zorazhuang

Baidu, Inc.’s (NASDAQ:BIDU) dominant market share in search, network effects, an economic moat, a compelling mobile ecosystem, a healthy balance sheet, a solid record of operating cash flow generation, and increasingly compelling valuation all provide the foundations for a bull case.

Q2 2022 (reported 30 August) total revenues were $4.43 billion, decreasing 5% year-over-year. Revenue from Baidu Core (i.e., excluding iQiyi) was $3.46 billion, down 4%; online marketing revenue was $2.55 billion, down 10% primarily due to the resurgence of Covid-19 in China. However, non-online marketing revenue was $906 million, up 22% year-over-year, driven by cloud and other AI-powered businesses. An increasingly compelling mobile ecosystem delivering synergies across search, mobile Internet, live-streaming, along with new traction found in Cloud, AI, Autonomous Driving, may help restitute growth prospects at this former market darling. Profitability likely is around the corner, as is, perhaps, a major turnaround.

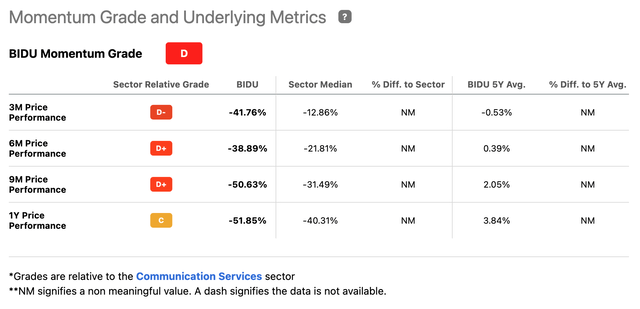

Momentum Has Been to the Downside

The stock of Baidu has been hammered. Check out the ADR’s momentum grade below.

All time capsules considered show clear underperformance of Baidu’s stock, as compared to its sector median – and by a wide margin.

The stock, which is down 78% from an all-time high of 354.82 reached on February 22, 2021, is also trading where it used to trade just about six years ago. Quite a haircut.

The reasons for this collapse of shares are many. A challenging market and increasing competition have dampened Baidu’s growth in advertising. Meanwhile, the emergence of major risk factors and horrific sentiment vis-à-vis Chinese stocks seem to have accelerated the downfall.

Baidu is Thwarting Growth Deceleration in Its Flagship Advertising Business

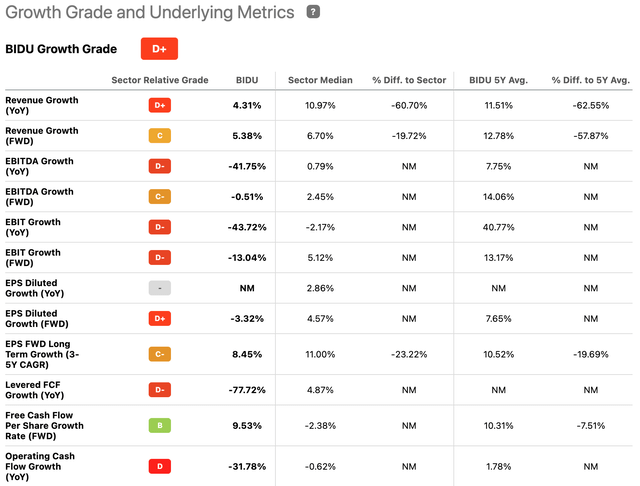

Baidu’s top and bottom lines growth has been heavily constrained over the past couple of years, contributing to the poor growth grade documented below.

