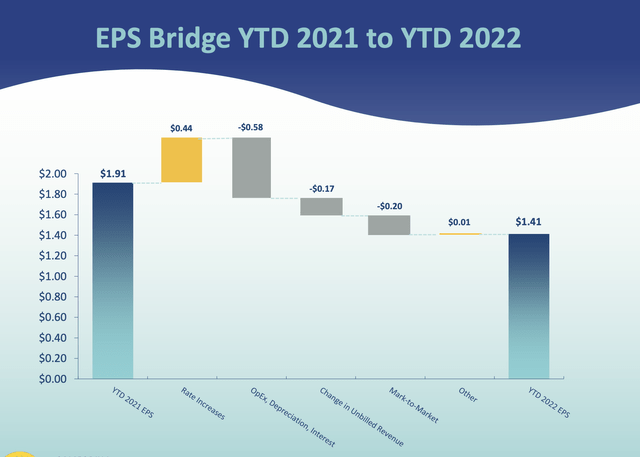

This trend becomes in fact only more pronounced when we look at YTD numbers. The company’s EPS declined 26% YoY for 9M22, with net income down 21.7%, even if top-line revenue growth numbers were over 4%. California being what it is, the company’s OpEx is increasing due to increasing wages, COGS/services, uninsured loss expenses, and bad debt reserves as people are facing payment issues.

On the positive side of things, the company managed to significantly increase its rate for the YTD, due to some deferred revenue changes, and some one-time gains.

The company also decided to issue equity to finance the ongoing capital improvement program – increasing share count by 2.2M over the last 12 months alone, which of course also contributes to the pressure.’

The EPS shows some of the pressures the company is currently under. Unlike YORW, which is increasing, CWT is having trouble getting its earnings to stay above the level of previous years.

There is also no news regarding the recently submitted case, and the company expects the final decision to come no earlier than 2023. This is a big one, because, without the decision, CWT cannot accurately forecast (nor can I) the cost of capital/debt, and CWT has not actually reserved for any potential outcome of the case. There are some risk components here to keep in mind – and very few of them are of a positive nature.

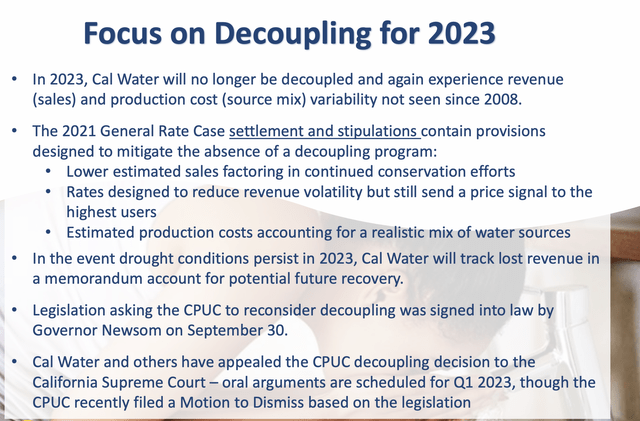

There is also an update regarding decoupling (or rather, the lack of decoupling), which is expected to lead to significant earnings variances.

Take this together with the fact that the company operates in a drought-stricken zone, with all Californian districts now in “stage 2” drought restrictions, and there is far more risk to this company than to peers like YORW.

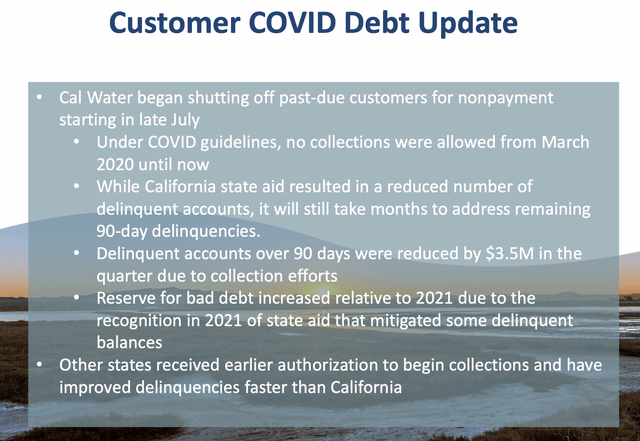

To me, this means that CWT cannot and should not hope to command the same sort of premium that YORW does, because it is not of the same fundamental quality and visibility. The company also has some real issues with COVID-19-related debt, where CWT had to start shutting off customer water for nonpayment. While this is down, this is still there. The fact is that other states are doing a much better job here than California is.

