imaginima/E+ via Getty Images

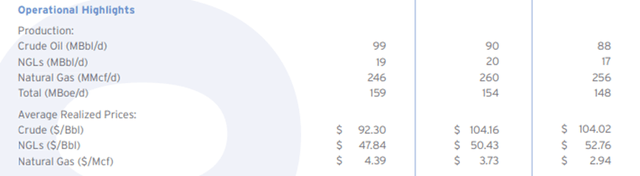

On December 1, 2014, Occidental Petroleum Corporation (OXY) announced it has completed the spin-off of its subsidiary California Resources Corporation (NYSE:CRC). The subsidiary produced crude oil, NGLs, and natural gas in California.

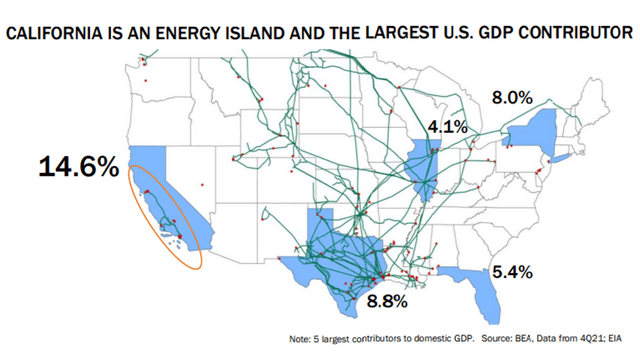

California is an “energy island” in the U.S. because it does not connect via pipelines to the other regions of the country.