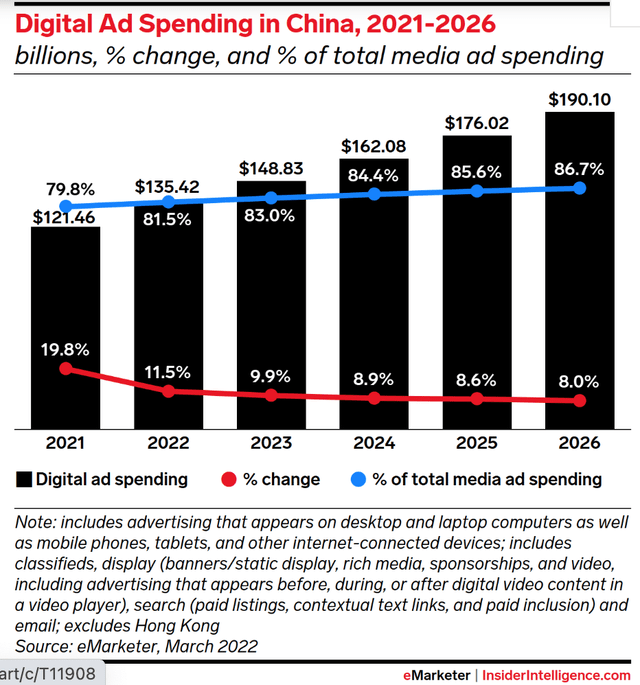

But the core advertising business seems to be normalizing and even resuming moderate growth, based on Q2 ’22 results, as margins improve amidst management’s effective execution. The company is poised to benefit from continued, despite possibly slightly decelerating (off a large base) growth in digital ad spending in China.

Ad spending in the Search Advertising segment in China is projected to reach US$52.97 billion in 2022 and show an annual growth rate (CAGR, 2022-2027) of 9.66%, resulting in a projected market volume of US$84.00 billion by 2027, still quite an opportunity.

Baidu’s online advertising business remains the leading source of revenue in the medium term given its dominant market share for search. In June 22, Baidu App’s monthly active users reached 628 million, up 8% year-over-year, and daily logged-in users reached 84%. The flagship app had reached 580 million MAUs in Q2 2021, increasing 9% year-over-year and 4% sequentially, signaling growth deceleration (but no collapse). The signs of a plateau only make it clear that Baidu management’s attempts at diversifying the business away from search make sense.

Baidu’s AI search engine has accumulated a large database of user behavior data in China. Network effects from two decades of search dominance establish a moat for the unit and help generate the most relevant content for users, resulting in increased usage and retention, more data, optimized search engine algorithm and relevancy of results or recommendations, and higher advertising efficiency on both PC and mobile devices. The ensuing competitive advantage is difficult to replicate. In turn, the prospect of a higher click-through rate prompts advertisers to pay higher cost-per-click, or CPC, for ads. Baidu may thus command higher cost-per-mille impressions, or CPM, and CPC rates relative to competitors (WeChat, Weibo, etc.).

Besides web search and through the building blocks of Baijiahao (blog-style platform) accounts, Smart Mini Programs (Baidu app incorporates smart mini-programs like Tencent’s WeChat to boost user growth) and other services, Baidu App provides users single log-on experience to a wide range of functionality dispersed across mobile apps and websites, as well as merchants a comprehensive suite of marketing cloud solutions. The wide range of services combine to deliver a spanning, open-platform ecosystem – all operating under the flagship Baidu app that further ascertains Baidu’s moat.

Emerging Businesses Including AI Cloud Are Starting to Gain Traction

Search remains a key business driver, but Baidu faces long-term challenges for advertising dollars from growing competitors such as Tencent (OTCPK:TCEHY) (WeChat, etc.) and Bytedance (TikTok, Douyin, etc.). New ventures (cloud, autonomous driving) thus constitute critical pursuits if Baidu is to regain growth status over the next decade.