All of this leads me into valuation, and as you might expect, not a positive picture despite the overall trend of outperformance here. I’m impairing this by 10% each year going forward to make it a more conservative case, and continue to view it as risky – for a water company. This is not risky in itself of course.

All in all, CWT is a safe company to invest in. Most of the adverse effects from unbilled revenue were due to comparison effects and timing of meter reads – not something that will actually change the thesis. There are also some unrealized valuation headwinds, droughts, fire seasons, and the issues of delinquent balances in California – still, I expect some of these to be solved. What we’re left with is a company that yes – is exposed to riskier geography than say, some of the central states, but also one of the most populated and highest-income areas in the nation – and growth opportunities remain good here nonetheless.

California Water Service Valuation

Still, we do want to make sure that we’re not paying too much, and as it stands now, this is not actually possible.

CWT trades at what I view as a massively inflated valuation of 37.5x. That’s above YORW – a better-rated and managed company in a better geography. That’s why I was neutral on the company before, and it remains the key reason I remain neutral on the company at this particular time.

Anything above a 33-35x P/E is too much here. Even if we consider a 34x P/E on a forward basis for the company, including some reversal and a slight amount of growth, we get barely double digits at 34.4x P/E.

Some might view this as good enough, but there’s too much forecast ambiguity for me in the 40% miss rate with a 10-20% margin of error from analysts here. The fact is, we’ve seen in the recent history of these companies trading far higher than I view them being justified doing.

Peers come in the shapes of other water companies such as American Water Works (AWK), American States Water (AWR), and others. I would also argue that the peer group includes ancillary service companies such as Finnish business Uponor (OTCPK:UPNRY), my primary choice for investing in water. Important to note though that Uponor lacks the comps regulatory characteristics, and is more of an industrial.

From a peer perspective, CWT is not the cheapest regulated water business – nor is it among the cheaper ones, going by an NTM P/E (Source: S&P Global).

The analysts following the company continue to be somewhat mixed in their expectations, 3 analysts follow the company – and 1 still considers the company a buy, despite an average PT of $63.7, implying an upside of around 1%, which means there’s an increase in the PT despite some of the quarterly negatives here.

I would carefully agree with the potential of such an upside, while at the same time cautioning that premium upsides always come at a downside risk.

I do not see the company having the same downward volatility as a tech or pure growth business – but I do say that there is potential for the company to drop to around 20-25x P/E, which should imply some taking care here.

In my last article, I called CWT a “BUY” below 30x P/E. That remains my stance at this time. However, given that we’re now much higher, my neutral or “HOLD” stance has become much firmer.

Here is my updated thesis for CWT.

Thesis

My thesis for California Water is as follows:

- Water companies are among the greatest in terms of safety, rivaling and exceeding even utilities. I follow many of them and invest in several. I do not yet own CWT, but I’m looking at establishing a position in the company going forward.

- In order to invest in the company, I want a sub-30x P/E on an LTM or blended historical basis. We’re currently slightly above 30x.

- For that reason, I’m a “HOLD” here. My current PT for the business is around $58/share normalized.

Remember, I’m all about:

-

Buying undervalued – even if that undervaluation is slight, and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

-

If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

-

If the company doesn’t go into overvaluation, but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

-

I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them (italicized).

- This company is overall qualitative.

- This company is fundamentally safe/conservative & well-run.

- This company pays a well-covered dividend.

- This company is currently cheap.

- This company has a realistic upside based on earnings growth or multiple expansion/reversion.

The company, because of this, is neither cheap nor has a good upside from a conservative point of view. Because of that, I cannot condone a “BUY” rating here.

Be the first to comment