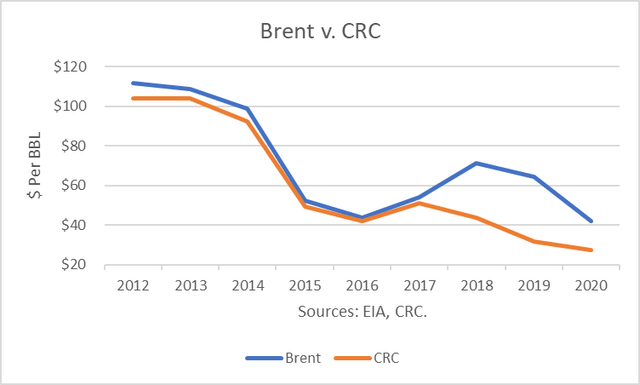

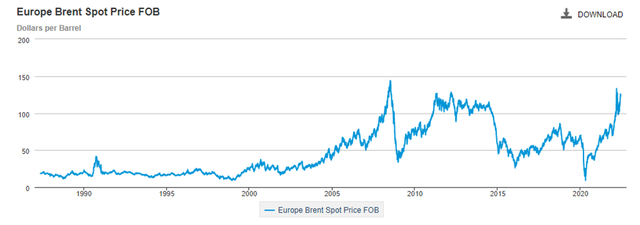

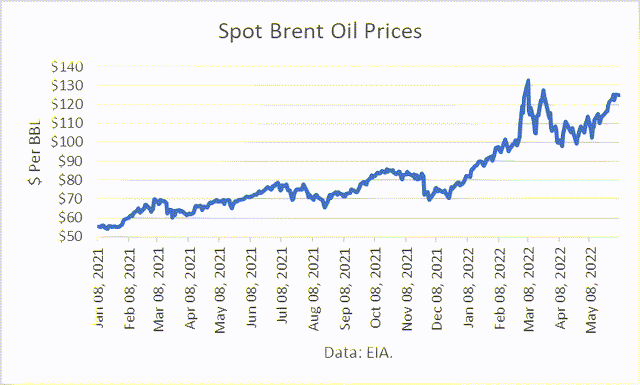

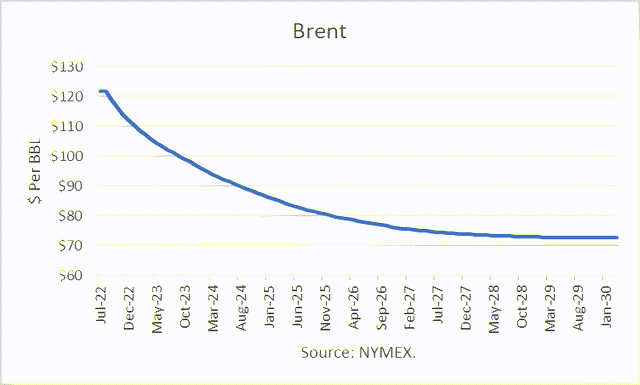

The basis for crude oil contracts in California is an average of in-State posted prices which have historically correlated closely with Brent crude prices. Brent is produced in the North Sea area of the Atlantic Ocean and is pipelined to the Sullom Voe terminal in the Shetland Islands of Scotland. It is a “waterborne crude oil” on which ICE’s Brent benchmark is based because it has access to global shipping, port and storage capacity. This gives it an advantage over other crudes which are landlocked and regional.

Refiners around the world process it. And it is a benchmark used to price over three-quarters of the world’s traded oil, as one of the most “liquid” crude grades. As such, it reflects global supply and demand factors, as well as expectations and risk premia.

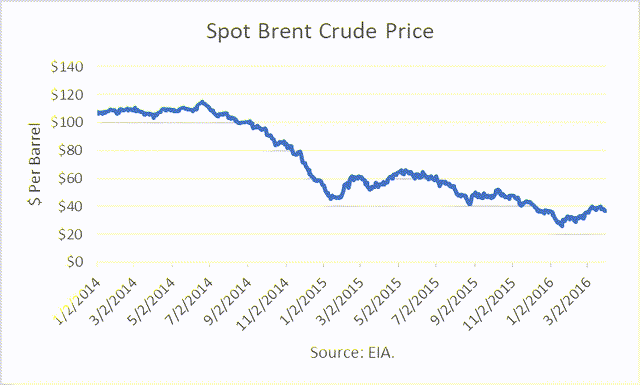

The timing of the spin-off was unfortunate for CRC. The spot price of Brent had peaked at $115.19 on June 19, 2014, and dropped to just $ 28.82 on February 11, 2016.

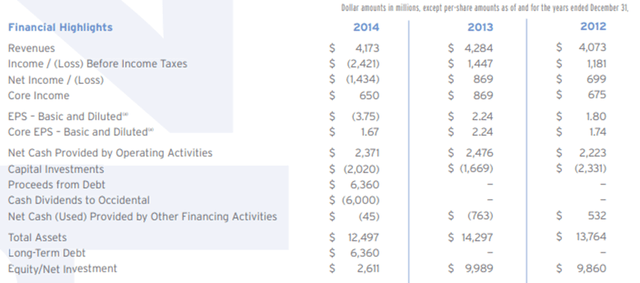

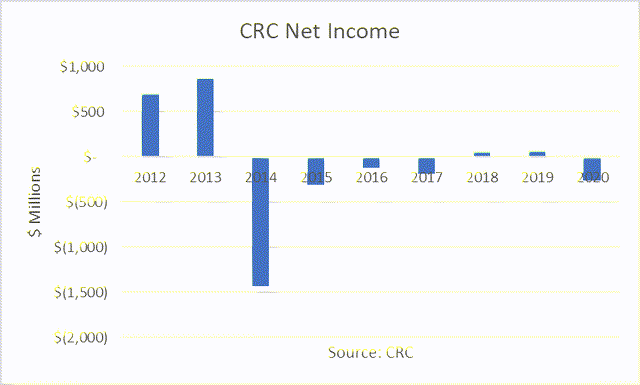

Whereas CRC had been profitable in 2012 and 2013 when selling crude at $104/bbl, it posted a loss of $1.4 billion in 2014 when it sold crude for an average price of $92/bbl.

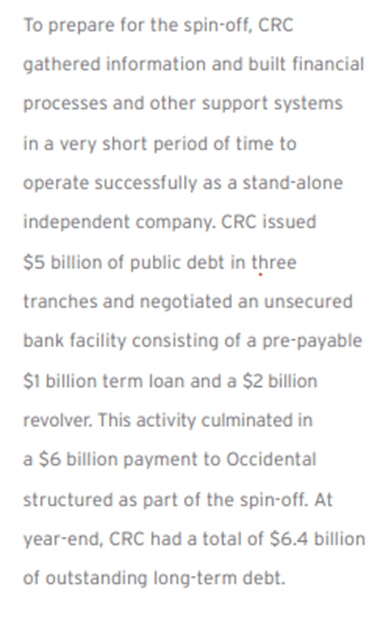

CRC had issued $5 billion of public debt in preparation for its spinoff, and its debt totaled $6.4 billion by the end of 2014.