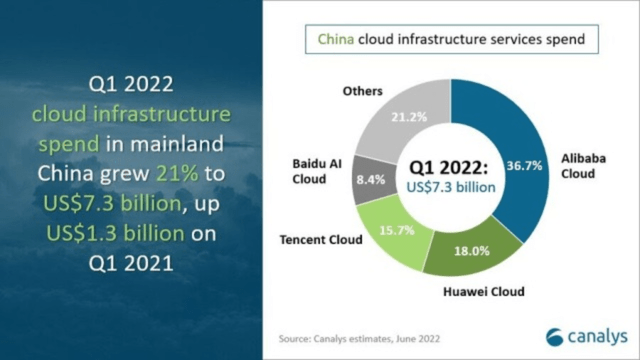

The company enjoys a critical head start in autonomous driving. But Baidu Cloud currently generates the greatest revenue, even if it faces stiff competition from Alibaba (BABA, OTCPK:BABAF), Huawei, and Tencent. Baidu AI Cloud, the fourth largest Cloud provider, has an 8.4 percent share of the market in China, but grows fastest, at 43% (year-over-year, as of Q1, ’22). Through its Kaiwu Industrial Internet Platform, Baidu AI Cloud is increasing its adoption rate in manufacturing, energy, and other verticals. The unit pursues SMBs and companies deploying a multi-cloud strategy. [Alibaba Cloud is leading the cloud infrastructure services market in Q1 2022, accounting for 36.7% (+12%) of total spend; Huawei Cloud is the second-largest, with 18% (+11%) market share; Tencent Cloud, the third-largest, has 15.7% of the Cloud market, but revenue fell slightly, mainly due to its internal business restructuring.]

Baidu seems to enjoy critical momentum. Its AI Cloud was again ranked the No. 1 AI cloud provider, according to IDC’s second half of 2021 report on China’s public cloud market report, issued in June 2022 (as reported in Baidu’s second quarter 2022 results announcement). The unit is doing to Baidu what Google Cloud did to Alphabet (which trails Amazon’s AWS and Microsoft’s Azure), and qualifies as no less than a game changer. Baidu AI Cloud revenues maintained rapid growth momentum of 31% year-over-year and 10% quarter-over-quarter (Q2, ’22).

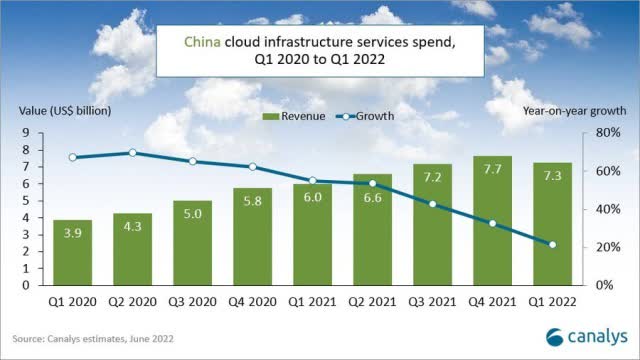

Cloud infrastructure services spending in China grew 21 percent to $7.3 billion in Q1 2022 (year-over-year), accounting for 13 percent of global cloud infrastructure spend. Growth has been decelerating lately, but the market remains dynamic, if competitive, and the opportunity sizable.

Canalys

The top four Cloud service providers have benefited from the expansion of cloud use and accounted for 79% (+19%) of total expenditure in China.

Emerging Autonomous Driving Is Well Worth Pursuing Given TAM; Its Monetization Is Starting

The potential total addressable market for autonomous driving is 9 times that of online advertising, per Baidu’s Management. The China Autonomous Vehicles Market is projected to reach US$ 98.89 Billion by 2030, growing at a stunning CAGR of 58.9% during 2021-2030. Management reported critical progress in Q2 ’22 and now is in the early stages of monetization. This is another gamechanger for Baidu – and its ADR.

As reported in Baidu’s latest earnings report, Apollo Go, Baidu’s autonomous ride-hailing service, provided 287K rides in the second quarter of 2022. On July 20, 2022, the service reached one million accumulated rides, serving passengers on open roads. Apollo Go started offering fully driverless ride-hailing services and received the permits to collect fees from customers in Chongqing and Wuhan on August 8, 2022. This has made Apollo Go the first and only of its kind in China to provide ride-hailing services without human drivers present in the car.

