agnormark/iStock via Getty Images

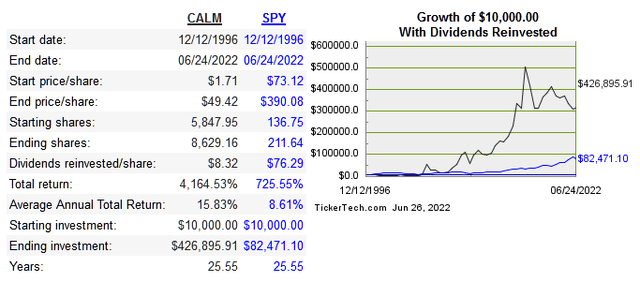

Cal-Maine Foods (NASDAQ:CALM) is the largest egg producer in the US with around 13% market share. As a low cost provider, they IPO’d in 1996 and blazed past the market in the long run.

Despite the impressive compounded growth in share price so far, the company is priced very high on a multiples basis while having negative cash flows.

The industry is estimated to grow around 5% for the rest of the decade. They are far less diversified than other food producers, and lately have put more emphasis on cage-free hens.

Moat

Having market share doesn’t necessarily mean the moat is indefensible. Market share of 13% is strong, and it’s not probable that a new, direct competitor will emerge to take them on The table below shows returns on capital and earnings power.

|

Company |

10 Year Median ROE |

10-Year Median ROIC |

10 year EPS CAGR |

10-year FCF CAGR |

|

12.1% |

11.3% |

-29.2% |

-197.1% |

|

|

9% |

6.2% |

4.3% |

14.36% |

|

|

14.4% |

8.6% |

15.5% |

20.6% |

Source: QuickFS

The median returns don’t look bad, but they have been declining for years. Margins at all levels have declined as well as revenue from the peak.

|

Year |

2016 |

2017 |

2018 |

2019 |

2020 |

2021 |

|

ROIC |

30.9% |

-7.7% |

12.1% |

5.1% |

1.7% |

0.2% |

|

Gross Margin |

33.9% |

4.2% |

24% |

16.3% |

13.2% |

11.9% |

|

Operating Margin |

24.6% |

-12.3% |

6.8% |

3.4% |

0.1% |

-2% |

|

Net Margin |

16.6% |

-6.9% |

8.4% |

4% |

1.4% |

0.5% |

The bad news about the declining ROIC is that the denominator(invested capital) has shrunk over the years, yet still the return numbers aren’t improving.

Capital Allocation

CALM has impressively delivered over the last decade or so. In 2009, they began paying down their 116 million in long term debt down to almost nothing. They also paid a dividend for the majority of the time but lately dividends have been sporadic. Share count has remained relatively steady, and I don’t expect them to become a net repurchaser anytime soon.

They have remained active in M&A and will likely continue as opportunities comes up. They have $16 million in cash and as previously mentioned they reduced long term debt drastically.

Valuation

Most direct competitors are private, so public comps are a bit more tricky. The closest competitor in terms of strictly egg production would be VITL, but they are very small in comparison and specialize exclusively in organic/premium eggs. So the comparison companies are the biggest in the agriculture

|

Company |

EV/Sales |

EV/EBITDA |

EV/FCF |

P/B |

|

CALM |

1.5 |

45.9 |

-72.4 |

2.3 |

|

ADM |

0.6 |

11.6 |

12.8 |

1.7 |

|

TSN |

0.7 |

5.6 |

17.2 |

1.6 |

Source: QuickFS

While the others are more diversified food producers, there’s nothing inherent to CALM in its current state to justify such high pricing on a multiples basis. Operating margin and FCF are both still negative. This isn’t the case with the bigger competitors. Fundamentally there is little risk in the company itself, most of the risk simply comes from paying too high of a multiple right now.

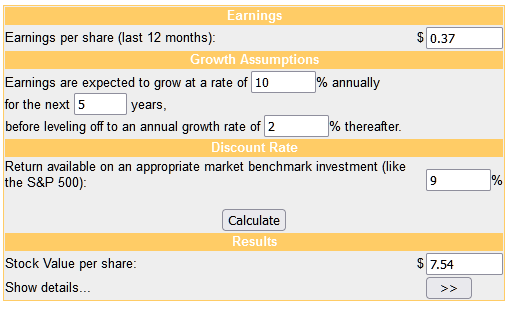

Using a DCF, CALM is also over valued using what I consider very optimistic estimates of their EPS in the future. So even giving them credit for a bit of a turnaround, shares are absolutely overvalued at current prices.

Conclusion

The fundamentals of CALM are solid, eggs are a consumer staple and the industry will grow worldwide. The real risk comes from buying at current multiples. The company is struggling to become cash flow positive, which shouldn’t be rewarded with such high multiples. With no way to grow into such multiples, it means those who invest now will have only modest fundamental growth and a possible contraction of multiples over time.

Be the first to comment