CRC

CRC’s crude sales prices did not recover by much in 2017, and they continued to drop in 2018, 2019 and 2020.

Consequently, CRC lost money in 2014 through 2017 and posted very small profits in 2018 and 2019.

In 2020, the global pandemic gutted oil demand. Then Saudi Arabia and Russia got into a price war in March, causing oil prices to plummet.

CRC filed for bankruptcy on July 15, 2020, because it was having trouble making payments on its debt. It proposed to shed about $5 billion in debt.

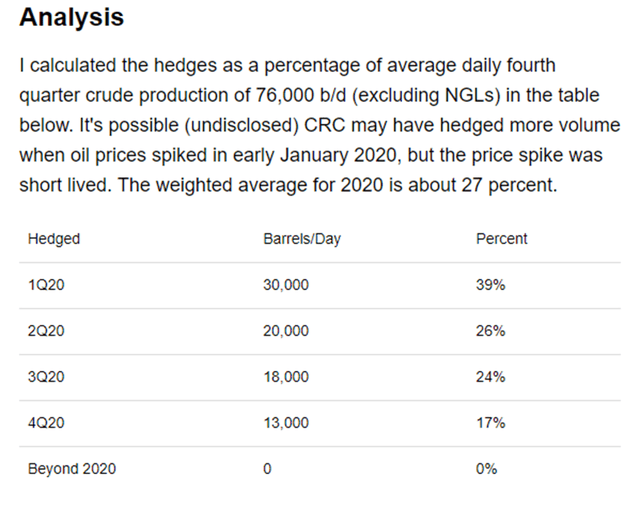

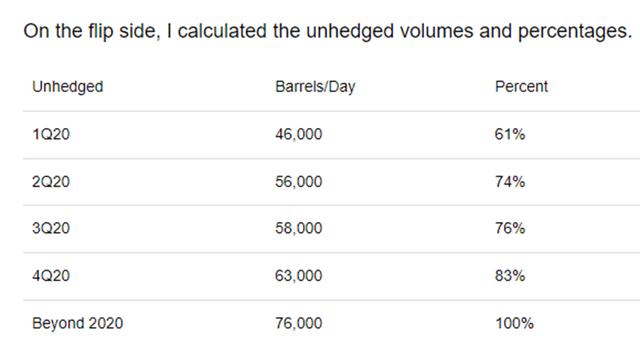

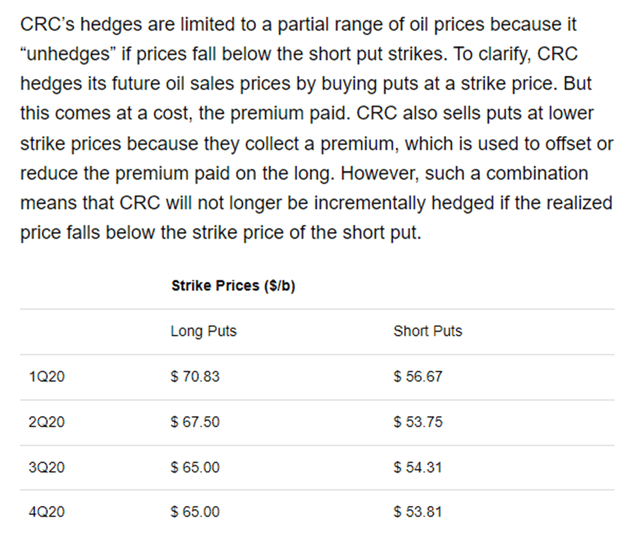

In August 2019, I first established a short position in CRC in my model portfolio in my Seeking Alpha Marketplace service, Boslego Risk Services. I concluded that CRC was largely exposed to the downside in oil prices because it had only partially hedged a partial price range, leaving the firm exposed. If CRC had a robust hedging strategy, I would not have shorted the stock. (I eventually closed my short position in 2Q20 when CRC fell below $1 per share for a nearly 100% profit.)