Apollo Go had already been granted the permits to charge fees for driverless ride-hailing services on public roads of the Yizhuang region of Beijing on July 20, 2022. Apollo Go expanded into Hefei (Anhui) and Chengdu (Sichuan) in July 2022, and is now available in more than ten cities in China, including all the tier-1 cities (Beijing, Shanghai, Guangzhou, Shenzhen). [Baidu launched a mobility-as-a-service pilot program in Guangzhou in February 2021. Guangzhou residents can use integrated apps to access robotaxis, automated shuttles, self-driving buses, autonomous police robots, and driverless vending carts, all supported by Baidu’s Apollo autonomous driving platform.]

Meanwhile, Baidu unveiled its 6th generation robotaxi vehicle Apollo RT6 in July 2022. RT6 is the first steering wheel-free, all electric model designed for fully driverless autonomous driving, with a detachable steering wheel unlocking space for a more versatile in-car experience. The vehicle has a dramatically lowered production cost of 250,000 RMB per unit. Apollo RT6 is set to join the Apollo Go ride-hailing service starting in 2023, expanding consistently to rapidly reach tens of thousands of units.

Baidu’s autonomous vehicles are still loss-making but monetization actually started and constitutes a critical milestone, ascertaining a positive trend of growth renewal for Baidu. The firm is China’s highest-profile competitor in a multibillion-dollar race with rival autonomous vehicle developers including Alphabet Inc.’s (GOOG, GOOGL) Waymo and General Motors Co.’s (GM) Cruise to turn tech into a major consumer product. The recent launch of new AI-enabled products signals the emergence of a large market opportunity for Baidu, which enjoys a first-mover advantage for autonomous driving and has the most autonomous driving licenses in China.

Commercial success has yet to be fully delineated, but revenue may start to contribute meaningfully in the near term. The enormous size of the market means the strategic unit indeed has the potential to become another game changer for Baidu (alongside AI Cloud). In our view, mass scale adoption is likely. Time-to-market is also getting increasingly clear, i.e., as soon as possible.

Other Growth Initiatives

Baidu’s other major AI areas include voice recognition solution DuerOS, a natural language-based platform and voice assistant system that supports TVs, speakers, and other smart-home appliances. DuerOS is also building its presence in automotive software for vehicles in China. One million vehicles run DuerOS on 600 vehicle models across 70 manufacturers, per Forbes. Intelligent driving and DuerOS account for 4% of Baidu’s Core revenue in 2020, a fraction that is expected to increase by 2025, although the level of monetization could vary significantly given the early life cycle of autonomous driving. Per recent quarterly results (Q2, ’22), Baidu’s Xiaodu Technology, the developer of DuerOS, continued to be ranked No.1 in smart speaker shipments in China for Q1 ’22, according to IDC and Canalys.

IQiyi, Baidu’s online video platform, faces still competition and does not seem to enjoy much of a moat. According to Questmobile, iQiyi is one of the two leaders in the video streaming industry in China with 570 million monthly active users (versus 540 million at Tencent Video) in March 2020. iQiyi’s monetization model has been shifting to a mix of advertising and subscription. iQIYI’s average daily number of total subscribing members for Q2 ’22 was 98 million, compared to 99 million for Q2 ’21 and 101 million for Q1 ’22. Membership appears to have stalled since the end of 2019, despite the impact of COVID-19 forcing people to stay home.

IQiyi’s long-term cash flow generation capability remains uncertain, similar to Netflix contending with heavy expenditures to invest in self-produced content to attract and retain users. iQiyi thus faces some lack of scalability and margin drag [as do Tencent Video and Youku-Tudou (under Alibaba)] due to the constant need to incur high content costs. Whether industry consolidation may confer on iQIYI, one of the dominant market players, a sustained ability to raise prices and help it become profitable once it hopefully spends less on growth (after accumulating enough compelling content that it can meaningfully reduce churn and overcome steep competition), has yet to be ascertained.

