JHVEPhoto

Intro

We wrote about Caesarstone Ltd. (NASDAQ:CSTE) back in April of this year when we stated that shares were getting to levels that were becoming too cheap for value investors to pass up. Our bullish premise at that time was that we were dealing with a company that had an ultra-low valuation but yet was still comfortably profitable. Fast forward three and a half months and shares now find themselves approximately 5% higher ($10.32) and we believe there are plenty more gains to come here especially when we observe what is happening on the technical chart.

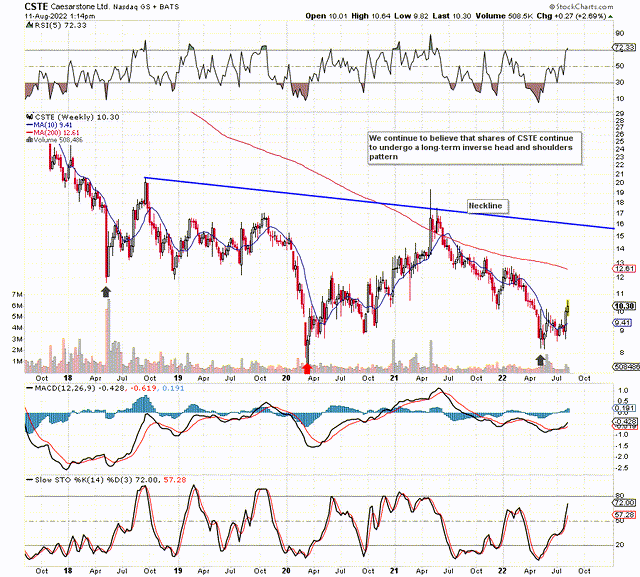

As we see below, we still maintain shares of Caesarstone are undergoing a multi-year inverse head and shoulders pattern where the decisive neckline ($15+) remains well above the prevailing share price. This brings opportunity to the table due to the height of the pattern in that the pattern will not be confirmed unless shares can actually break through this resistance area. Recent shares price action though has been very solid post Q2 earnings with shares now trading well above their 10-week moving average of $9.41. in fact, shares now look to be on course to test their 200-day moving average of $10.75 per share.

CSTE Technical Chart (Stockcharts.com)

We state the above because of the three main areas we vet when doing our due diligence on a long-term play. These are the company’s profitability management stewardship and the respective valuation of the company.

Profitability

With respect to Caesarstone’s profitability, adjusted diluted earnings per share came in at $0.20 for the second quarter which was only fractionally down compared to the same period of 12 months prior. However, consensus believes bottom-line profitability will grow by close to 10% this year ($0.91 per share) despite the fact that this bottom-line annual estimate has declined by roughly 4% over the past 30 days alone. However, the company’s fourth-quarter estimate of $0.30 per share continues to increase in value and this is encouraging in that earnings revisions may finally be bottoming out somewhat.

We state this because Caesarstone’s current return on capital over a trailing 12-month average comes in at a mere 2.35% whereas the stock’s 5-year ROC average comes in at 5%. Suffice it to say, based on historic trends, the company has not been able to return in profit what it traditionally has been able to do off its capital. In effect, even if ROC can return to a 4%+ level, we would expect shares to be priced significantly higher from where they are at present.

Management Stewardship

We have alluded to this in the previous commentary in that as shares have continued to struggle over past years, shareholder equity has continued to increase. In fact, at the end of the company’s most recent quarter, shareholder equity surpassed $515 million which was a record in itself. The number of shares outstanding has remained constant at approximately 34.5 million and management recently announced a dividend payment of $0.25 per share which will be paid later this month. Given the irregularity of dividend payments, the current prevailing dividend yield is subjective but the point is the following. Rising equity, a controlled float, and distributing dividends to shareholders are all areas that are under management’s exclusive control. Furthermore, management continues to aim toward being a $1 billion countertop outfit by the end of fiscal 2025 ($685 million in sales at present) by adding more value through ongoing acquisitions and improvements in the CS Connect platform.

Valuation

Despite the run-up in the share price since the company’s second-quarter earnings print, shares continue to trade at a very attractive valuation. With a book multiple of 0.7 and a sales multiple of 0.52, Caesarstone has an excellent base to build from considering the strength of its balance sheet. Everything centers around the global growth acceleration plan by means of prudent inventory management, better productivity at Richmond Hill, stronger leadership both at the global and regional levels and of course, diversification of products beyond the traditional. Improvements in these areas simply have to move the valuation over time, especially with respect to the company’s sales and assets.

Conclusion

Caesarstone has been able to offset rising costs in its business by stronger volumes as well as higher sales prices. This is encouraging given the fact that investment costs have remained elevated as the company continues to invest through the cycle. Let’s see if the 200- day moving average can be now taken out in due course. We look forward to continued coverage.

Be the first to comment