In my subsequent article, California Resources: Crude Oil Hedge Analysis For 2020 And Beyond, I wrote:

Boslego Risk Services Boslego Risk Services Boslego Risk Services

CRC Reorganization

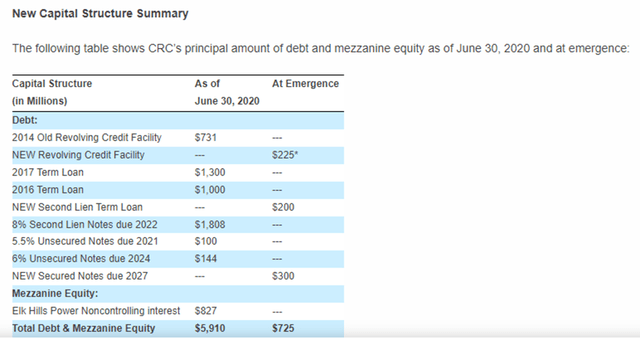

In just three months after filing Chapter 11, a federal judge approved its reorganization plan. The bankruptcy court approved about $4.4 billion of loans and notes to be swapped for equity.

And on October 28, 2020, shares of the Company’s new common stock began trading on the New York Stock Exchange under the ticker symbol “CRC.” The new capital structure included total debt of $725 million.

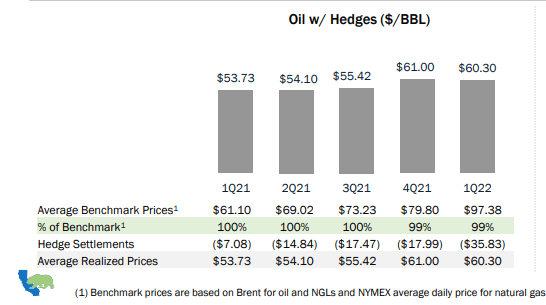

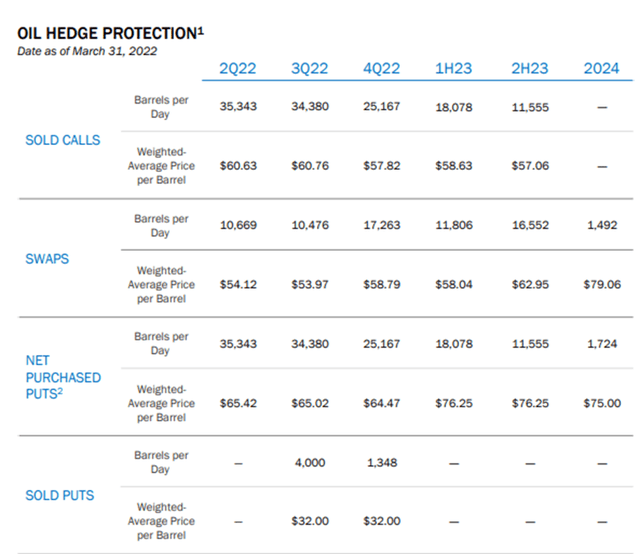

According to its June 2022, Investor Presentation, CRC had legacy hedges in place according to the table below. It had bought put options to protect against very low oil prices, but apparently financed the puts purchases (in whole or in part) by selling call options, which provide a fixed payment to CRC in exchange for CRC taking an unlimited risk, if oil price rose above the call strike price.

Oil prices had recovered due to production restraint by OPEC+, which includes Russia. And U.S. shale oil production was gutted by the oil price collapse in 2020, and its recovery has been slow.

On February 24th, 2022, Russia invaded Ukraine in a “special military operation,” and oil prices soared because the conflict involved a major oil producing and exporting country, Russia. Prior to that event, the Chairman of the U.S. Joint Chiefs of Staff, Gen. Mark Miley, had testified that a Russian invasion of Ukraine would result in the downfall of Kyiv in just “72 hours.”

No one I read predicted that Ukraine would mount such a stiff opposition, likely including President Putin, with the aid of military equipment from NATO countries. President Zelenskyy of Ukraine had reportedly been offered refuge by NATO, but he declined to leave Kyiv.