Profitability & Cash Flow

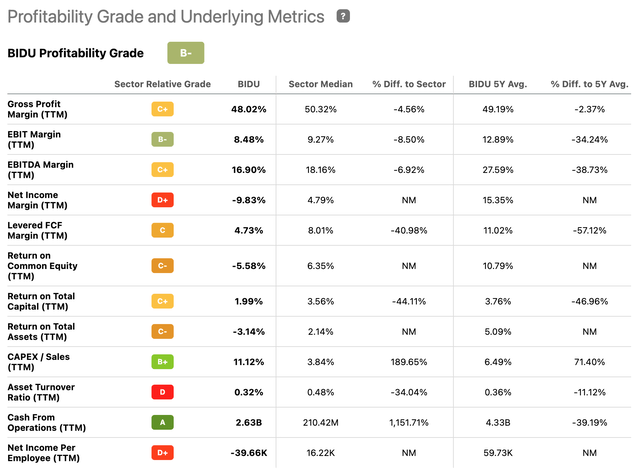

Baidu is transitioning from a search-driven one-trick pony to a more diversified business model with the hope that it can reboot growth of both its top and bottom lines. But the company’s profitability and cash flow generation capabilities are far from being the disaster the recent share collapse seems to portend. The profitability grade table below indicates as much.

Gross profit margin, returns on equity, capital, and assets, are all decent. Cash flow from operations remains excellent. Only net income gauges sharply fall short. Let’s drill.

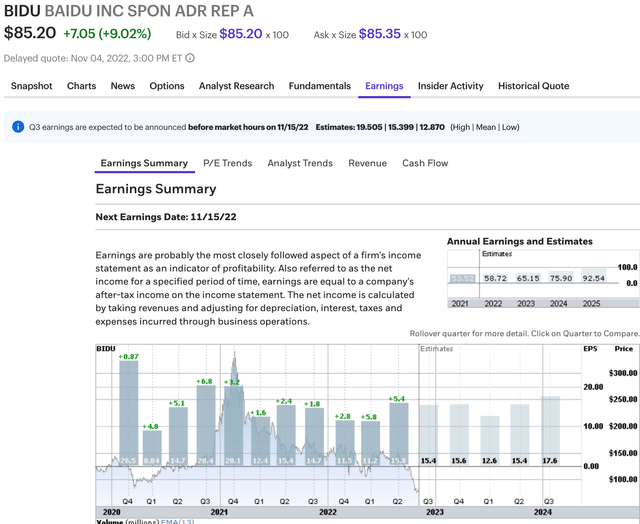

Check out the earnings summary below.

Not exactly the picture of a dying business. Wall Street clearly anticipates ongoing improvement of earnings generation potential. Of course, management may fall short of consensus; but the trend is clear enough. The ADR’s recent fall seems totally disconnected from the company’s earnings’ power.

The income statement shows a rather healthy picture, including stable operating income, as well. Currency exchange losses and, more importantly, other Non Operating Expenses are the main culprits contributing to the deterioration of net income. Per Q4 and FY 2021 Results announcement, an impairment loss of RMB 4.3 billion from long-term investments hit results in 2021. (A significant portion of long-term investments, including but not limited to investments in equity securities of public and private companies, private equity funds and digital assets, is subject to quarterly fair value adjustments, which have clearly contributed to net income volatility.)

The cash flow statement shows a healthy picture, as well. Cash flow from operations has recently decelerated, but remains comfortably positive. Baidu’s balance sheet seems no less compelling. As of June 30, 2022, cash, cash equivalents, restricted cash and short-term investments were $28.28 billion, and cash, cash equivalents, restricted cash and short-term investments excluding iQIYI were $27.55 billion. Free cash flow was $823 million, and free cash flow excluding iQIYI was $826 million.