The attempted takeover of Kyiv failed, and Russian troops have withdrawn from the area. And the head of Ukraine’s military intelligence stated his belief that “most of the active combat actions will have finished by the end of this year.”

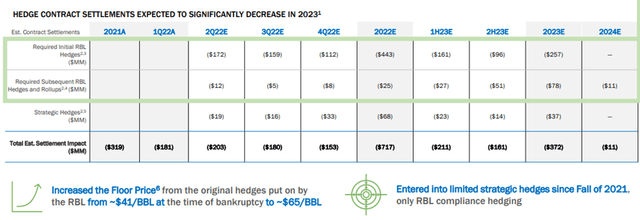

CRC’s hedges have been hemorrhaging money, given the oil price surge, which had begun prior to February 2022, and their positions. As of March 31, 2022, the hedges had lost $1.429 billion, according to its presentation table below.

Much of this loss is “unrealized,” meaning that the contracts are apparently open and the losses are “marked-to-market,” subject to change as prices change. I estimate that the hedging losses are more than $200 million more since end-March, though I do not have enough detailed information to make an accurate estimation.

Management wrote in the presentation that its hedging strategy is expected to change.

Market Outlook

Of course, the outlook for future oil prices depends on how the Russian-Ukrainian conflict proceeds, and how exports of Russia’s oil supplies are affected. Brent futures prices remain “backwardated,” meaning deferred contracts are priced lower than the nearby contracts. That is common when there are “war risk” premia attached to prices, or when oil supplies are short of demand.

NATO countries have responded with a series of measures to isolate Russia and cut-off its source of oil revenues, to the extent possible. The U.S. has banned imports of Russian oil, and the EU has agreed on a partial ban of Russian oil imports. “This immediately covers more than two-thirds of oil imports from Russia,” according to European Council chief Charles Michel. The ban will apply to 90 percent of Russian oil imports by the end of the year.

Also, the U.S. had announced that it will draw down its Strategic Petroleum Reserves (SPR) by 180 million barrels over 6 months, amounting to one million barrels per day. And the International Energy Agency (IEA) announced an additional 60 million barrel SPR drawdown.

The head of Vitol Asia, Mike Muller, recently said that the release of oil from the SPRs and increase in OPEC+ production quotas. Vitol is the world’s largest independent oil trading company.

In addition, the U.S. has been attempting to renegotiate the Iran “nuclear deal,” which could remove sanctions from Iranian oil exports. Muller doesn’t expect a new deal this year but says the Biden Administration will “turn a blind eye” if Iran sells sanctioned oil.

And the Biden Administration has announced that it “will ease some sanctions on Venezuela in exchange for continued dialogue between President Nicolás Maduro and the opposition.” Chevron’s (CVX) CEO Mike Wirth said CVX can help double Venezuela’s 800,000 barrels per day production within months.

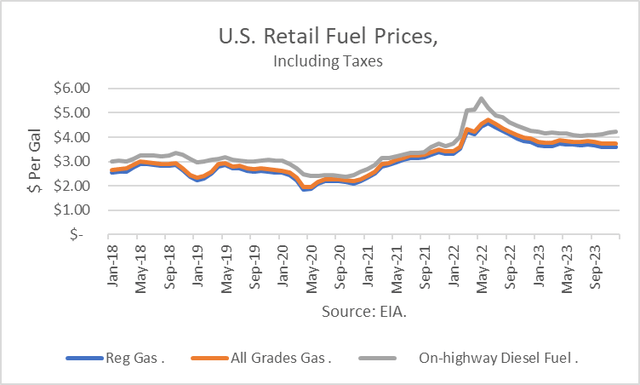

U.S. gasoline prices have surged to levels that are affecting demand in the largest oil-consuming country in the world. The EIA recently reported that U.S. average retail gasoline prices have hit $5.00/gal for the first time ever.