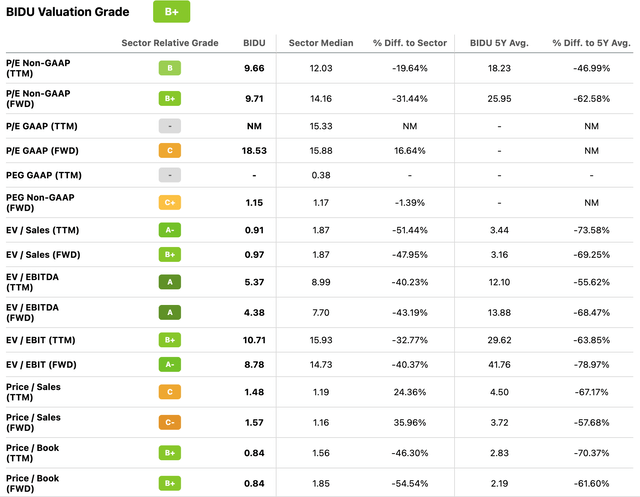

Valuation

The valuation grade below is even more compelling. Most gauges suggest the ADR is cheap. P/E Non-GAAP, Enterprise Value over Sales, EV/EBITDA (well under 10), and Price per Book all register well below Sector Median, suggesting a steep discount.

A price per book of .84 seems nearly ridiculous when considering the S&P 500 (SP500) Price to Book Ratio is 3.78. Alphabet, by comparison, trades at 4.43 times book value.

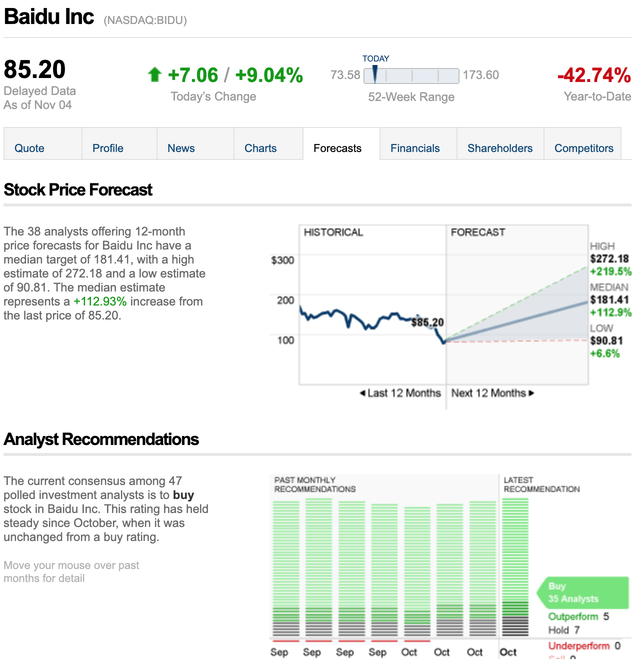

The 38 analysts offering 12-month price forecasts for Baidu have a median target of 181.41, with a high estimate of 272.18 and a low estimate of 90.81. The median estimate represents a +112.93% increase from the last price of 85.20. Good for a double-bagger, perhaps, and more.

A fair value estimate for Baidu of US$ 180-185 per share implies a 2022 P/E ratio of around 25+ times [after accounting for an exchange rate of 7.19 CNY/USD (or 7.85 HKD/USD) and an ADR conversion rate (ORD to ADR ratio) of 8]. Comparatively, implied P/Es at their fair value estimates are 35-40 times for Alphabet and 50+ times for Alibaba. Tencent trades even higher, closer to 75x.