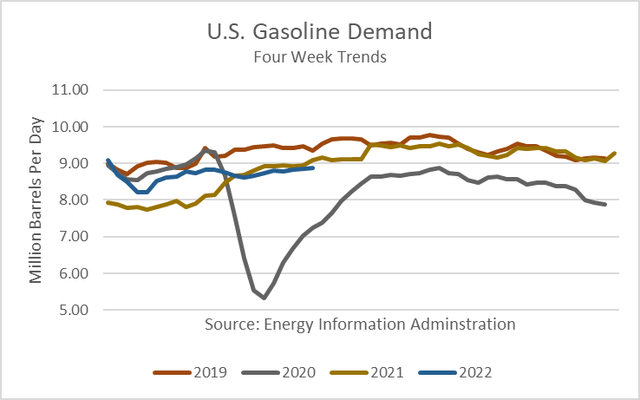

And high oil prices have begun to bite. U.S. gasoline demand in the 4 weeks ending June 3rd is lower than for the same weeks in 2021 and 2019 (pre-pandemic).

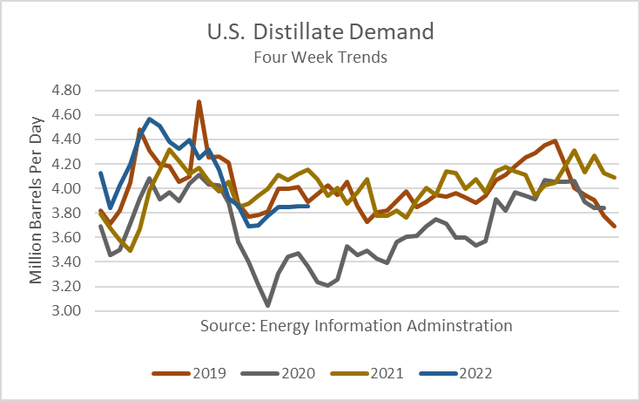

Distillate demand, which includes on-highway and off-highway (farming) diesel fuel and home heating oil, is likewise lower than in 2021 and 2019.

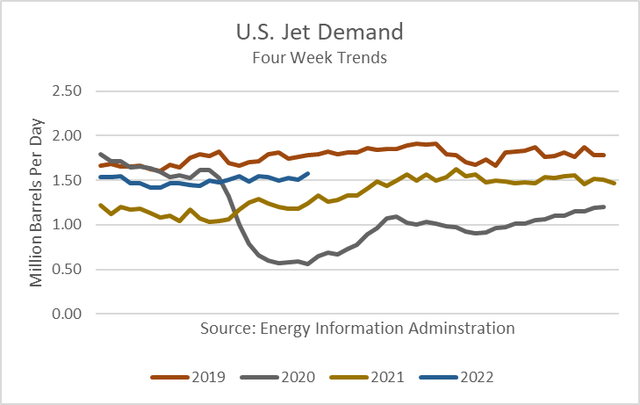

Jet fuel demand is higher than in the past two years but remains below 2019.

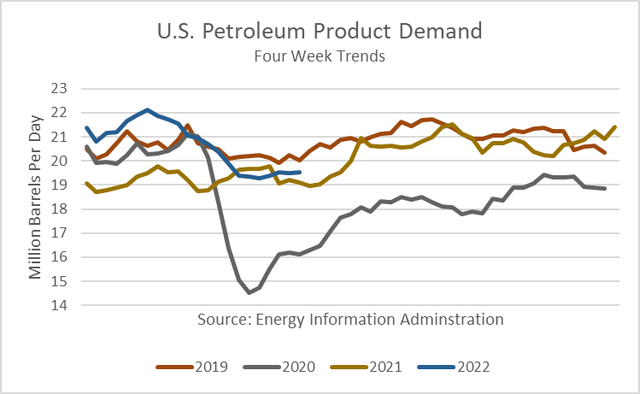

In total, petroleum product demand remains below pre-Covid-19 levels.