A reasonable 10% five-year CAGR for Baidu assumes a conservative five-year CAGR of 5-7% for Core online advertising amid intensifying competition, a more aggressive CAGR (at least 15-20%) for AI Cloud and emerging technologies, which will likely incur significant R&D spending given their early life cycles, and a symbolic 0-1% five-year CAGR for iQiyi, which has incurred high content costs and steep competition, and recently plateaued. A conservative gross margin close to 50% and operating margin slightly over 10% in 2022 may complete the picture. But it is our firm belief that autonomous driving will blow all estimates and financial models, once it kicks into high gear.

While the Opportunity Seems Sizable, Always Be Cognizant of the Business, ESG, and Regulatory Risks

Intense competition remains a key concern. Online video platform iQiyi sure is one victim and bears the brunt of it, but AI Cloud is not immune either. Moat-protected Baidu Search seems less exposed, although it is competing with other internet giants, Tencent and Bytedance. Aggressive spending in video content, AI, and mobile functionality have eroded margins. Baidu also competes in cloud computing. It may enjoy a first mover advantage in autonomously driven cars in China, although AutoX, Pony.ai, Didi Chuxing, TuSimple, are waiting right around the corner. It is premature to predict that Baidu will be the ultimate winner in AI and the ROI generated will be high enough, but recent progress, particularly as relates to autonomous driving, sure holds promise.

Regulations regarding data, security, anti-trust, restrictions by US or China and audit inspections by the Public Company Accounting Oversight Board (“PCAOB”), constitute further risks to the bullish scenario. There have been concerns about the future of Chinese stocks listed on U.S. exchanges, as regulators hope to make Chinese companies comply with U.S. auditing rules. Many Chinese firms have created shell companies in the Cayman Islands that control businesses in China. The Cayman enterprises can issue American depositary receipts, or ADRs, that trade in New York, but aren’t subject to some U.S. laws because the Securities and Exchange Commission and New York Stock Exchange often defer to a home country’s rules. Such Cayman firms aren’t allowed to list in China. One key implication for investors is less disclosure.

Under President Donald Trump, the United States passed the Holding Foreign Companies Accountable Act (“HFCAA”), which threatens to delist Chinese companies from the NYSE if they don’t meet U.S. auditing standards. In 2022, the PCAOB added large Chinese companies including Baidu, Pinduoduo (PDD), and Alibaba, to the HCFAA. Following a ground-breaking deal, China recently invited U.S. audit inspectors to evaluate its companies. The good news is, U.S. audit inspectors have finished their first round of on-site inspections ahead of schedule, as reported by Bloomberg on Nov. 4. That’s a positive step for a deal that should prevent the delisting of shares of U.S.-listed Chinese companies. A successful review of Baidu’s accounting could serve as a catalyst for the ADR by removing a key overhang on the stock. The elimination of such a risk factor would finally allow BIDU, a discounted ADR, to trade based on fundamentals.

Business ethics (ESG) risks may impact medical advertising (15% of advertising revenue) on Baidu’s platform. In 2016, a patient died after he mistook a promoted ad on Baidu’s search for a cancer treatment, triggering increased scrutiny over advertising content. Chinese authorities launched new regulations and enforce stricter standards for online advertisers.

Leadership turnover has been a concern in the past. 4-5 years ago, Baidu lost a couple of key executives including its COO and head of AI and Apollo, but leadership has been stable ever since.

Macro shocks – More Risk Factors but in the End, Investors Should Win

Other risk factors go well beyond business, regulation, and governance. Macro shocks like epidemics (COVID-19, etc.), the pursuit of a political and social agenda (making shareholders’ rights the least of the Chinese Communist Party’s concerns and current CCP general secretary Xi Jinping’s priorities), not to mention China’s war games vis-à-vis Taiwan, with the concurrent threat of military conflict, add to the complexity.

The U.S. and China have already sparred over sanctions against Russia. Tensions between the two countries have increased following U.S. Speaker of the House Nancy Pelosi and other U.S. politicians’ recent visit to Taiwan, despite the U.S.’s longstanding “One China” policy. Before investing, ask yourself then, what if China invades Taiwan? After all, China has pledged to reunify Taiwan, which Beijing considers a renegade province, with the mainland, and hasn’t ruled out military force. I used to own a small position in Yandex (YNDX), the Russian search engine. Yandex’s trading has been suspended on the NASDAQ since February 28, 2022. The war in Ukraine, and a complex geopolitical and macro backdrop, can exact a terrible toll on portfolios.