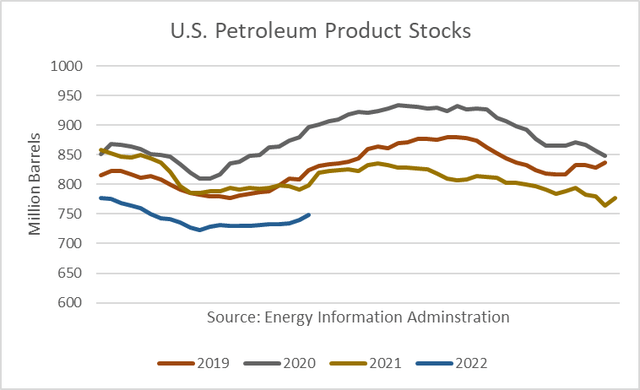

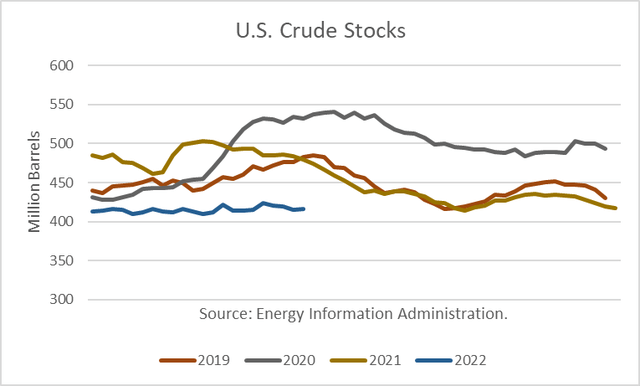

Supporting oil prices is low oil inventories. Total U.S. petroleum products are at the lowest levels seasonally for at least 4 years…

…and the same is true for commercially-owned crude oil stocks (excluding SPR).

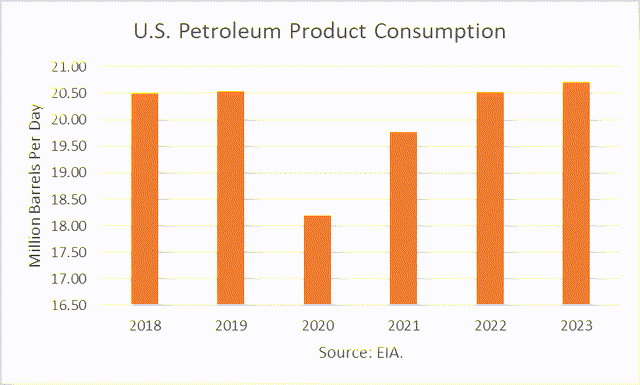

Looking forward, the EIA projects in its Short-Term Energy Outlook (STEO) dated June 7th that total U.S. petroleum product consumption in 2022 will average 20.54 million barrels per day (mmbd), about the same as in 2019. And it projects consumption of 20.73 mmbd in 2023, a very small increase.

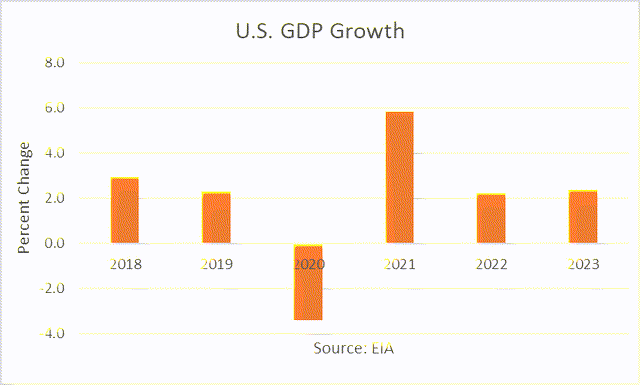

But that outlook is based on GDP growth of about 2% a year in 2022 and 2023. And that growth rate is doubtful. High oil prices and inflation are causing some economists to expect a recession is coming, which would adversely impact oil demand. “There is a significant likelihood of a recession in the not-too-distant,” according to economist Larry Summers, former Treasury Secretary and past president of Harvard University.

World Inventory/Price Model

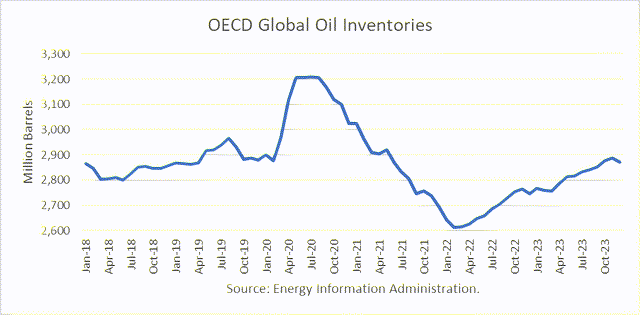

Finally, the EIA STEO for June includes their forecast for OECD oil inventories. Based on their projections going forward, inventories have bottomed and are likely to rise.