Now, it seems unlikely that China will invade Taiwan (the same way it was deemed unlikely Russia would invade Ukraine a few months before the Russian invasion actually took place…). The country last fought a major war against Vietnam in 1979. Further, China would have to incur a steep cost preparing for an invasion. A complex daylong war game, played out a few weeks ago at a Washington think tank, demonstrated how destructive any attempted Chinese invasion of Taiwan might be. China would have to conduct the largest and farthest amphibious invasion in modern history. No walk in the park, even after accounting for China’s military advances of recent years. Plus, Russia’s unexpected early setbacks in its invasion of Ukraine may give Chinese leadership pause.

The war in Ukraine has exacted a catastrophic human toll. But it sure has benefited Putin in at least one critical way – reinforcing the energy edge Russia enjoys, the one and only competitive advantage the otherwise rather weak economy (#11 by GDP behind Brazil, Italy, and Canada – yes, that low) boasts, by triggering an oil and gas crisis. China and the United States play on a whole different level – tech, fintech, biotech, and more. (A weakened Europe trying to find cohesion after Great Britain’s European Union exit only gives that much more leeway to the two leading economies of the world.) But the US and China seem to be playing nice and fair on a rather level playing field in the end. Isn’t Li Qiang, now the second-ranking member of the 20th Politburo Standing Committee of the Chinese Communist Party, the man who opened the Shanghai Stock Exchange STAR Market, oversaw foreign investment in Shanghai – including Tesla’s (TSLA) Gigafactory – and is most often regarded as pro-business, having close ties to entrepreneurs such as Alibaba founder Jack Ma, on top of being a close ally of Xi Jinping?

A ruthless economic war, for sure. But Baidu should thrive in a high-risk yet well-controlled environment. That Xi and Li are having top priorities beyond shareholders’ very own (i.e., accelerating the implementation of their common prosperity vision with the newly elected Standing Committee) does not have to mean they’re pursuing Baidu’s equity holders’ ruin. In the end, the prosperity of the Chinese requires a prosperous economy; social justice comes on top. Xi is no Putin; he may not need a war to win it. He’s not after shareholders – just pro-social; there is a difference, which has key implications for Baidu owners. It is quite possible, and in the end desirable, that Chinese ADRs including Baidu’s see a major rerating over the next 1 to 5 years, even from Xi’s perspective. Powerful businesses spawn wealth, and a country needs some in the first place to share it.

Conclusion

Baidu may constitute a significant wealth creation opportunity for long-term investors. The firm qualifies as:

- A data-centric juggernaut boasting a dominant share in search, network effects, an economic moat, and a compelling mobile ecosystem with a unique database of user behavior data.

- A healthy balance sheet, solid record of operating cash flow generation, and increasingly compelling valuation, add to the stock’s appeal. Profitability is around the corner.

- Negative momentum and market sentiment have punished the ADR, presenting bargain hunters with an opportunity.

- The core advertising business seems poised to resume moderate growth. Monetization of new growth ventures including Cloud, AI, Autonomous Driving, is gaining traction, and the company may finally contemplate a decisive turnaround.

Solid appreciation potential exists within the next one to five years. Bullish investors should start accumulating decisively. The more cautious ones – i.e., those waiting for the next bull market in Chinese stocks and/or greater visibility into Baidu’s future sales, cash flow, and earnings – might prefer to dollar cost average.

Editor’s Note: This article was submitted as part of Seeking Alpha’s Top Ex-US Stock Pick competition, which runs through November 7. This competition is open to all users and contributors; click here to find out more and submit your article today!

Be the first to comment