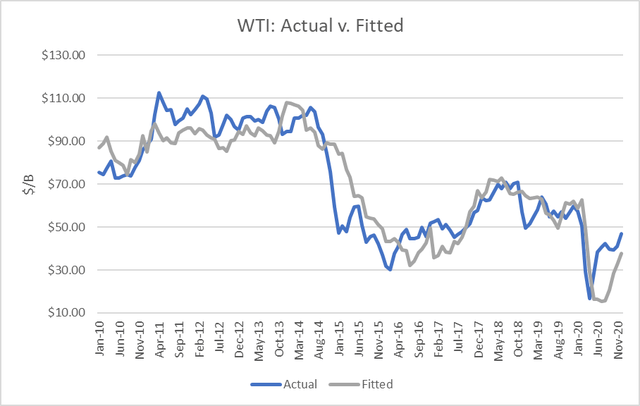

I have a regression model that relates OECD inventories to WTI crude prices. It has an r-squared of 82 %, which means inventory levels “explain” 82% of price levels.

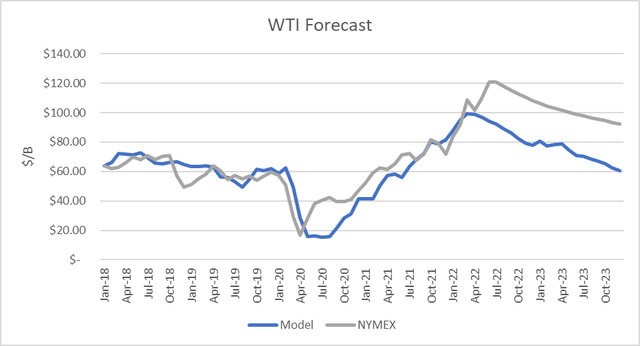

Based on EIA’s inventory projections and my price model, I projected future NYMEX WTI crude prices. (WTI and Brent crude prices have a 99 % correlation). My projection shows oil prices dropping even more so than does the NYMEX futures market, as of June 10th.

However, as noted above, developments in the world oil market are more uncertain than they usually are, given events involving Russia. And a “war risk” premium is likely to remain in oil prices in the foreseeable future.

Conclusions

The total return from investing in CRC over the past 12 months has been 38% as of this writing. That compares favorably to -10% from the SP500TR. However, in the year-to-date, it has only gained 2.8%, despite the surge in oil prices.

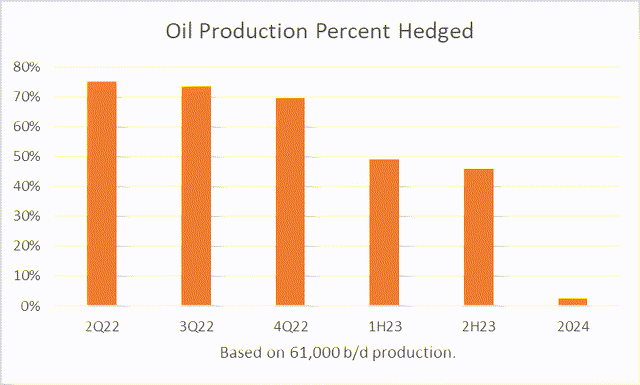

I believe that is largely due to the oil hedges it has in place. The average benchmark price in 1Q22 was $97.38/bbl, but CRC’s average realized price was $60.30/bbl because of realized hedge settlements (losses). Unrealized losses for this quarter and future quarters are over $1.1 billion, based on my estimate, but my information is incomplete.

CRC

Looking forward, the current hedge percentage of oil production, including Short Calls and Swaps is as follows, assuming oil production of 61,000 b/d:

CRC management has signaled the market to expect changes to its hedging strategy. I believe that a change in hedging strategy could have a major impact on CRC’s ability to prosper in the months and years ahead. I expect that they will be able to improve the hedging strategy to enable the company to capture more of the upside, given the state of the market. Therefore, I rate it as a Hold for those with a position and a Buy for those willing to speculate that the hedging strategy will be improved.

Be the first to comment